The stock market has spoken, and the bears are still clamoring for a wipeout. We’ll never understand why anyone pays to listen or invest with individuals who consistently sing the same tune with very little success. We don’t claim to be right all the time, but we are certainly more right than wrong, and we quickly reverse our thinking when the market tells us otherwise. That’s the beauty of technical confirmation: price is truth.

We use 100’s of indicators, inter-market relationships, a unique signaling methodology, sprinkled with fundamental logic to arrive out our conclusions. Since the end of Sept, we have been preparing our readers for the possible seasonal bounce in the stock market, and precisely called for the bounce to start mid-week last week. So far, the SPX is up almost 200 points off the low in a little over a week. Timing is everything, and we are proud that our methodology can be so precise.

We wrote in last week’s mid-week report, to consider index longs, as well as detailed 4 large cap tech set ups to consider.

Here is the performance of all those ideas in less than a week.

In the last week’s Macro report we also highlighted to consider Gold on Weds as our signaling methodology aligned at that date. Gold bottomed the day after and is now up +3%.

The bottom line is our premium content ($24.99/month) has incredible value. In one week’s, trading you could have paid for the next 10 years of a subscription.

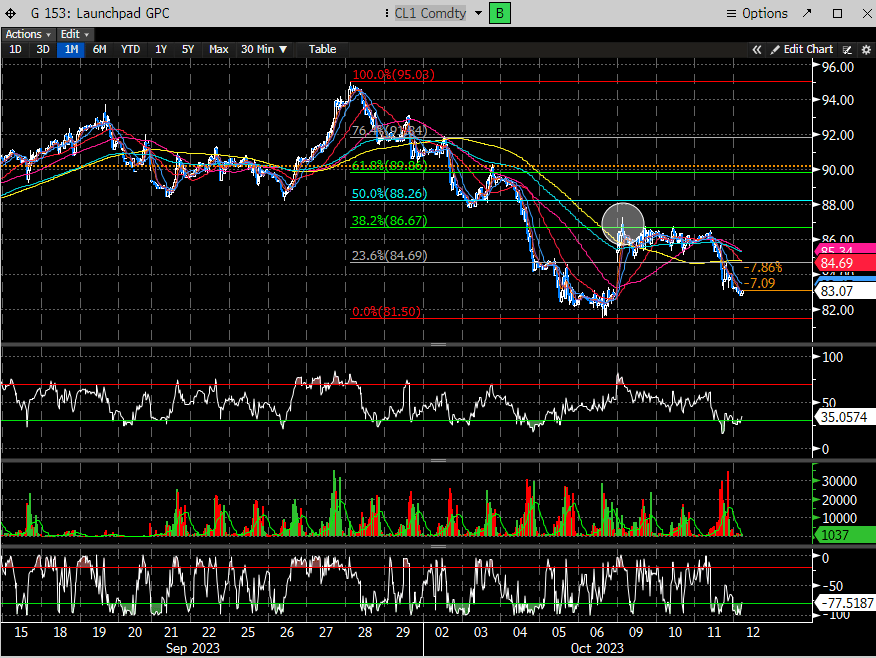

Last weekend we surmised that any dislocation caused by the unfortunate events in Israel would likely get bought, unless oil prices skyrocketed. We even posted this likely range for oil in the reversion scenario.

And Oil topped out at 87.24.

Could oil still inflate should the escalation spill over into other parts of the middle East? Definitely, but there is one area where we think there will be enough warning, and that’s oil. So far, oil doesn’t seem too concerned.

And our “Three Horseman" indicator has now officially rolled over.

The $USD has now broken trend for the first time since the July bottom after failing at the 50% retracement level.

The 2 year treasury rate has lost its trend line from May and now below the 50 day MA. The 10 year and the 30 year are also looking quite wobbly.

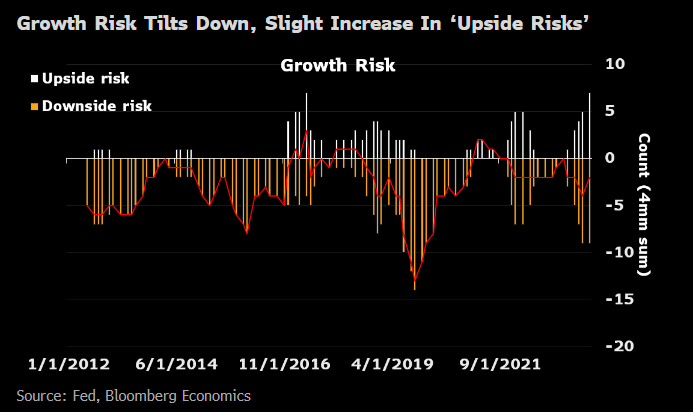

Today’s Fed minutes showed the committee more cautious in its outlook for the economy, and thus showed some tempered enthusiasm for more hikes. They believe their policy is restrictive enough and may look to be patient to let the hikes work their way through the economy.

*They mentioned household finances were coming under pressure due to high inflation and declining savings.

*Some concern over the lagged effect from the UAW strike.

*The job market remains tight though some measures were easing, with the imbalance of labor demand and supply abating.

*They seem to believe that inflation forces have subsided, but still too elevated.

The bottom line is that the Fed minutes were decidedly less hawkish and centered more around how long to keep the terminal rate in place. This is a notable change and likely keeps the rate market subdued for the foreseeable future.

Of course, we do get CPI in the morning which could easily mess everything up.