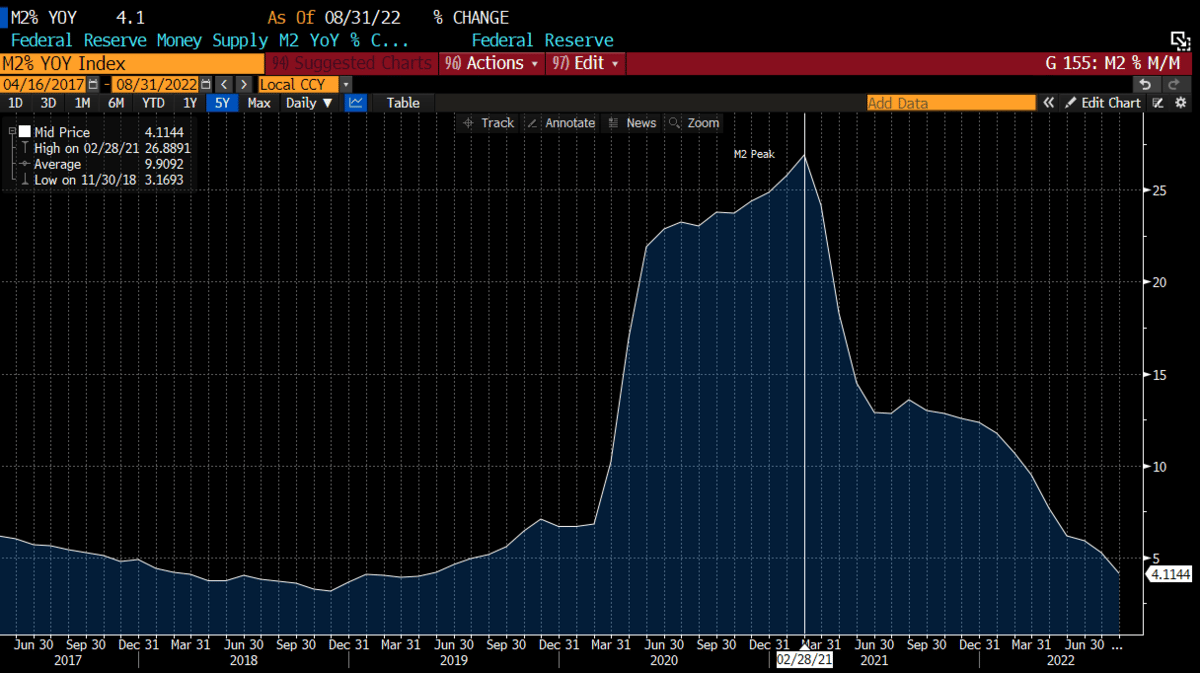

The stock market in Sept was abysmal, and why we advocated sidestepping it in late Aug. QT was set to double, which means less liquidity in the system. Anyone who tells you that liquidity isn't the driving force for investment gains, is trying to push their own narrative. The fact that these well known, high paid strategists, have teams of people and write very lengthy reports, dissecting every angle of the market, except the one that matters the most, is incredibly absurd. The same people who were telling their clients to buy every dip on the way up because the Fed was printing incessantly, now are telling you it doesn't matter. Sorry to bust their bubble, but we could have saved those firms millions of $'s in compensation and wasted good will with their clients if they just followed this one chart.

It's no coincidence that this peaked in late Feb of 2021. Most of the "no profitability growth basket" peaked around the same time."

