The unfortunate reality of this week is that our “Three Horsemen” Indicator has been too hot for equity markets to stomach. Despite being correct on our inclination that the market might revert Friday’s weakness early in the week, that strength was met with aggressive selling into the close today.

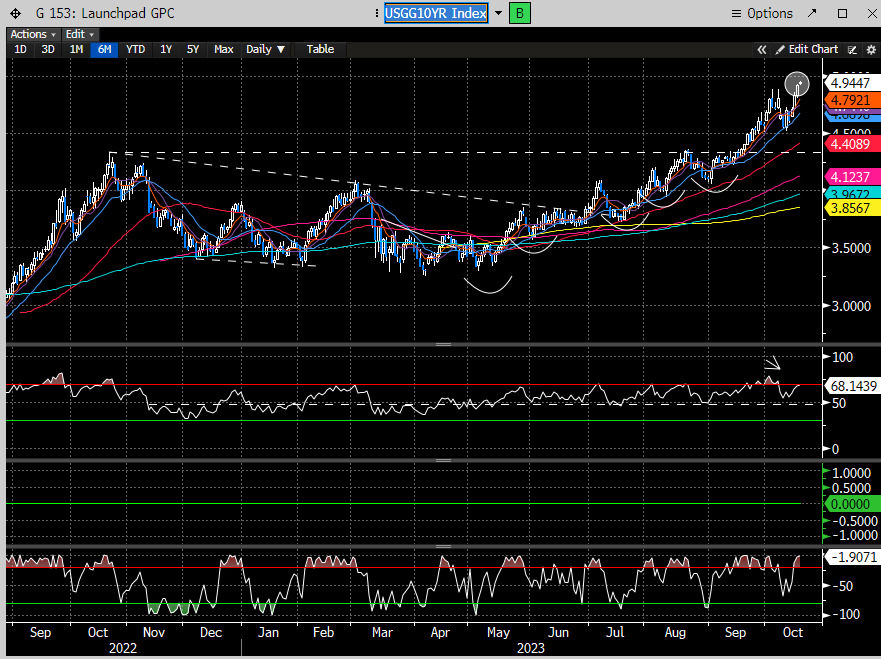

Despite our futile call in trying to call the tops in rates, Treasuries continue to break out. Last week we highlighted the importance of this week’s trade with respect to the direction of rates as the set up for either a break up or a break down, was present. We guess the market was setting up to breakout.

The 10 year is now at the highest level for the year.

As is the 2 year.

Oil is now back up to $88.

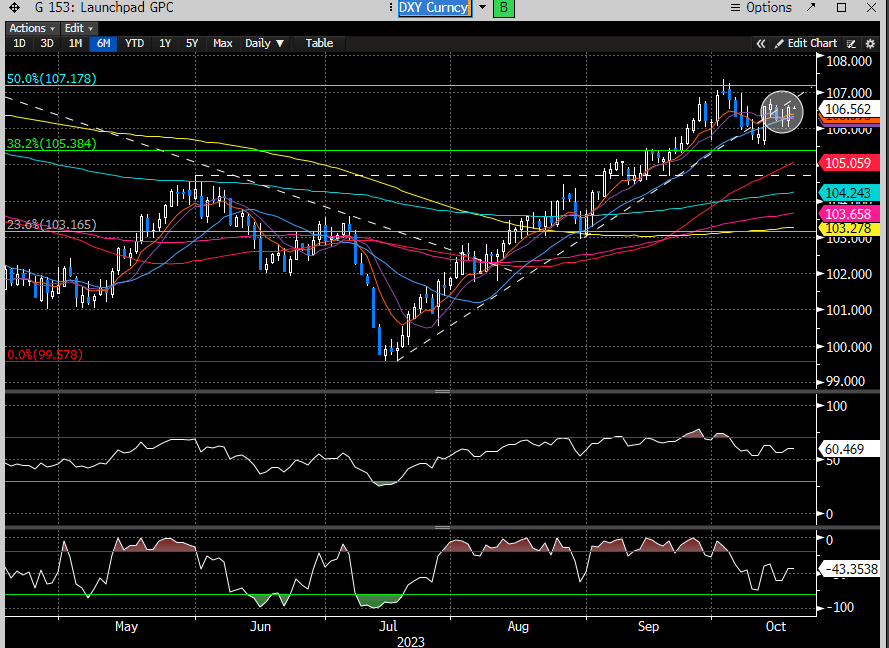

While the $USD is also regaining its momentum.

This is not what we have been hoping for to start the bullish seasonality trade. Fortunately, we have only been positioning for tactical trades, and last weekend we were hoping for a gap down into lower levels that never came.

