Quite the rollercoaster ride in the stock market since we turned the calendar year. The 1st week of Jan bludgeoned and punished late buyers, only to reverse this week and now a stone’s throw from the Dec highs. We mentioned in our report over the weekend that the market seemed set up to counter trend rally this week and that’s what occurred. The strength of that rally is a bit more surprising and something we will opine on below in the premium section.

We opportunistically bought the dip in some of the large cap tech names and the semis, and that has worked out handsomely. We have been selling them into the strength and trailing our gains. When the mosaic of the market gets a bit blurry, we get tactical with our trading.

In our last report, we had discussed the notion of a head and shoulders top formation in the SPX. The current rally in the SPX is possibly forming the right shoulder.

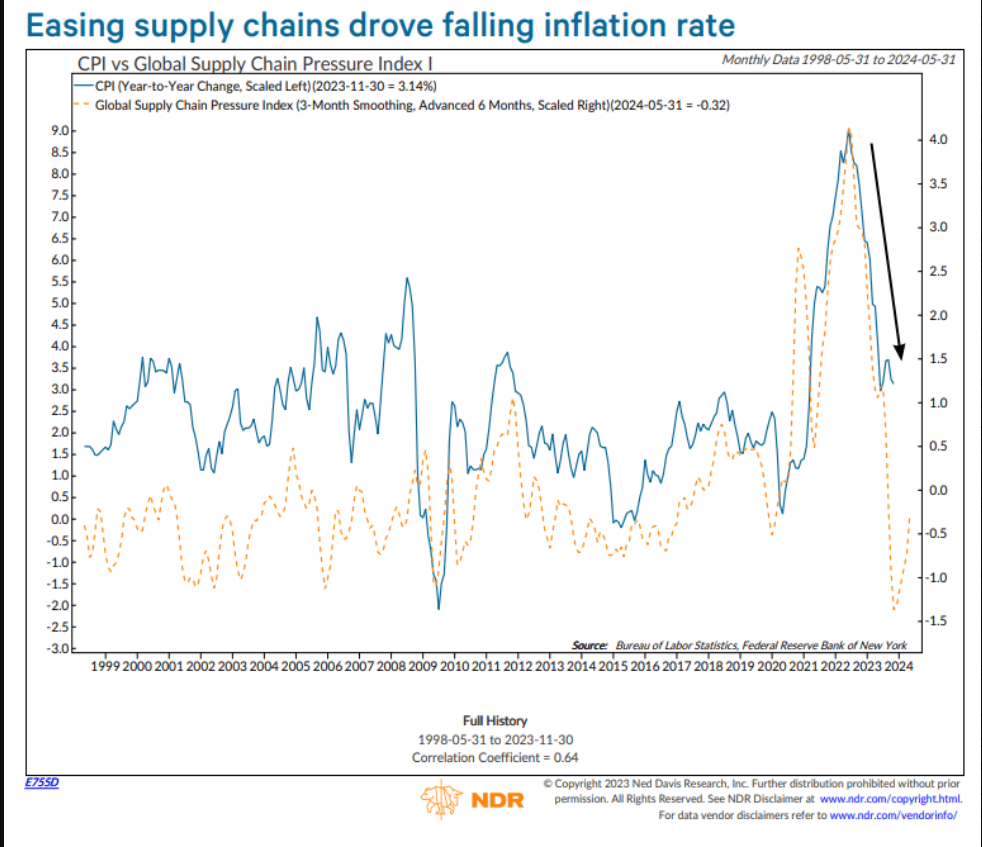

The bigger question remains, does the SPX reject here or challenge the recent highs? We think, unfortunately, this will be decided by the macro releases due in the morning. Recall from last week, the CPI and Jobless claims data are due in less than 12 hours. Inflation has been a hot button issue for the last 2 years, and now it’s finally deflating. As we mentioned last weekend, we see no reason for this to stop its descent and should be supportive of the market.

Another reason to expect more disinflation:

Concurrent to this release, Jobless claims will be reported. We have our reservations given the ISM employment subcomponent weakness we discussed in our weekend report. Should this be notably weak, this could offset any good will offered by continued disinflation.

At the very least, it should inflect some volatility into the morning trade.

What are the clues to how the stock market might react? We will share those below in the premium section.