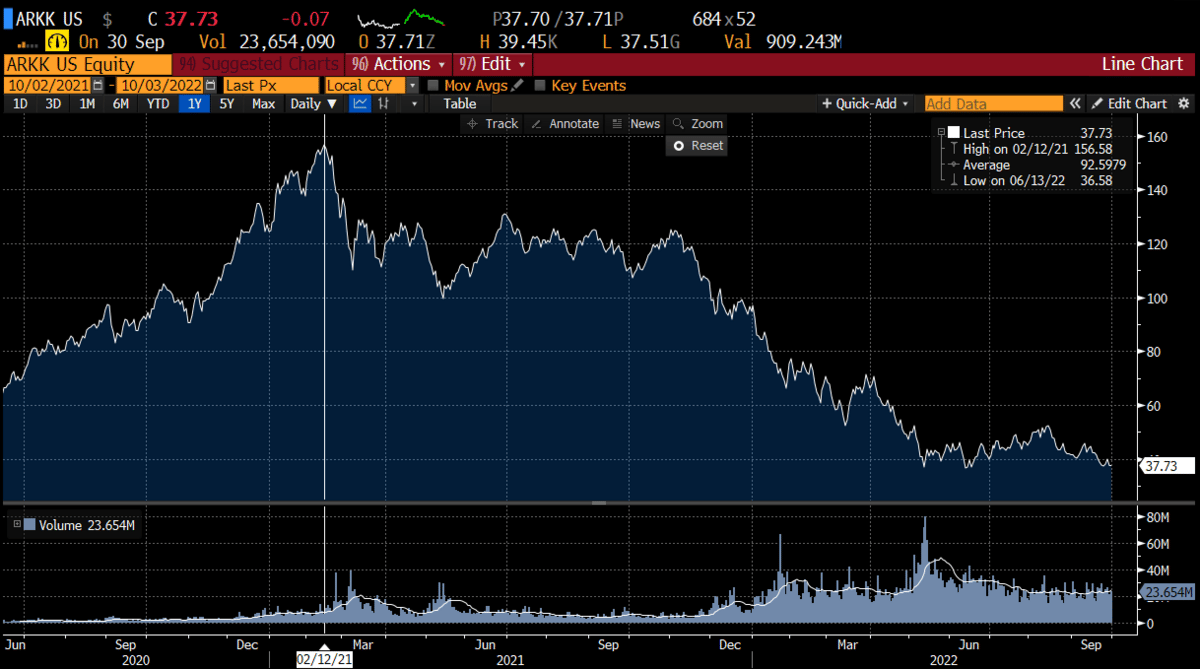

ARKK is the posterchild of the excess money bonanza. This peaked 2 weeks before the M2 was reported.

