If anyone is a fan of Phil Collins, then you remember the 80’s song, “Land of Confusion.” While the song has a much more political bent to it, we can’t remember a time where the masses were so confused by the action in the stock market. Bank failures, re-accelerating inflation and a new payroll number that pushed the unemployment rate down to 3.4%. The dual mandate from the FOMC is to raise rates until inflation and unemployment reach their stated goals. After a full year of interest rate increases, at the fastest pace in history, they remain stubbornly stuck at an uncomfortable level. Yet, the stock market doesn’t seem to care. Is the stock market creating a false sense of security for the bulls and the rug pull is coming once it sucks in more investors? It’s possible. It’s easy to paint a bearish picture as there are no shortage of things to be bearish about. The issue with this statement for bears, is just that….”it’s easy to paint a bearish picture.” We can’t tell you how much banter we get on Twitter from so-called armchair macro and economic tourists who think they know a thing or two about how macro cycles work. We have been at this for 2.5 decades and we can tell you that we are always confused, always in doubt about our own convictions, and always willing to accept the other side of the argument. These people are so convicted in their beliefs, so confident that they are right, it screams neophytism. They simply haven’t been at this long enough to be humbled by Mr. Stock Market. So, with that, we give our condolences as their time will inevitably come.

Last week’s job report, showed an acceleration in hiring and pay in Apr as job placements picked up.

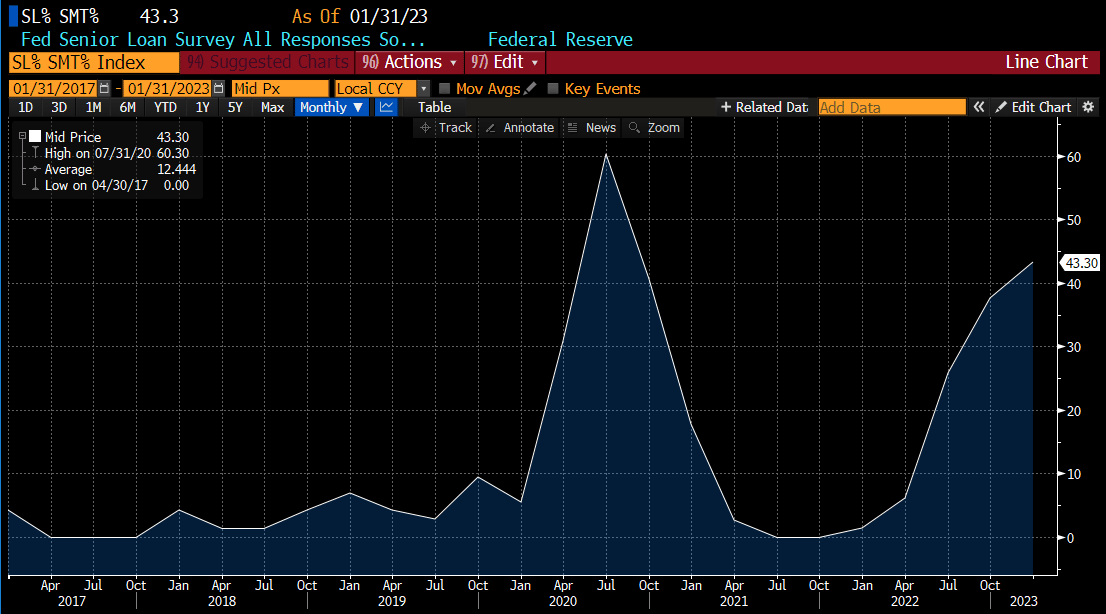

This is certainly at odds with what the Fed is trying to accomplish. Greater employment and higher pay, means more consumer spending, which undoubtedly impacts prices as there is more demand for goods and services. But is this enough to get the Fed to back down off their rate pause rhetoric? We don’t think so, as there seems to be enough momentum within the FOMC to let the rate cycle do its intended job of slowing down economic activity. Couple that with a reinvigorated banking crisis, and the notion of additional credit tightening is real and evident in the loan surveys.

So why does the market rally in the face of re-accelerating inflation and employment? In our opinion, strong employment trends imply we are still a ways off from any recession, or possibly one that is milder than originally anticipated. This would make sense as the stock market seems to be looking past the recently reported earnings slowing banter from the bearish Wall Street Strategists. If the Fed is done raising rates, and the economy is still slowing albeit not falling apart, maybe this is a goldilocks scenario? We don’t necessarily subscribe to this notion, just something to consider as we weigh all options. Remember, price is truth. Which means to not argue with the stock markets price action. The stock market is the collective wisdom of Trillions of $’s of some of the most well-resourced, intelligent people on Earth. Which means our opinions don’t mean much. As Buffet always says, “in the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

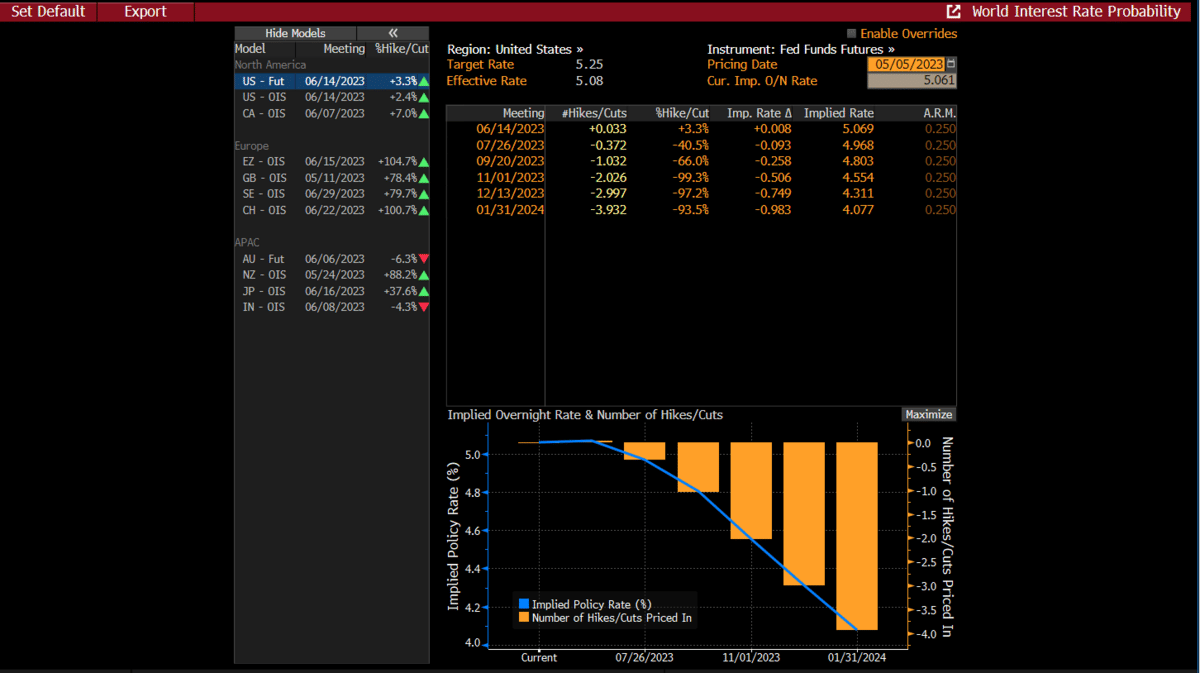

The employment report on Friday did move the goalposts on the Fed Fund Futures implied probability curve, but only slightly. The odds of another rate hike in Jun are about the same as a rate cut. However, expectations for rate cuts later in the year were pared a bit. There is now only a 37% probability of a rate cut in July, and a 100% of one by Sept.

