We anticipated a volatile week, but the strength of the post-election rally seems to have caught many by surprise—and with the FOMC decision still ahead, there's even more in play. Bonds are tumbling, stocks are surging, and large-cap tech is hitting new highs—something for everyone.

Notably, the SPX is not only at all-time highs but also posted the best post-election day in history, according to Birinyi Associates.

What could a Trump presidency and its pro-growth policies mean for the economy?

- Tax Cuts: Likely to improve corporate margins and drive personal consumption.

- Tariffs: Could benefit small- to mid-sized U.S.-focused businesses (SMBs) but pose challenges for companies with significant exposure to China.

- Strong Dollar: Driven by protectionist policies, a stronger dollar may reduce imports while aiding SMBs.

- Deregulation: Expected to favor the M&A market and further support SMBs.

The Russell Small Cap Index (RTY), largely composed of these SMBs, reacted strongly—closing up nearly 6% on Wednesday, even as the rate complex surged higher (more on that later). This underscores the strength of our July call to rotate out of large caps and into small caps, a move that has now outperformed by over 1600 basis points.

Countless times have we discussed the positive construction of the RTY weekly chart and our 2382 cup and handle measured move target. We recently predicted the target would hit before year-end. Well, Christmas came early. For the record, this has been our target since February.

Full transparency: we did see higher yields as an impediment to the RTY breaking out. We got that part wrong, but our long positioning has stayed constant since summer.

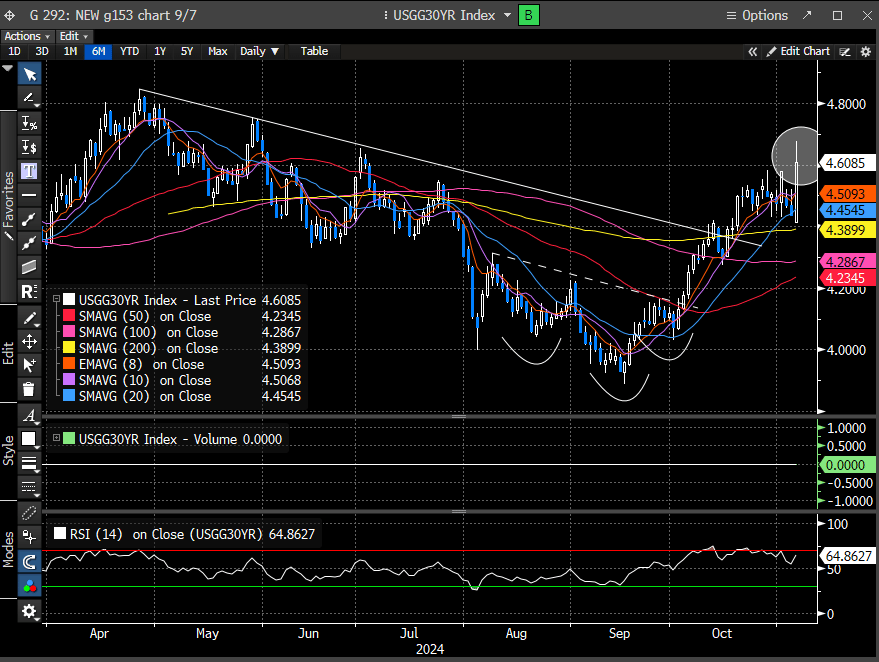

The downside is higher inflation, which is being expressed with the rate complex breaking out. The 30-year treasury yield reached the highest level since May.