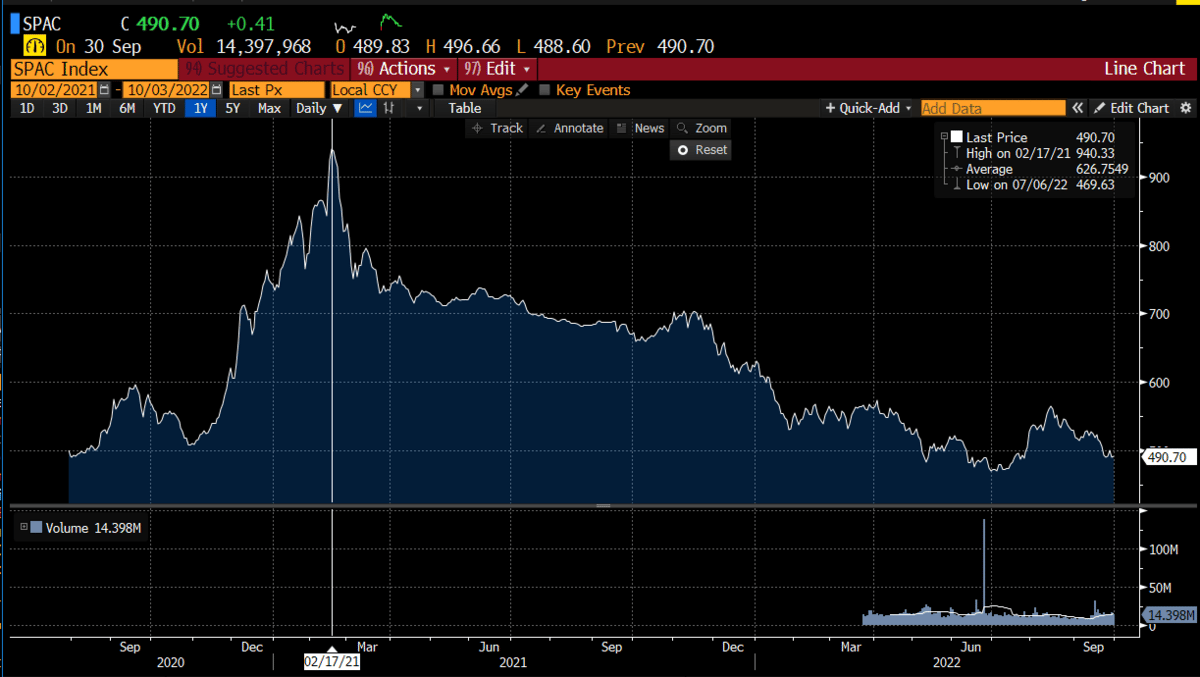

How about the SPAC index?

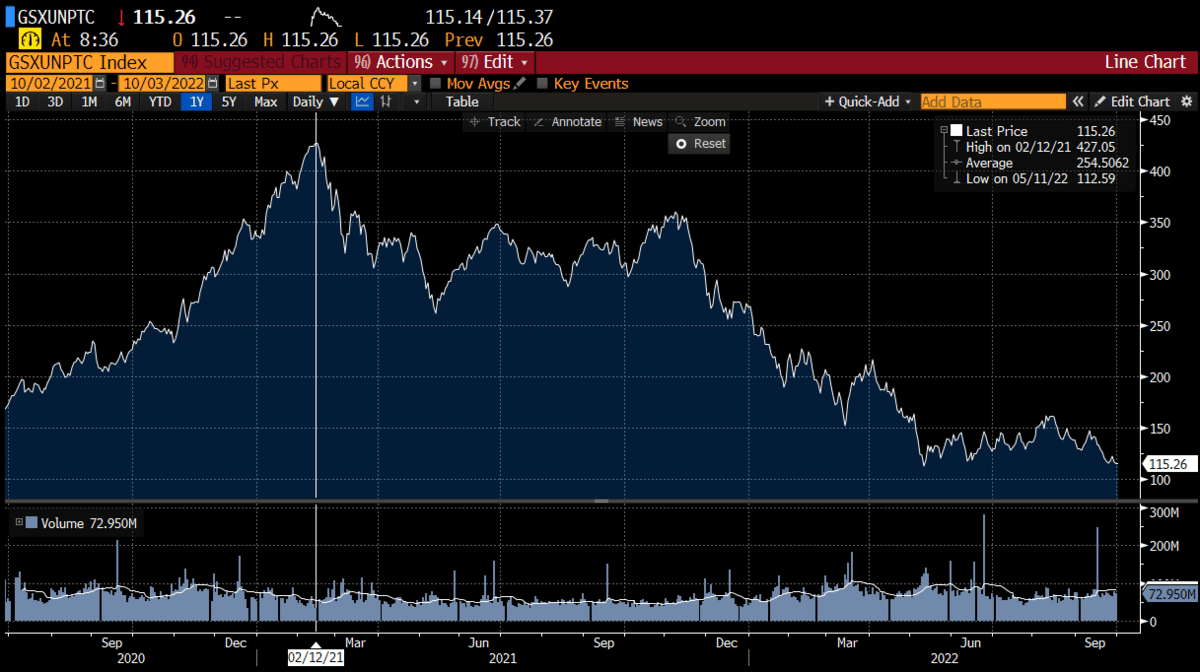

Here is a custom GS basket of stocks that is comprised of non-profitable tech. Coincidence these all peaked in Feb '21? ummmm, doubt it.

