What an incredible week/month in the stock market for those who think differently. We started writing in early Oct that the boat was lopsided with bearish sentiment. We saw early divergences building in our internal metrics to suggest being bearish and playing for some sort of crash was a low probability outcome. We had multiple TF DeMark confluence coming into view.

We wrote in early Oct that we believed a major pivot in the stock market could come soon, and that the CPI could be that clearing event. Did we know that it would be? Of course not, which is why we look for confirmatory signals for such. Was it easy to stay long from the depths of the Oct lows? No, it never is. In fact, we were shaken out of our initial position on the diamond reversal in early Oct. We wrote that a break of the trend line and recapture of the 20 SMA, would set up for a test of that diamond gap down window. That occurred, failed and set up a bull flag above the Sept DTL. What happened next? Oct 21st was a follow through day (FTD) to break the bull flag. We have written here and mentioned to readers of our report, to learn about the importance of an FTD.

Bears simply continue to ignore simple market structure changes.

Let's review:

1) Oct 13th - CPI bullish engulfing on higher-than-expected inflation

2) Oct 17th - Sept DTL break

3) Oct 21st - bull flag building above the DTL with an FTD bullish engulfing candle on the WSJ Fed leak to close back above the 20 SMA and the all-important diamond gap down window.

This is not rocket science, its simply noticing a pattern of strength that is building under the surface and then looking for confirmation by the index price action. If you simply waited to initiate a position on the close above the gap down window @ 3752 (w/ a stop below 3739), you just pocketed +150 SPX points with minimal risk.

Here is the step-by-step roadmap we deliver to our readers.

The SPX has now rallied +400 points since the Oct CPI lows when the world was calling for an outright crash. It's never easy to trade these types of moves, but at least we weren't caught on the wrong side.

Some people on Twitter are saying that bulls got lucky with the WSJ article leak on 10/21. Were we lucky in identifying this divergence from our Oct 16th report?

Fast forward to today and the Dow is up +11% since that report. The market will reflect the future and some very sophisticated professional fund managers were positioning for this event. Is it legal? No, but don't think for one second that the market isn't completely rigged to benefit a certain class of very connected investors. Our job is to recognize that something has changed and to capitalize on it. We are mere paupers in this game but big money leaves footprints all over the place - did you see them? We did.

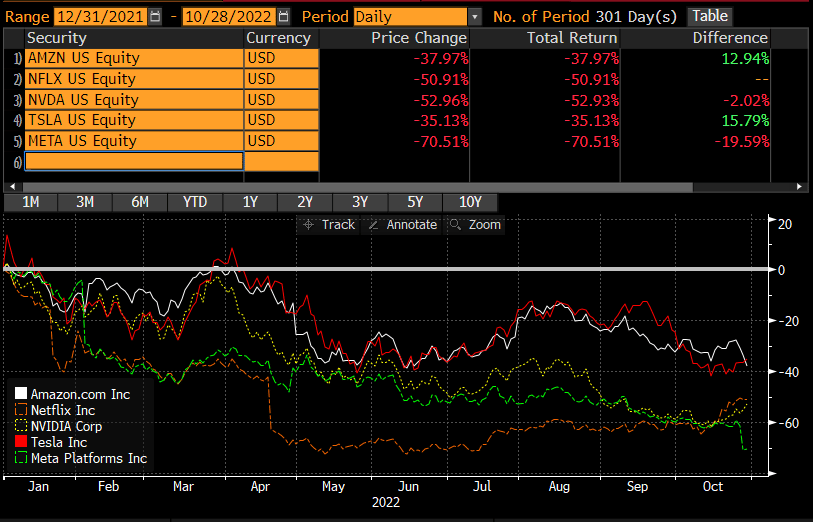

We can tell that most new traders don't understand how this game is played at the highest level. It's not what you see in front of you that gets reflected in the stock market, it's what hasn't been contemplated and discounted. New players to this game thought that the terrible FANG earnings would disrupt the market. FANG has only recently begun to come aggressively unraveled. The largest generals are always the last to fall. The rest of the market was already discounting the worst months ago. How can the market rally when the largest members are cutting their numbers? Simple, the FANG stocks have been getting pounded all year. Their numbers were not that bad 2Q's ago, yet they are down roughly ~50% since the beginning of the year. This has already been discounted in the market, and since these were the last to fall, money has been rotating to other sectors and stocks.

How can you measure internal strength?

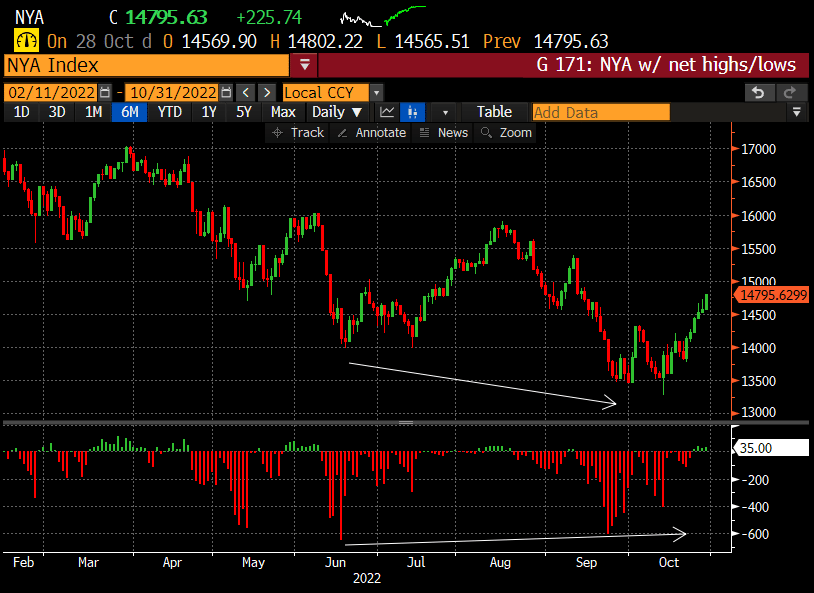

Here are 2 charts that we share often. It measures the Net New Lows for the major indexes. Notice anything difference vs the Jun lows?

For the NYA index the Net New Lows in Sept were slightly higher vs Jun yet the index went -5% lower.

The Nasdaq is even more pronounced, with Net New Lows bottoming in May yet the index was -9% lower. These are positive divergences that must be considered when thinking about the path for market direction. This also tells you most of the carnage outside of the FANG stocks has been discounted.

The biggest hurdle for the market continues to be the trajectory of interest rates. There is significant debate amongst the most sophisticated players in the world where rates are going. While we cannot tell you where the terminal rates end up, we did tell our readers in early Oct that we believed a major pivot for rates would occur over the ensuing month and that this would be equity supportive - that's exactly what has happened.

Currently the 10 yr yield is down -10% from the peak in Oct. Whether this is the ultimate peak or rates have a higher trajectory into next year, we cannot say with any conviction. But the leak to the WSJ was done for a reason. Is the FOMC worried about breaking something or have they seen cracks they are not comfortable with? Does that mean they start to tamp down their hawkish rhetoric? We are leaning yes, but that's just a hunch, and what the market has been anticipating.

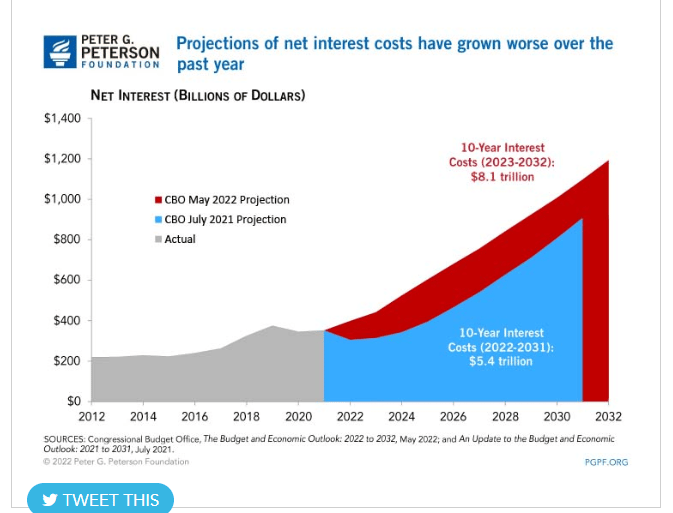

We would think this isn't helping the situation either. Interest expense on US Debt is set to explode if we continue on the current path.

We can only imagine the behind the door political discussions regarding this as we head into the mid-term elections in 2 weeks. The FOMC meeting this week should reveal some clues as to their intentions. Is it binary? Yes, and littered with risks for both longs and shorts.

Regardless, we will continue to analyze the market and report on the developments that are presented to us.

If you want to stay on the right side of the market, we would seriously consider subscribing to receive our premium content below.