Are we in the midst of a banking crisis or has the Fed put in enough back stops from seeing everything cascade lower? It’s a question that nobody has the correct answer. The reality is we are now operating in a very gray period. Gray periods in the stock market, otherwise known as periods of uncertainty, are notoriously hard to predict, fraught with volatility, and driven by every datapoint and major news item that hits the wire. The media and Fintwit “experts” will have you believe they know how this going to play out. We promise, they don’t. As we saw in 2018, the Fed raised rates into an impending slowdown, put “QT” on autopilot, and the markets reacted aggressively lower when they pushed things too far. The ensuing reaction from Powell was to pivot to rescue the markets. Will the same thing happen this week? We can surmise the outcome, but the reality is we simply do not know. We know the Fed is in a “powder keg” scenario, facing stubbornly high inflation and employment, coupled with facing a potential banking crisis that is being driven by the trajectory of rate dynamics. They can balk at the banking crisis and keep pushing rates higher and risk more calamity, or deal with the fallout from higher inflation and hope a years’ worth of rate increases finally does what its intended to do. Coincidentally, banking issues should slow down the extension of credit as banks are forced to protect their businesses and tighten up their lending standards.

This is an interesting chart from Goldman Sachs detailing how much lending exposure the US has to small and regional banks.

“Small/medium banks account for 50% of US commercial and industrial lending, 60% of residential real estate lending, 80% of commercial real estate lending, and 45% of consumer lending.”

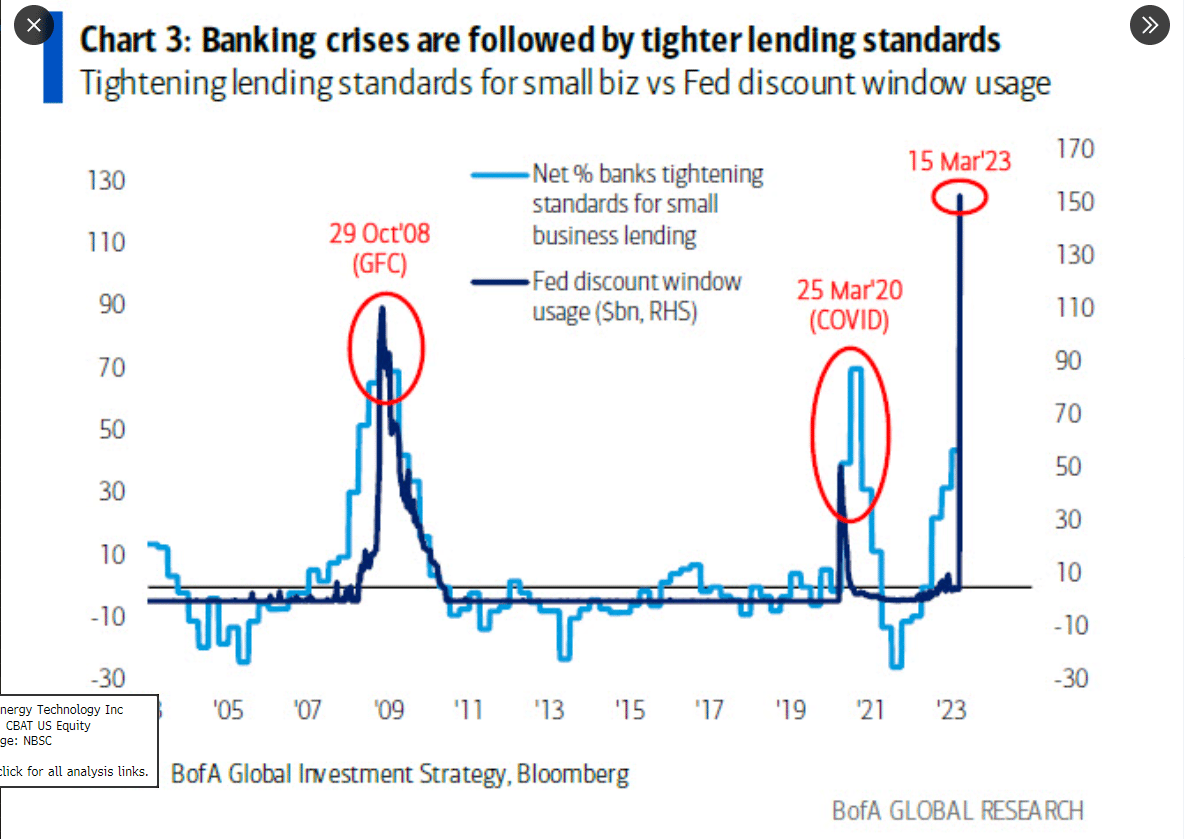

This implies any restrictive lending activity at the small bank level will undoubtedly have reverberations across the economy. This is evidenced by this chart from Bank of America indicating such.

Economies are built on credit and liquidity. Choke off that liquidity and activity will undoubtedly slow. This seems like an easy decision for the Fed. Why press rate rises too much further if the desired slowdown in activity is currently in motion now that small banks are teetering on the brink of oblivion? We don’t think they will, and we stick to our 25 bps raise forecast for this week with the likelihood of talking up a more dovish outlook. Do we know this for sure? Of course not, which means tread carefully. The risk of an ‘18 style meltdown, if he stays hawkish, is real, in our opinion.

Fortunately, last month, we took off our large tactical bullish index and growth stock positions. We sold into the FOMO of the crowd pushing a “no landing scenario.” We balked at that notion and have since seen the market come crashing back down to earth.

Here is an excerpt from our Feb 2nd (stock market peak) report:

“The euphoria is certainly building, and if you bought well, this is a good place to exit those longs unless you have duration. We have taken off almost all tactical long exposure and will look to revisit some of these ideas on the next reversion. “

Here is how the market has fared since exiting our long trade in Feb:

SPX -6.3%; Nasdaq - 4.67%; Russell - 13.76%; Dow -6.44%

Of course, we did not know that a bank crisis would unfold, but we did know the market was getting a bit frothy and undeservingly so. This coupled with our proprietary signaling analysis, kept us out of trouble and holding on to our massive YTD gains.

Sentiment has now completely flipped. 1 month ago this index was in the “Greed” zone, and now it is in the “Extreme Fear” zone. As described above, we sold that FOMO last month, and now the bears are pushing for new lows in the indexes. If fear is this palpable, does the market typically reward the masses? NO!

We are not suggesting the market can’t trade lower. We described the scenario above where that can very well happen. But when the boat is so loaded on one side, rarely does the market reward such herding.

At the time of this writing, UBS has agreed to takeout CS. CS is a very large global bank, and their counterparty risk is not something to take lightly. This is likely why large cap banks were hit so hard on Friday. If CS were to fail, the fallout could be catastrophic. Shoring up this situation is certainly a positive, but risks of further bank deterioration is still lurking.