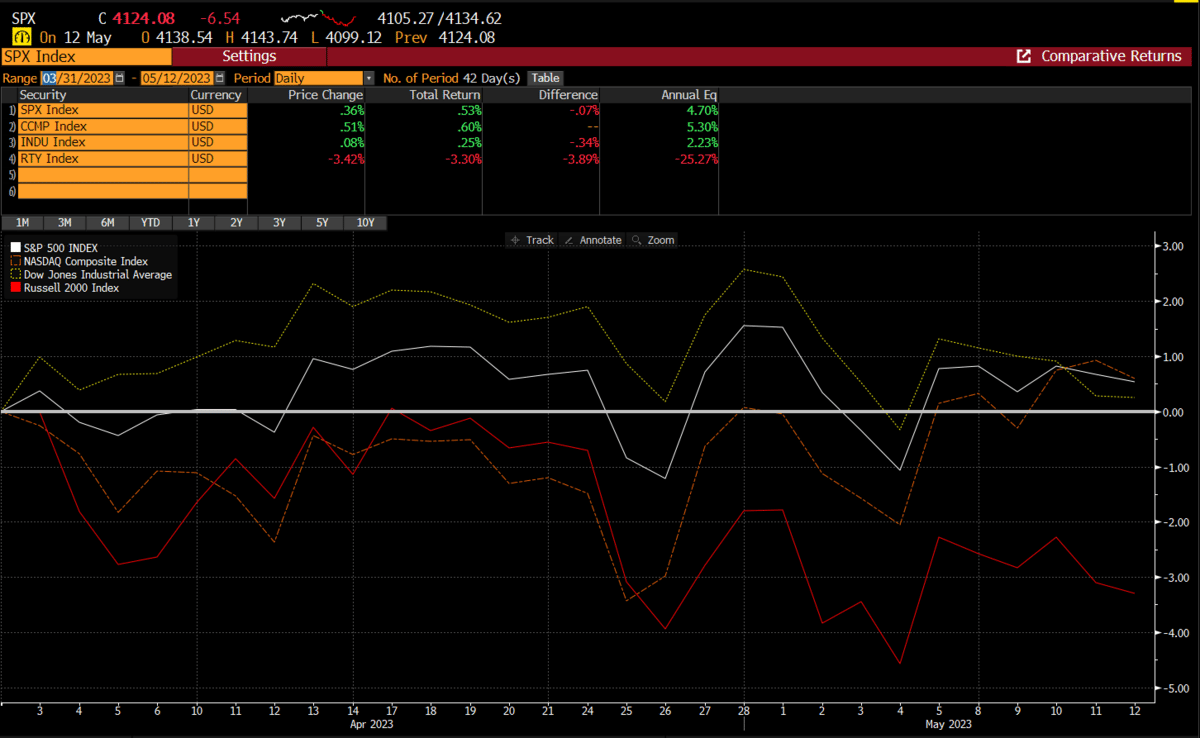

The incessant chop fest in the market continues. Since the end of March, the stock market has done very little. In the last 6 weeks, the major indexes (ex-Russell) have produced a whopping 95 bps of gains, combined. In essence we have gone nowhere.

Sometimes bear markets just tire you out. The constant back and forth with very little progress is a disaster for trend traders, as there is no discernable trend to capitalize on. We have been writing for some time that we think the market will be stuck in a large range and frustrate both bulls and bears. This has clearly been evident since the Feb peak. The issue for the stock market is there is too much anxiety about what the future holds, discretionary investors have no conviction and remain grossly underweight the indexes. Systematic investors have been driving the bus, and the swings are mainly due to them pushing around the indexes with every datapoint, but not enough movement to unhinge the current malaise. Will that come this month or into Jun? Possibly, the bears will certainly tell you it will happen soon. There are a plethora of newsletters published weekly, calling for the bears to crumble the market, but alas, it never happens. Maybe one day they will be right?

