The stock market continues to be treacherous as the macro factors continue to outweigh any short-term positivity. We have been steadfastly bearish on the macro all year long despite the chorus of positive narrative shifts any time the stock market bounces from CNBC, Wall Street strategists and FinTwit furu's. That has proved to be correct as we have yet to see any material impact on the macro data from the aggressive Fed rate hikes (see recent employment report). Lower peaks for employment throughout the year is directionally important, but these numbers are still very strong, especially in the face of rates being up +100% since the start of the year.

Hikes can take 9-12 months before any real deterioration is evident in the main street economy. We'd venture to say that this is even more pronounced in the current environment since the US government has been lining the people's pockets since they dropped the liquidity bazooka during the Covid Crash. Meaning, consumers have an abnormal amount of liquidity vs. prior rate cycles, to shield them from inflationary pressures, for now. Couple that with a shortage of workers during the pandemic, and employers are reluctant to let people go despite the price pressures they are seeing. Unfortunately, the weight of those pressures, unless they magically abate, will inevitably force employers to cut. The pace of which can precipitate rather quickly when that breaking point is reached.

We have recently been discussing the notion that the Fed is going too far and will force something to break. The UK situation was a warning shot, but the Fed is reactionary and not proactive, so an evident policy mistake has yet to reveal itself (Credit Suisse next?). If you ever had any doubt about the Fed being able to engineer a soft landing, don't, they've had a very poor track record of doing so, and this environment is arguably the most complicated in its history.

Here is a chart of the last 3 Fed hiking cycles. Notice how most peaks in the SPX occurred at or around their last hike. Contrast this to the current cycle and the SPX peaked before the first hike even took place. Now notice how all peaks in the Fed Funds rate were then immediately followed by a large drawdown in the SPX. Why was the Fed cutting rates? Put simply, they broke something. What that will look like in our present environment, we don't know, but we can surmise with max certainty, that it's coming.

We discussed above that the state of the consumer is different vs. prior cycles because of the massive liquidity that was spoon fed them during the pandemic. Consumers built up $2.1-$2.4T (depends on who you believe) in excess savings during the pandemic but now are drawing down savings at an alarming rate. According to Ian Shepherdson at Pantheon Macroeconomics, the recently reported data suggests that 31% of those savings have been spent. While we can argue that the consumer still has well over $1T in savings to pad them, it's not enough to prevent credit card borrowing and loan delinquencies from ballooning.

