This week's Macro report is a day delayed as I was caught unable to return home until now. Thank you for understanding.....

2 weeks ago we wrote to expect a bear market rally and that occurred. This week we advocated to sell strength as the market had some overbought signals that needed to be worked through but also a few other macro headwinds to consider.

Let's review last week's Macro report to see how things shook out. We have been advocating that the market may have put in an intermediate term low a few weeks ago and to expect chop until new data presented itself. We posited that the jobs # on Friday could spook the market and we were right.

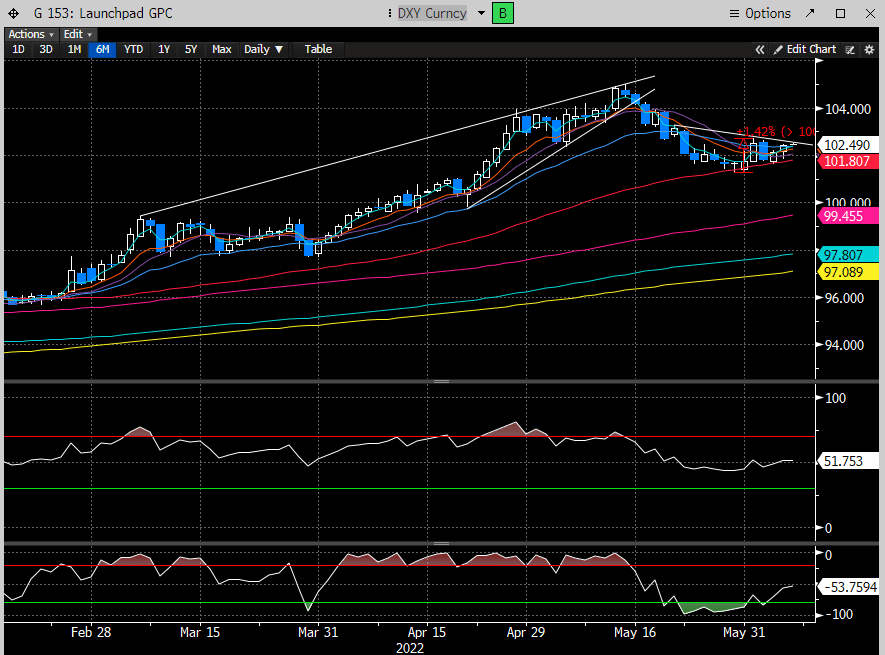

We also highlighted that the 10 year and the dollar could see reversals and would pose a headwind for the market.

DXY was up +1.5% at the high last week and the US 10 year was up +12.5%

The stock market last week was clearly choppy and finished the week in the red.

We also discussed our view that oil was about to break higher, and if gets much higher would not be good for the market. WTI closed +3.3% for the week.

We have a new opinion about oil's direction in the intermediate term which we will discuss shortly.

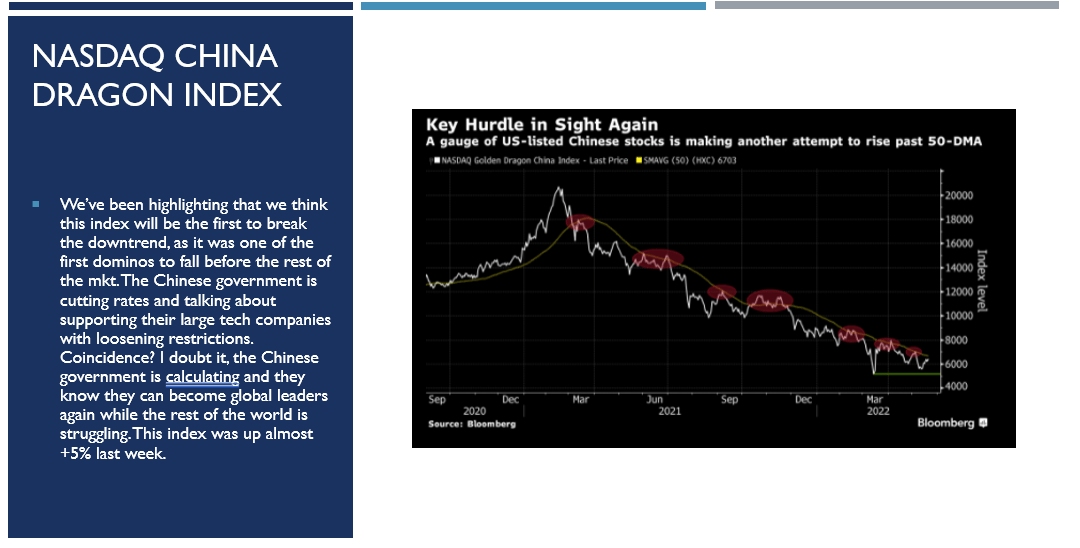

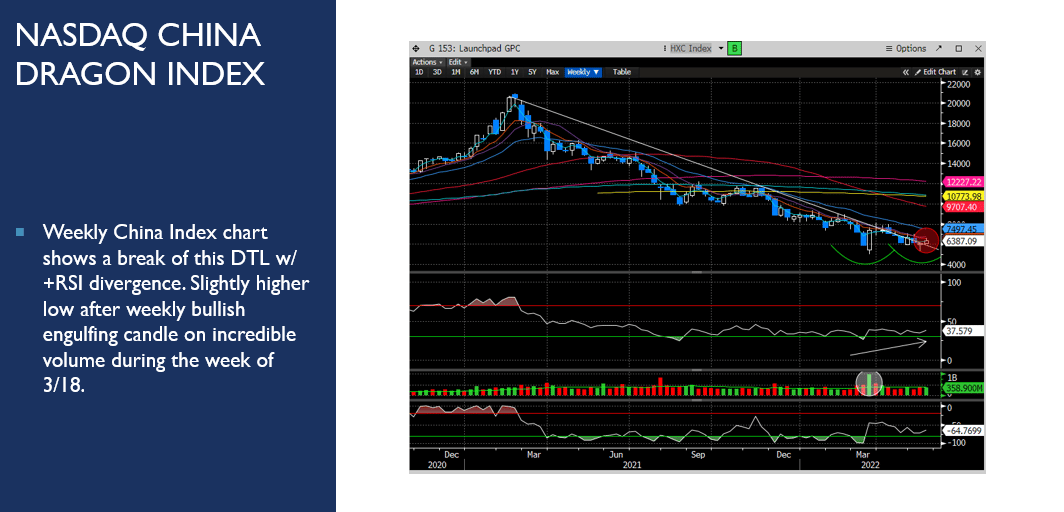

If you are a subscriber than you know that we have been advising new long entries in only 2 sectors: Energy and China. I believe we may have been one of the few recommending China stocks 2 weeks ago and we have had quite the run since. In fact, the Nasdaq China Dragon Index is up +20% since we started recommending it in the Macro Report.

See our slides from the report 2 weeks ago:

More on this topic discussed below.