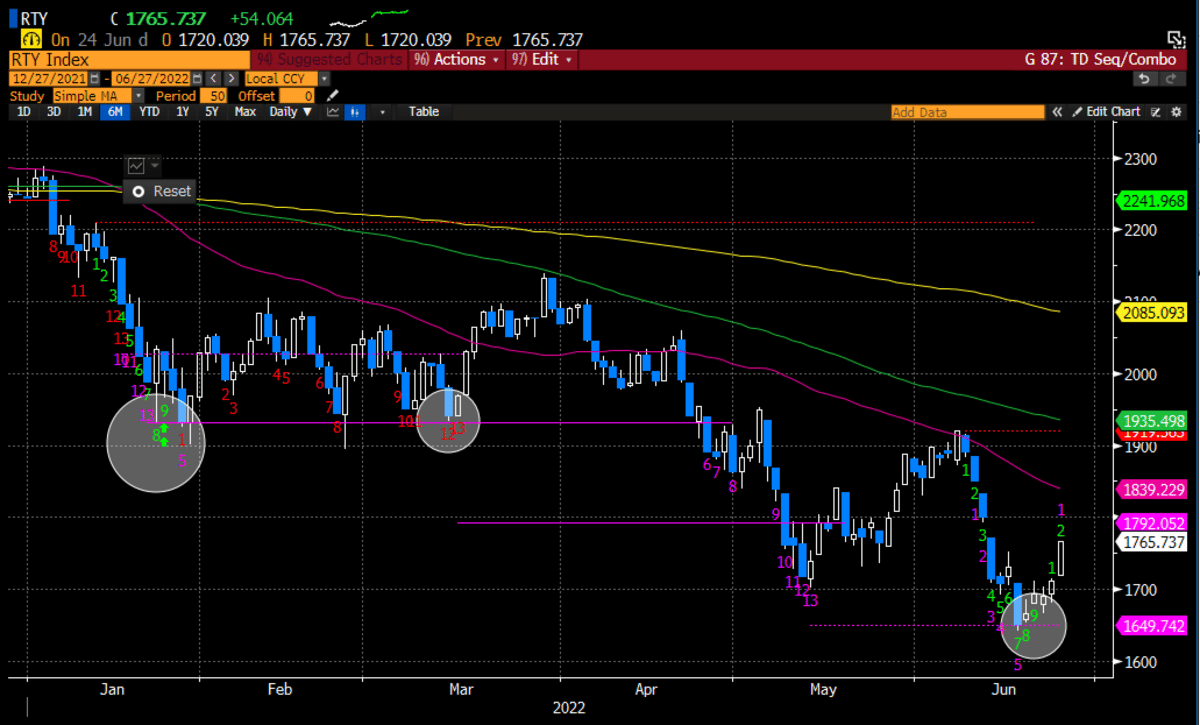

In our last weekend report we discussed the possibility of a new sequence of DeMark signals printing on Monday (9-13-9) and to expect a rally. This after the Combo version 1B 13 printed the week before. The strength on Monday negated the ensuing 9 counts to complete the pattern for most major indexes, except the Russell.

Regardless, our weekend report discussed quite a bit of confluence to expect a counter trend bounce and our update mid-week confirmed to stay the course. The market is up considerably since our call last Sunday to position for a long index bounce. We discussed 3 targets for that upside bounce and the first was hit (3900) on Friday. Is there enough juice for the remaining 2 targets?