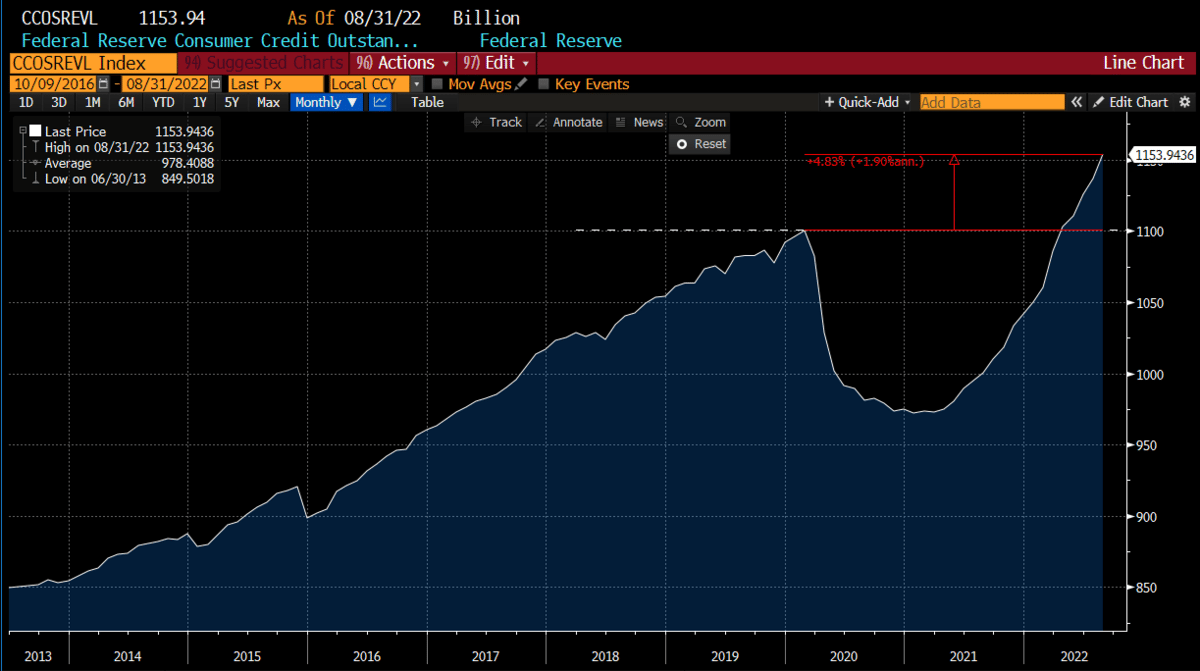

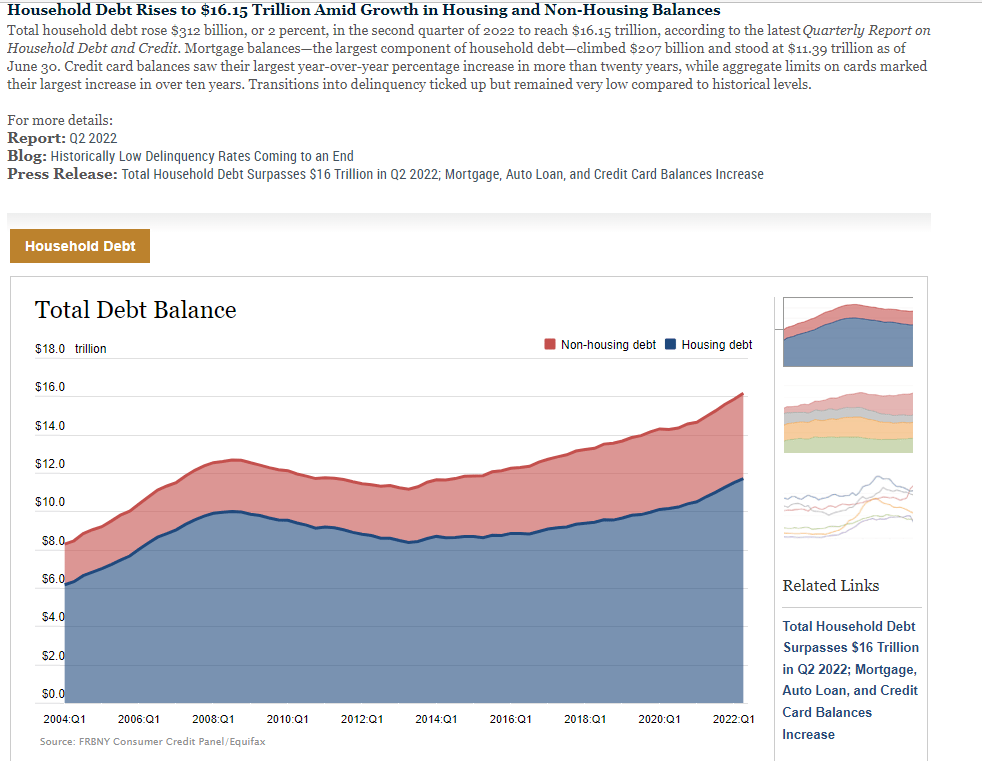

Credit Card debt is now almost +5% above peak and saw their largest year over year increase in more than 20 years. To make things worse, according to Nancy Lazar, 60% of that debt is carried for over 1 year. Credit Card debt resets higher with interest rates so carrying this debt is becoming increasingly burdensome.

Total Household Debt continues to tick higher....

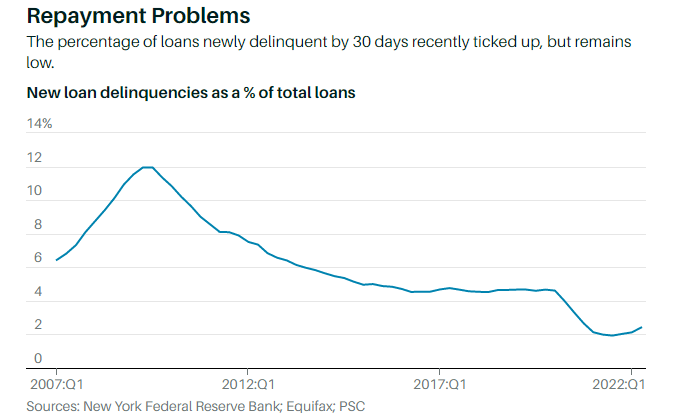

And loan delinquencies are beginning to tick up despite being low historically. Bottom line, delinquency risks are rising.

While we wrote in our midweek report that we didn't like the market set up into the jobs # on Friday (excerpt below), we admit we didn't think such a negative reaction would ensue. This is almost starting to feel capitulatory, where large swaths of investors are starting to give up. For bottoms to occur, we need to see more of this despair.

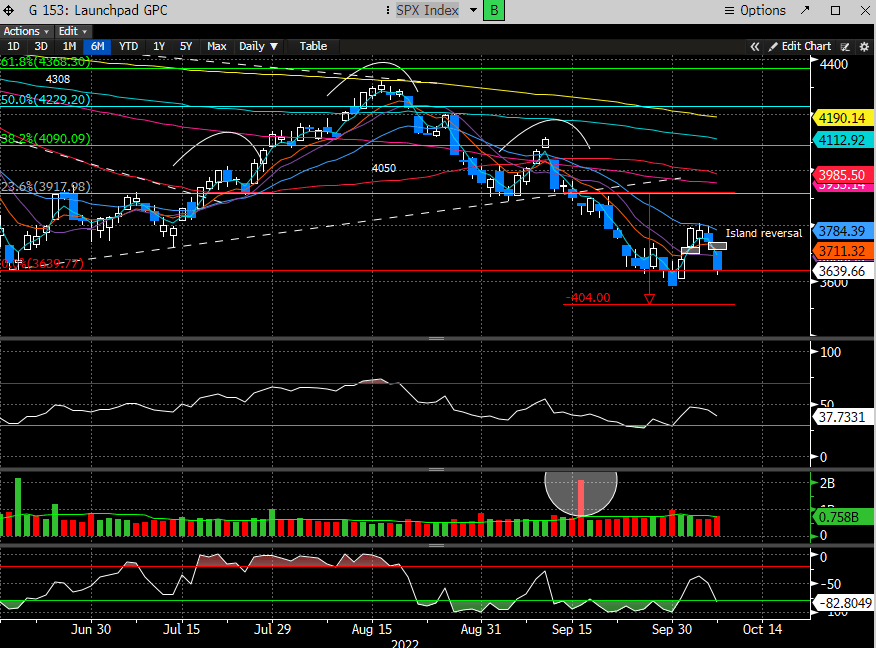

We had been bullish heading into this week for a counter trend trade and caught a +5% move in the SPX but Friday's action stopped us out of our balance. The look of the SPX is not pretty. We went from a bullish island reversal the prior week in the major indexes to now a bearish island reversal. Our Head and Shoulders continuation pattern measured move target is likely to be met around 3500.

Where do we go from here is likely going to be determined by Thursday's CPI. Another tough set up to trade as a hot number is not going to be receieved well.

If you find value in our analysis and would like to read the balance of this report, please consider subscribing below.