We hope everyone who celebrates Thanksgiving had a wonderful and safe holiday. We did not do a mid-week update last week, given the shortened holiday week, but everything in the stock market continues to progress exactly as we predicted.

If you are a soccer fan, the World Cup is in full swing and what a treat it has been to watch the matches with family and friends. While we are US based, we find ourselves glued to most of the matches and rooting for a number of the competing teams. The founder of CSC played Division I soccer in the US and getting to share the joys of watching such an incredible tournament with his 2 young aspiring soccer playing children, has been an incredible treat, and one we will forever cherish.

The market continues to confound the bears who have allowed their stubborn bias to ignore the rapidly improving underlying internals and some very simple market structure changes. We have been discussing these since the Oct low prints around SPX 3500. We have continually posted publicly and privately some of these improvements and index levels to consider for upside trades. Those trades have yielded us 500+ points in the SPX in 7 weeks.

Bears have not let up and continually press their short bias. We on the other hand have no bias and despite being bearish on the macro, the economy is not the stock market. We have successfully navigated every major market swing this year and profited handsomely. We are hard pressed to find a better market timing report than this weekly rag. We use proprietary timing signals, combined with traditional TA and inject fundamental logic into each report and market prediction. Most of our competitors are simply one dimensional, and the stock market is much more complicated to view it through one lens.

Our pricing will increase by 25% for all new members in December (current members will not see a price increase).

One dimensional thinking is how you lose a lot of money by getting caught on the wrong side of the market. If you have any sort of duration (meaning you trade or invest on time frames greater than a few days), you will find our work to be very complimentary, and you will have a better sense as to when it's time to increase exposure and when it's time to dial things back. Individual stock patterns can look fantastic but if the market is about to enter a corrective phase, do you really want to increase exposure? Most stock movement is dictated by the trend of the market - get the direction of the market correct and trading individual patterns will yield much better results. This is how we add value.

From our Oct 9th report: "We know heading into mid-terms and the 3rd year of the presidential cycle, the stock market tends to do well. Is it possible that all these DeMark signals are lining up to position for the inevitability? We think so."

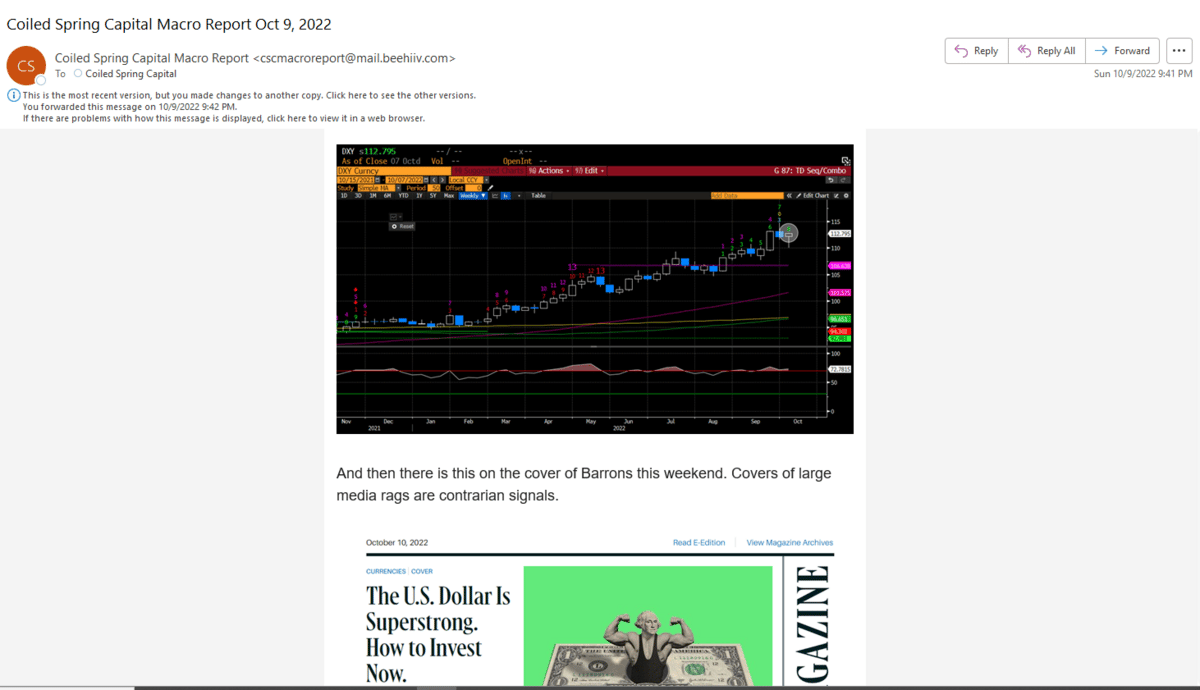

We wrote this about the $USD in that same report: "The $USD also with a double top look, with lagging RSI and now a new DeMark Sequential 13 sell on the daily.... A weekly 9 sell can print this week.... And then there is this on the cover of Barrons this weekend. Covers of large media rags are contrarian signals."

It's no surprise the strength of the $USD was plaguing risk assets. Get the direction of the $USD right, and you can make assumptions about a stock market rally. Since Oct 9th, how did the $USD trade? It's down as much as -7%, which is quite a big move for a currency as large as the $USD. Coincidentally the SPX bottomed that same week after the CPI print. It's not magic, its understanding how intermarket relationships work. This is what we do.

And for those that think we are full of it, here is the conclusion page from that Oct 9th report: "While we cannot rule out a bearish plunge into a climactic low this month, we are getting increasingly bullish about a larger potential pivot in the market. Whether the CPI this week is the defining lever that catalyzes this move is hard to say. We do know that the daily, weekly, monthly confluence in our DeMark charts is undeniable, rare and meaningful. We believe that a major market pivot could take place this month."

The stock market bottomed post the CPI print. Enough said on that topic.

Last week we showcased a few patterns that gave clues as to the topping of the market last year and we also showcased a few on why the Oct low was shaping up to be meaningful. That proved to be correct and why we have been on the right side of the market. Unfortunately, perma-bears will only have you believe their bias by only showing you one side of the story. Perma-anything is bad for your health.

Here are some things to consider that notable stock market bears won't show you.

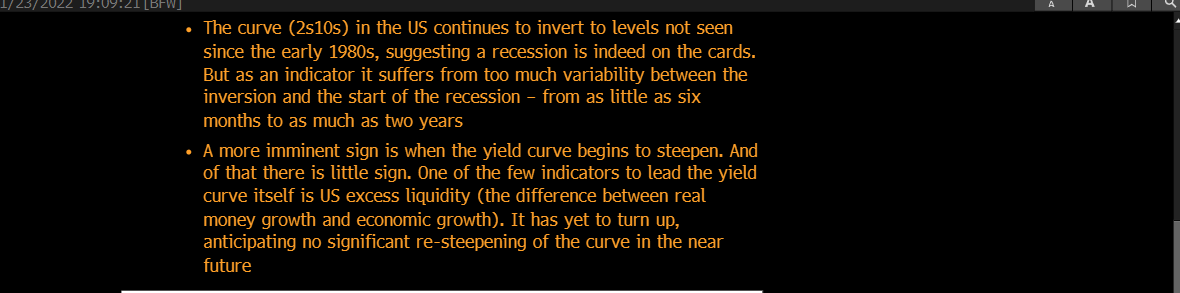

Drukenmiller is one of the best out there. But even his indicators are suggesting a recession is not imminent and why we have seen the market adjust higher. Remember, the market prices in what it thinks will happen, but if certain inputs change, it adjusts in the short term until that forecast changes. This doesn't mean the market is out of the woods. Quite the contrary given the level of curve inversion. To consider that the economy will not enter into a recession over the next 2 years is naïve. The depth and length of that recession is what's more important. We have discussed repeatedly that the stock market has been discounting a recession for over a year. That recession has not come yet. Are their cracks and signals that it will? Of course, and we have been highlighting some of those for our readers. The 2/10 curve inversion is one of the best predictors of such and it continues to invert. Thats not good, but the steepening is what signals the Fed is behind the curve and needs to cut rates. Historically, that means too much damage to the economy has been inflicted.

There are other signals to suggest the market was overpricing the recession risk in the short to intermediate term.

Recall what we spoke about previously, when the inputs change, the market will adjust. We are seeing that now. This does not imply that we are out of the woods by any stretch. We continue to think the economy will worsen considerably. It's not in our best interest to hypothesize how much and for how long, but it is our job to decipher the signals in the market to determine how to position our portfolio in the short to intermediate term.

If you are sick of being on the wrong side of the market, we would consider signing up for our newsletter. Pricing will increase next month by 25%.