We were not able to get the mid-week report out as we were traveling, and our Thursday flight didn’t end up getting into Austin until 2am. Normally scheduled reports will resume this week.

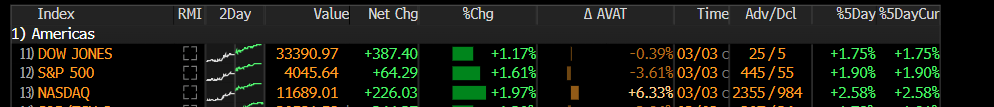

Last weekend we wrote that a bullish turn in the market could happen around mid-week. We were starting to hit OS metrics on various instruments and DeMark signal alignment was coming into view. This after removing our tactical sell/short position into the confluence zone. Last week the market had its best day in a month.

Let’s review how we have been positioned since the start of the year. We were heavily bullish for all of January and positioned for a stock market rally. We elected to buy growth stocks which significantly outperformed any other sector by a wide margin. We sold that entire long position into the FOMO in early February, and turned tactically short into the last week of February. We then suggested getting tactically bullish in the middle of last week.

Here is an excerpt from last weekend’s report depicting our new tactically bullish index view:

How can we nail every swing in the market with that level of precision? We have been studying markets for over two decades, and we have developed a proprietary methodology for identifying trend changes. Sometimes those trend changes are very short term in nature and sometimes they are longer tailed. Our goal is to give our readers the best tools to gain edge in the market. We don’t simply react to changes, we anticipate them. Identifying trend change is an art, and even some of the highest paid so-called experts, have zero ability to identify material changes in market structure with any sort of accuracy. We spent the bulk of our career on Wall Street working for investment banks, and we can honestly say that most of what you read out there is only correct half of the time. We think that’s mediocre, and if you are sick of mediocre, we encourage signing up to see the balance of our analysis and improve your chances of winning in the market.

Being agnostic to market direction helps us keep an unbiased view for where the stock market is headed. If our opinions don’t line up with our signaling methodology, then we choose our signals over our opinions. The incessant bear rants on Twitter and in the media when the market is down, as it was in February, is laughable. They think they can talk down the market with their loud tweets and TV appearances. We are not debating whether their fundamental view is wrong, in fact we think fundamentally, the economy is in a tough spot. Inflation seems to be reaccelerating and the terminal rates are pressing higher. Meanwhile the stock market is expensive, especially considering the risk-free rate is 5%. This is certainly a head scratcher if you are a bear. Remember, the stock market is not the economy, and every day that passes, we are one step closer to recovery.

Liz Sonders from Schwab has an interesting take, calling this a rolling recession. Meaning, we are seeing pockets of recessionary data: (Manufacturing, Housing, Tech layoffs, earnings contraction). A rolling recession implies various sectors of the economy take turns contracting rather than simultaneously. It is entirely possible that if this is the case, then the action we are seeing in the stock market is somewhat justified, and our comment above, regarding being one step closer to recovery is valid. But we are not here to make that claim. We simply follow our signals, and overlay fundamental logic, to derive our conclusions.

This week is going to be interesting but fraught with risk. Powell is testifying on Tuesday on Capitol Hill, in his biannual monetary policy report to the US Senate Banking Committee. He will undoubtedly echo his recent commentary on inflation being too high and that interest rates will need to go higher. None of this is new news, but if he is more aggressive and signals a move back to jumbo rate hikes, the market could certainly falter. We will also get payrolls on Friday, which has been stubbornly strong. A strong report will bolster the case for additional hikes. The following week we will get CPI. Certainly, a plethora of landmines for the bullish trade.

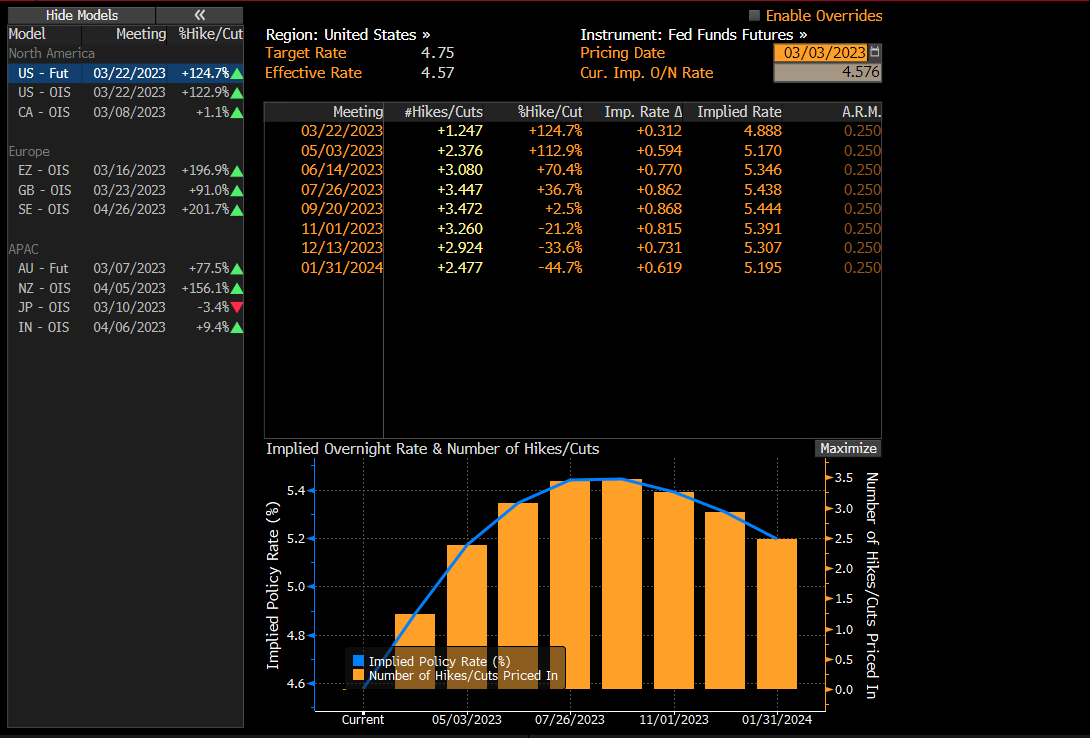

Implied volatility for these events are showcased on this chart. Citigroup seems to think that market is underpricing these events. Regardless, we should expect a lot of volatility.

Currently, the market is expecting another 25 bps raise in March, but these key events could push that to 50bps. That could create a volatility event. Currently March has a 24% chance of an additional 25bps (50 bps total).

This sets up for an interesting week. Do we stay tactically bullish or get more defensive?