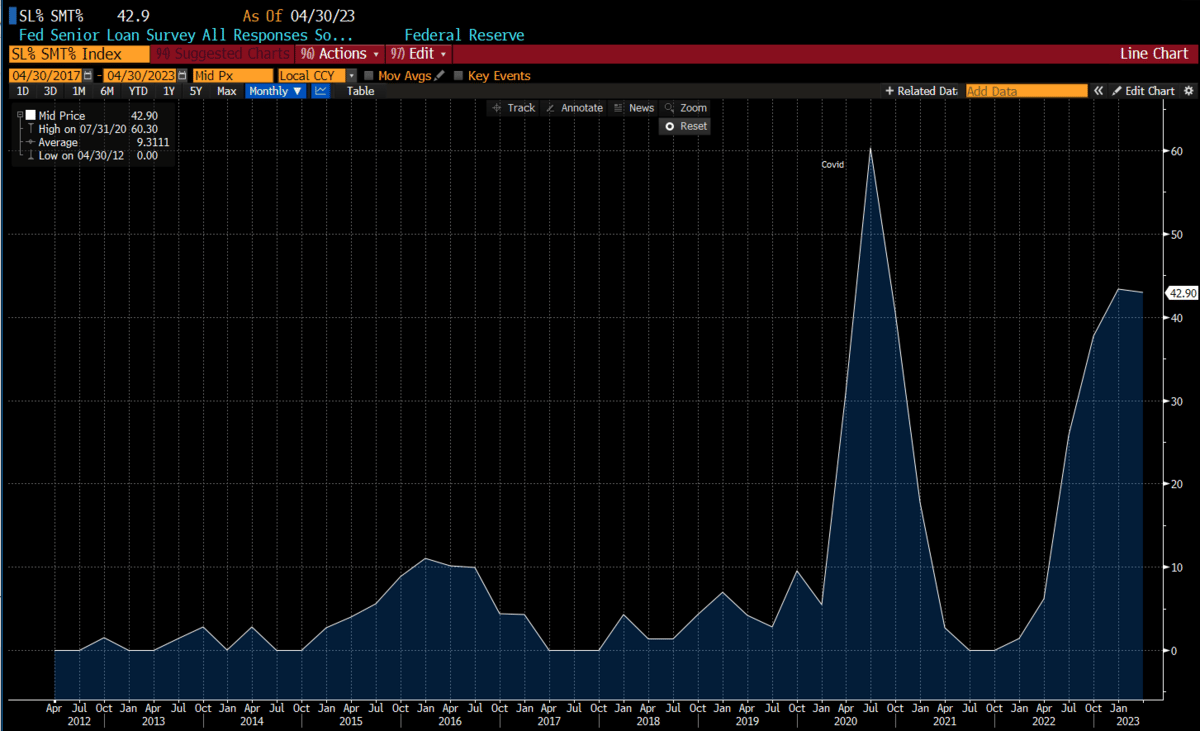

There is no shortage of reasons to be bearish. In fact, fundamentally, we are very concerned. We see potential fallout from the banking crisis only now starting to show its colors. The loan survey recently reported demonstrates how tight credit is at the moment.

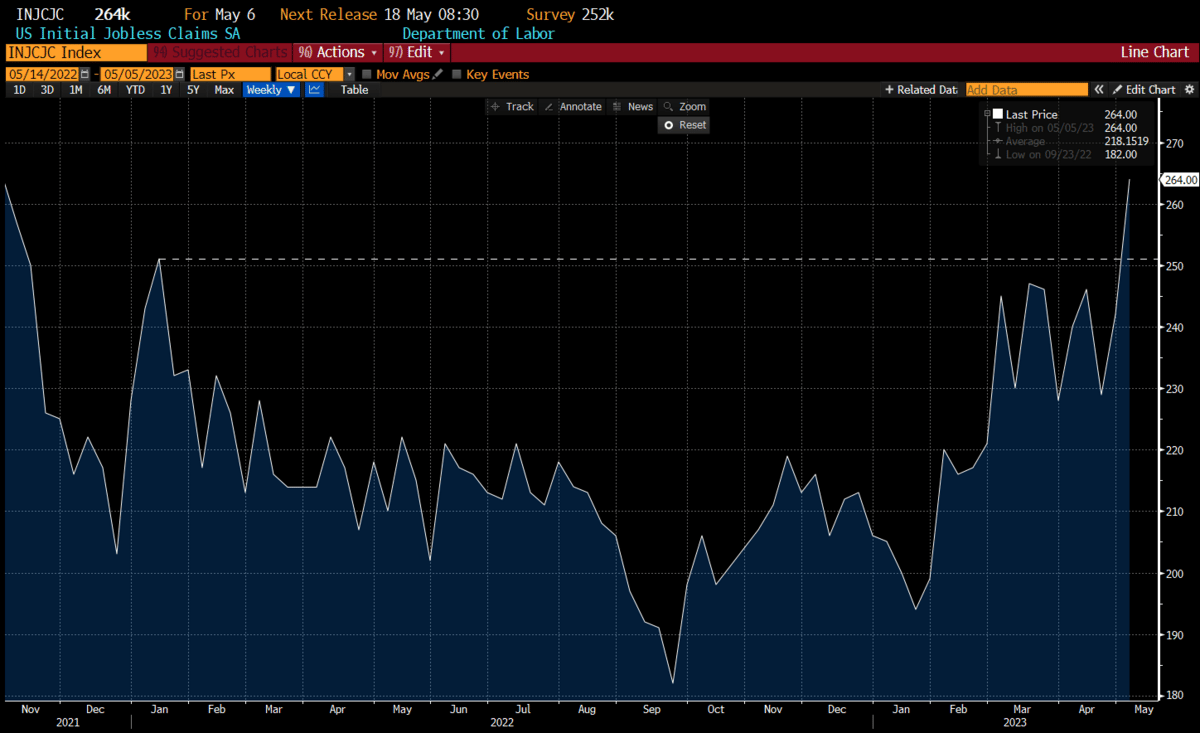

Jobless claims spiked last week and are now the highest since Jan ‘22. Remember, the payroll number is a lagging indicator, and jobless claims are leading.

