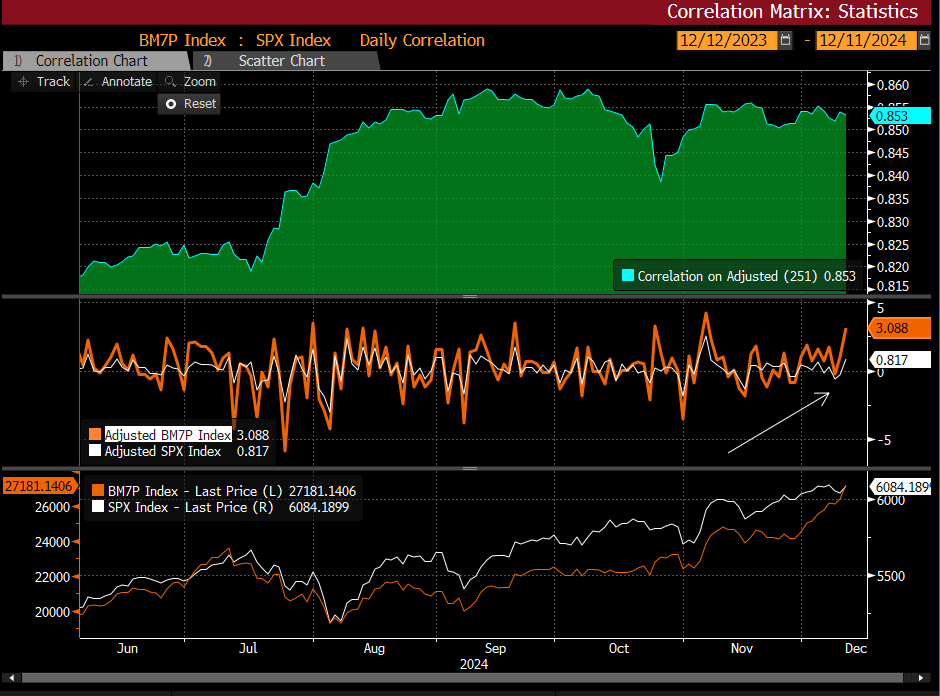

In our 12/8 report, we spent considerable time discussing the Mag 7 Index and its importance to the overall stock market, not just from a sentiment standpoint but also the correlation relationship between index performance and the rest of the field. The bifurcation in performance between most stocks in the index and the Mag 7 has blown out again in favor of the Mag 7.

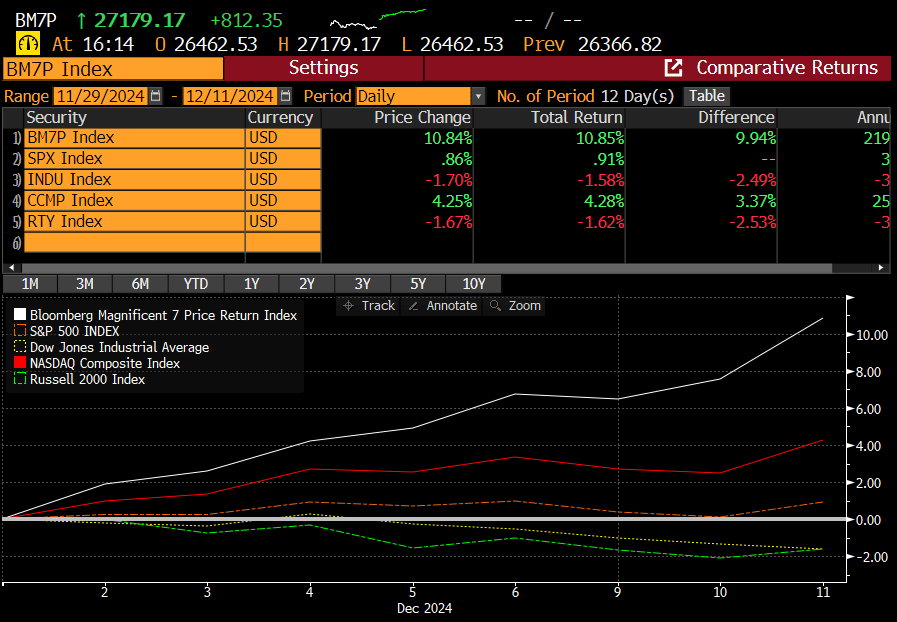

Ten days ago, we made the case that the Mag 7 index was poised to break out. Since that prognostication, the Mag 7 has exploded higher, returning almost 1000 bps over the SPX.

