The bond market rout is nothing short of amazing, but also quite troublesome. We have been writing for some time that sky rocketing treasury rates will not be met with open arms by risk assets. And so far, that has wrung true. We have coined the term, the “Three Horsemen,” to describe the 3 most important instruments to watch if you are trading the stock market: Oil, Treasury Yields and the $USD.

We will admit, we have been premature in trying to call the top in rates. So far, the relentless ascent is making trying to trade the stock market extremely treacherous. Every piece of macro news is magnified, as was yesterday’s volatile JOLTS number that expanded.

How bad has the treasury market been?

Bonds maturing in 10 years or more have slumped 46% since peaking in March ‘20, according to Bloomberg. Compare that to the 49% plunge in US stocks post the Dot com bubble. 30 year bonds are even worse, losing 53% vs the 57% equity slump during the GFC.

Treasury bonds are the most widely held instruments in the world. This sort of degradation in prices has far reaching impacts. Some of which is simply unknown at this point. Sure, we know bank balance sheets are in bad shape after the SIVB melt down in March. But we can’t help but wonder what is lurking around the corner that we can’t see. Central bank balance sheets are littered with treasury paper, as are pension funds.

We continue to tell our readers that without the bond market reverting some, any rally in the equity market will be difficult to sustain. Today, bonds backed off a bit and the equity market rallied. Oversold markets and a little rate reprieve can go a long way. The issue directly in front of us is that the payroll number on Friday has the ability to send the market screaming higher or plunging back into the abyss.

Today’s ADP report did show cooling employment statistics, but they don’t always correlate.

According to the ADP report, US companies added the fewest number of jobs since the start of ‘21 and pay growth slowed, pointing to weakening in labor demand in several industries. Private payrolls rose 89K vs 180K in Aug.

Friday’s payroll is expected to show a 155K increase, and as we mentioned above, the ADP is not always a good predictor of where the BLS data gets reported. This sets up for a fairly binary event.

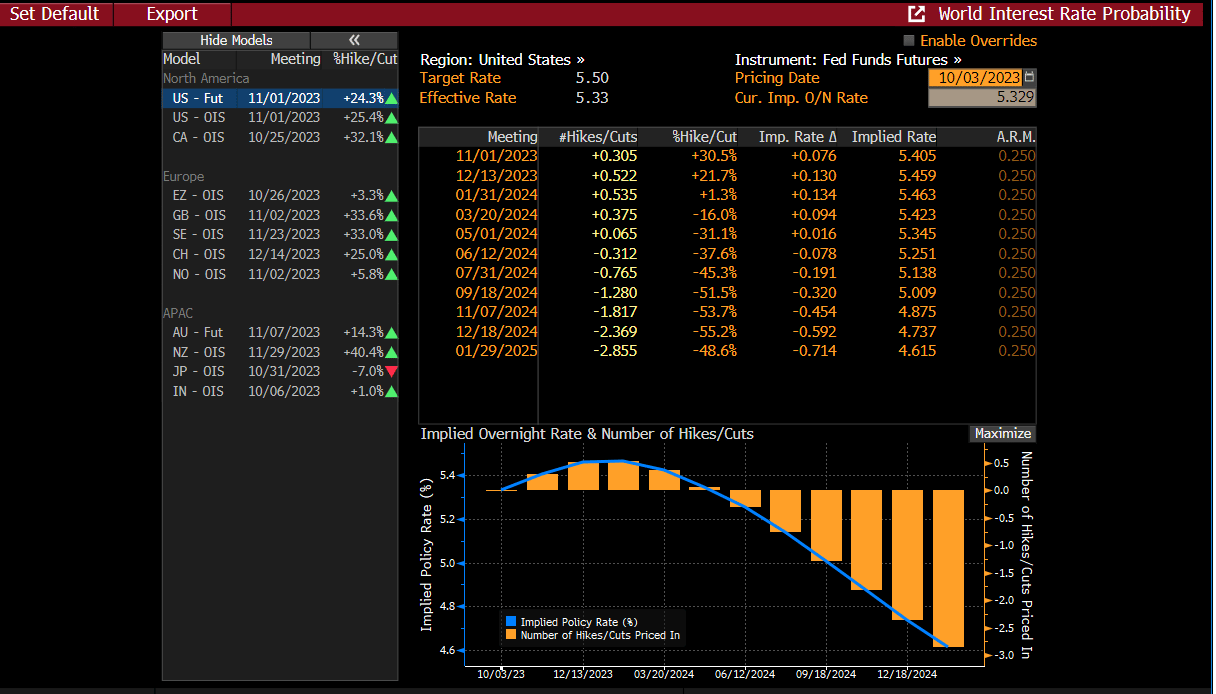

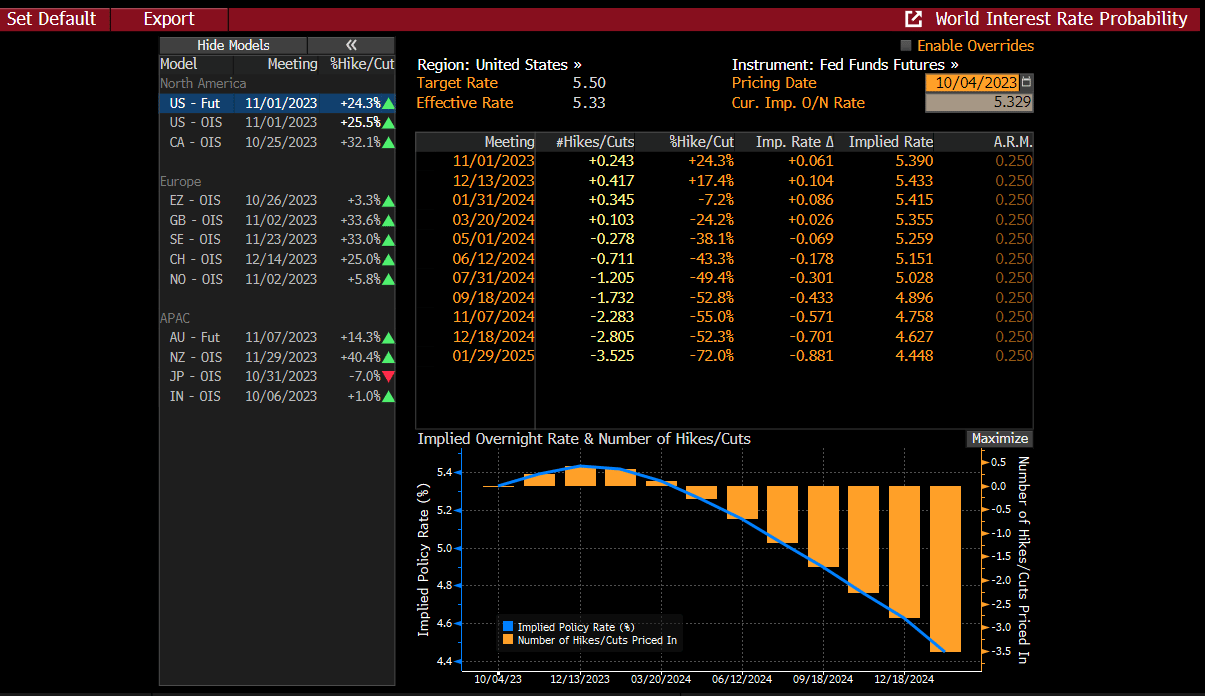

The payroll report has the ability to swing around the Fed Fund futures, which saw a decent uptick for another rate hike at the Dec meeting spike post the JOLTS data…

but backed off meaningfully after the ADP report.

Treacherous market indeed.