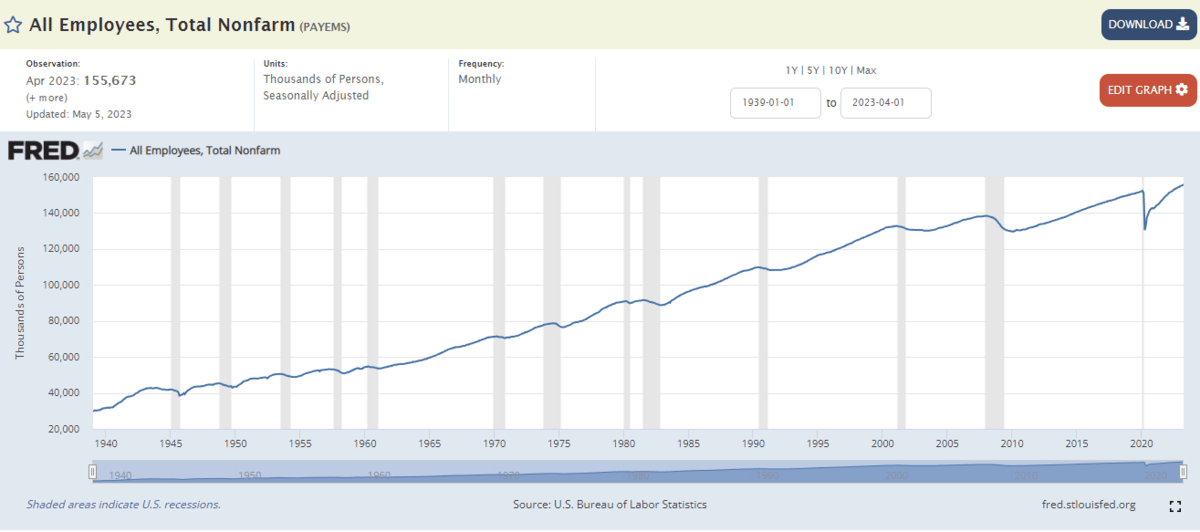

This is a chart from the St Louis Fed and demonstrates that employment drops only when recessions begin, and usually is the last metric to fall as companies try to hold on as long as they can before culling their staff.

