What a difference a year makes. What do we mean by that? Last year the Nasdaq peaked on Nov 22nd. Bitcoin peaked on Nov 10th. The Russell peaked on Nov 8th. Since that fateful week, the Nasdaq has lost over -37% peak to trough, Bitcoin -77% peak to trough and the Russell has lost over -33%. By any standard, that's quite a bit. Losing over 1/3 of value for anything can be catastrophic.

Conversely, during that time frame, the 10-year yield is up over +200% and the $USD is up over +22%.

Here is a snapshot of the time frame from when the Nasdaq peaked on Nov 22nd to the present. (This does not account for recent peaks, but you get the picture).

The week of Thanksgiving is typically bullish as lower volume trading usually invites a slow grind up into a typically bullish Dec. But last year's Black Friday was anything but typical. In fact, it was the bloodiest on record. If you recall this is when the Omicron Variant was first discovered. While this was arguably not the catalyst for the '22 bear market, it did set the stage for an abysmal year for market returns.

What are the chances that history repeats and this week is horrific for the stock market? We'd venture to say low barring any nasty macro headlines. Last year, the riskiest parts of the market had already peaked 2 weeks prior, but the SPX didn't actually peak until the 2nd trading day of the new year.

Let's review a few warning signs during that time period that suggested to be cautious on the market.

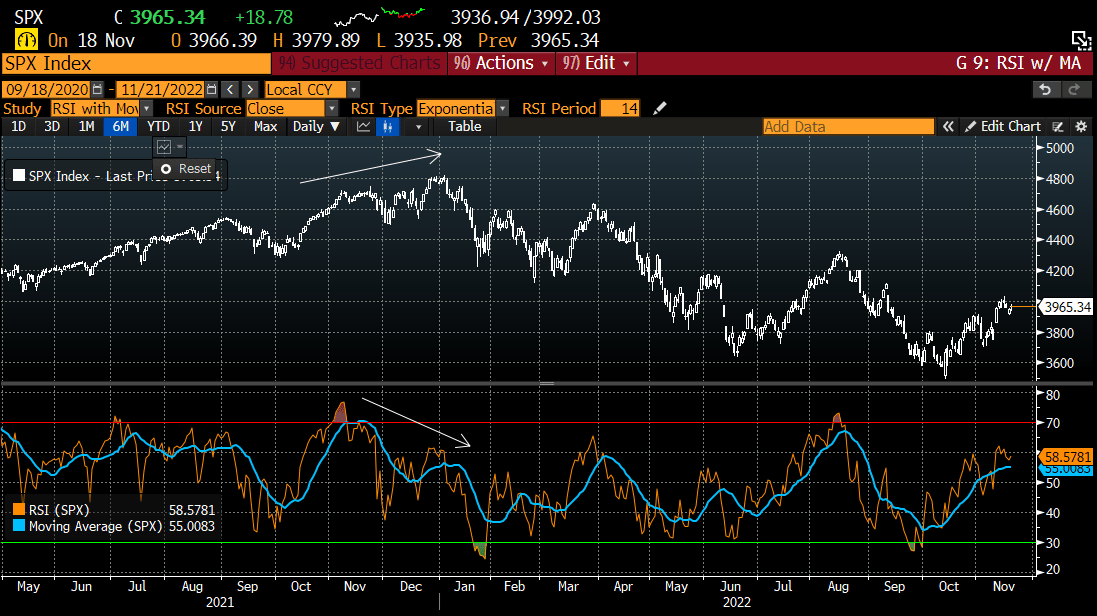

1) The SPX made a new high on much lower RSI momentum.

2) The Nasdaq was not making a new high with the SPX. The Nasdaq had been the clear leader post Covid Crash, and now was losing momentum. This was a character change.

3) The Russell was far below its peak in Nov when the SPX made a new high.

4) The McClellan Summation Index actually peaked in Dec 2020 and had successively lower peaks into every index high. This means fewer and fewer stocks were participating.

*Keep in mind this is just a small subset of the divergences that were occurring at that time*

Fast forward to today and we see a lot of differences.

We know that Nov/Dec are typically bullish months for the indexes....

So should we expect a bullish end of the year rally?

Let's examine some of the differences we alluded to above to see if any conclusions can be made on end of the year market direction.