We talk to a wide range of investors, from seasoned professionals to retail traders, and the sentiment during a strong market trend like this one is often remarkably consistent:

“This can’t last forever.”

“These moves are parabolic—this won’t end well.”

“Is it time to short the market?”

Why do people instinctively want to bet against what’s working? It’s the opposite of FOMO—let’s call it "Anti-FOMO Derangement Syndrome" (AFDS for short). Meanwhile, we also hear from newer investors who’ve stayed on the sidelines all year and now, after a big move, are asking if it’s a good time to buy in. You can’t make this stuff up!

This is precisely why technical analysis (TA) is essential for timing the market. TA provides an objective view of buyer and seller behavior. Not all TA is created equal; it’s more art than science. Just as fundamental analysts study balance sheets and macro trends, good technicians build a roadmap of market sentiment through price action. Market moves leave “footprints,” and skilled technicians know how to interpret those clues.

Now, here we are—professionals and retail investors alike, scratching their heads after a post-election rally, wondering what’s next. If you’ve been following our reports this year, you know we’ve been on the right side of the trend throughout. We also pull back long positions or add short exposure when TA signals it’s time, as we did in July before the market’s steep drop into August.

Do we get every move right? No, but we get most of them, and we stay aligned with the prevailing trend.

So, is SPX 6K the top? If you read our last report, you already know our stance. Stay tuned for more on that shortly.

In our 11/6 report, post-election, we highlighted potential near-term upside. And so far, it’s playing out.

The SPX has propelled precisely to the levels we suggested it would struggle and is now consolidating. From our 11/6 report we wrote:

“If the SPX were to hit 6K in the coming days (161.8% fib extension), we think reversion, or a pause is likely.”

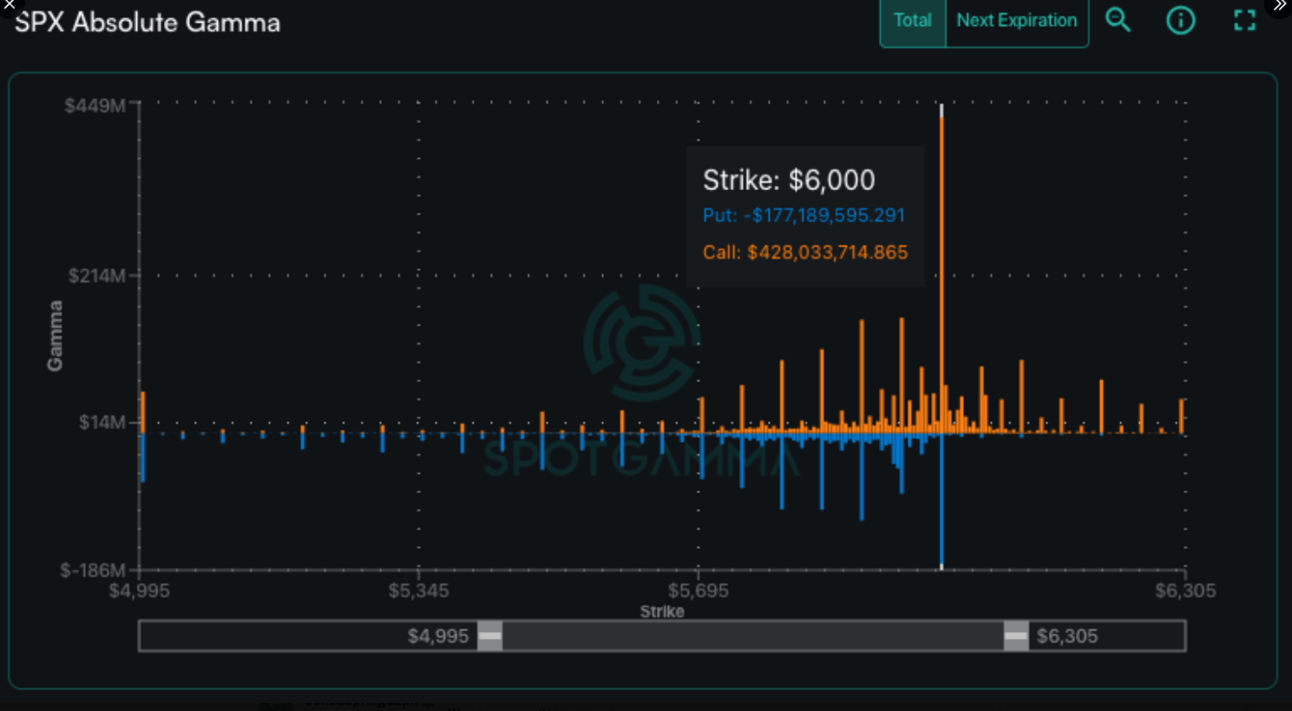

The SPX has gone nowhere for four trading days since reaching our short-term target and likely hovers around the 6K area until Friday’s OPEX unclenches its grip.

The SPX strike with the largest open interest is the 6K level. This implies there likely will be very little wavering from this area until OPEX passes.

Does that set up for a possible retracement next week? It’s certainly possible negative seasonality into the post-OPEX week in November.

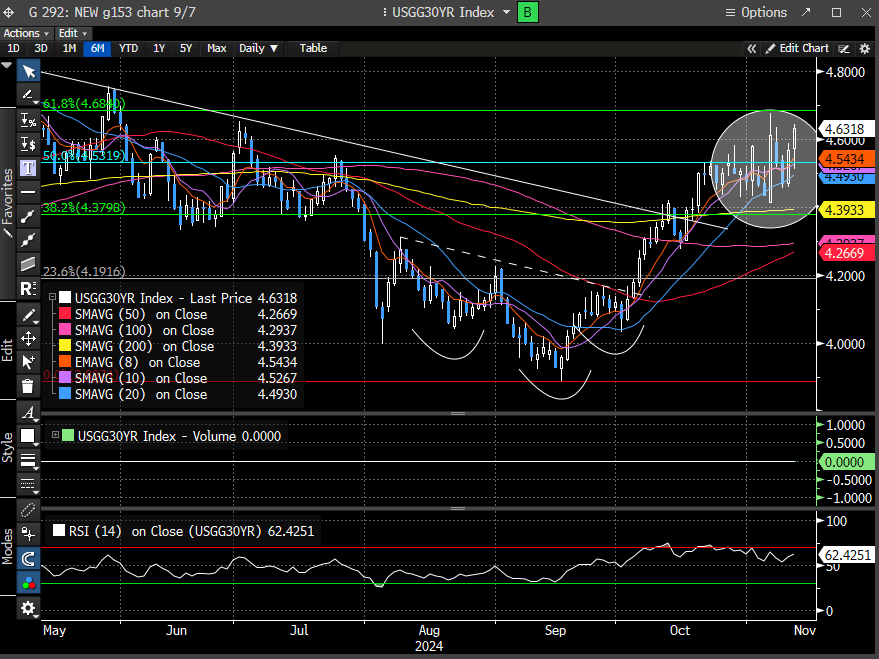

Today’s CPI report didn’t do much for stock market index movement, but the bond market is reacting with longer-term yields pushing higher. The 30-year treasury yield closed at its highest level since July. Rising yields continue to be the largest risk facing the stock market.

CPI reported roughly in line with forecasts, which leaves a December interest rate cut as still the most probable outcome. Post the CPI release, the probabilities for a December rate cut in the Fed Fund Futures market jumped from <60% yesterday to 82% today.

The GS Financial Conditions Index continues to ease in 2024, supplying more ammunition to expect indexes to remain supported through the end of the year.

But like we always say, markets do not move in a straight line.

Let’s review the charts…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade