There's something irreplaceable about autumn in New York City—the sensory shift from the sweltering concrete jungle to crisp, invigorating air, and the energy of people on the sidewalks somehow more alert, purposeful. Fall there holds its own brand of magic, and for many, nothing quite captures that electricity like playoff baseball, especially when the Yankees are in the mix. Having been in the city for those incredible late-90s years through 2019, with the Yankees dominating headlines year after year, your nostalgia is real and well-earned. Watching them now, without being right in the heart of the action, it’s natural to feel that bittersweet distance. The city pulses with extra life during Yankees' playoffs—a buzz that’s contagious and memorable.

This market situation, like a Yankees playoff run, feels pivotal. Much like a tight series hinging on a few key plays, we find ourselves awaiting crucial reports and data to tip the scales. As we noted in our 10/28 analysis, specific market-moving factors—earnings from major Mag 7 players and key economic indicators like the PCE and payroll report—have the potential to influence the next big shift. So far, three of the five Mag 7 companies have reported, with GOOG sparking some optimism initially before it quickly cooled, anticipating further data. MSFT and META, unfortunately, haven’t provided the anticipated support. At this point, futures, especially on the Nasdaq 100, are showing strain. It’s a bit like watching your team struggle with two outs; a game-changing move could still happen, but the pressure is on.

The Nasdaq 100 Futures are currently testing the lower end of this bearish rising wedge formation.

The SPX futures have a similar pattern in play but are already breaching the lower bound.

Our increasingly cautious view of the stock market over the last two weeks is finally starting to show more visible cracks. Tomorrow’s PCE report, should it show a reaccelerating inflation rate, has the power to disrupt an already very fragile market, positioning it for further declines. The expectations are for a mild uptick in the monthly headline number, but the year-over-year comparison should hold relatively steady. An in-line number should reinforce the view that inflation is slowing.

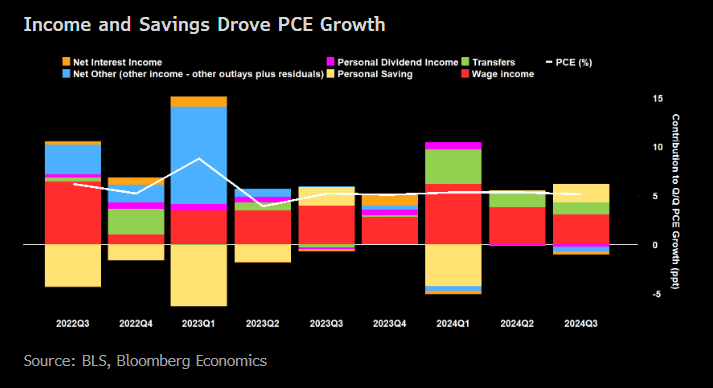

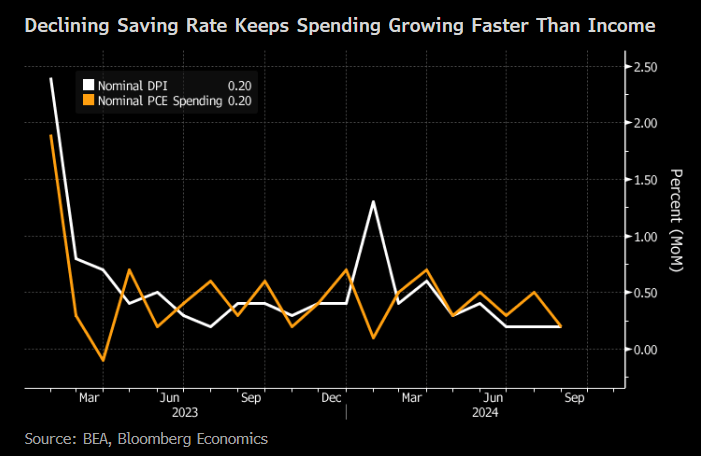

The uptick in inflation is being driven by higher incomes driving increased spending.