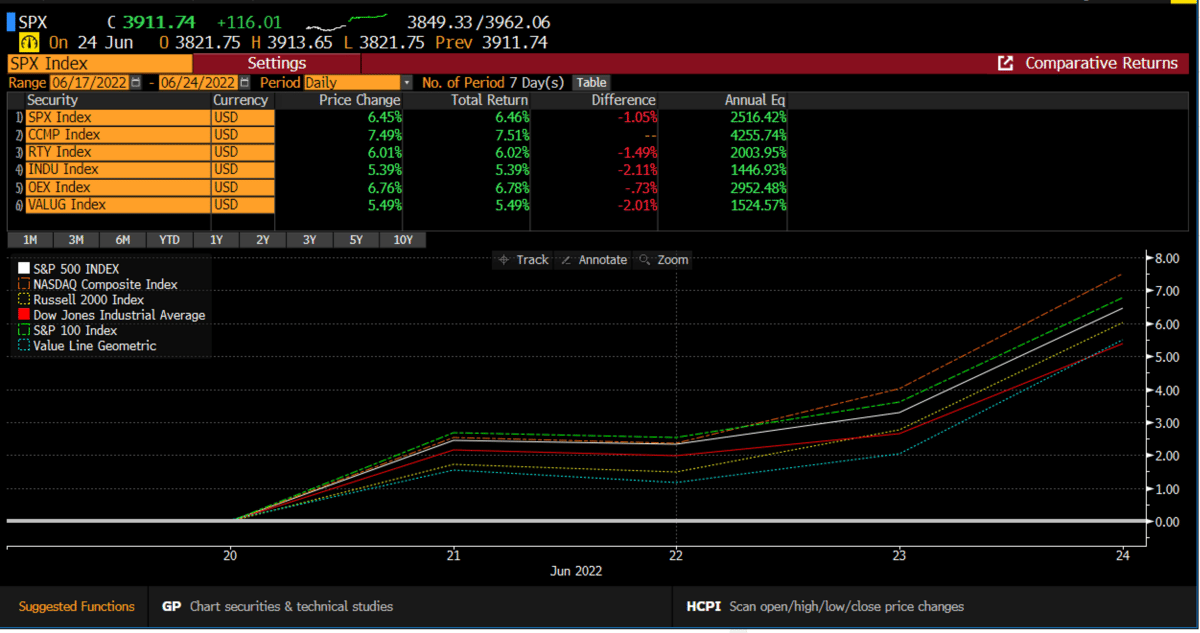

Here is the performance of our newsletters premium calls over the course of the last week.

SPX +6.45%; Nasdaq +7.49%; Russell 2K +6.01%; Dow Jones +5.39%; S&P 100 +6.76%; Value Line +5.49%.

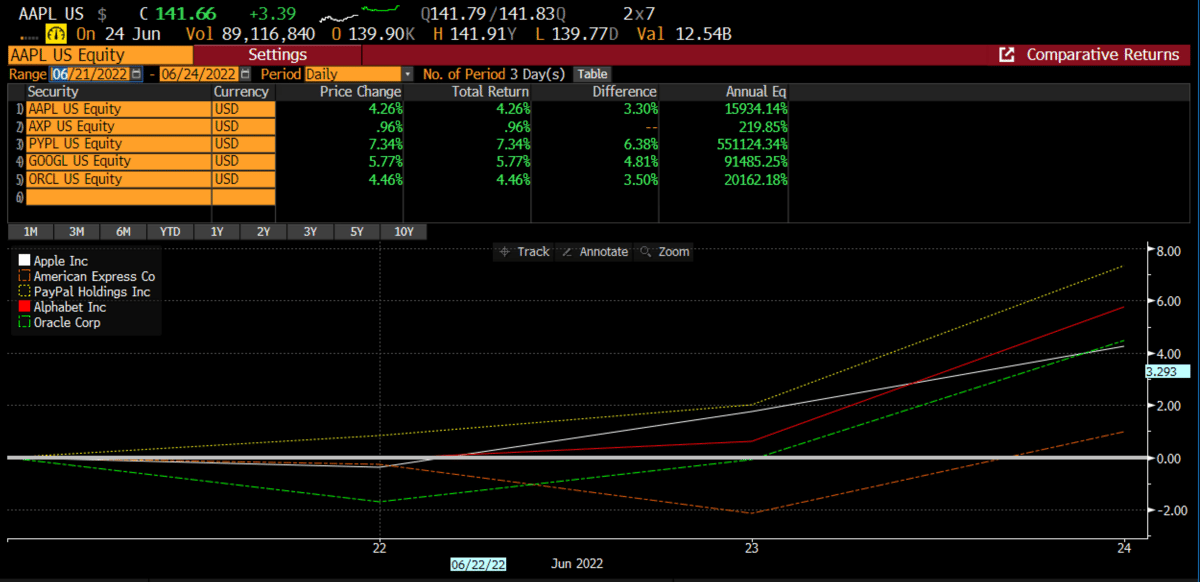

We also sent a mid-week update (Weds pre-mkt) with a number of individual stock set ups to consider - here is the performance since:

AAPL +4.26% (actually +9% since we first highlighted on public twitter); AXP +.96%; $PYPL +7.34%; GOOGL +5.77%; ORCL +4.46%

Part of our thesis for a counter trend rally this week was the roll over of rates. Since the combo 13 sell on the daily, the 10 year is down almost -15%.

Lastly, we did make the case for trading Bitcoin and Ethereum long on the DeMark buy signals. Both had good weeks.

Bitcoin is up +24%

Ethereum is +45%

So for the price of a gourmet salad ($19.95/month), premium members received some pretty outstanding calls.

How should we think about the upcoming week?