Bank contagion is a dangerous and very serious concern. Most people who have been trading for less than 14 years have little experience in understanding the implications. I suspect as the week unfolds, we will hear similar stories to SIVB (i.e. Signature Bank closure at the time of this post), who miscalculated their own risk, held too much treasury paper, too much exposure to high growth tech companies and VC’s, and put their depositors at risk. When a company cannot shore up their capital holes, they go bankrupt. When a bank cannot, the FDIC takes over. This is what happened to SVB. SVB is the 15th largest bank in the USA, and an SPX 500 company. This is not small potatoes, and the risk of contagion is very real. How meaningful is hard to say, but my thinking is the contagion will be minimal and focused on smaller banks with smaller deposit bases. Large banks are heavily regulated and have been stress tested to avoid a repeat of 2008. This means large money center banks should be fine and be able to whether this storm. In fact, they should emerge victorious as the smaller banks struggle to maintain their depositor base. Rising rates is great for loan spreads but expensive to keep their depositors in place. Losing depositors is one way how banks get themselves in trouble. The carnage last week in some of the regional banks was astonishing and reminiscent of ‘08 when bank exposure to toxic paper was opaque and pervasive.

So, what does this mean for the market? It’s hard to say, this sort of exogenous shock can shake confidence and lead to more carnage as fear of the unknown builds. Some refer to this as the “cockroach theory,” where there is never just one.

We also have to assume 2 banks going under in the same week has to grab the attention of the FOMC. Recall what we’ve been saying since last year, the pace of interest rate hikes is unprecedented and likely to break something. Things are now breaking.

How did the bond market react to this event? Quite meaningfully.

Last Weds there was a 74% of a 50bps hike for the March meeting. This has now been reduced to 33%. Prior to this week the Fed Fund Futures market was pricing in cuts starting in Nov and now that has shifted to July.

The bigger question is, has the Fed gone too far with interest rates? Is this the seminal moment where the curve starts to un-invert. If you recall, when the curve un-inverts, this means the Fed is behind the curve, and has to cut rates fast to keep liquidity in the system. When this happens, the damage is already done, and the economy is likely headed for a hard landing. Bank contagion can certainly be the reason as the Fed floods the economy with liquidity to stem a banking crisis.

In our mid-week report we discussed the notion of short-term rates topping out. While that call was correct, we’ll be the first to admit, it was purely a technical call. Bank contagion was not on our list of reasons to expect a reversion in rates.

Here is an excerpt from that report:

“We have written a few times that the stock market cannot sustain any rally with the trajectory of rates continuing to push higher.”

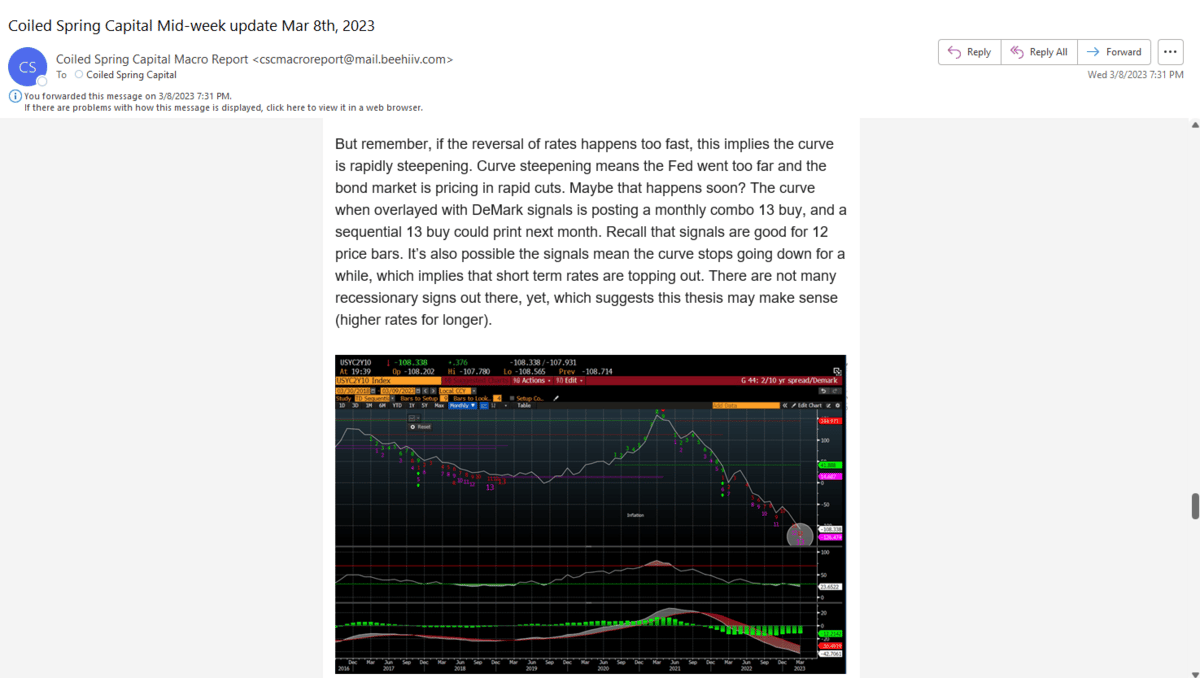

“There is now signal alignment for the monthly as well, which printed the 13’s 4 months ago. So, more confluence in signals to support at least the stalling out of the ST rate trajectory.”

“But remember, if the reversal of rates happens too fast, this implies the curve is rapidly steepening. Curve steepening means the Fed went too far and the bond market is pricing in rapid cuts. Maybe that happens soon? The curve when overlayed with DeMark signals is posting a monthly combo 13 buy, and a sequential 13 buy could print next month.”

This has suddenly turned into a treacherous market. While we were not positioned short for this last move, we did exit most of our residual long positions prior to Powell’s speech, near 4100 on the SPX. Our last communication from our mid-week report was:

“The market is quite tricky right now, as the set up to be long or short remains difficult with all the macro cross winds…The market could swing meaningfully lower in the NT. While we see the potential for ST rates to start topping out from a DeMark and technical standpoint, the NT macro news can still trump the signals in the very ST.

“Sometimes being patient and waiting for the fat pitch to re-engage is a better strategy vs swinging at every pitch. Thus we will remain on the sidelines until the picture becomes more clear.”

Did the picture just get murkier or is there opportunity amidst the carnage? Let’s dig in deeper….