The caveat is that under-saving drives spending, implying that spending is growing faster than income. If the employment picture continues to cool, this will undoubtedly revert as consumers become more cautious.

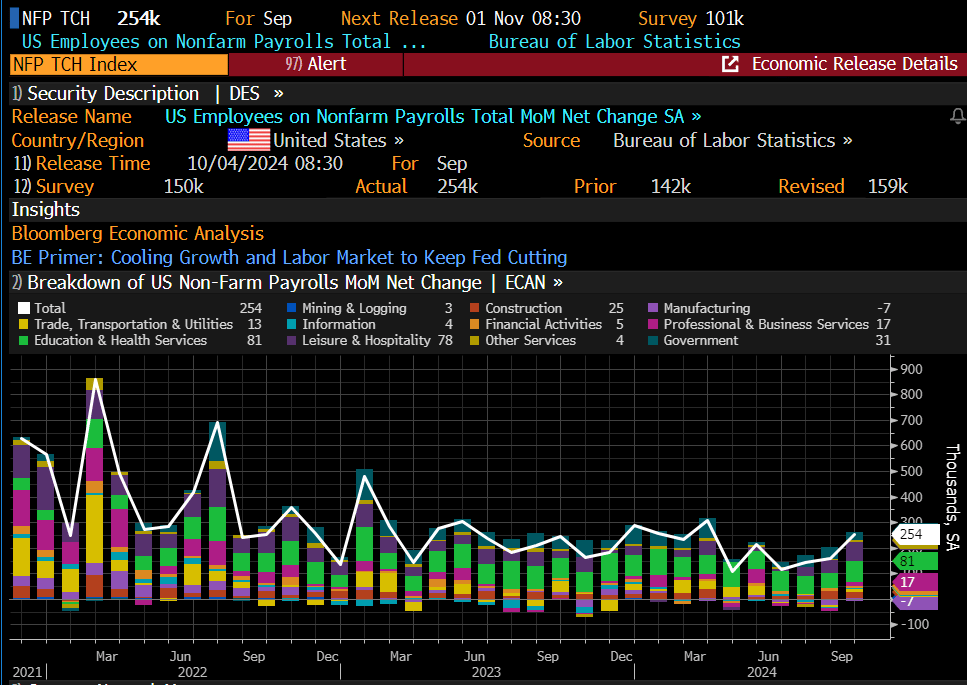

Friday, the critical payroll report will be released. The current forecast is for 110K jobs, which is below the 254K September figure. This suggests unemployment will stay unchanged at 4.1%.

While we are not economists, anything largely in-line with the referenced numbers above may actually support the stock market. The status quo will keep the Fed on track with rate cuts, but should we get notable strength in either report, we will likely see another leg up in rates, most likely pushing the stock market lower.

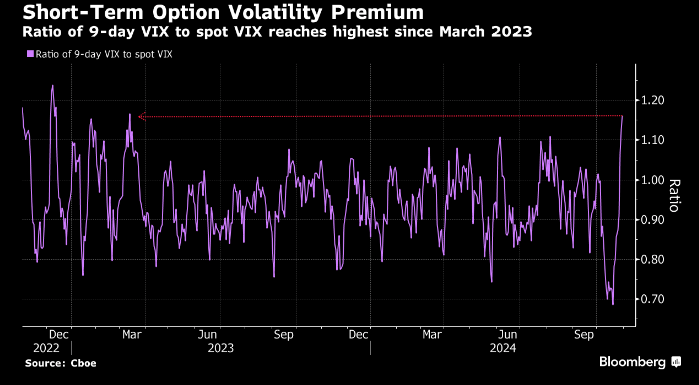

The volatility complex is hedging out these risks as we head into next week’s election results and FOMC meeting. The ratio of 9-day VIX to spot has reached the highest levels since March 23, the time of the regional banking crisis.

The stage is set for macro curve balls to be thrown. The stock market is at the plate. Batter up!

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade