It was a wild week in the markets. In fact, the post CPI report led to the worst day in the stock market since 2020. So much for the inflationary peak bull narrative that so many ill-informed market participants were boisterously touting on CNBC and FinTwit. Tisk, tisk...

Our message has been steadfastly bearish on the macro since Jan and we have timed every major market swing since June. Markets do not move in a straight line, and it is our job to help professionals and serious traders, navigate that landscape. In fact, we were positioned bullishly into this week, but determined that the CPI was in fact too binary to consider holding our directional long position into, especially as the pre-market, pre-CPI bid, was actually hitting our 4170-4180 SPX target. This newsletter has now successfully navigated ~1350 SPX points since the June low, in both directions.

$19.95/month for this level of precision, maybe seems too reasonable?

The biggest issues for the stock market and the economy, remain interest rates, inflation, and a misunderstanding of economic cycles.

The first issue is rising interest rates. The FOMC, who meets this week, has expressed at nauseum, how they are intently focused on bringing down inflation. This is quite reminiscent of Draghi's famous missive "whatever it takes" speech from 10 years ago.

https://www.bing.com/ck/a?!&&p=0ee6b0c0f94dd09bJmltdHM9MTY2MzQ1OTIwMCZpZ3VpZD0yODEzZWIxYS1mMTJmLTZkNzYtMzQ4My1mYjNhZjBjOTZjNzEmaW5zaWQ9NTI2OA&ptn=3&hsh=3&fclid=2813eb1a-f12f-6d76-3483-fb3af0c96c71&u=a1aHR0cHM6Ly93d3cueW91dHViZS5jb20vd2F0Y2g_dj10QjJDTTJuZ3BRZw&ntb=1

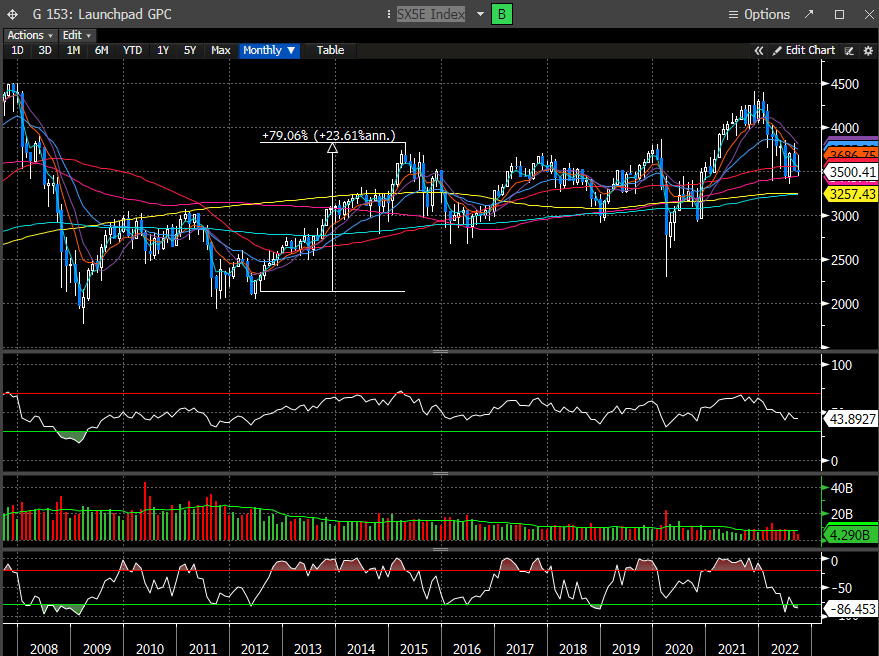

Back then, standing in front of the ECB money printing press proved to be a grave mistake. Here is a chart of the Euro Stoxx Index (Blue Chip European Index, priced in Euros). From July '12 to Apr 2015 the index went up +79% in pretty much a straight line.

So, this begs the question: why are so many participants eager to fight the Fed who is raising interest rates at the fastest rate in over 40 years, while simultaneously shrinking their balance sheet? Markets thrive on liquidity, and the FOMC is using an industrial sized vacuum to suck that liquidity out of the room.

The second issue is inflation. Obviously these 2 are related as the FOMC is raising rates in an attempt to squash inflation. The CPI was reported on Tuesday and the core actually ticked up. Oil has come down quite a bit and that is why the headline number receded but the core strips out food/energy and still remains stubbornly high. We have been in the camp all summer that inflation is likely peaking but peaking is not the same as reverting back to trend, which is 2%, and coincidentally the FOMC's target.

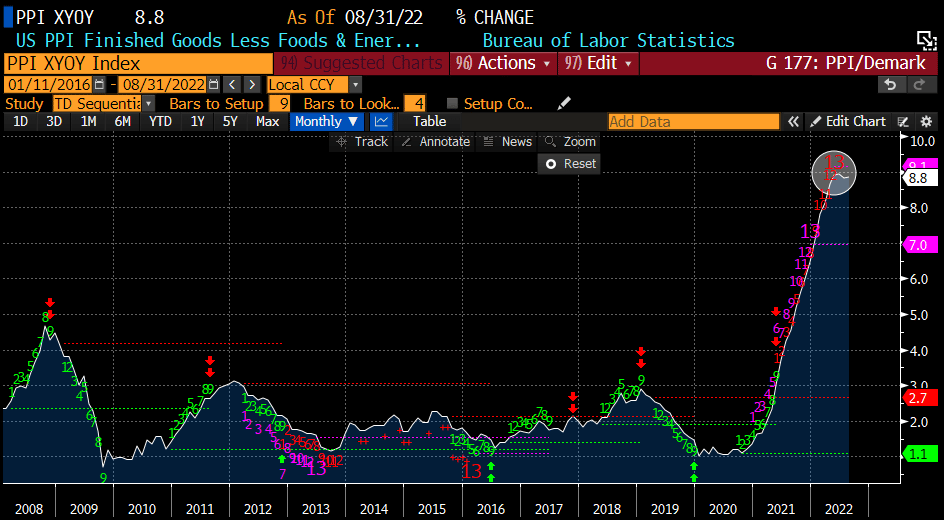

Inflation peaking can be depicted here. As you can see, if you overlay DeMark signals on the CPI, it posted a cluster of 13 sells, with a sequential 13 printing in Jun. And now with a price flip down (Green 1 below the price bar).

The PPI has a similar look but the DeMark Sequential 13 recently printed and now just starting to turn down.

While we can view this bullishly, they both have a long way to drop before getting back to some sense of normalcy.

If you apply a similar analysis to core CPI, we still have 3-6 months before a 13 sell will print. Does a 13 sell have to print for this to turn down? Of course not, but if we are thinking in terms of how to invest in the stock market, this remains an issue and could linger for some time. 3-6 months actually lines up with the Fed possibly starting to cut interest rates.

Fed Fund Futures heading into the FOMC have an 80% probability of a 75 bps hike on Weds and 19% of a 100 bps hike. There is a 90% chance of another 75 bps hike in Nov, with another high probability of 50bps in Dec. The probability of a cut still remains in the May '23 TF.

The last issue is the economic cycle. Currently we are not seeing recessionary activity, but the probability is rising. We have discussed savings rate sinking, credit card debt above previous peaks, employment trends weakening and earnings revisions likely. We are not going rehash our comments here, as we have written about them multiple times over the summer. But the bottom line is that stresses are building, and these will undoubtedly get worse.

The biggest question remains, has the stock market priced in all these risks?