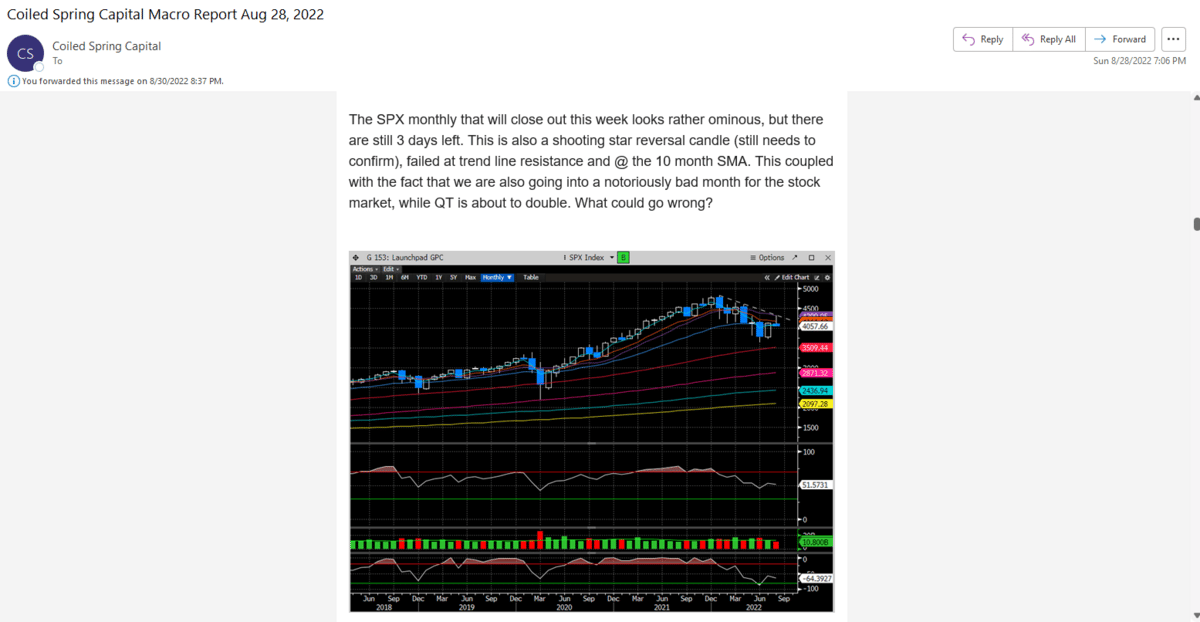

We highlighted to be very cautious into Sept given the backdrop.

Here is our Aug 28th weekend report. Simple yet meaningful.

And while we got caught a nice countertrend move into the next swing high for 300 points into our resistance zone, the failure from there has been soul crushing (-13% for the SPX since Sep 12th pre-CPI high). Caution into Sept was warranted no doubt.

