It's been a good week for our directional stock market and sector calls. While we admit we were a few days early on the market turn, the last DeMark buy signal nailed the low for the SPX and we still caught 500 points in the Nasdaq.

We also caught $10 in WTI (oil) when the rest of the world was shorting the commodity. Here is an excerpt from our report 2 weekends ago.

This is a chart of our SPX weekly we've been discussing at length all year. We mentioned back in May that this H&S top formation yielded a measured move target of around 3585. We also posited back then that maybe it will catch up with the 200 weekly SMA (yellow) to form a bottom. The SPX low in June missed this target by 50 points. Last week, we tagged this target while bouncing perfectly off the 200 weekly SMA @ 3585.

We find it quite comical how quick the narrative can shift in the media and FinTwit from all the doomsday rhetoric a week ago to now the Fed pivoting again. The problem with the Fed pivot discussion is it likely will require something really bad to happen, unless inflation miraculously collapses. We have news for our readers, "really bad," is just that, really bad. If some exogenous event happens and the Fed has to rescue the markets, the damage will be long tailed and market destructive. Regardless, predicting this is near impossible.

In fact, we posted this chart in our weekend report.

And what we posted in Twitter:

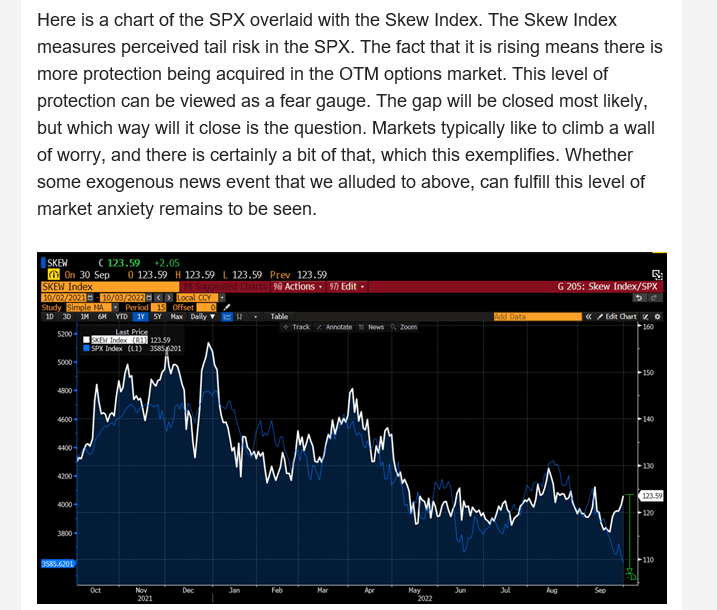

Since this post the SPX is up +5%. When the boat is loaded in one direction, it rarely works out. Think of it like this, if everyone is hedging for a crash, why would we crash? It's already being contemplated. Crashes tend to happen when nobody expects it.

Yesterday we did get the JOLTS number which saw the largest drop since the pandemic (1.1M in Aug). This clearly points to a cooling job market and one of the Fed's desired outcomes with their rate campaign. This gives some credence to the Fed slowing things down and why the market ripped yesterday.

Here is what the Bloomberg economist is saying:

This report on the back of a very poor ISM reading last week.

Now this week's macro focus will shift to the employment report on Friday. This is backward looking but will likely be met with volatility if it's too hot. This is tough set up to trade.

If you have interest in reading more of our analysis, consider becoming a premium member below.