Another wild week in the stock market with indexes ping ponging back and forth but ultimately finishing much higher. This all occurring with the 10 year also gaining +5%.

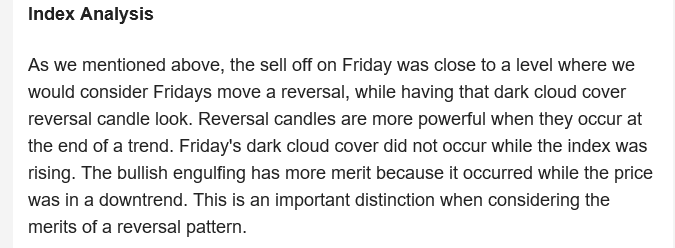

Last weekend we talked about reversal candles and what merits a true reversal pattern. We even highlighted here the Friday reversal post the large post CPI bullish engulfing candle. While many penned that as a sign to sell, we took much more of an open-minded approach. Here is the excerpt from our weekend report:

We also looked at the shorter TF Fib retracement for Fridays move and determined that 61.8% actually held and would still be considered bullish. Here is that excerpt:

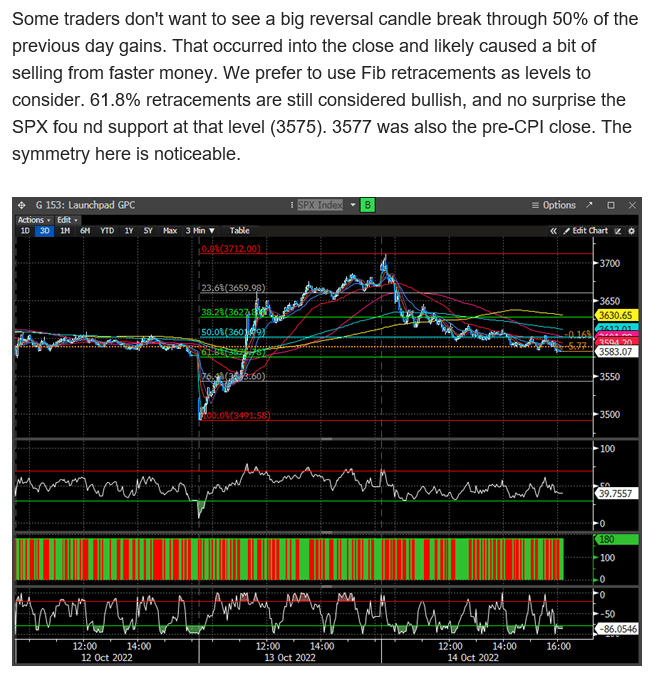

And how did the SPX react to that 61.8% Fib level above?

Quite well, in fact, it never looked back. Here is the 5 day chart for the SPX.

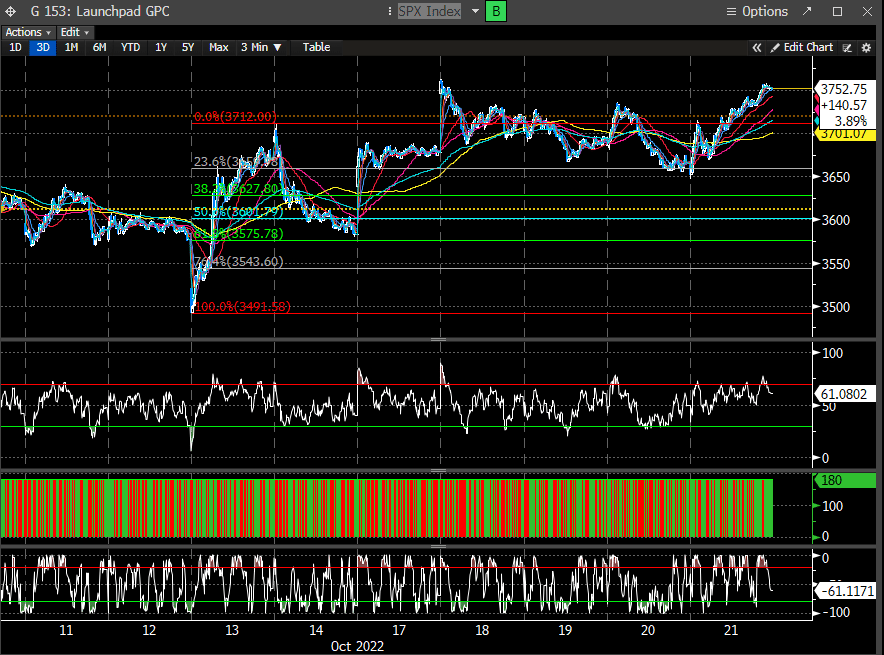

Premium readers can attest that we have been leaning bullish as our analysis tracks hundreds of different indicators, and positive divergences have been building. The first test was a break of this DTL from Sept, the second test was a close above the 20 day, and the third is a close above the Oct 10th gap down window. All 3 of these occurred last week.

We discussed the importance of a follow through day, and that also occurred on Friday. 2 seemingly leading indexes and a reason for our bullish lean were the Dow and the Small caps (Russell). Here is an excerpt from last weekend's report:

The Dow closed up ~1500 points higher on the week and printed it's second bullish engulfing in 7 days, on expanding volume. The Dow also hit the DeMark propulsion target @ 30974. The declining 50 day is now the real test as it failed here in Sept.

We also highlighted the Russell as something to watch for additional clues to market direction. Here is an excerpt:

Lastly, in our Tuesday night report we suggested the market ideally needed to consolidate under the gap down window to set up for an eventual break and that the rates market needed to cool down for any advance to sustain. The rates did anything but cool down last week, but we did get a lifeline on Friday from the WSJ who reported the Fed would likely slow hikes after the Nov meeting. Into the Friday Fed leak to the WSJ, the SPX did consolidate nicely into a bull flag pattern, which set up for the eventual break we were suggesting. Fridays bullish engulfing through bull flag resistance, on expanding volume, is a nice way to finish the week and buck the consistent trend of Friday sell offs.

The pause by the Fed is a welcome surprise as we have been writing that the consistent upgrades of the rate cycle timeline was being met with increased equity market volatility. Currently the Fed Fund futures are now pricing in +50 bps for the Dec meeting. Will the FOMC revise their leak to the WSJ? It's possible but the parabolic rise in rates, undoubtedly had them spooked. Whether they saw something breaking or fear of that inevitability, the market received the news well.

So where do we go from here?

If you would like to keep reading our analysis, please consider subscribing below for $19.95/month. We will be raising rates over the next few weeks for new subscribers and thus to lock in our insanely reasonable rate, we suggest signing up before the increase.