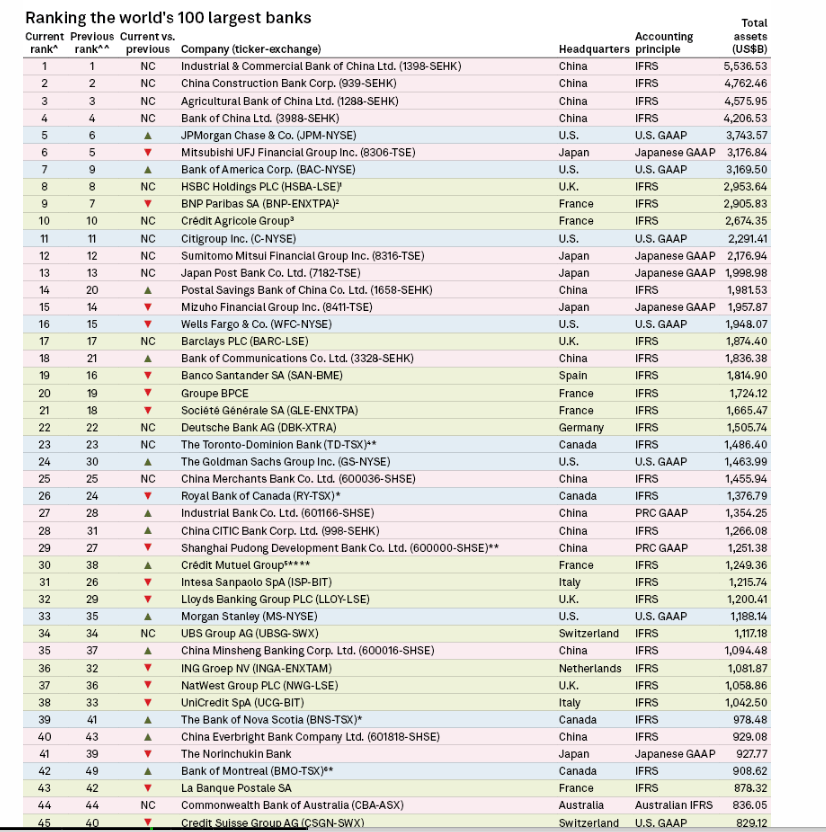

The Fed over the last week has been doubling down on their hawkish rhetoric, despite what seemed like a possible Lehman moment in the UK, with pension funds lacking liquidity. We have been talking about the velocity of the rate rises for weeks and how much stress that can place on the global financial system. Models are built for some sort of equilibrium, but when that equilibrium is thrown into question, chaos can ensue. Volatile Treasury moves and $USD strength are driving the potential for systemic breakdown. Rumors over the weekend are that Credit Suisse is having its own liquidity issues. While Credit Suisse isn't the powerhouse bank it was 20 years ago, it still ranks in the top 50 in assets with $830B in assets, according to SPG global.

The issue isn't if CS is big enough to matter (IMO it is), but who else around the globe is experiencing liquidity problems? The cockroach theory is that there is never only one. Here is the chart that has everyone concerned. The 5 year CDS is +250 bps from 55 bps at the start of the year and now is near their highest on record.

Credit seizing up for big liquidity issuers effects the globe in some capacity, and the level of severity is hard to evaluate until after the fact. Will this turn into '08 all over again? We'd venture to say no, as most banks have much better liquidity situations vs that time period as do corporations. That doesn't mean there aren't significant risks lurking under the surface.

And when things break, there can be considerable fallout. What that is remains to be seen and is the tail risk that everyone seems to be positioning for given the level of put protection we've been seeing over the last 2 weeks.

