Over the weekend we discussed the notion that management teams this earnings season had no business nor any motivation to be overly optimistic about their outlooks. Last week it was Musk from TSLA to talk down the economic picture and today it was META. Meanwhile most companies are struggling as the grips of higher rates are seemingly permeating corporate spending and their ensuing outlooks. The next shoe to drop is employment as management teams most likely will do their best to protect their margins and balance sheets. The reality is, this is the Fed’s intention, so should we be surprised? Not at all, we knew it was going to come, but the extent of the fall out and the duration are the real wild cards.

Bulls will have you believe that a recession was already discounted last year and thus we should look forward through the eventual Fed orchestrated slow down. For most of the year, we subscribed to this notion, but the reality was the market was pricing for a recession that never came. Fast forward 12 months, and the underlying economy is still quite strong. This will be evidenced by tomorrow’s GDP report, which should post an eye-popping number. The expectations are for +4.5%. Thats pretty remarkable if you think about how many rate hikes have taken place over the last 1.5 years. The stock market simply priced in a much worse economic situation, which clearly was inaccurate.

Bears will have you believe that a credit event or black swan event is coming and to prepare to test last Oct lows. This is certainly a legitimate argument and also something we have subscribed to over the year as the rapid ascent of treasury rates can cause something to break. We saw this in March with the regional banks, but since then, rates have continued their ascent, inflating the risk once again that something bad is lurking behind curtain #2.

As much as we like to try and predict price, we don’t try and predict economic outcomes. We make logical guesses on what we think will transpire and let price confirm those beliefs. If price does not confirm we remain open to changing our opinions as we believe price is truth.

As we cited above, GDP will be reported tomorrow and likely will not be enough to move Powell from his current stance to pause at the next meeting. Though we are quite sure it won’t sway him to suddenly become more dovish. Friday we will also get PCE which is the Fed’s preferred inflation metric. Both can be market moving events if they are wildly out of line. Recent strength in the CPI, retail sales, payrolls, and PMI’s, are causing a bit of trepidation for this report.

We wrote 2 weeks ago that we thought the narrative would shift to earnings and so far, earnings have not been enough to keep the market bid. The large cap tech companies have started reporting, and besides MSFT, have been disappointing.

Not only has earnings been a bit of a dud, but treasury rates picked back up again today after getting sold in the beginning of the week. We’ll see if they stay bid after the next 2 days of macro data, but as we’ve been saying, the market cannot sustain any advance with most of the curve this elevated.

Part of the issue is the bond market is focused on the expectation the Treasury will unveil auction size increases next week at its quarterly refunding announcement.

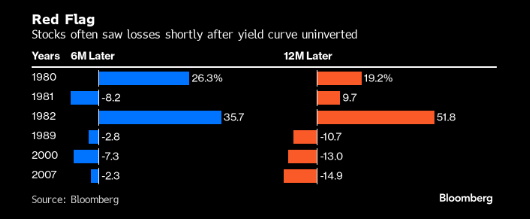

More parts of the curve are now starting to un-invert.

While this is a function of higher LT rates and not necessarily short rates collapsing, historically it’s been a red flag. Credit spreads tend to widen while stocks tend to see losses in the months after the 2/10 curve un-inverts.

Clearly there is worry building in the stock market, and excessive worry is typically when you are supposed to buy the fear.

Is now one of those times?

Please consider subscribing below to read the balance of the analysis.