It's been a good a few months for our larger stock market directional swing calls as we have correctly timed and pinned each major swing in the market since Jun. We were very publicly bullish at the Jun lows, and we were very publicly bearish into the Aug highs. Since the beginning of Sept, we have written that downside is limited and weakness was to be bought, tactically. Here is an excerpt from our conclusion page in last weekend reports where we identified weakness was likely to be bought as a function of the building negative sentiment and extreme OS indicators.

We also wrote in our Mid-week update that continuation off the lows was likely to continue. Here is that excerpt from that report:

The SPX has since bounced +4% off the 3900-3920 level we have been highlighting as critical to hold. The Nasdaq has bounced +5%.

But have we just witnessed another bear market bounce? We were clearly stretched on the downside and a rebound was likely, but the macro picture is not improving. We have been increasingly worried about the fundamentals and the macroeconomic picture and sounding the "all clear" signals seems a bit misplaced and hopeful.

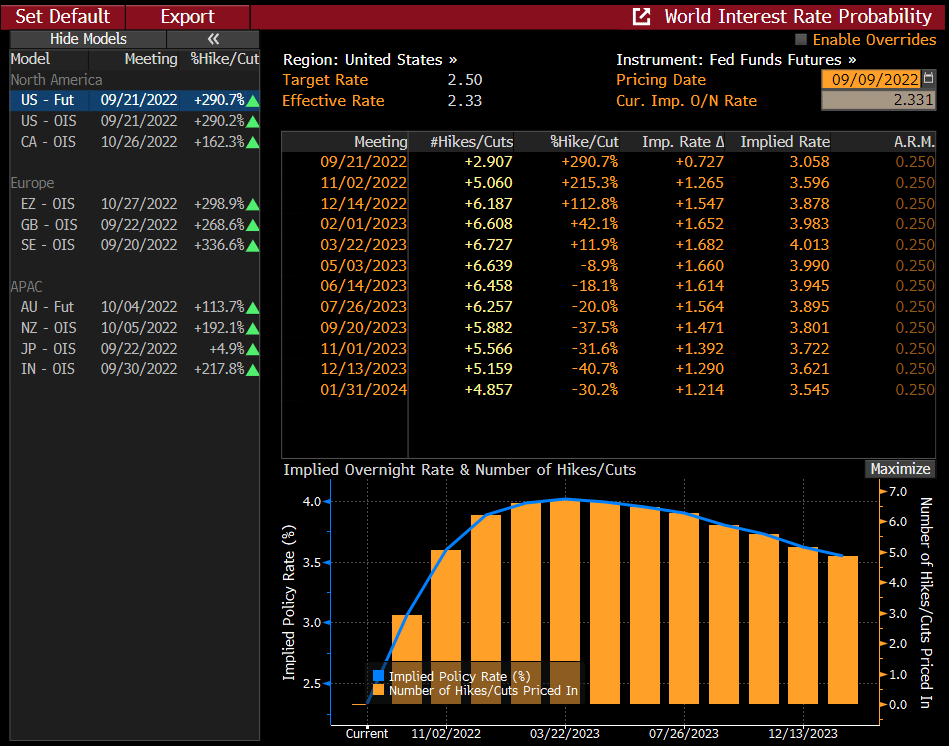

This month we will get another super-sized rate hike. The Fed has been adamant around controlling inflation and any hopeful pivot from the FOMC, seems a bit wishful. Here is the Fed Fund Futures probability matrix. +75 bps in Sept, followed by +50 bps in Nov and another +25 bps in Dec. May '23 is the first month that the bond market believes a rate cut could happen. Could it come sooner? Sure, but that would require a rapid deceleration in the economy and most likely would not be receieved well by the stock market.

Inflation is still running well ahead of the 4% top interest rate anticipated in this matrix, and thus cash/purchasing power is worth less, when factoring inflation. CPI is slated to be released on Tuesday, and most likely will recede from the prior month as gasoline and energy costs are lower. The street is looking for +8% vs. +8.5% in July. But for Core (Ex-food and Energy), the survey is actually ticking higher (+6.1% vs +5.9% in July).

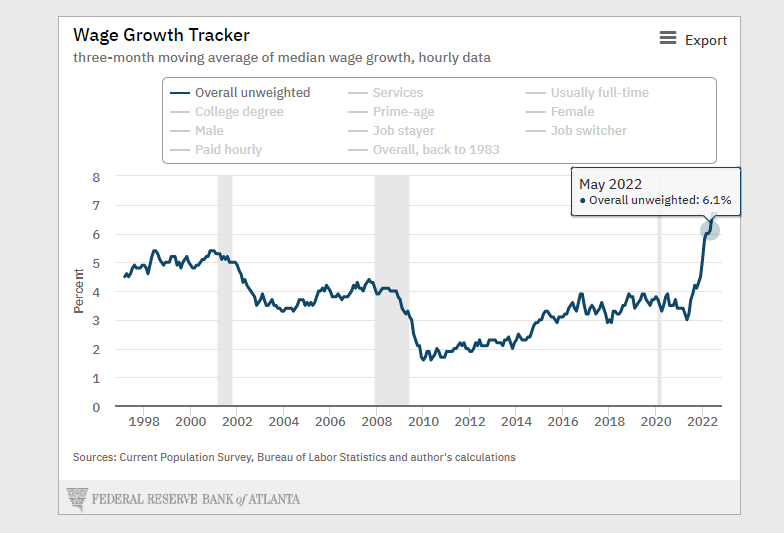

Wages are still not keeping pace with inflation and the Atlanta Wage Growth tracker is only up +6.7%, which implies the consumer purchasing power is not keeping pace with inflation. This is unsustainable and why the Fed is hell bent on getting inflation back to trend. The eventuality of unchecked inflation is consumer consumption contraction.

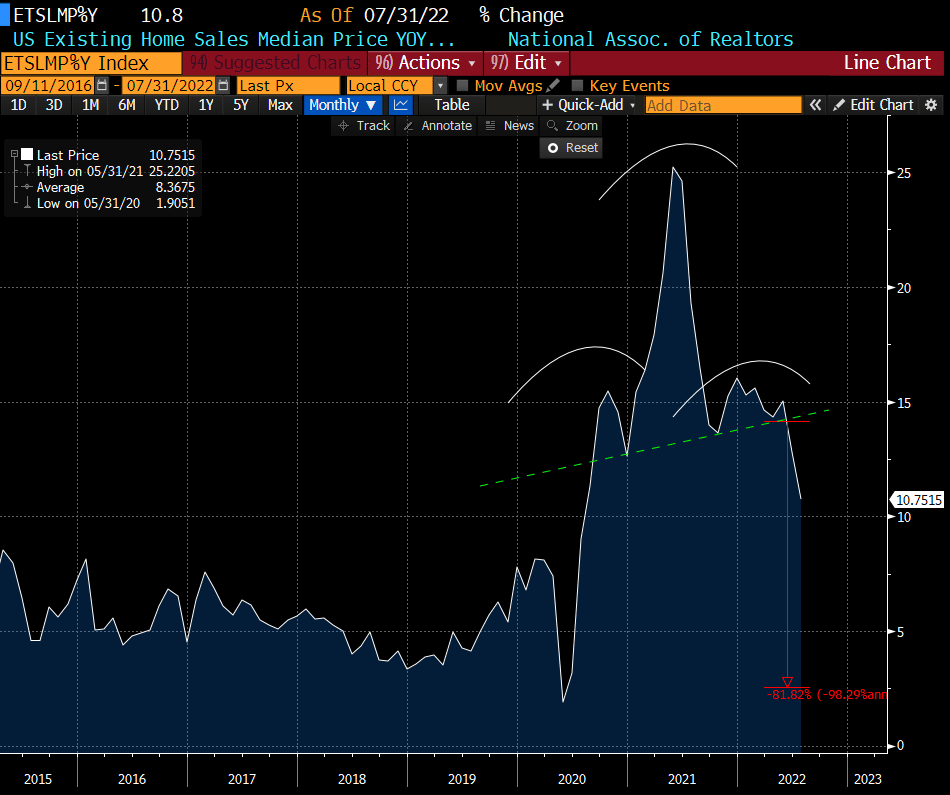

In the meantime, the housing market continues to implode. Why does this matter? Because it's the single largest asset weighting for an individual, and when the value of an individual's house declines, historically, consumption declines usually follow. Consider how m much household net worth has exploded upward since the Fed has been accommodative. This is now higher than during the housing bubble and during the Internet bubble years. Household net worth is +$39 trillion post Covid stimulus or +158% relative to GDP. Compare that period to the housing bubble and the dot com bubble, of +98% and +79%, respectively. The speed of the recent decline in housing activity is also much worse when compared to those bust periods.

Existing home sales are down 27% from the peak.

New home sales are down -50% from the peak.

Contrast that with new home sales under construction....

"Houston, we have a problem."

What happens when all these existing sellers have to cut price materially because they can't afford to live?

Prices for existing home sales are cratering but have they cratered enough? This is a clear head and shoulders top break, with a measured move target close to the Covid lows. It remains to be seen whether we can apply technical analysis to this sort of dataset, but the picture is clear, its going down precipitously and likely will continue if rates keep marching upward.

But as we have penned many times before, the stock market does not move in a straight line. How should we think about the stock market set up for this week?

To read the balance of the analysis, please consider subscribing for a very reasonable $19.95/month. One very small directional swing trade will pay for years of your subscription.