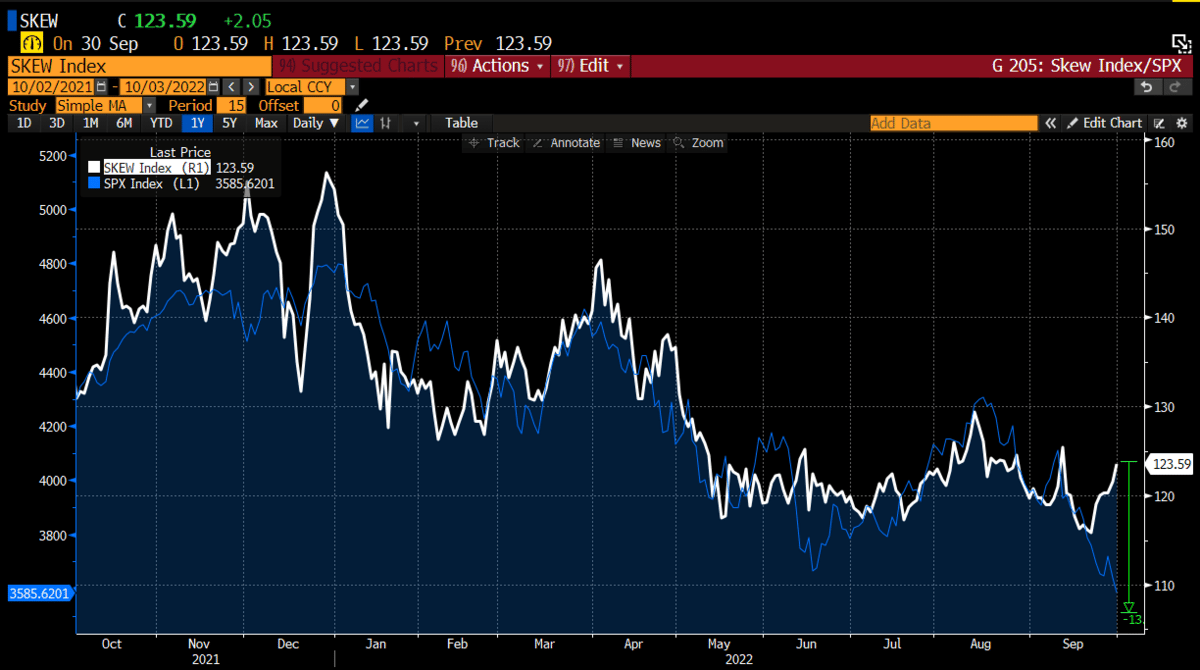

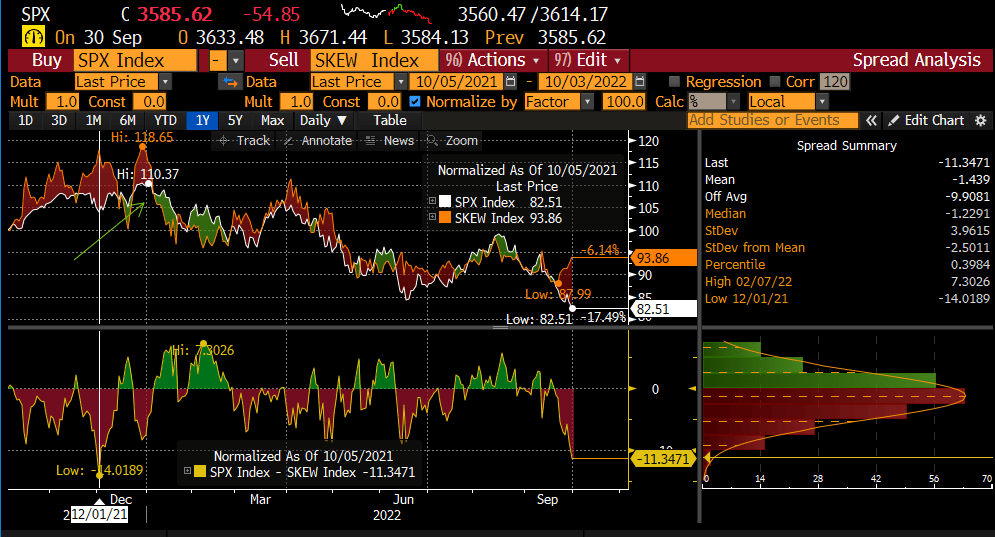

Here is a chart of the SPX overlaid with the Skew Index. The Skew Index measures perceived tail risk in the SPX. The fact that it is rising means there is more protection being acquired in the OTM options market. This level of protection can be viewed as a fear gauge. The gap will be closed most likely, but which way will it close is the question. Markets typically like to climb a wall of worry, and there is certainly a bit of that, which this exemplifies. Whether some exogenous news event that we alluded to above, can fulfill this level of market anxiety remains to be seen.

The spread analysis shows how wide this relationship has gotten. The last time it got this wide, the SPX rallied into the Jan peak before collapsing. We'll have to see how this plays out.

If you are interested in reading more of our in-depth analysis on the stock market, we encourage signing up below.