The stock market action in the last week was quite gross, but we can't say we are surprised. We have been suggesting a test of the SPX lows was coming for some time, yet pundits on CNBC, Fintwit Furus and Wall Street strategists have all been pointing to various breadth thrusts, FIB retracement violations, Inflation peaking, etc., as reasons why this wasn't going to happen....yet here we are. It's amazing how many of them were advising buying near the Aug highs and how many of them are now pointing to 3200 as the next target on the SPX. You cannot make this stuff up. Buy @ SPX 4300, sell @ 3600....got it.

There are some very smart and astute people we admire that have stuck to their views all year and have continued to suggest all rallies were bear market rallies. They have been right. We have been advocating a similar narrative and we are proud of that.

Despite the angst and blowback, we get from publicly expressing our views, it still takes quite a bit of fortitude to hold those beliefs from being altered.

We posted this on Twitter publicly on Aug 11th, just to shelve the confidence that was pervasive about the bottom being in.

This along with many additional bearish sounding tweets were met with some very angry bullish retorts. Most were disrespectful, and inaccurate, and we were forced to block them.

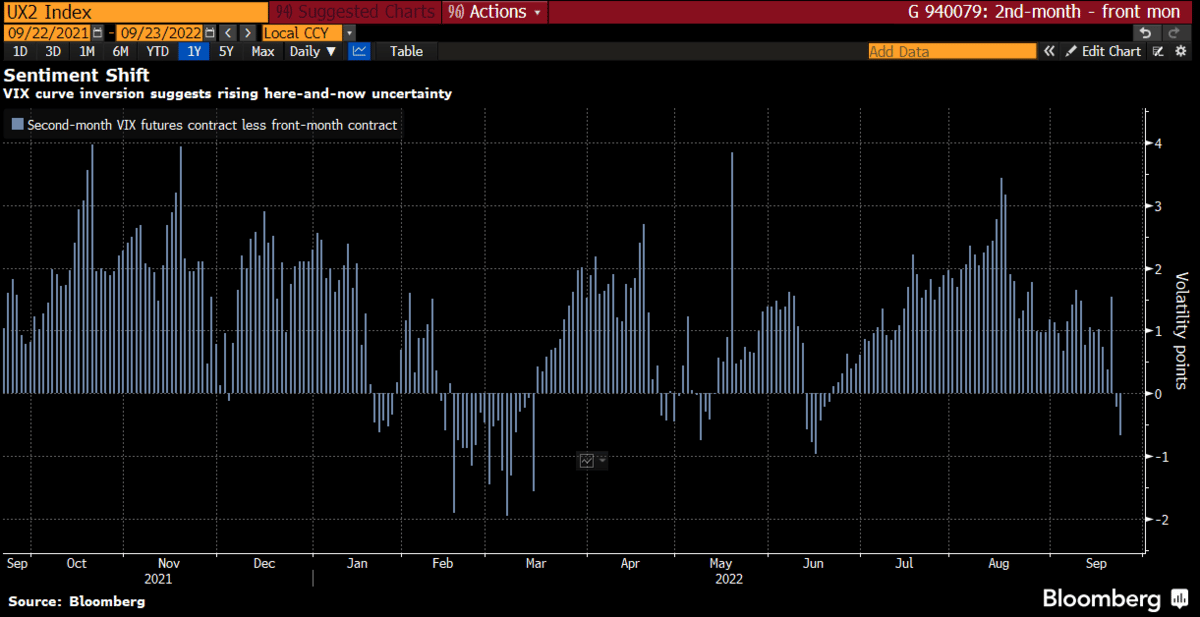

Moving on...Volatility has finally reared its ugly head. We warned in late Aug that Sept/Oct is the worst stretch of seasonality all year. And the set up coming into Sept was quite awful. That belief is corroborated by the last 2-week stock market drubbing. The SPX is down -11.50% since the Sept swing high and now the VIX curve has inverted.

What did Powell say that was so different than what he has been advocating all summer? Nothing really, it's just that the market narrative has now shifted to higher rates for longer as evidenced by the dot plots.

The 2nd derivative and something we've been discussing for members, is the notion that when the Fed raises rates as fast as they have been, because they are behind the curve, global equilibrium gets thrown into chaos. This is when something breaks. Couple that with an equally aggressive global central bank inflation fighting initiative by increasing their own sovereign rates, and the cocktail for disaster is poured.

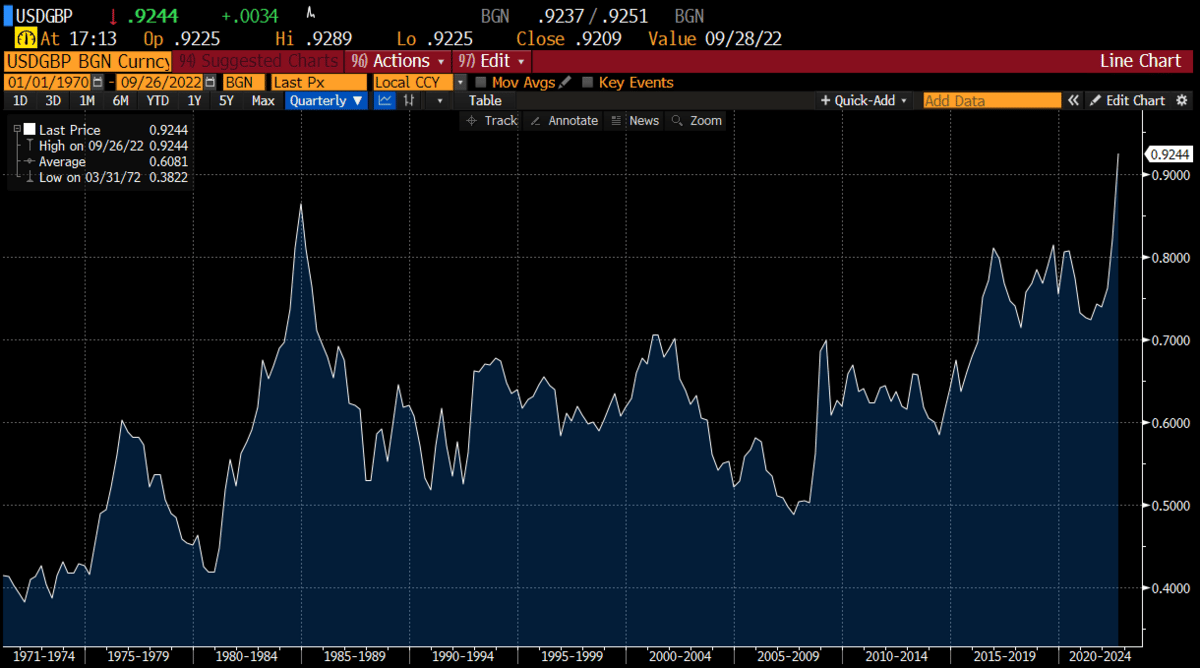

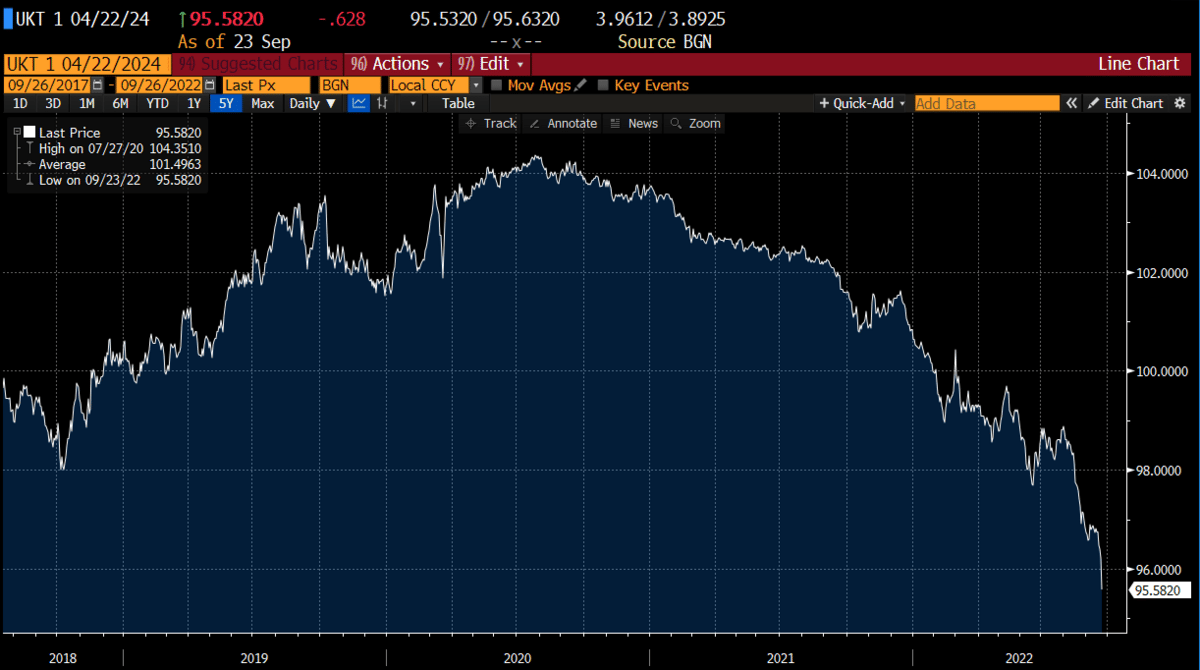

We saw evidence of this on Friday when the UK surprised the world and cut taxes. The British pound proceeded to tumble to 37-year lows against the $USD on Friday. The 2-year Gilt jumped 38 BPS to 3.878%. Usually, the relationship between FX and Yields are directly correlated. This screams of a loss of credibility and suggests the BOE will have to raise rates aggressively to thwart a currency implosion.British Pound:

UK Gilt:

Separately the $USD strength became too much for Japan on Thursday and they intervened in their own FX market for the first time since 1998, as the Yen fell to 24-year lows vs the $USD.

Japanese Yen:

All goods and services are priced in FX, and when those markets get dislocated, they cause quite a bit of disruption, which is felt across the globe. Especially when those currencies are denominated in the larger developed markets, such as Japan or the UK.

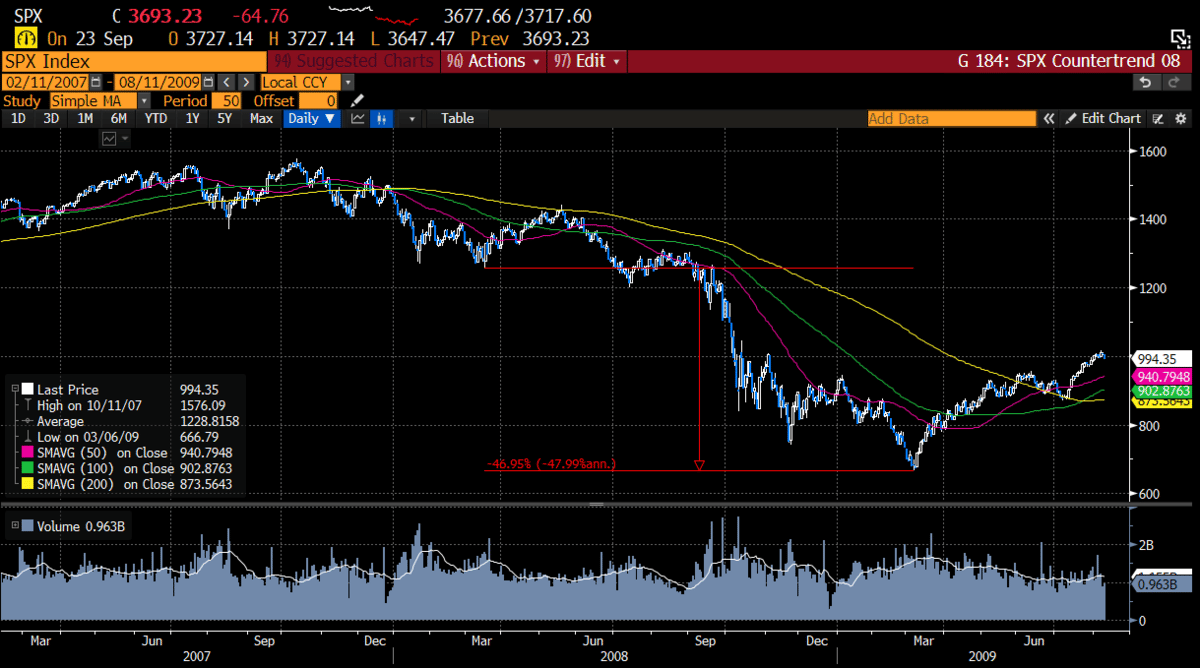

The reality is the Fed has expressed no interest in stopping their rate cycle campaign unless inflation reverts back to trend. In our last weekend report, we discussed the possibility of peaking inflation but suggested that reverting to trend will take time. But much like during the 2018 taper tantrum, when something breaks, the Fed will react. We fear that this reality will come before they reach their inflation target. When it does or how it does is anyone's guess. While the UK issue or Japan intervening in their own currency market doesn't seem like a black swan event, maybe it's just a forewarning of bigger issues to come. Recall Bear Stearns' Hedge Fund issues occurred in 2007. The firm didn't fold until March of '08. The SPX went down another -47% after the JPM buyout on Mar 16th, 2008. Lehman didn't fall until Sept.

Something to consider before putting all your chips on the table.

But as we have said many times before, markets do not move in a straight line. To read our current assessment of the market set up, please consider our premium membership below.