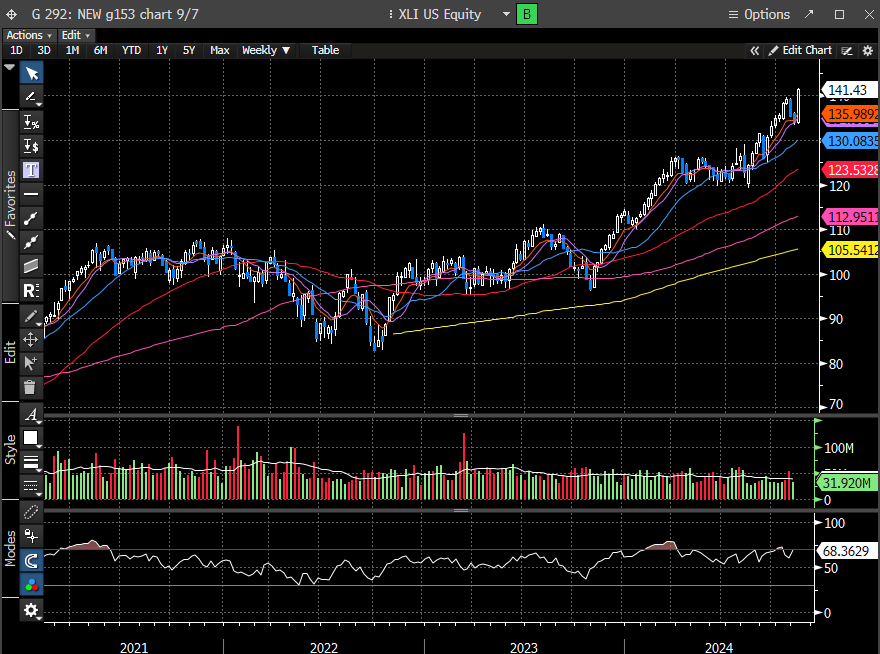

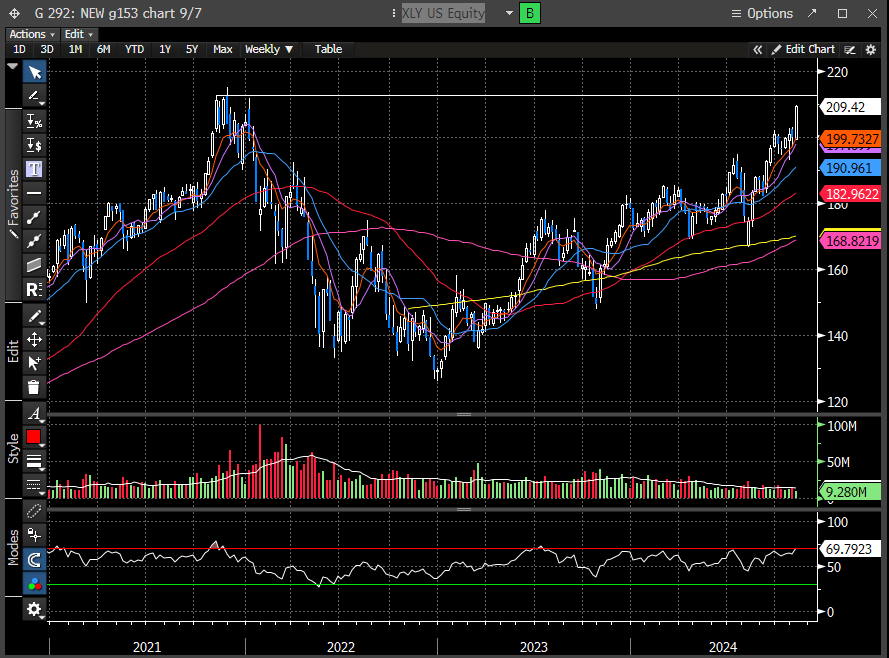

The sectors and industries poised to benefit most from Trump’s policies include private health insurers, industrials, crypto, energy, and banks. With consumer confidence likely to improve, consumption should rise, favoring consumer discretionary stocks. Rather than reiterate what other strategists have extensively covered, we’re focused on what’s unfolding in the charts—where the true story lies.

Transports just broke out to a new ATH. This upends the Dow theorist’s concern that a lagging transport complex is not confirming the Dow Jones ATH.

Industrials printed a new ATH today.

As did Financials.

Consumer discretionary is getting quite close after lagging all year.

The Nasdaq 100 Index posted its first ATH since July.

As did the Magnificent 7 Index.

If it walks like a bull market and smells like a bull market, it must be a bull market. The stock market is doing what bull markets do—it’s breaking out. And the breakouts are pervasive.

Our stance since October was to buy dips opportunistically. And while we favored a little more downside before reversing, the SPX bottomed at the top of our specified buy range.

This excerpt from our last report discusses the support range (5660-5700). The SPX bottomed at 5696 on Monday.

Our biggest question exiting the weekend was whether we would see notable construction changes in the indexes after the election to reverse the recent technical damage. Now we have our answer.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade