As we wrote in our Weekend Macro report, the CPI was a binary event. We actually wrote that the market would likely trade up into the event, as the internals suggested so...this did occur up until 8:30am EST today, when the CPI was released. Our recent upside target for the SPX was 4170-4180, and this mornings $SPY futures high (Pre CPI) was 4175.

Here is that excerpt discussing the importance of that level.

The CPI report was down mildly, but was above the consensus forecast, while the core rose as well. We have been adamant that CPI will not recede into the night, as some very well-paid strategists on CNBC/Wall Street have been clamoring for and a reason for their bullish views. We have been very publicly bearish on the Macro (see last week's report) but were positioned tactically long the stock market since SPX 3920 and into this week.

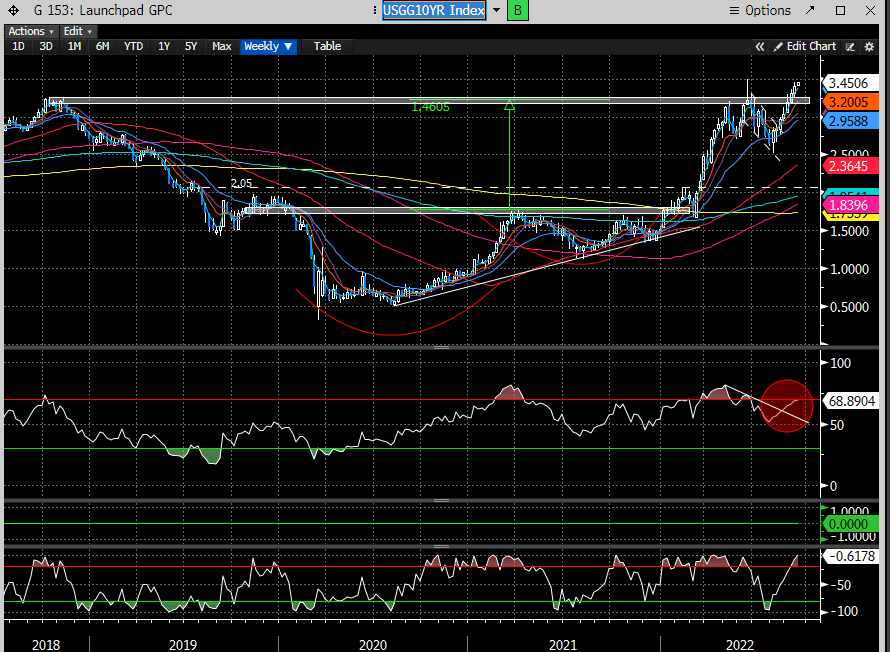

While there were many underlying internal improvements that we track to consider staying long this week, the CPI was simply too binary to carry longs into the event. In fact, the 10 year bond was giving us those clues. Here is what we wrote in our weekend macro report:

And 2 days later....

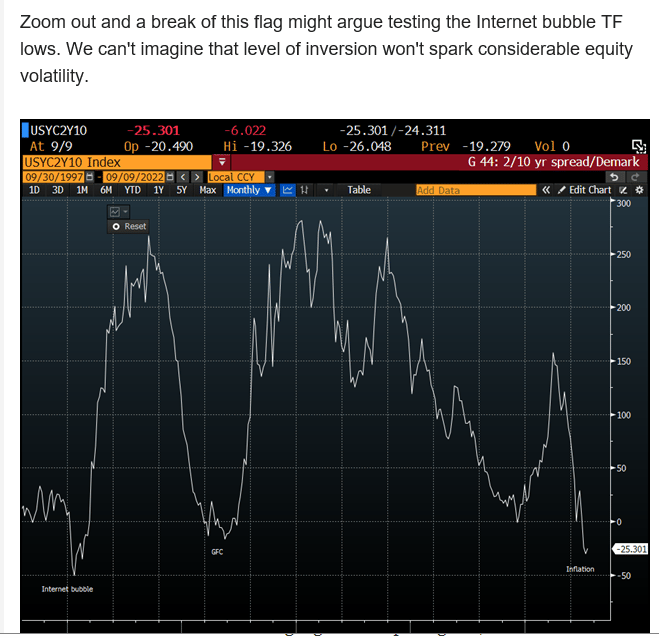

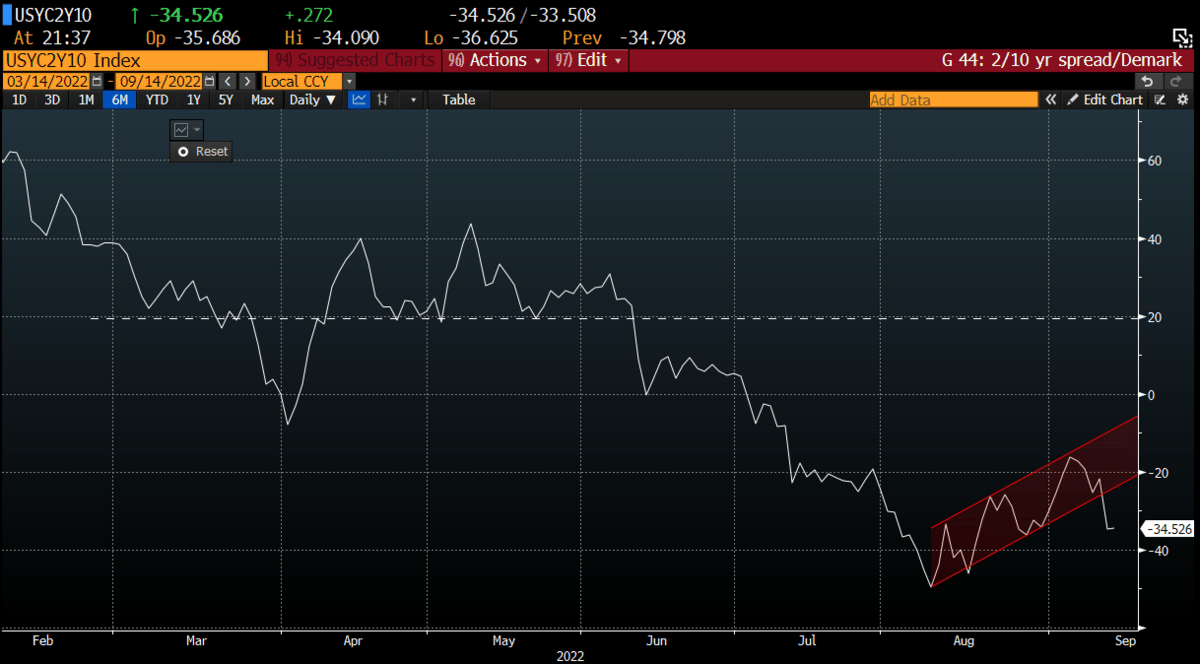

We also discussed the 2/10 year spread in our report and on public twitter and a reason to remain concerned.

And after today? Bear flag break.

So where do we go from here?