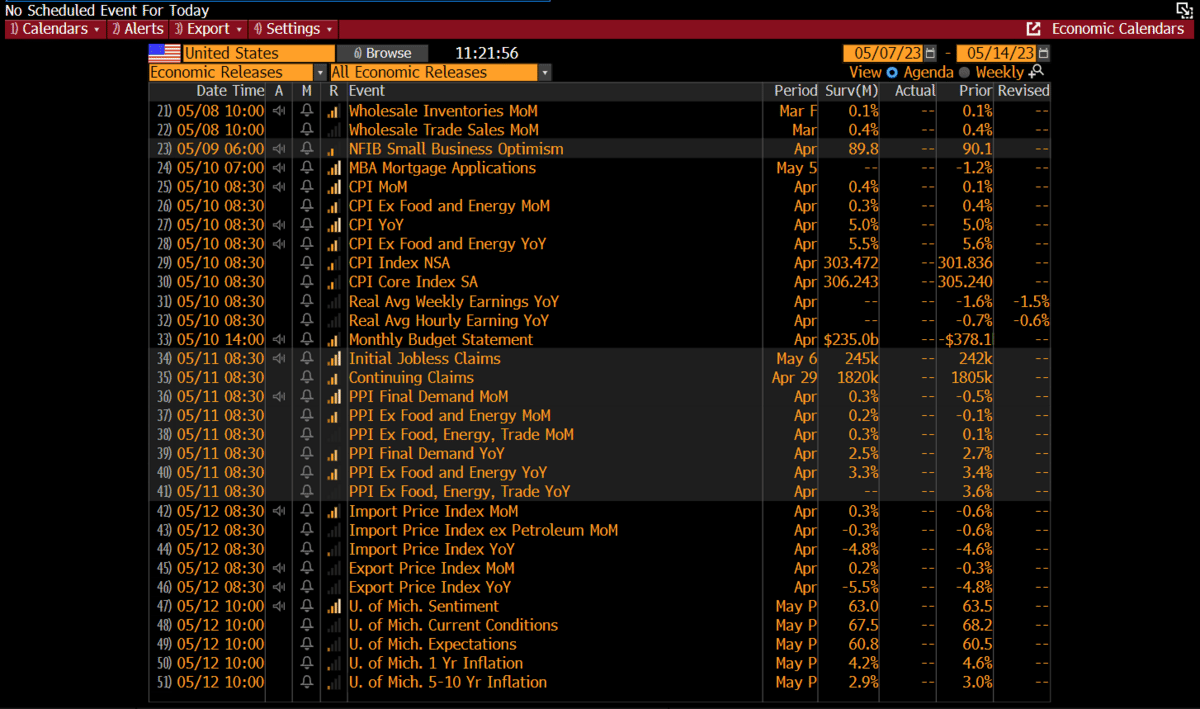

This week we will also get new inflation statistics: CPI/Weds and PPI/Thurs, followed by consumer confidence on Friday. As we have seen previously, these reports have the ability to move the Fed Fund probabilities quite a bit, and big changes usually come with some sort of dislocation.

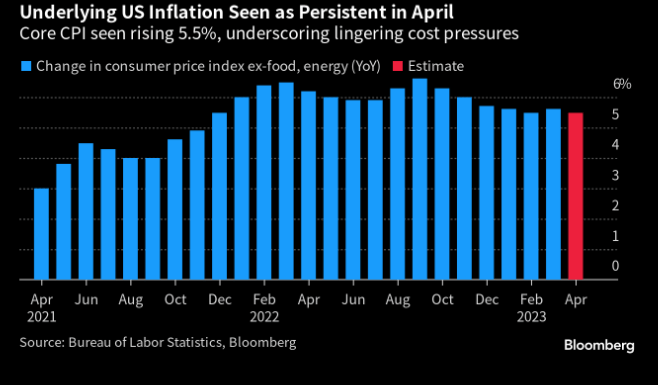

Core CPI has hovered in a 5.5-5.7% range for the past 4 months, underscoring the nature of how sticky inflation has become. The current expectations are for it to ease a bit in the Apr reading.

Recall what Chairman Powell said at the FOMC meeting last week:

This sets up for another potentially binary report. Although, anything in-line will likely be viewed positively in our opinion. Re-acceleration is what bulls should be fearful of.

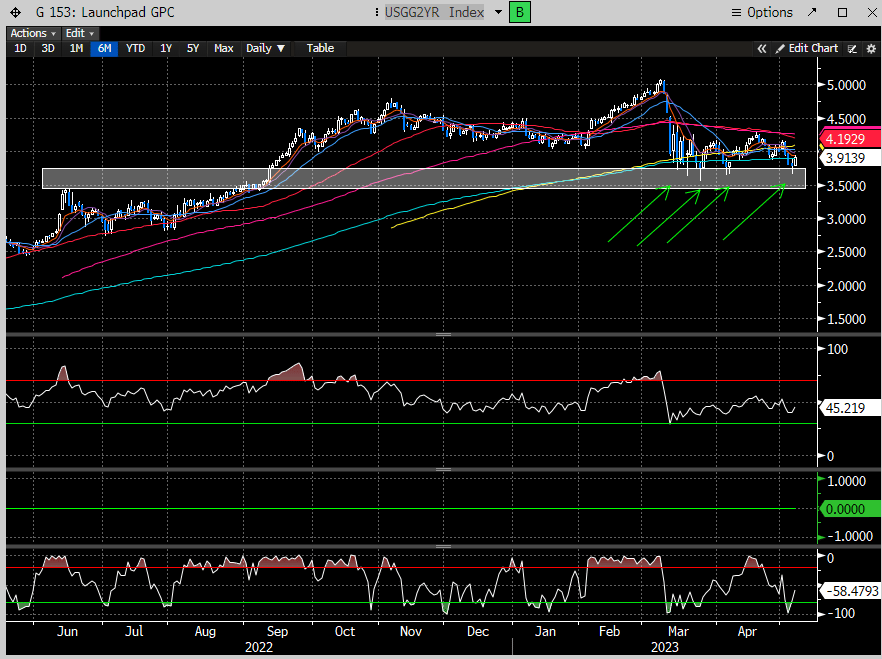

The 2 year is arguably the best forecaster of rate trajectory, and this picture implies lower rates in the future with Fed Funds currently above 5% and the 2-year struggling at 8 month lows.

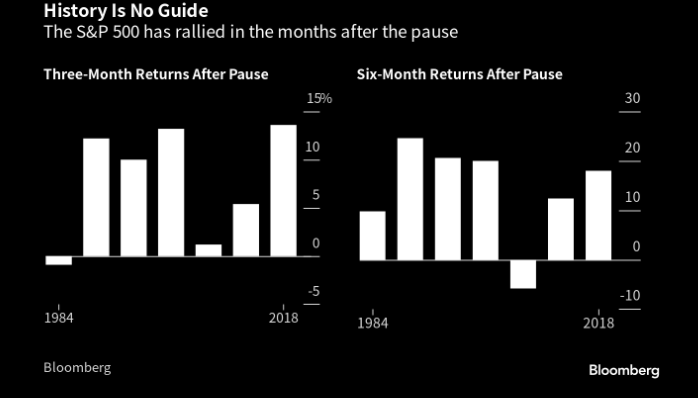

Last week we discussed the probabilities of buying the last rate hike. Was that what occurred last week with the stock market closing the week on a high note?

Recall what we wrote last week, and that buying the last rate hike works in a mild inflationary environment but historically has not when inflation is running hot.

Here is that excerpt:

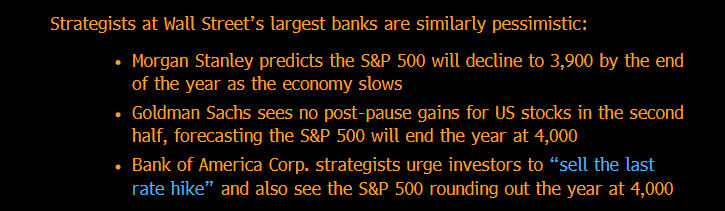

Wall Street Strategists remain concerned about a growth slowdown in the back half of the year.

While we agree it is a realistic fear, the notion of a milder than expected recession or slow down, and one where the market may be sniffing out an earlier recovery than many believe, is also something we need to consider. The price action thus far seems to agree with the latter.

To continue reading the balance of the analysis, please consider subscribing below. We will include a major counter trend trade stock idea at the end of the report.