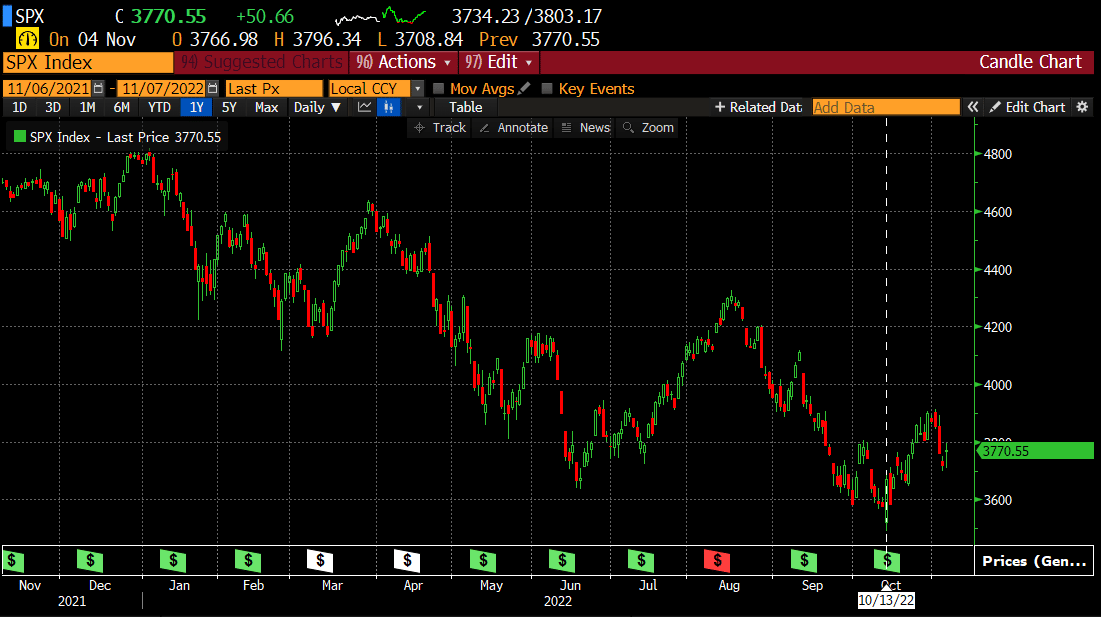

Never a dull moment in the land of investing. We have written many times that when everyone is overloaded on one side on the boat, rarely does the stock market tip in the direction of the masses.

We wrote this in the public twitter sphere on Oct 20th when most of the world was preparing for a crash:

The SPX went on to post another +6.5% from there before rolling over. As our readers can attest, we exited our long exposure right into the peaks of that rally. Here is that excerpt again from our last weekend Macro Report:

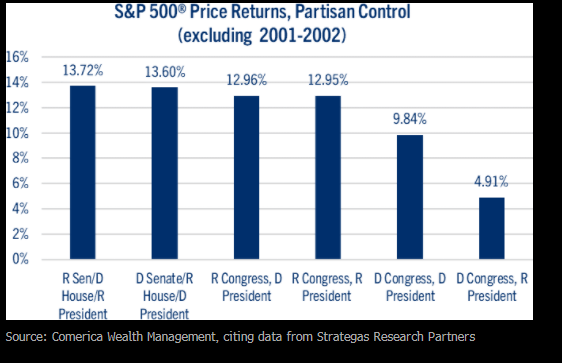

This week we will get the midterm election results followed by Oct CPI. Another week littered with landmines. The polls for midterms indicate the Dems could lose control of the House or the Senate. A divided government is typically positive as it invites gridlock for legislative change. This sounds counter-intuitive, but uncertainty is what plagues markets, and certainty over no major legislative changes is good for stock prices historically.

But don't take our word for it, here is the data:

According to Bloomberg, option prices indicate the SPX would rise as much as +.7% on a Republican win and fall as much as -3.3% if the Dems hold on to Congress. Get your popcorn ready!

Regardless, over the long term, the performance post the mid-terms into the 3rd year of a US presidential cycle, are some of the most bullish time periods for stocks. Bespoke says the performance is positive into a 3rd yr presidential cycle, +83% of the time, where the SPX rises +14% on average.

Even near-term performance post the mid-terms is positive:

Of course, past results do not guarantee future results, but bears are trying to growl into the wrong side of history. Our experience after 23 years in the markets, are that cycles matter, and ignoring them to satisfy one's own narrative can prove dangerous.

While we understand that this year's set up into this bullish time period is a bit bleak, and maybe historical precedence may not matter under the current macro backdrop, sentiment and positioning remain very subdued. In other words, if you are worried about the market and the economy, the media is worried, and every major asset manager on the planet is worried as well, who is left to sell?

In October, positioning from professional money managers was some of the lowest in decades. That has since improved recently but is still low by historical standards. This implies the pain trade into the end of the year is still up.

If the midterm results don't provide enough volatility into the stock market this week, Thursday we will get the CPI (inflation reading). Recent inflation readings (CPI/PCE) have surprised to the upside, but the stock market reaction was positive post the last CPI.

The current estimate is for +7.9% from a year ago, only down slightly from +8.2%. Strip out food and energy and the index likely edged down to +6.5% from Sept's 6.6% advance. This is still far above the Fed's 2% inflation target. How the market reacts to these events will be telling.

Trying to determine what's next for the indexes and stock market direction is not an easy task, especially in the face of such a news driven week. Our goal is to dissect the underlying trends and provide actionable intelligence to participate.

Let's review...