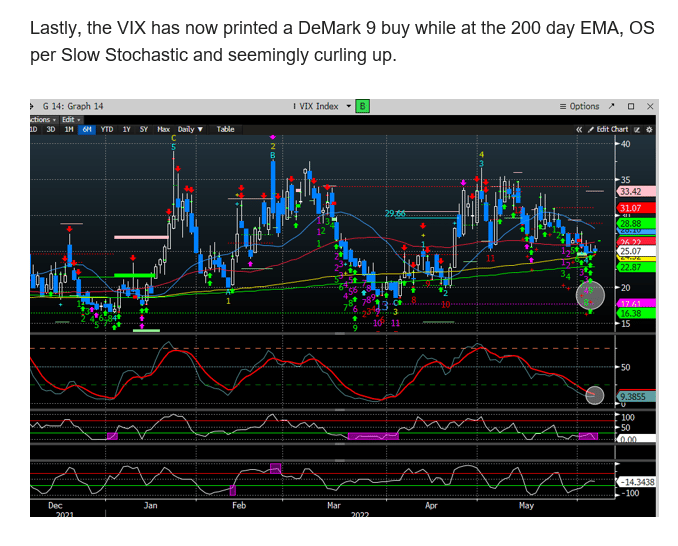

In our 6/5 Macro report we discussed how all volatility instruments we track were posting DeMark 9 buys, and that adding protection seemed like a good idea. The $VIX is up +41%, $VXN + 35%, and the $RVX +34%, since the signals. See excerpts below:

We are still on Day 3 of the sell set up.

Today the SPX tagged one of our support levels, we thought needed to be tested. We discussed downside levels in this past weekend's report (161.8% projection level from Jan high @ 3749). This also coincides with the Jan/March '21 double bottom.

For the Russell we discussed last Tuesday night why we thought the red box resistance level was a good spot to short. Now down over -10% in 4 trading days.

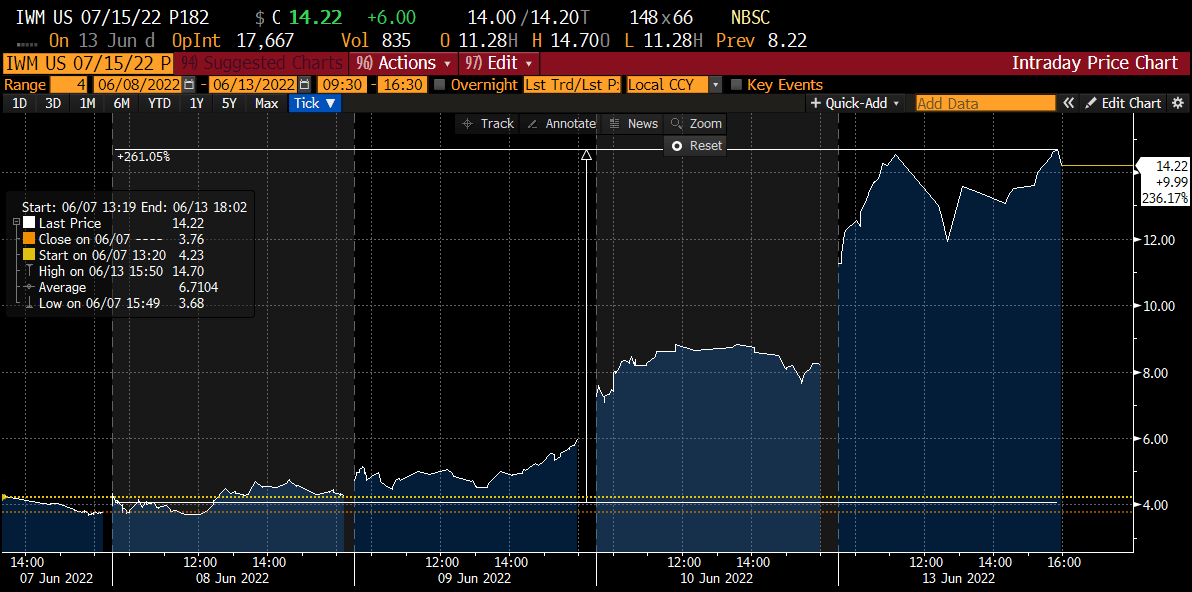

The IWM puts we highlighted are now up +260%.

The bigger question is, do we think a tradeable low into the FOMC could occur?