On Jun 6th, Jim Cramer, with 1.8M Twitter followers and a TV show that pays him $5M/year, literally told all of his viewers, including his paid subs in his investing club, to buy dips in energy.

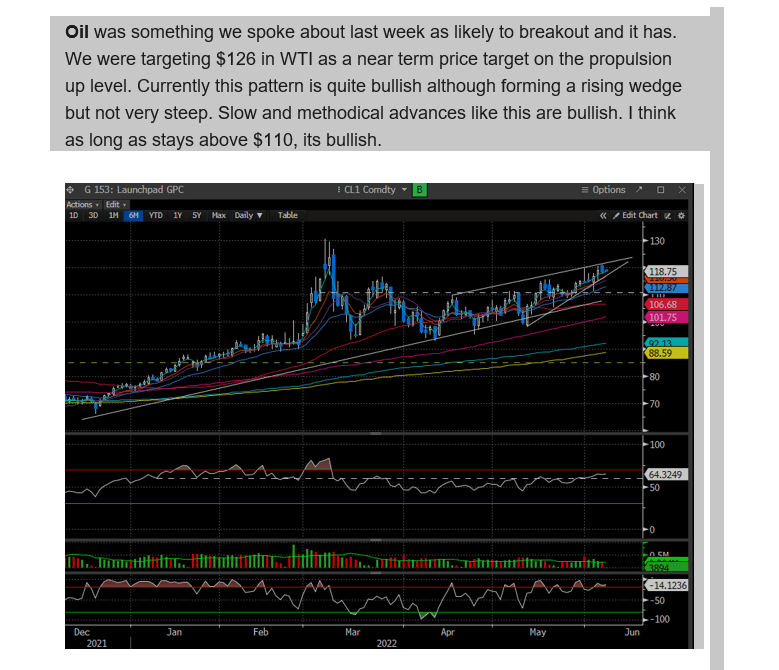

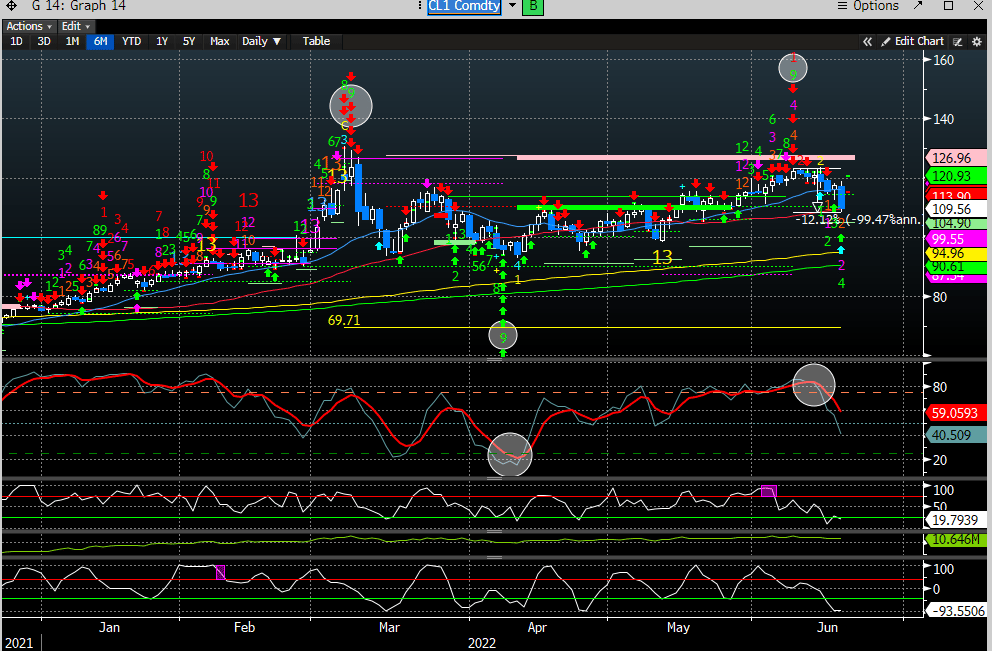

We remember this because, on the same day we wrote this newsletter, expecting oil to top soon. We advocated to tighten stops on longs in energy stocks as believed they could roll over if the commodity got hit. Here is an excerpt from that report:

Since Cramer's timely call to buy energy, the commodity has declined -12% since the DeMark 9 sell printed and the XLE (oil stock ETF) has declined -22%. Maybe he should subscribe to our service for $19.95/month?

More on our energy thoughts later...

We also wrote in a mid week report 2 weeks ago to consider shorting the Russell and since then it is down -14%.