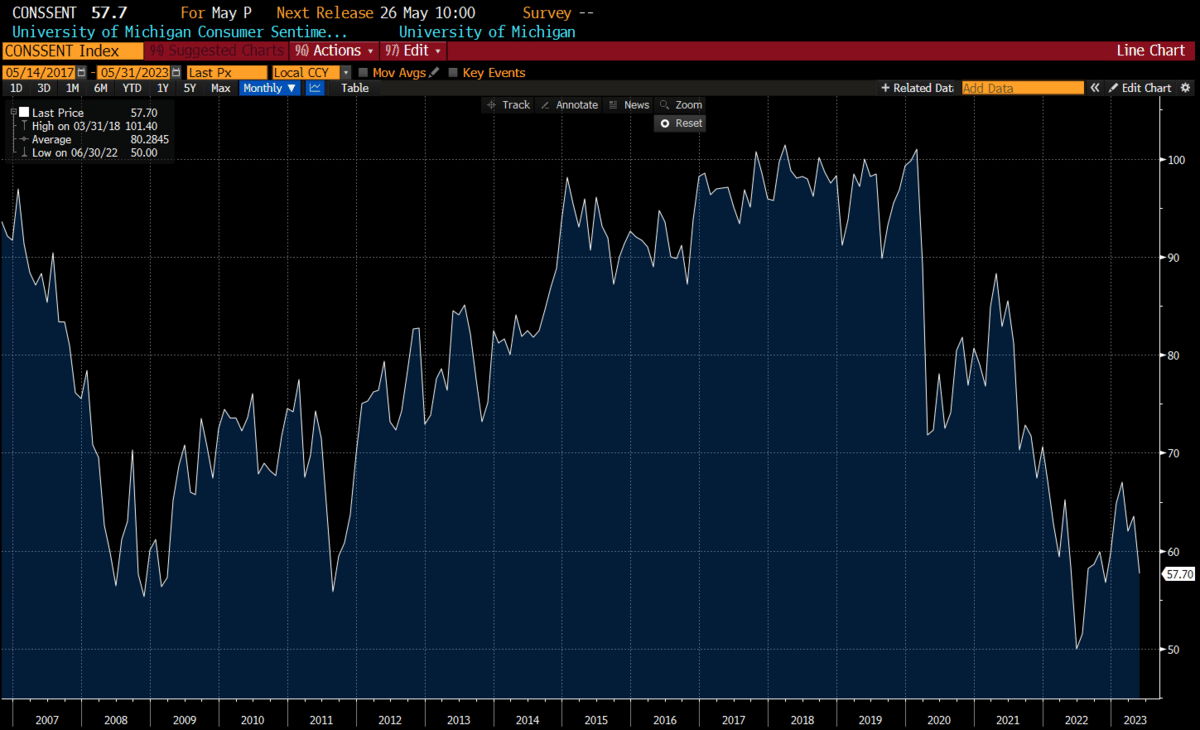

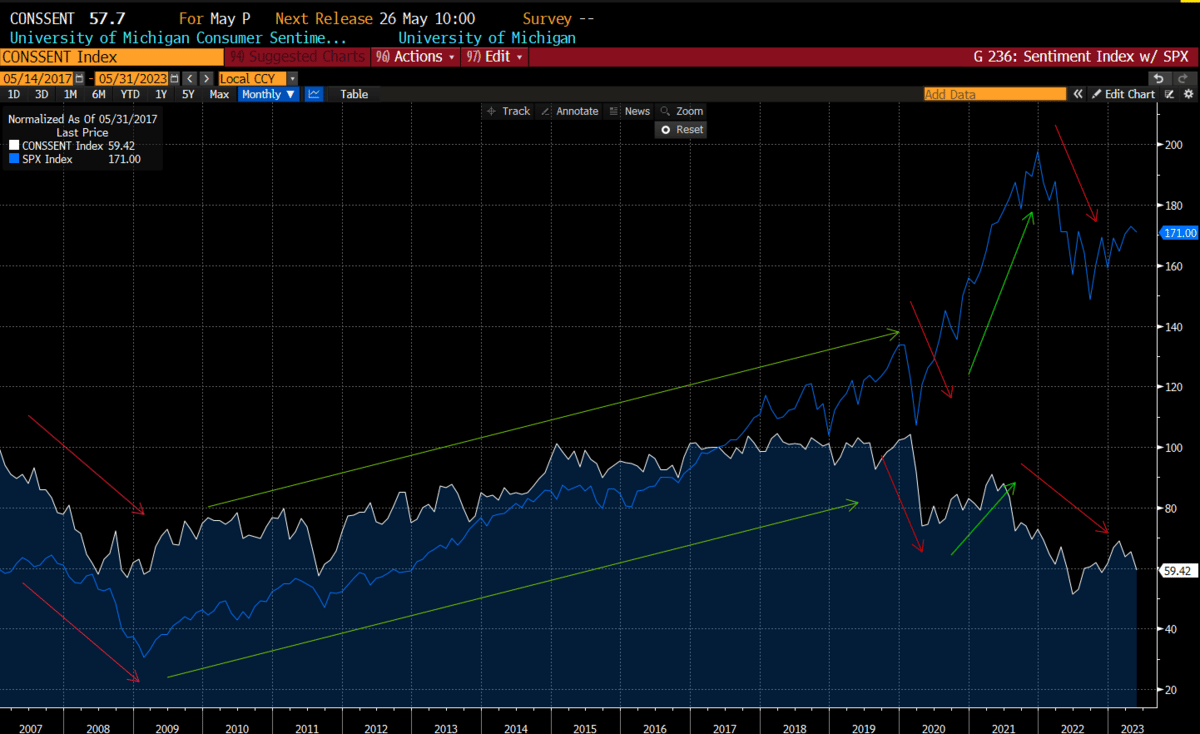

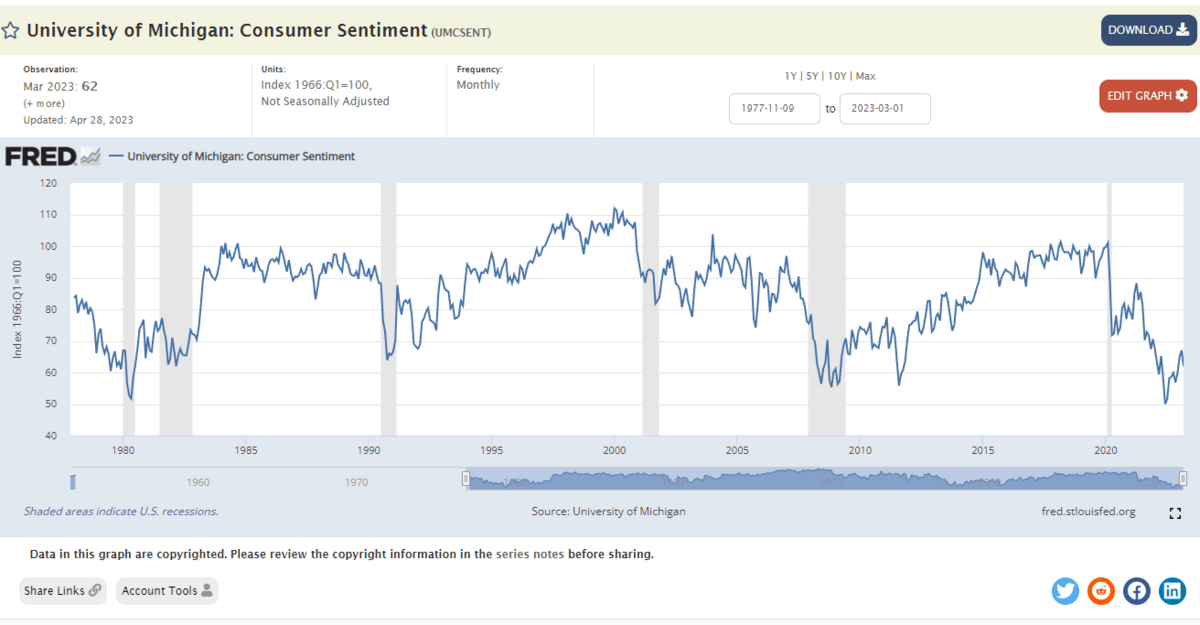

Last week’s consumer confidence missed the estimates by a wide margin (sentiment is a leading indicator). The University of Michigan’s latest survey showed the index plunged 5.8 points, to 57.7 vs expectations in the lows 60’s.

Consumer sentiment is important as US GDP is 70% tied to consumer spending. If they start pulling back, there is a ripple effect across all industries and hence why the stock market tends to track consumer sentiment.

Here is another chart from the St. Louis Fed demonstrating that consumer sentiment typically is in decline before the onset of a recession.

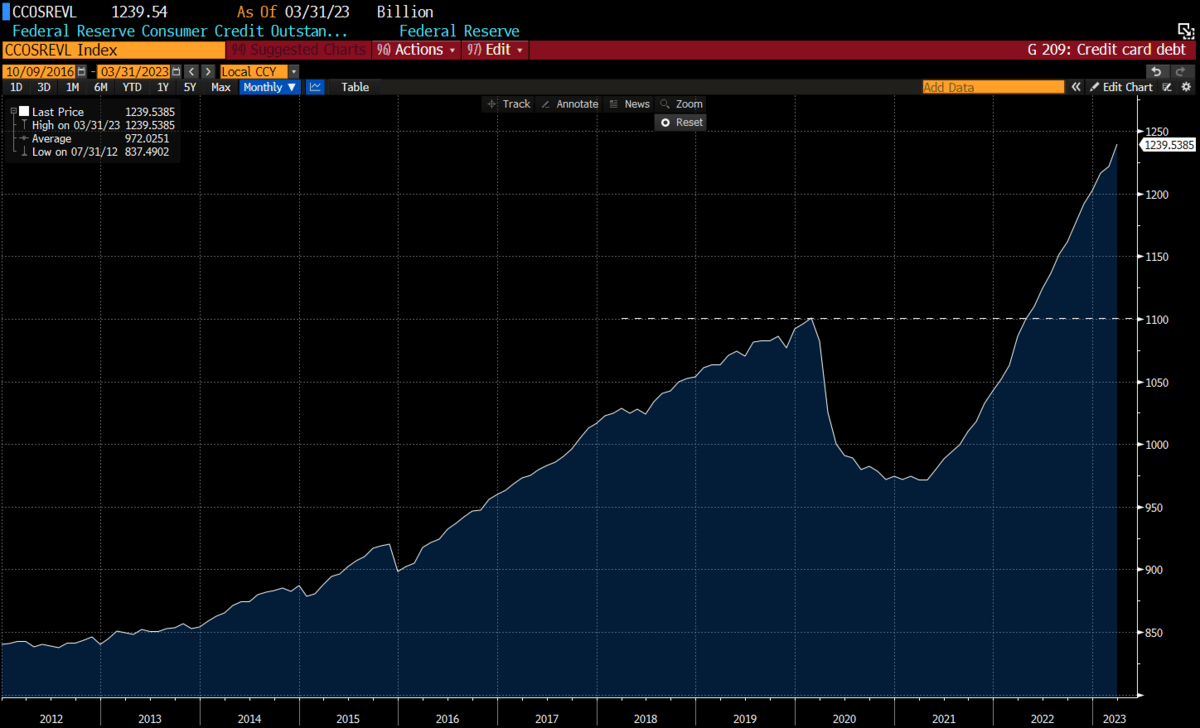

And when you consider this against the backdrop of consumer credit outstanding, the consumer seems to be in a very precarious situation.

The anti-pivoters seem to believe the Fed will continue to press the rate hike rhetoric, with Powell potentially doubling down with his speech this Friday. We disagree, we think the Fed is stuck in a political maelstrom with exceedingly high debt service costs, stubbornly high inflation, a debt ceiling debate and significant macro weakness brewing under the surface. There is enough evidence at the small bank level that we are in a much tighter credit environment than what Fed Funds are exhibiting. This implies the current environment is plenty restrictive and further tightening could be disastrous.

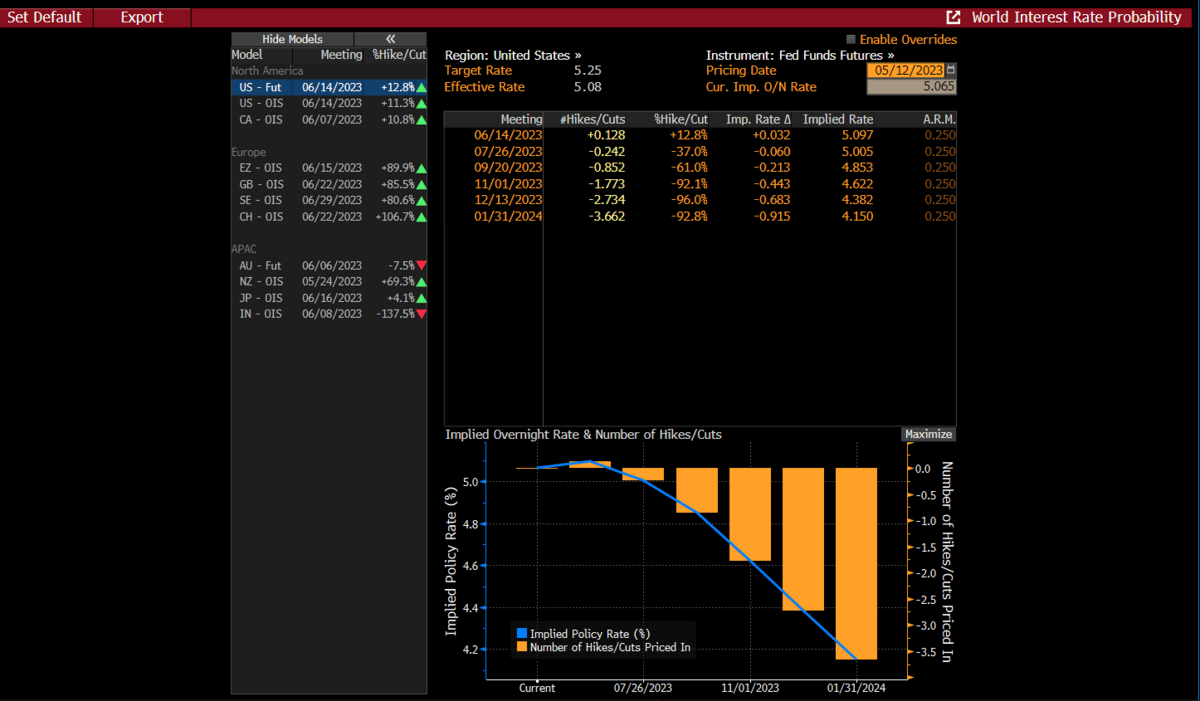

Maybe this is what the bond market is trying to tell the FOMC. Fed Fund Futures are still discounting 3 cuts by the Jan ‘24 meeting.

There is some debate whether the bond market is correct here as the Fed has rarely cut rates with the unemployment rate below 4%. Only 6 of the 124 fed-funds rate reductions since 1971 occurred with a sub 4% rate, and 2 were during Covid, and 3 in ‘19 with inflation running below the Fed’s 2% rate target. The other instance was in Jan ‘01 as the economy was headed toward the post dot-com bust recession.

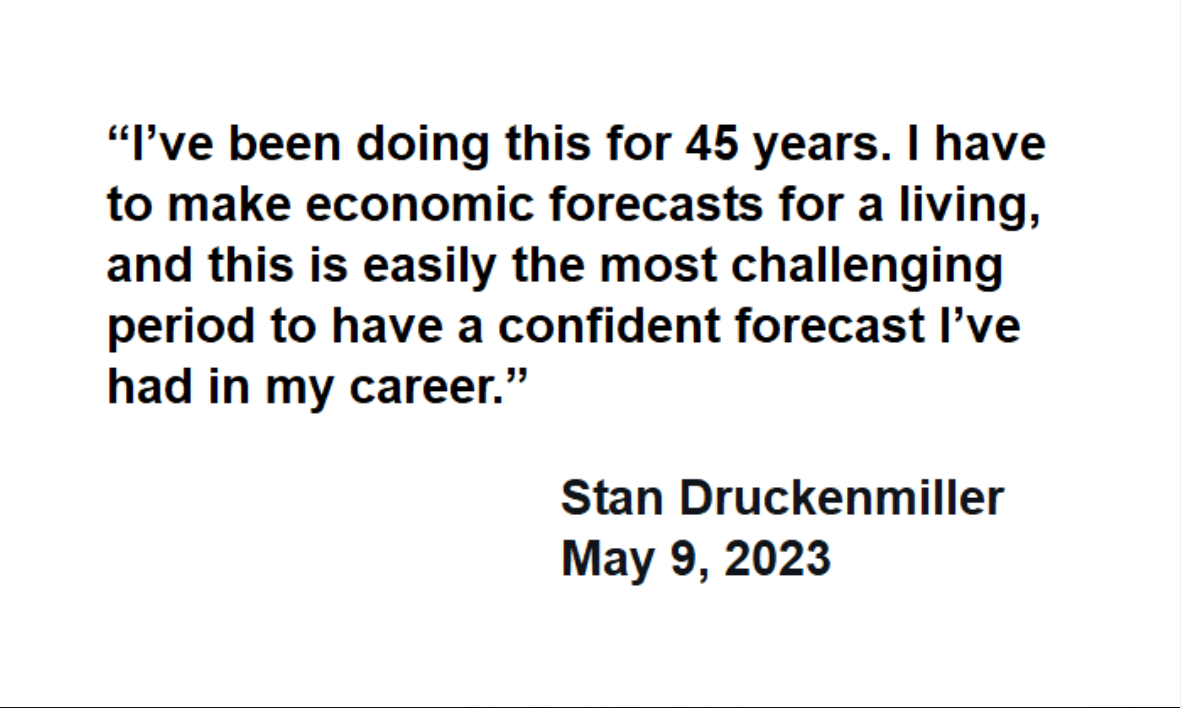

Now you know why the market is having such a tough time deciding on direction. Even Stanley Druckenmiller stated recently that he has confidence which way the economy is headed but he doesn’t have confidence in the stock market’s direction. In a recent interview, he said he was only 60% invested, as a result.

The flip side of this bearish argument is that everyone is bearish. This is the most telegraphed recession in history, and thus most people are positioned bearishly. Rarely does the market do what everyone expects and is positioned for.

While CPI remains elevated, as reported last week, this was the 10th straight month of decelerating inflation and the PPI rose at the slowest pace since early ‘01. According to Bespoke, when the annual CPI rate has declined by at least 500 bps over the previous year, the SPX has put up a median +14.9% over the following 12 months.

As we illustrated above, the Fed Fund Futures are pricing in a pause by the FOMC next month. Stocks have historically done well during a Fed pause, according to Credit Suisse, where the SPX has returned +16.9% on average in the 12 months following the last interest rate hike of a cycle and losing 1% on average after the first cut.

As we have discussed in previous reports, investors are not positioned for a rally. Equity exposure for discretionary investors remains heavily underweight the market and only at the 9th percentile historically, according to Deutsche Bank. Most investors believe a meaningful drop will come allowing them to deploy their capital at lower prices. See comment above about lopsided bearish positioning. Given that most institutional investors are benchmarked against the SPX on annual performance, breaking up out of the current range will undoubtedly force investors back into the market.

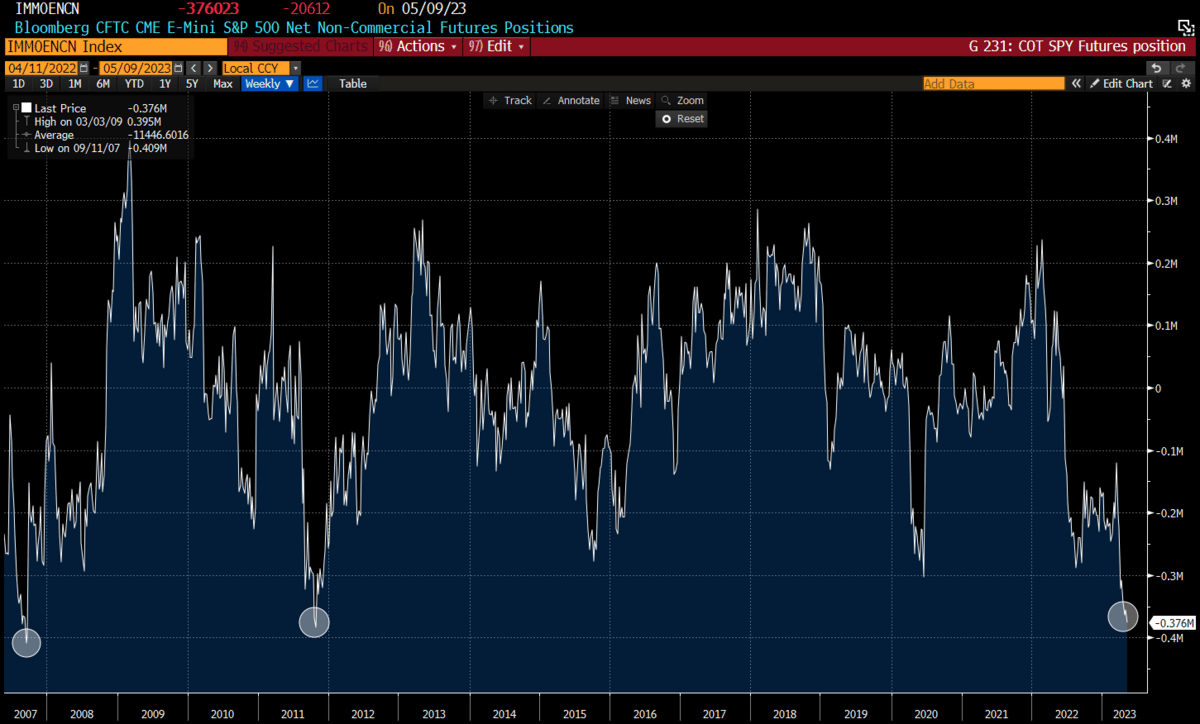

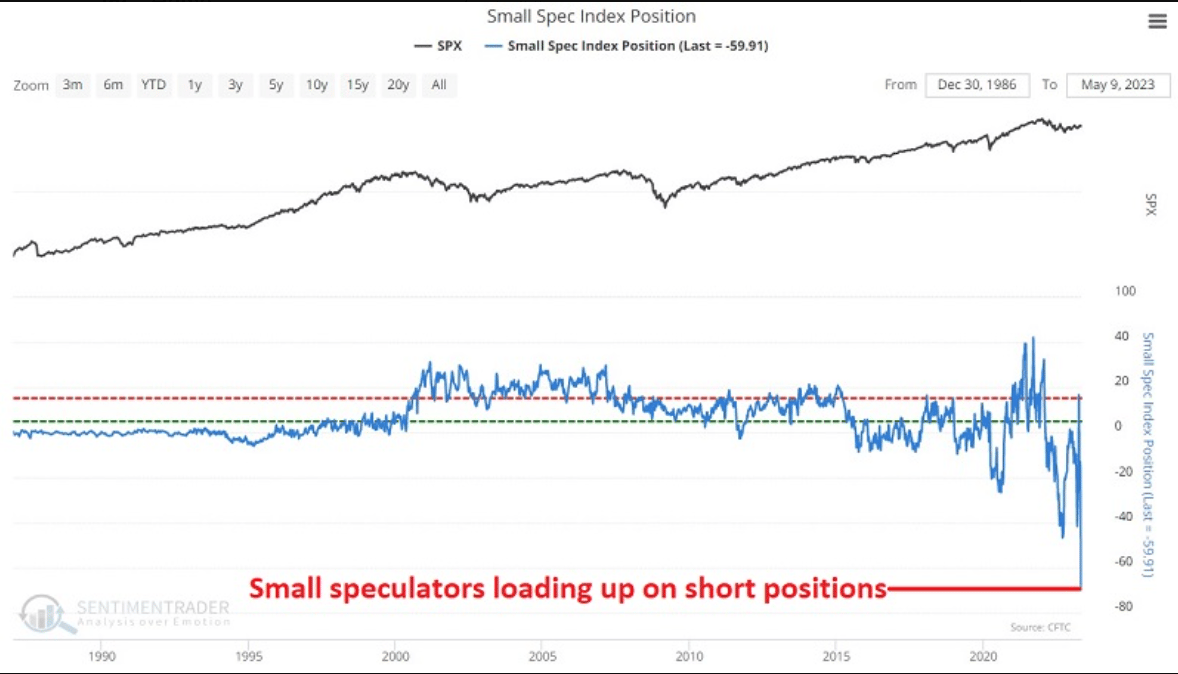

Here is a chart of Net Non-commercial futures positioning. Still heavily net short as implies that any break of the range on the upside could cause quite a short covering rally.

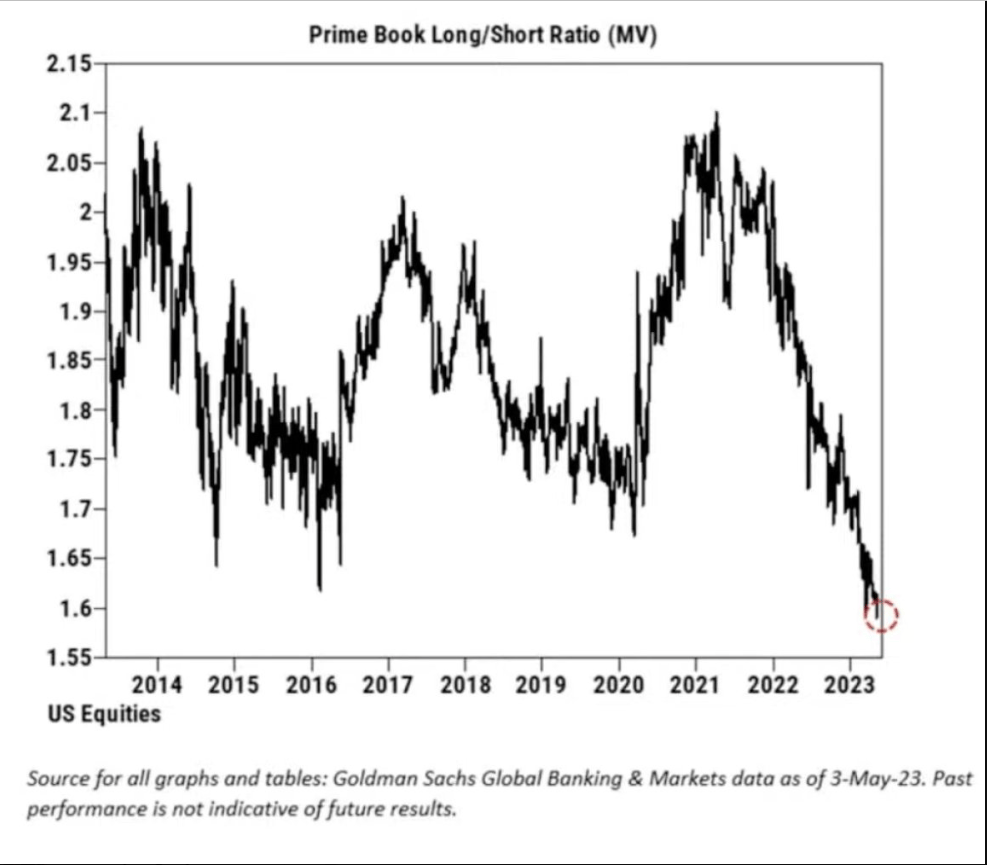

Here is a chart of the Prime Brokerage book from Goldman Sachs showing how lopsided their hedge fund clients are:

And small speculators are aggressively short. Since when does this cohort get rewarded for being so lopsided? We think you know the answer.

Remember, markets like to climb a wall of worry and there is certainly enough to be worried about.

For more detailed analysis of the current stock market landscape and how to position your portfolio, please consider subscribing below.