AI-ighty Potential

Dubbed the "the rocket fuel of AI" by Wired, this groundbreaking innovation has sparked fervent excitement across Wall Street. And with projections soaring to a potential market cap of $80 trillion – equivalent to 41 Amazons – the magnitude of its impact cannot be overstated.

But here's the real deal: nestled within this tech revolution lies an opportunity for sharp investors to invest in a remarkable company poised to dominate its corner of this burgeoning market.

And thanks to The Motley Fool, the full narrative of this extraordinary tech trend has been compiled into an exclusive report, designed to arm you with the insights needed to make informed investment decisions.

The Fast and the Furious franchise is a wild ride of fast cars, high-octane action, and a glorification of speed, crime, and camaraderie. With plots designed for pure, mindless entertainment, the series defies logic—but not profitability. Over 20 years and ten movies, it has grossed more than $7 billion, making it the eighth highest-grossing film series of all time.

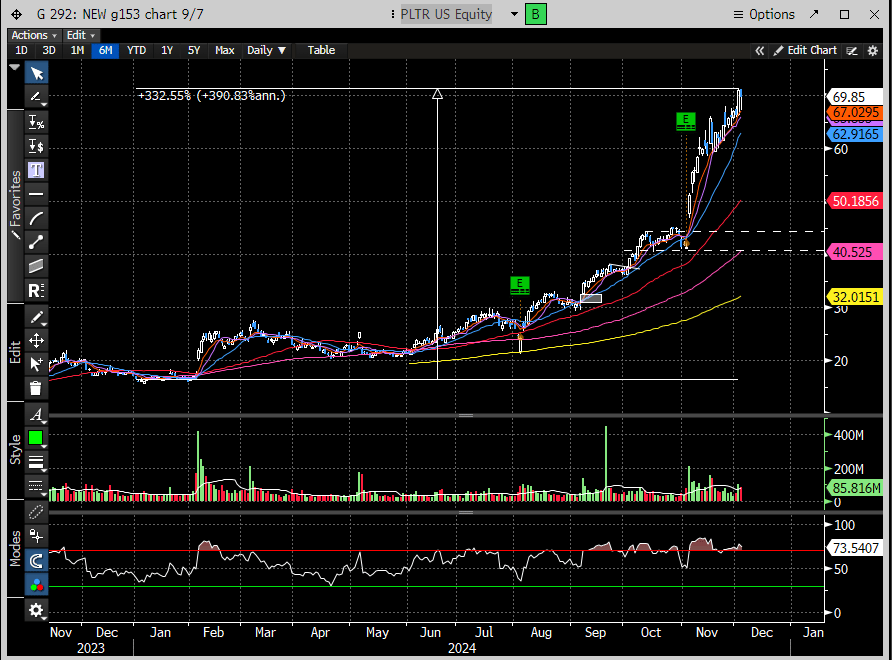

The recent stock market rally feels eerily similar: fast, furious, and seemingly untethered from fundamentals. Institutions are racing to close performance gaps, driving exaggerated moves in stocks with little substance behind them. Post-Q3 earnings reports are fueling sector-wide rotations, pushing valuations to dizzying heights. Fundamental analysts are left scratching their heads as stocks like PLTR skyrocket. Over the past year, PLTR has more than tripled in value, becoming one of the best-performing large-cap stocks. Its addition to the SPX earlier this year provided another 130% boost, yet its valuation now borders on absurdity—trading at 45x next year’s revenues.

But since when do we really care about valuations? In theory, we don’t—until they start to matter. While price drives the market in the short term, valuations eventually catch up. Right now, the SPX is starting to look a bit frothy, trading at over 22x next year’s EPS. That’s not bubble territory yet, but it’s certainly on the high side, especially if growth slows or macro conditions shift.

The chart below highlights the SPX's forward twelve-month (FTM) P/E multiple over the past 25 years. Currently, valuations are nearing the highest levels we've seen since the post-COVID crash peak. The only period with higher multiples was during the dot-com bubble. This should raise eyebrows for anyone making longer-term bullish bets, as such elevated valuations can present significant risks to sustained market continuation. While markets can defy gravity in the short term, history suggests that such lofty multiples eventually demand a reality check.

A significant driver behind the SPX's valuation bump is the outsized influence of the Mag 7. This elite group of stocks is currently trading at over 32x next year’s earnings—a substantial premium. To put this in perspective, that's approximately a 500-basis-point increase compared to their forward multiple at this time last year. This sharp rise underscores the concentrated impact these stocks have on the broader index, magnifying both its upside potential and valuation risks.

This is reflected in the Mag7 Index performance, which is up over 60% this year.

That brings us to the big question: Is this sustainable? The honest answer is probably not. However, as we've consistently emphasized, we don’t need to justify why the market is behaving a certain way. Price is our guide—not theories or opinions. Price is never wrong; only the narratives we construct around it are.

Do we believe the current stock market trajectory can continue indefinitely? No, we do not. But that doesn’t mean we’re fighting it, either. When the evidence suggests the market is ready to revert, we’ll be among the first to advocate a more defensive—or even bearish—stance. Until then, arguing against the trend is a losing game.

We’re not in the business of calling exact tops. Our goal is to prepare our readers for the inevitable turn, not predict the precise moment it happens. And if we happen to call the top, well, that’s just a bonus. In the meantime, those betting against this trend, hoping for a perfect reentry point, are missing out on some of the most lucrative opportunities the market has to offer.

The SPX’s impressive 27% year-to-date gain has made fools of those predicting doom—be it a stock market crash or a recession. Now, as these bears scramble to justify their underperformance to investors, they’re being forced to chase the rally, bidding stocks higher in the process.

Fortunately for our readers, we’ve been positioned long for most of the year, sidestepping the more significant drawdowns in April and July-August. This approach has allowed us to capitalize on the strength of this bull market while minimizing unnecessary risks.

In our report over the weekend, we highlighted the Mag 7 index as a break-out candidate.

Here is the excerpt from our 12/1 report:

“the pattern still looks like a bullish consolidation, and these stocks are on the verge of breaking out.”

Fast forward three days, and the Mag 7 has ripped 4% higher to forge a new ATH.

While our media analogies may be a bit tiresome, our analysis and performance speak for themselves.

Let’s dig in…

We are running a promotion for our Macro Report and our Idea-tier. These promotions end on Friday. Waiting has an opportunity cost and there is a lot of opportunity in the market. See both offers below.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade