Bear markets are volatile and last week was a good reminder of that. Overly positioned shorts into the CPI got whiplashed and bulls who bought the reversal candle saw half those gains evaporate. The reality is we should expect this type of volatility for the foreseeable future. We have been writing for some time that the macro data deterioration has yet to show up in earnest, and earnings numbers for 2023 remain too high. This invites more weeks like last to keep investors and traders on their toes when battling for direction.

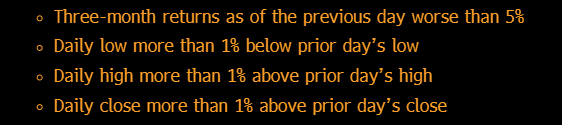

Post CPI the market quickly broke down losing +2% in the morning only to engulf the entire previous days candle. This reversal candle usually augurs for some sort of continuation. But these are not normal times, and options proliferation has made the market swings that much more pronounced. Bloomberg ran an analysis for how many times this type of reversal has occurred when the stock market is mired in a downturn, much like now. Here are the parameters:

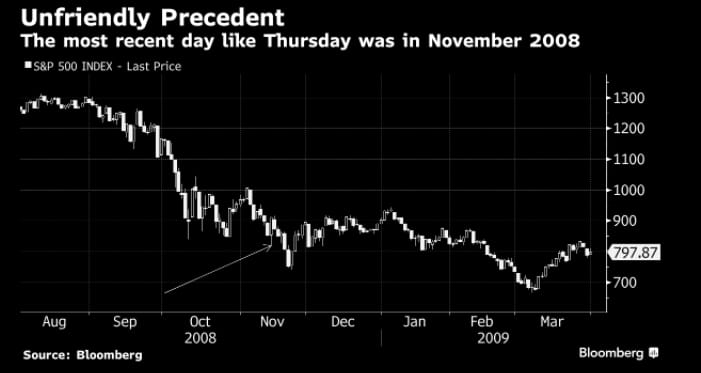

This only produced an N of 2 in the last 40 years. The most recent was Nov 13, 2008. This clearly did not mark the low during the GFC.

The 2nd instance was during the internet bubble crash and produced a bounce for a month before rolling over.

No 2 time periods are the same, so it is tough to glean too much from this but just that we should remain open-minded of the potential outcome after last week's reversal.

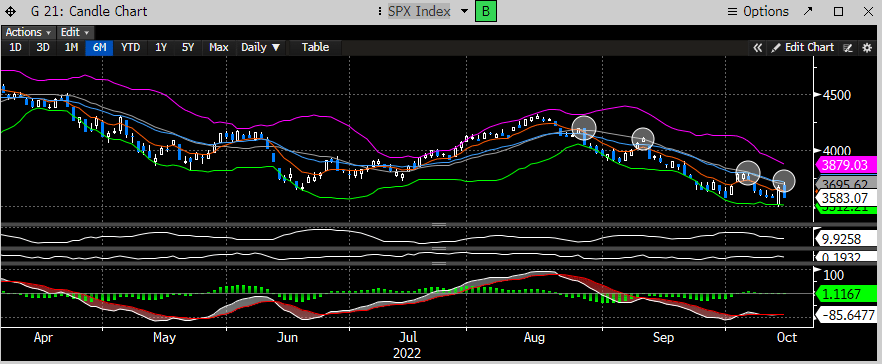

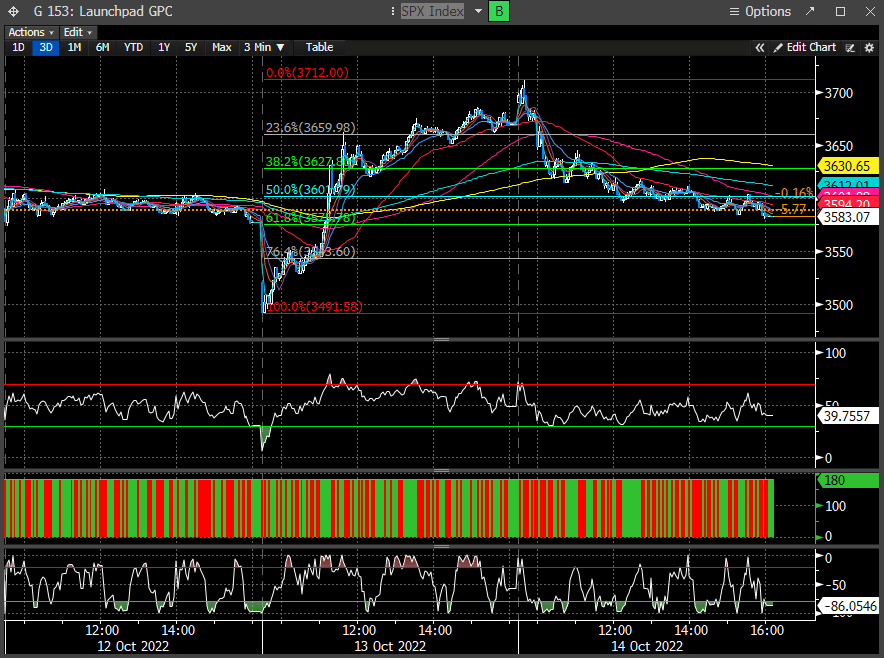

In our Thursday night report, we highlighted the 20 day as a level that needed to clear as it has been keeping a lid on any rally attempt since breaking it in Aug. Sellers showed up on Friday at the declining 20 SMA and grinded the indexes down all day.

Some traders don't want to see a big reversal candle break through 50% of the previous day gains. That occurred into the close and likely caused a bit of selling from faster money. We prefer to use Fib retracements as levels to consider. 61.8% retracements are still considered bullish, and no surprise the SPX fou nd support at that level (3575). 3577 was also the pre-CPI close. The symmetry here is noticeable.

The market is basically trying to confuse us all on which way it wants to head next. The next big event for the market is earnings. We are going to hear over the next 2 weeks from some fairly large companies, and their view of the economic backdrop is likely going to drive increased volatility.

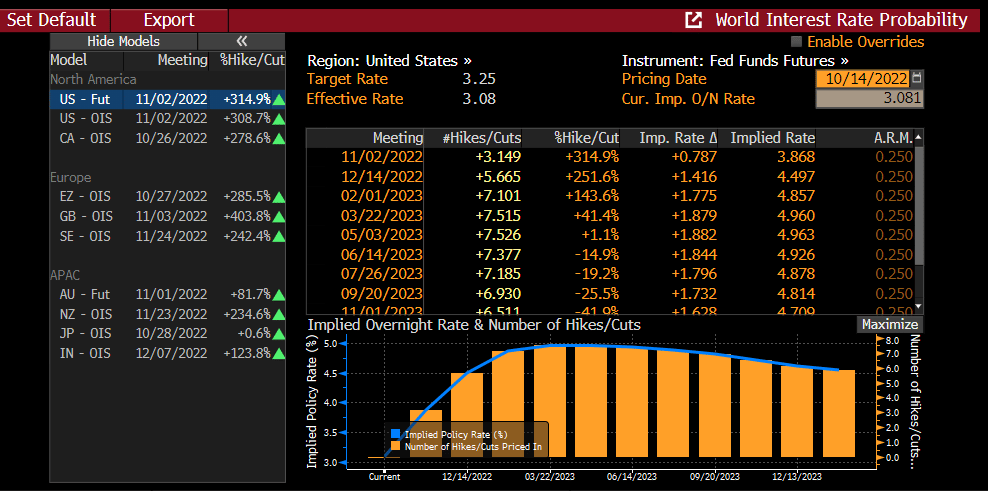

Interest rate expectations have also increased with the hotter than expected CPI and Fed Fund futures are now pricing in 4.95% by Mar '23 vs 4.5 at the beginning of the month.

As long as rates expectations keep adjusting higher with elevated inflation/macro data, the market is going to be hard-pressed to find a bottom. While we have seen some evidence of capitulation in some instruments and from a number of Wall Street strategists, our sense is we need to see some of the Macro data turn down. This may seem counter intuitive, but the reality is the Fed admittedly will not stop their rate campaign until they see their policies working.

This week's macro data is a bit light, but we will get some housing statistics. Earnings will also be in full swing and likely the bigger determinant of direction this week.

If you would like to read the full analysis, please consider subscribing below.