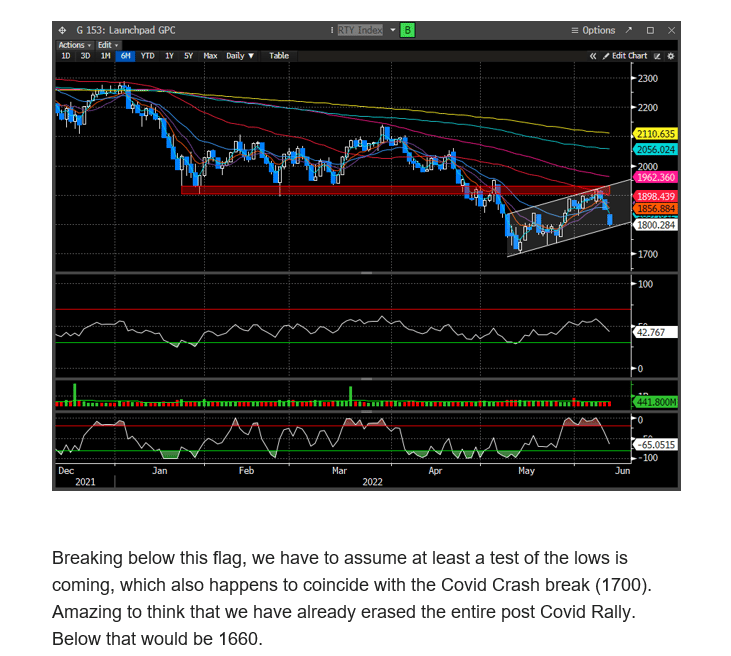

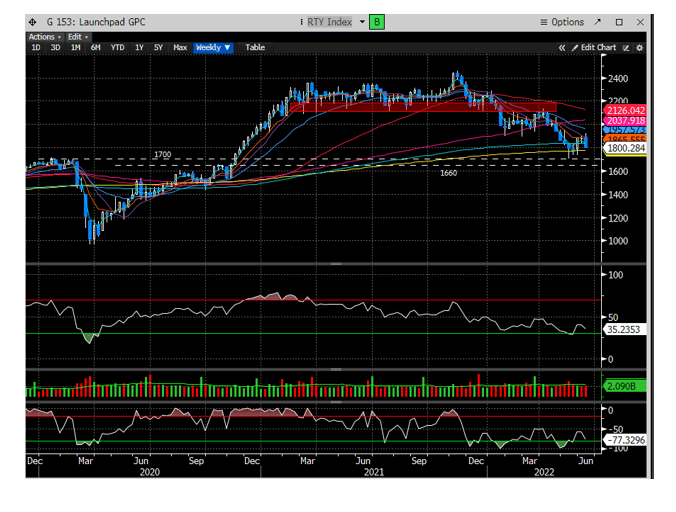

Last weekend we also wrote to expect some continuation in the Russell if it broke this bear flag, which would likely lead to a test of 1700 and then 1660. 1700 was defended at first touch but gave way soon after. We closed Friday @ 1665. See excerpt below:

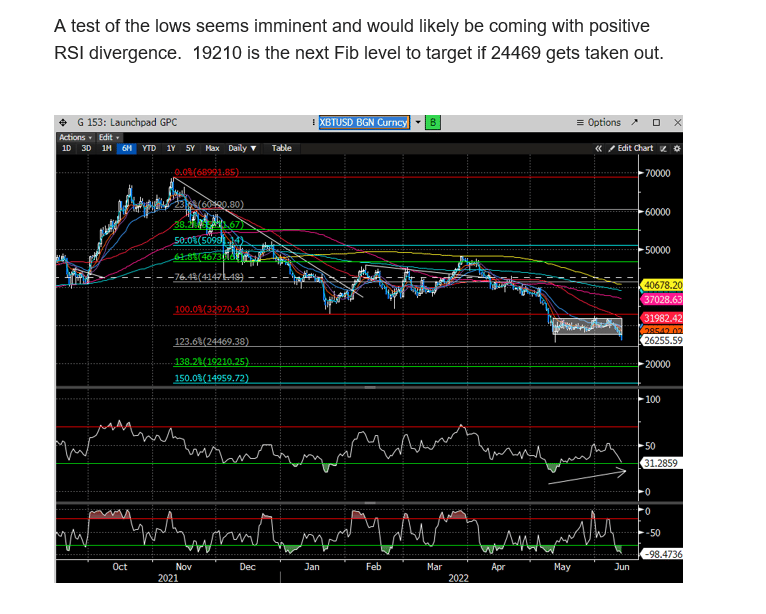

We also have been advocating for months to avoid Crypto and last weekend we wrote if 24469 gets breached for Bitcoin to expect a test of 19210. As we write this its trading @ 19480.

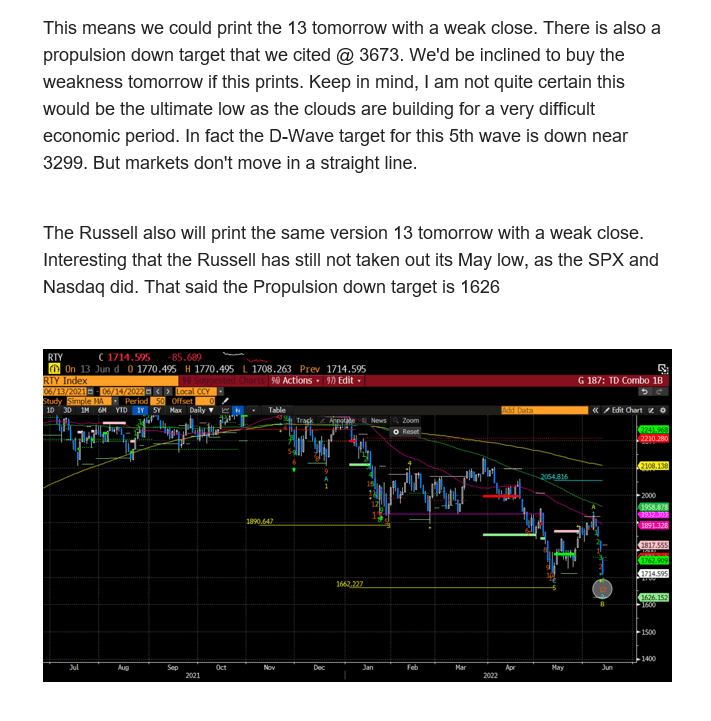

We also wrote a mid-week piece discussing a potential trade into FOMC.

The Index did see a quick trade for +100 handles post FOMC but quickly gave that up the next day. Our level to consider longs was tested (3673) - We closed Friday @ 3674. The Russell got as low as 1640 and did not clip our 1626 level.

While the FOMC was not the catalyst for a sustained tradeable bounce, we see some interesting things lining up for this week when considering how to position.