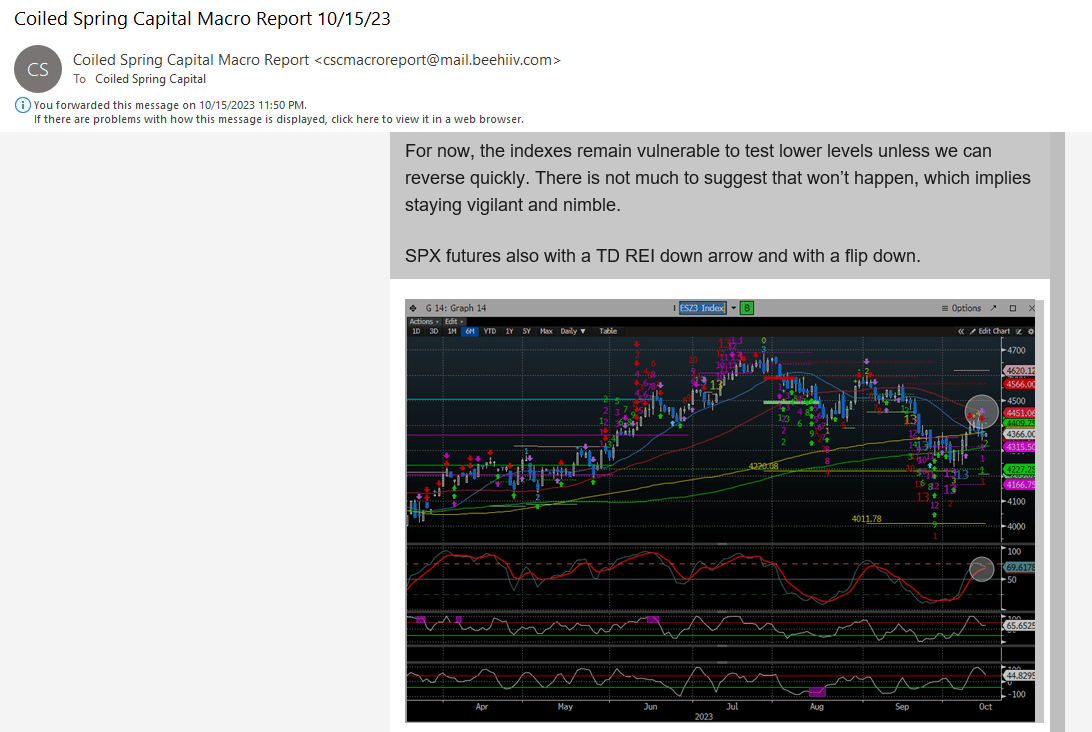

Here is a snapshot of that report:

“For now, the indexes remain vulnerable to test lower levels unless we can reverse quickly. There is not much to suggest that won’t happen, which implies staying vigilant and nimble.”

Our main watches for this week were the “Three Horsemen” and the Russell. Both indicated to us that the market was not done selling down, and thus remaining tactical and opportunistic proved to be the right approach.

Here is an excerpt from our conclusion page:

Despite the index reversal on Monday/Tuesday, today was met with aggressive selling. We continue to advocate caution as any rallies will have trouble sustaining if Treasuries, Oil and the $USD don’t revert. So far that has not occurred. Does this mean we won’t be tactical? No, in fact last week’s message to buy into our reversal zones still holds water. We will review below in the premium section.

There has been some speculation that the Chinese obvious absence as a Bond/stock buyer is impacting the markets. That may be true as they attempt to prop up their own currency, but we don’t have a strong opinion whether this is accurate.

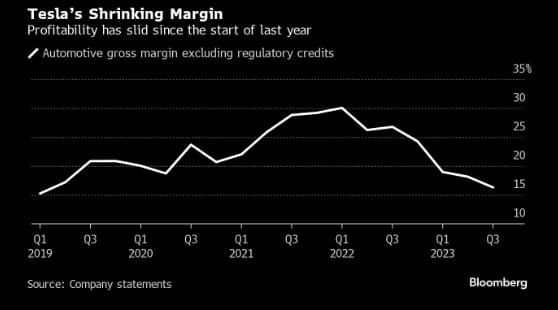

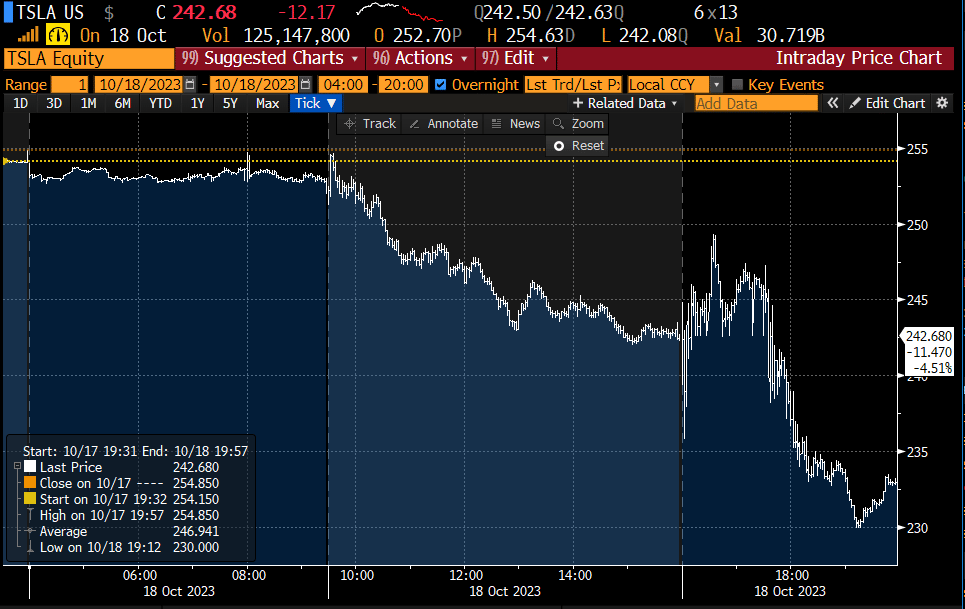

Despite the tough macro back drop for stocks, we also started large cap earnings after the bell. TSLA missed and NFLX raised prices. We don’t think there is enough there to sway markets since they are both heading in opposite directions.

TSLA missed on margins after a series of price cuts, which should not be much of a surprise. More importantly was Elon Musk’s tone on the call. He sounded fairly gloomy about the growth and the outlook for the economy. Their delivery number also implies they lost market share.

The stock reacted poorly AH after Musk dampened the mood.

NFLX on the other hand added more subs and announced a price hike.

Investors cheered the report and drove up the stock materially AH.

We don’t necessarily think either of these says much about the upcoming reports. Regardless, we will offer our opinions about them in the premium content below.