“The bottom line is that the boat is taking on enough water to tip over, but it may take more bad weather…”

In our 10/16 report, we used the analogy above regarding the stock market. At that time, we were speculating that a poorly received TSM report could be the storm that collapses an already fragile semiconductor group, taking the rest of the technology sector with it. TSM reported a very strong number, and that thesis was squashed.

However, in an earlier 10/6 report, we discussed the potential for dislocation in the stock market if yields rebounded too aggressively.

Here is the excerpt from that report:

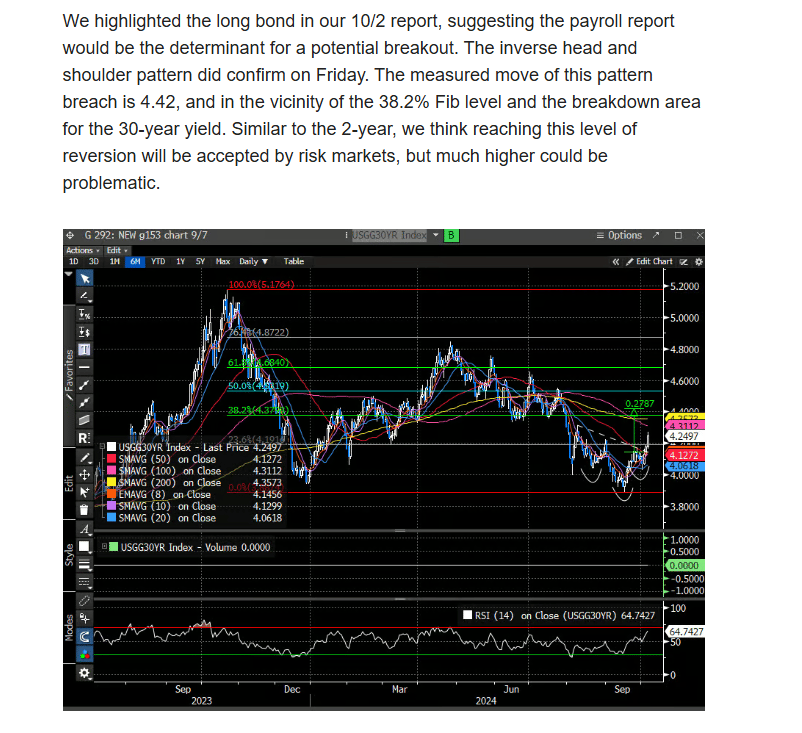

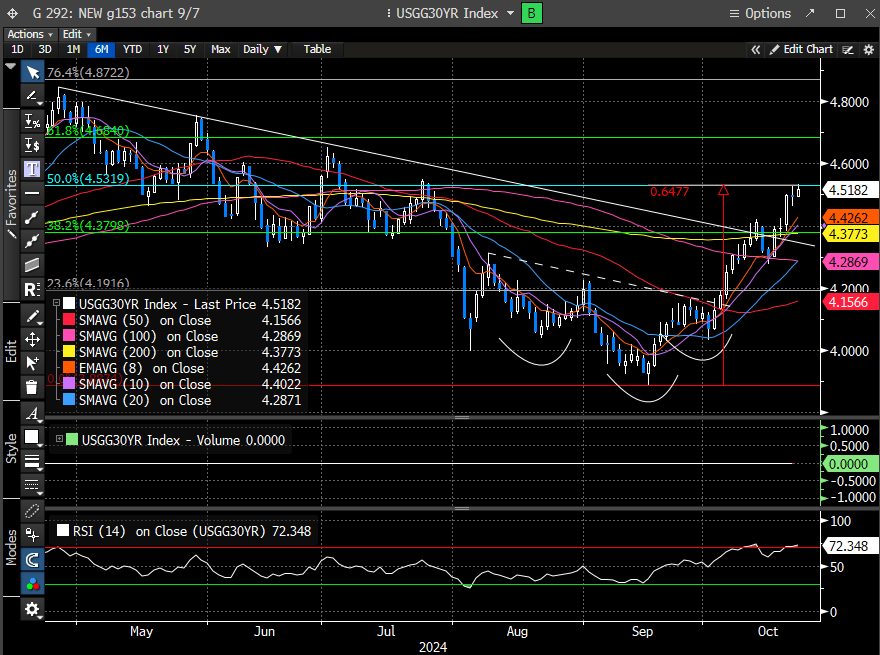

Pinpointing the exact yield level at which investors take notice is somewhat arbitrary, but it's largely about the rate of change. When a key instrument like treasuries moves too quickly—whether up or down—it can cause dislocation across other areas of the market, as investors rapidly adjust allocations between asset classes. Over the weekend, we specifically discussed the likelihood of rising yields in the 30-year bond, and since then, the 30-year yield has climbed another 13 bps, marking a total ascent of nearly 65 bps since mid-September. For such a widely-held and heavily-traded instrument, this is a significant repricing. A swift rise like this almost always introduces volatility into the stock market, and this week, the market finally started to take notice.

The term premium on 10-year Treasury notes—an expression of the extra yield investors demand for holding longer-term debt rather than rolling over shorter-term paper—has risen sharply from near zero to just under a quarter point this month. It's now at its highest level since last November. This increase is essentially a reflection of perceived future risks, such as inflation, increased Treasury supply, and the uncertainty surrounding the upcoming election. This surge in term premium is contributing to growing concerns that the Fed may have been premature with their 50 bps rate cut in September as markets start to reassess future risk factors.

As we hinted earlier, the risk boat was primed to capsize—and capsize it did. The Russell Small Cap Index (RTY), most vulnerable to rising rates, has fully reversed the gains it posted last week. This sharp reversal underscores the heightened sensitivity of small caps to interest rate fluctuations, as rising yields put pressure on companies with tighter margins and higher debt loads. The swift unwinding of last week’s momentum is a clear signal of the growing strain from elevated rates across the broader market.

The SPX is currently testing the first support zone that we highlighted in last week’s report.

The Nasdaq is as well.

Over the past two weeks, we’ve highlighted the growing technical risk factors facing the stock market, particularly the presence of DeMark sell signals across multiple time frames and indexes. While we don’t take these signals lightly, we use them as early warnings to watch for further evidence of an impending trend reversal.

The market is now contending with a confluence of uncertainties—earnings season, the October payroll report, the upcoming election, and another crucial FOMC meeting. This creates a volatile backdrop, and investors may hesitate to commit new capital in what feels like a sinking market. Historically, markets tend to recoil in the face of such uncertainty, amplifying the potential for more volatility and, possibly, broader dislocation.

The big question is whether this is the beginning of a more significant retracement or if the selling will remain contained. While the recent downside pressure raises concerns, we haven’t yet seen confirmation of a broader breakdown. As always, we’ll be closely monitoring technical signals, market breadth, and reactions to upcoming data releases to determine whether this is a short-term shakeout or the start of a deeper correction.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade