Here comes the boom! Or at least, that’s what we thought. The most anticipated market event of the month turned out more like a blockbuster movie with a thrilling trailer but a lackluster plot. NVDA reported, and the stock was trading roughly flat in after-hours.

There was nothing fundamentally wrong with their earnings report—it just lacked the “wow” factor that fuels market enthusiasm. While they beat revenue estimates in most categories, they fell short of the lofty expectations many had set. The launch of the Blackwell chip is a positive development, but the higher development costs are weighing on margins. In the end, we’re left with what we’d call a "nothing burger." It’s not enough to reignite the market’s animal spirits heading into the year’s end, nor is it substantial enough to exacerbate the already bearish construction in the indexes.

So, do you want fries with that nothing burger?

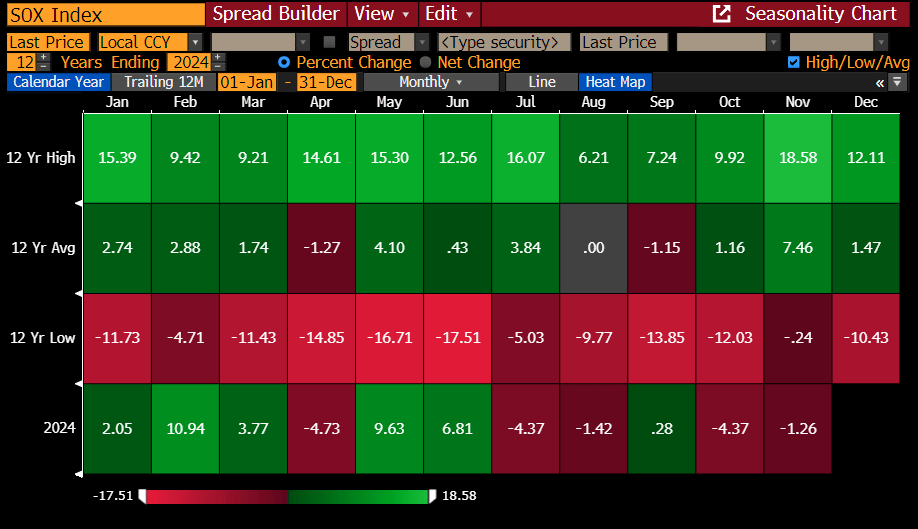

As we noted in a previous report, the semiconductor space’s bearish posture has been a growing risk for the broader market. The SOX Index had already gapped down last week following a weak AMAT report, and NVDA's underwhelming reaction is unlikely to help turn the tide.

If the month ended today, the SOX Index would log its worst monthly performance in over 12 years—a staggering statistic, especially considering November’s historical reputation as the best month to be long semiconductors. Could we see a mean-reversion rally into the end of the month? Given the current bearish momentum, it feels like a long shot, but stranger things have certainly happened in markets.

After an impressive rally this year, the stock market appears to be showing signs of fatigue, and the semiconductor sector stands out as a prime example of this weariness. Given the critical role semiconductors play in driving broader market sentiment, can the rally persist while this key sector teeters on the edge?

We’d argue the answer is likely no. Currently, the Software sector is attracting much of the hot tech money as investors chase year-end performance. While it’s possible that Software could carry the torch into December’s end, it raises a bigger question: is this sustainable, or is it merely masking broader market fragility? The jury is still out.

Technology stocks account for over 30% of the SPX’s composition, with semiconductors making up over one-third of the tech sector—on par with Software. That’s a significant burden for software stocks, especially considering that the group is already trading at a lofty >10x P/S (based on IVG).

How much more heavy lifting can Software do to offset the struggles in semis, particularly with valuations stretched to this extent?

Perhaps the Mag 7 Index can shoulder the load. It's no secret that the Mag 7—comprising the seven largest tech stocks—plays a critical role in the health and trajectory of the SPX. Right now, it’s delivering. With two days still remaining in the week, the Mag 7 Index is printing an inside week above its breakout pivot. If it holds this formation and closes on Friday in this position, it suggests the indexes could continue their upward momentum. This could provide the necessary fuel for the broader market to push higher, even if other sectors are facing headwinds.

The weekly pictures of the other sectors we've been monitoring—Transports, Financials, and Industrials—are holding up, and the index deterioration so far doesn't seem widespread enough to signal a major issue.

Transports (IYT) are experiencing a low-volume pullback to the all-time-high (ATH) pivot. There’s nothing overtly bearish about this action. This is often a healthy consolidation pattern that can provide a solid base for further gains if the sector resumes its uptrend. Given the low volume, the pullback appears to be a natural correction rather than a sign of significant weakness.

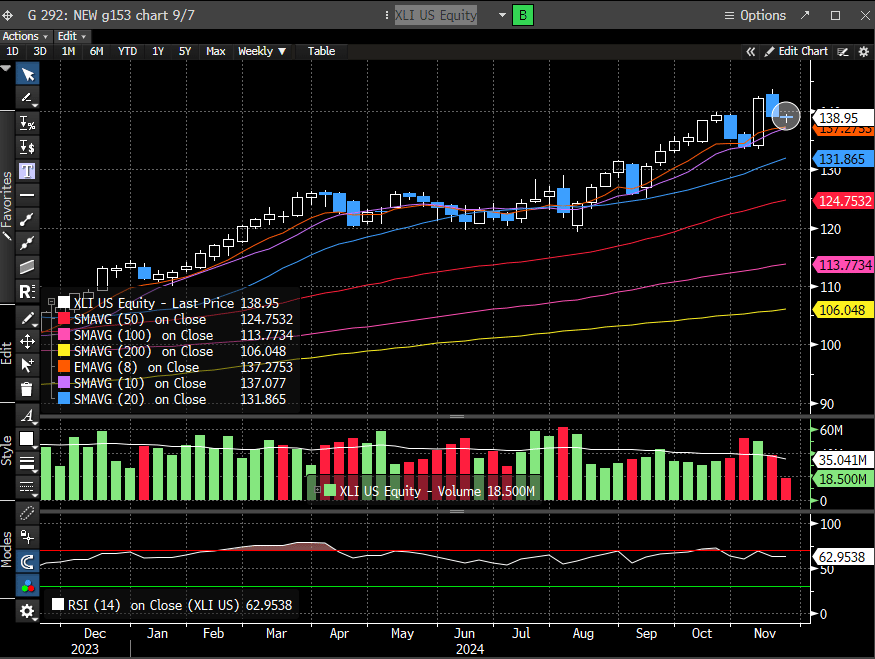

Industrials (XLI) also seem to be in a similar position as Transports. The sector is experiencing a low-volume pullback, and the small-range candle indicates that buyers are stepping in at current levels. This type of price action is generally constructive, as it suggests that there is support in place and should resume its upward trajectory.

Given the lack of heavy selling volume and the presence of buyer support, the pullback looks more like a healthy consolidation rather than a sign of significant weakness. As long as XLI holds above key support levels, this sector could continue to contribute positively to the broader market trend.

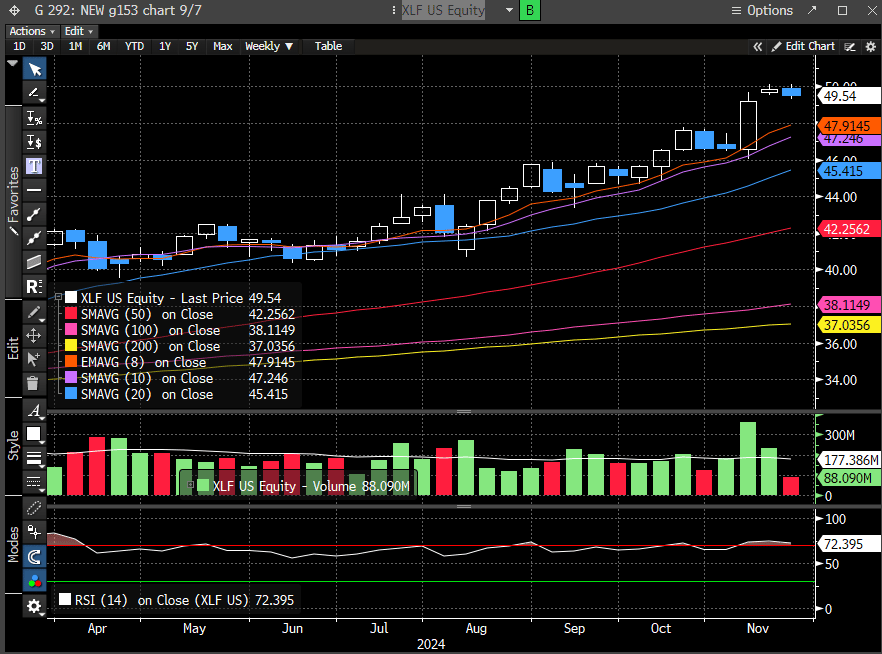

Financials (XLF) are showing strong relative strength, holding the bulk of the breakout candle from two weeks ago with minimal retracement. This is a highly bullish sign, as it indicates that the sector is maintaining its momentum and that there is strong buying interest even after a significant price move.

When a sector experiences a breakout and then holds most or all of that move without much pullback, it suggests that the bullish sentiment is likely to persist. Given the resilience shown by XLF, it’s likely to be a key driver of any broader market rally, especially if other sectors start to show more positive signs.

While it's true that we can debate the stock market's valuation, its lack of a clear catalyst, and the challenges posed by the rates complex, the key underlying drivers of index performance remain largely intact. Despite concerns over elevated valuations and the potential headwinds from higher rates, the structure of the market—particularly the strength in sectors like Financials, Transports, and Industrials—suggests that the broader index performance has solid support.

Yes, things can change quickly in the stock market, and risks can materialize unexpectedly. However, from a technical perspective, there lacks significant evidence at this moment suggesting we're on the brink of a major correction. Instead, the market appears to be consolidating after a strong move. Unless there's a clear breakdown in these key sectors, the current picture suggests the bull market is still intact, for now.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade