We’ll be the first to admit that we didn’t anticipate Powell’s hawkish commentary today to trigger such a severe market reaction. In hindsight, the deteriorating market breadth and excessive positioning we highlighted in the NAAIM survey over the weekend were clear warning signs. If this level of breadth weakness had appeared at any other time of the year, we likely would have leaned more bearish.

While we’ve been raising caution flags all month, we thought this would manifest as a 1Q issue. Sometimes, markets need a catalyst to unleash the pressure already building under the surface, and Powell’s decision to dial back rate cut expectations was precisely that spark. The result? The worst market reaction to a Fed meeting in years.

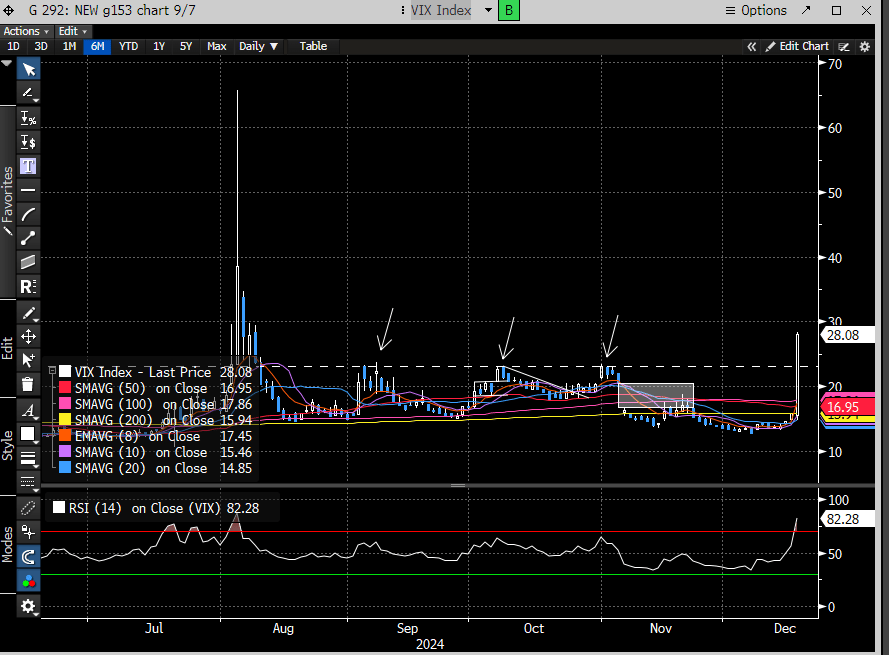

Not only did stocks take the proverbial elevator down, but volatility erupted. The VIX surged 77%, breaking through the resistance pivot that had capped volatility since the August selloff in Japan. This marks a decisive shift in market dynamics and underscores just how fragile conditions had become.

We had assumed Powell had learned from his 2018 misstep, which sent the stock market plunging nearly 20% into December, but today’s actions suggest otherwise. It’s hard not to question the motives behind such a move. Was it politically driven, with a new administration about to take office? Or is he perhaps setting the stage for Trump to emerge as the market’s savior? At this point, speculation abounds.

If the Fed’s overarching message is to remain data-dependent, it begs the question: why deliver a hawkish surprise that rattles markets during the final two weeks of the year?

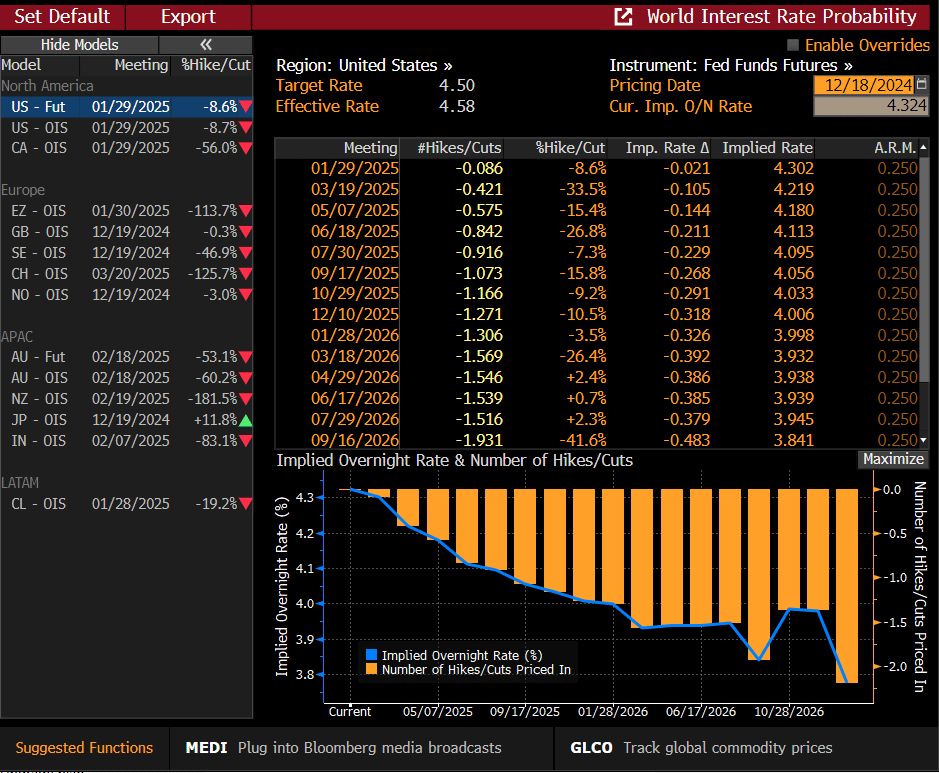

The Fed’s new dot plot is below:

Heading into today, the market had priced in expectations for three rate cuts next year. However, the updated Fed Funds forecast now suggests only a 100% probability of a single rate cut. Such an abrupt shift in interest rate projections tends to rattle markets, as they are forced to swiftly recalibrate expectations.

This kind of sudden adjustment often triggers volatility, as portfolios realign to the new reality. The market’s reaction today was a clear reflection of its distaste for surprises, especially when it comes to the trajectory of monetary policy.

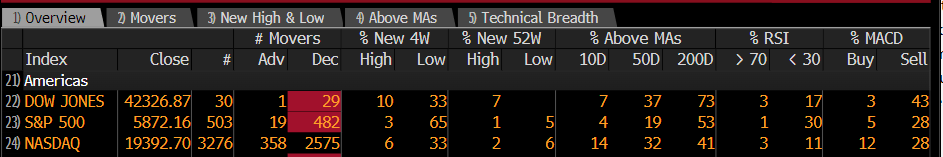

The stock market did not take it too well, with big intraday reversals to close on the lows. The Nasdaq and the Russell Small Cap Index (RTY) were hit the hardest.

Breadth was nothing short of abysmal, with only 19 out of 503 SPX stocks closing higher, producing a staggering 25-to-1 downside day—a classic washout scenario. The issue, however, is that breadth declines of this magnitude are preferred to be seen near the tail end of a panic, not at its onset.

While this suggests the potential for some short-term relief, it also casts serious doubt on the prospect of an end-of-year melt-up rally. The severity of today’s action likely resets expectations, making any immediate recovery feel more like reversion than a springboard for a rally.

In our 12/15 report, we hypothesized that Powell would need to deliver, at a minimum, a status quo message to sustain the potential for an end-of-year rally. However, with the new information in hand and the glaring absence of catalysts to reverse today’s damage, it’s clear the market is poised for, at best, a period of digestion.

Now that Powell has firmly delivered coal to everyone’s stocking, the question becomes: how should we approach the market setup from here?

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade