Monthly calendar turns have been rough lately, with investors hoping for positive fund flows to support the first few days of a new month, only to see that optimism crushed. August started with a sharp drop, as the SPX fell 7% within a few trading days. September wasn’t much better—after Labor Day, the market took another dive, with a 4% pullback. Now in October, the SPX has already shed nearly 2% in just two days. And with U.S. election results not finalized until November 5, the start of next month doesn’t look promising either.

While we didn’t exactly predict these sharp declines in August and September, we did signal caution heading into October, a historically volatile month, as noted in our weekend report.

The catalyst for this week’s quick decline? A weak ISM report, coming in at 47.2, marking six consecutive months of contraction. Although the number improved slightly from the prior month, anything below 50 still signals a shrinking economy.

In the past two months, recession fears have quickly dissipated following weak reports, as subsequent economic data showed unexpected strength in other areas of the economy. This Friday’s payroll report could bring another round of volatility, especially if it falls short of expectations. Bloomberg economists are predicting a strong payroll number, which could further fuel the “no-landing” narrative. Regardless of how the data shakes out, the market’s whiplash reaction to each macro release continues to be mind-numbing.

As we highlighted over the weekend, the stock market has had a stellar run, rising in 8 out of the first 9 months of the year, marking the best start since 1997. September also capped a five-month winning streak, the longest since 1980 during an election year. However, this history now stacks the odds against the bulls, making a green October less likely.

JPMorgan warns that systematic funds (CTAs) could start unwinding U.S. equities if the market doesn’t push higher this week. Goldman Sachs echoes this sentiment, estimating up to $47 billion in stock could be sold, further tilting risk to the downside.

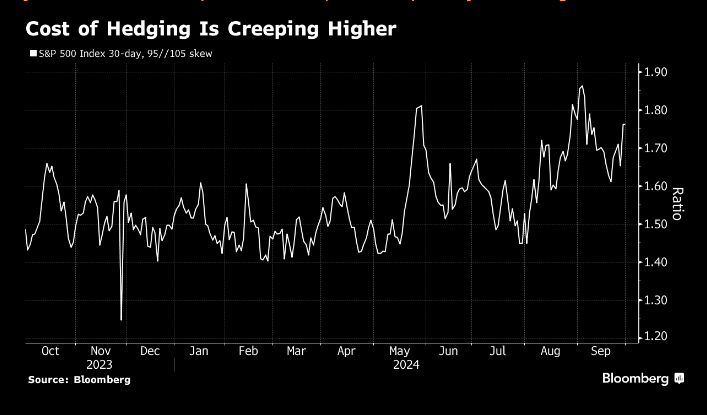

The options market is reflecting this growing anxiety as well, with the cost of hedging against a 5% decline climbing noticeably.

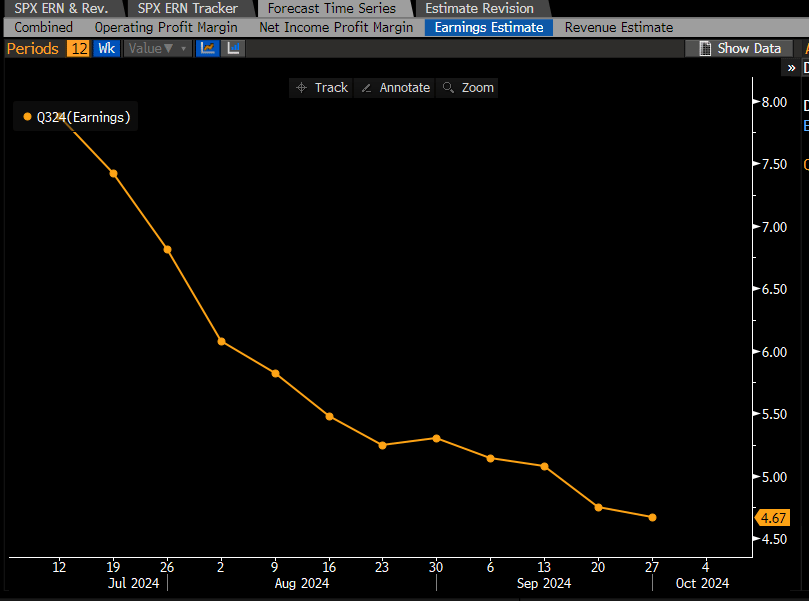

October is also the start of the Q3 earnings season, and estimates for SPX profit growth are slowing.

SPX earnings estimates have nearly been halved since July, which could stir up additional volatility ahead of earnings season as investors adjust their positions to account for slower growth. However, the lowered expectations set a more achievable bar for companies to exceed, making the second half of October potentially more favorable for stocks.

In our recent reports, we signaled caution heading into October, and so far, that sentiment has proven justified. We continue to expect a choppy month with the potential for more downside ahead. However, this doesn’t imply a bearish outlook. Markets rarely move in a straight line, and our goal is to ensure readers are prepared for all potential outcomes.

Let’s review the charts.