It’s misplaced to be bearish on the market when the Mag 7 leads. That’s just math. But as we’ve pointed out in previous reports, this usually comes at the expense of the other 493. The month-to-date sector performance for the SPX is extremely top-heavy, and corrective action in the indexes is happening under the surface. This is coming at the worst time for underperforming investors, as they cannot close performance gaps when the bulk of the alpha is generated in so few stocks.

To make matters worse, the de-risking of crowded beta longs since last week has caused significant volatility. Below is a chart of the Goldman Sachs Hedge Fund basket, which lost over 3% since Friday before rebounding today.

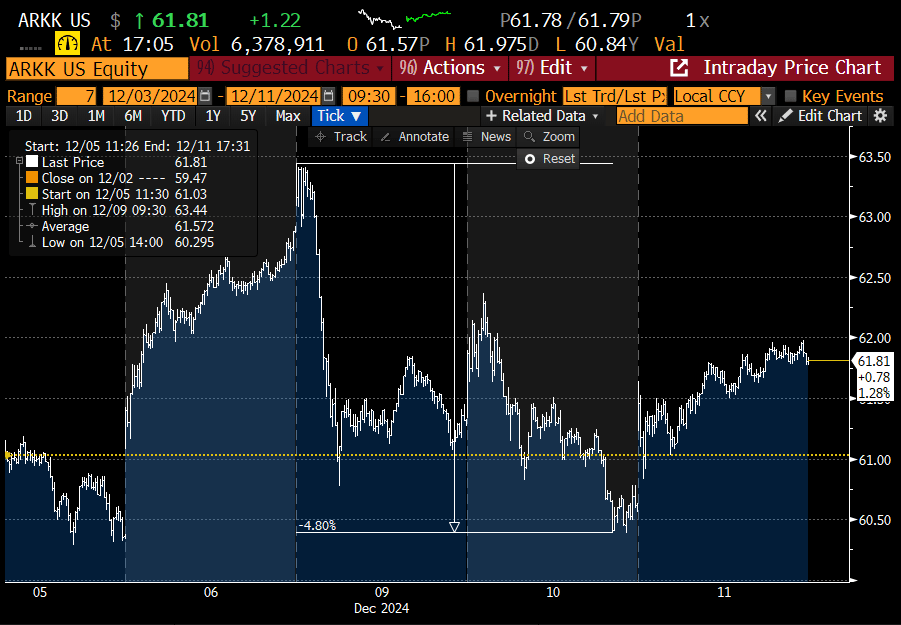

ARKK, which is a proxy for high-beta growth, saw an almost 5% decline from Friday’s close into Tuesday. This decline occurred while ARKK’s biggest holding, $TSLA (16%), has catapulted higher.

Before Wednesday’s reversal, the prior two days in the stock market proved painful to any late buyers chasing performance. Fortunately, our analysis correctly called for volatility to ensue into this week, helping us to largely sidestep any late FOMO buying. A good number of momentum stocks saw double-digit declines since last week. The level of carnage was masked at the index level thanks to the outperformance of the Mag 7.

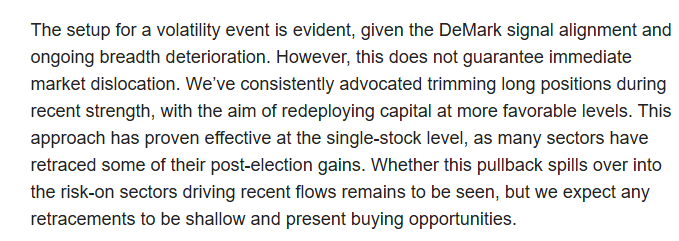

Below is the excerpt from the conclusions section of our 12/8 report:

The big question is, was today’s CPI release the clearing event that kicks off a year-end rally?

CPI was released this morning and remained firm as prices continued to rise in November. It appears that disinflation is stalling.

However, the report strengthened the case for the Fed to cut rates at their meeting next week. Probabilities for the Fed to cut 25 bps leaped to 98%, roughly double where they were 3 weeks ago; the full-year forecast also improved to 83 bps points of additional cuts for next year. Of course, these probabilities can shift, but from now into the end of the year, there isn’t much to derail these projections.

Since when have markets not liked increased certainty? Today’s market rebound is indicative of that.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade