The world was positioned for a stock market crash and what happened? The exact opposite. Being loaded on one side of the boat rarely works out. Our analysis is designed to help our readers identify major tuning points in the stock market. Sometimes not being on the wrong side of the market is just as good as calling the low.

Last week we highlighted just how bearish the world had become. We talked about the peak in rates, oil rolling over, a stubborn $USD but showing cracks. The stock market is a very complicated animal, and if you trade or invest in the stock market and do not consider what is happening in the most liquid well trafficked instruments that are impacting the stock market than you are doing yourself a disservice. We read a number of newsletters and most ignore simple market structure changes just to satisfy their own bias. We have no bias. Sure, bull markets are more fun for us, but that doesn’t mean we lean in any particular direction. We simply call it like we see it.

The free readers of this newsletter that refuse to pay $24.95/month to read our premium content, miss out on what our rigorous analysis, sprinkled in with 24 years of experience and logic, conclude. Maybe you hate money. Maybe you hate taking the time reading a lengthy report that comprehensively canvases most major instruments. Maybe you want to be spoon fed the conclusions and how to trade them. That is not us. We provide the backdrop with our unique and proprietary analysis so that you can feel empowered to make your own conclusions and do your own trading. We read as much opinion as we can because we don’t profess to know everything. We sometimes rely on other people’s work to help us paint the muti-colored canvas that it is the stock market. Different opinions help us challenge our own thinking but at the end of the day, we let our analysis guide our projections.

We are not always right, but we are right more than we are wrong. And that’s what makes people successful in the stock market.

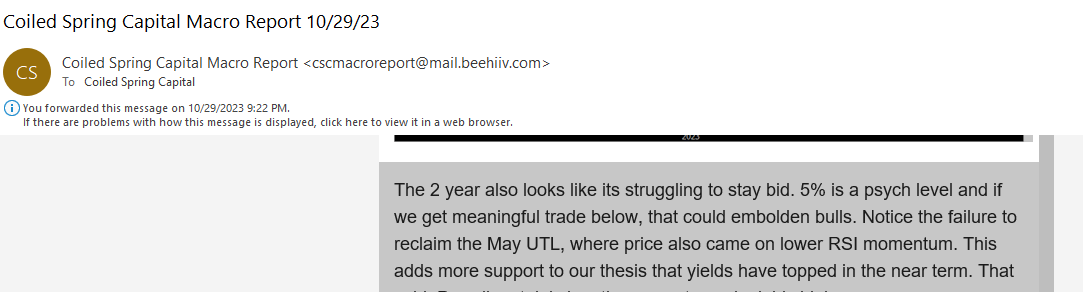

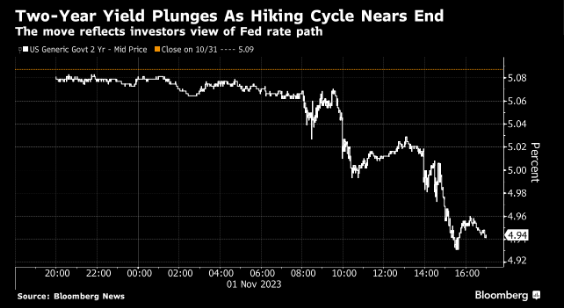

Last weekend we talked about the weakening trend in the 2-year treasury rates. Today that is seemingly playing out.

Here is an excerpt from last weekend’s Macro Report:

“This adds more support that yields have topped in the near term.”

Today the 2 year saw a meaingful break of this pattern lower.

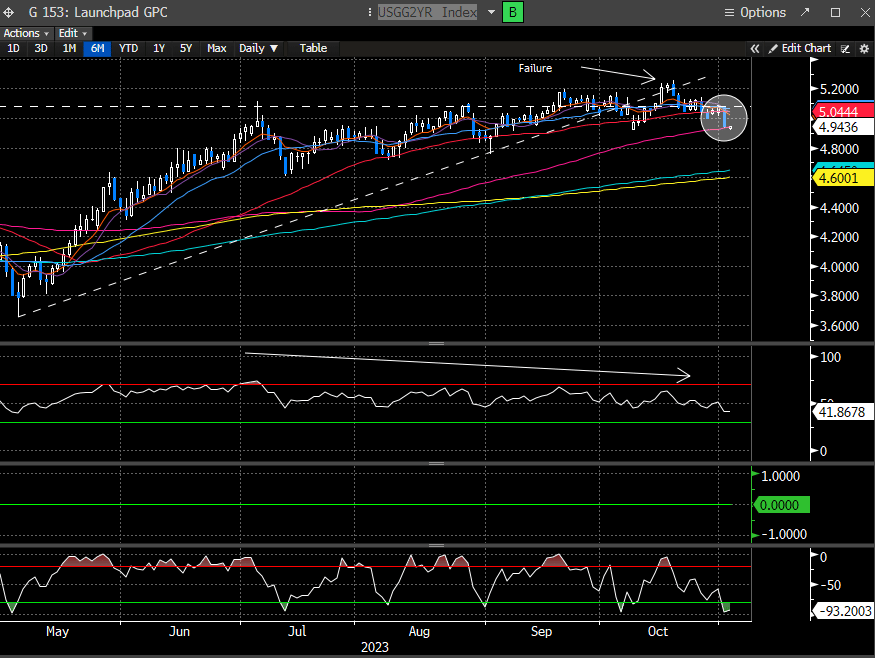

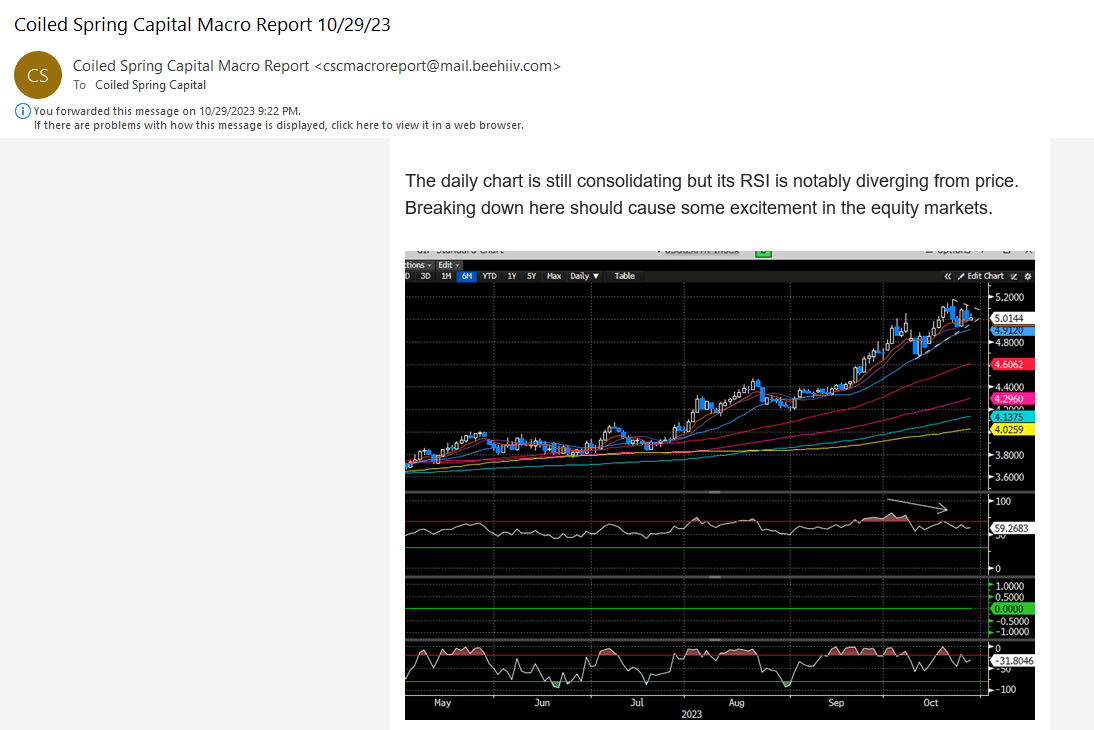

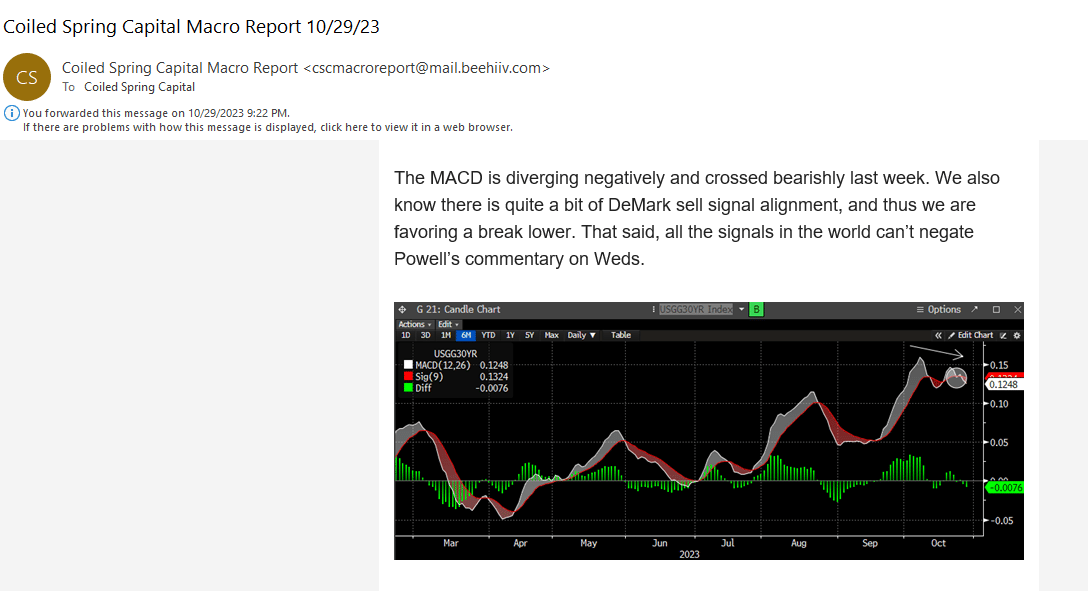

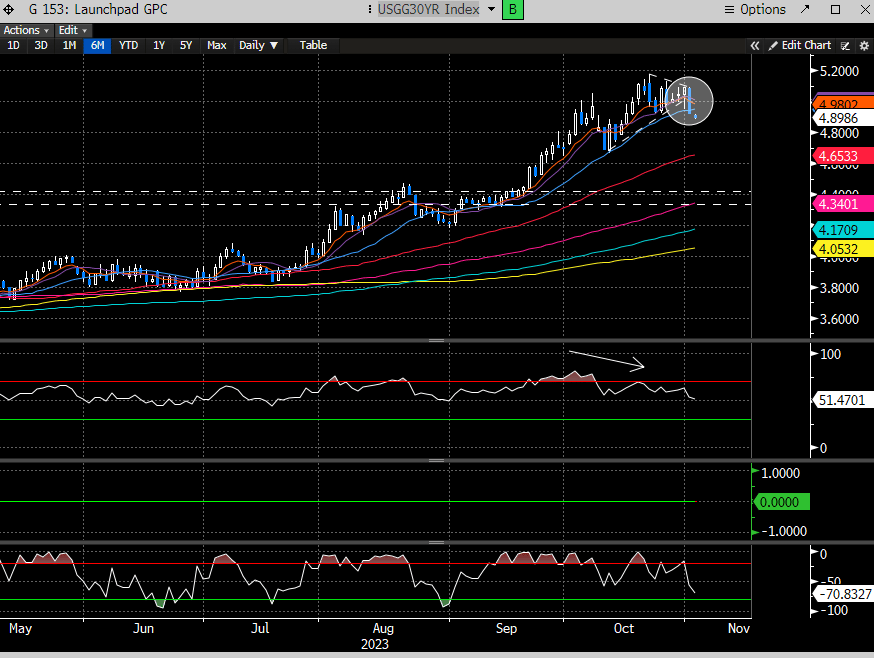

And what about the 30 year treasury?

Last weekend we wrote this:

“The daily chart is still consolidating but its RSI is notably diverging from price. Breaking down here should cause some excitement in the equity markets.”

“The MACD is diverging negatively and crossed bearishly last week. We also know there is quite a bit of DeMark sell signal alignment, and thus we are favoring a break lower.”

A fairly nasty break of this bullish pattern ensued.

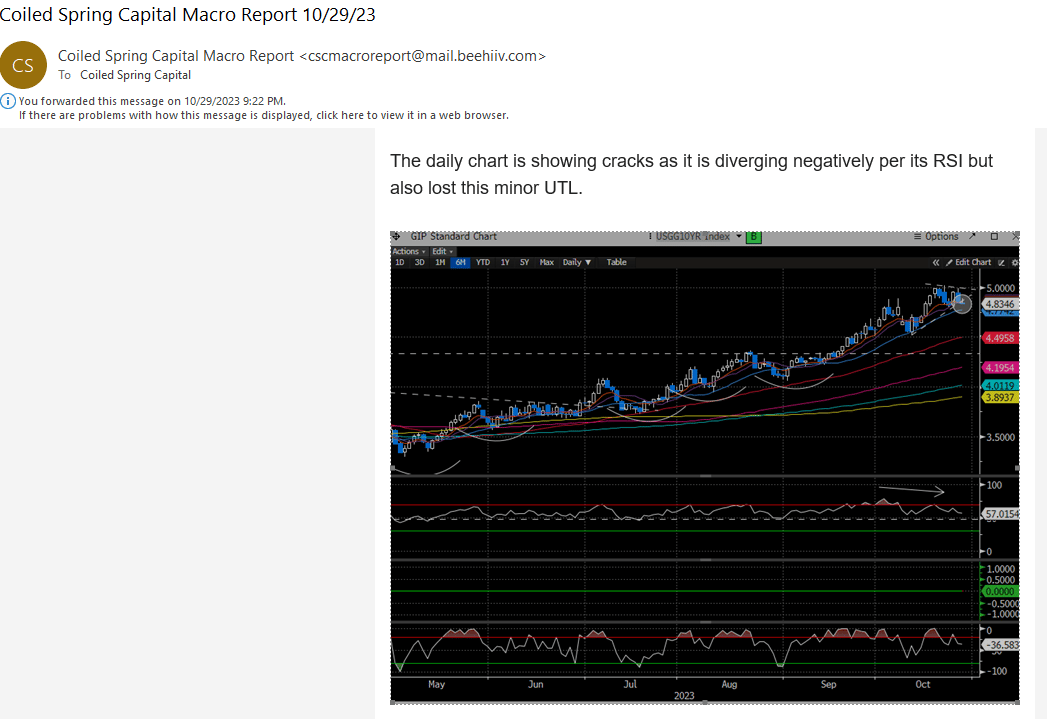

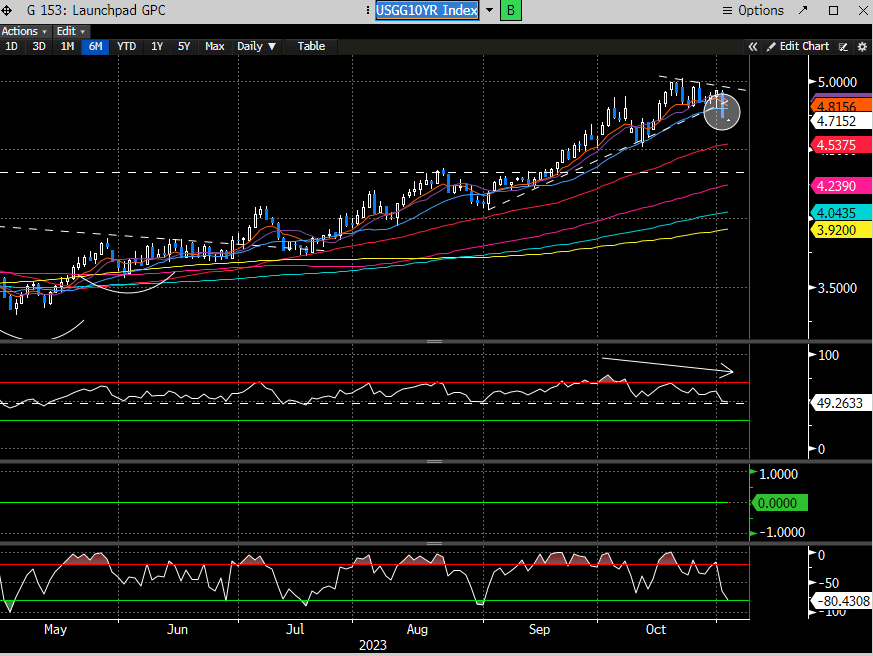

The 10 year was fairly similar.

From last weekend’s report:

“The daily chart is showing cracks…”

Which resulted in a nasty break down of this pattern.

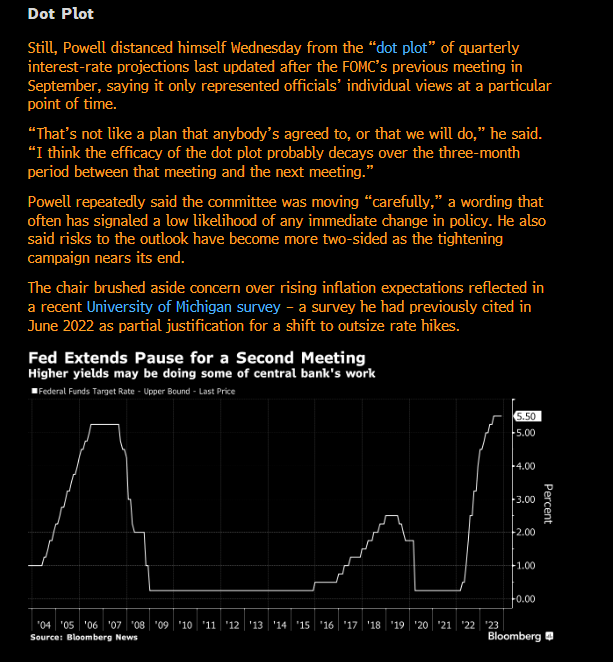

The bears are scratching their heads as to why this happening. For one, the charts were already indicating this was the higher probability outcome. We don’t have to be genius economists to decipher or project the Fed’s next move. We always tell our readers that we don’t make bold predictions around what the FOMC will do, we only speculate. We thought that Powell would be somewhat hawkish, and he was, initially. Where the bulls got emboldened, was the dial back in treasury rates after he signaled the likely end to rate hikes. Our readers know that we have been saying the peak in rates likely already happened for this cycle. Can that change if we start getting hotter inflation trends? Of course, but that may be a next year event. For now, Powell is admitting they are restrictive enough and that the recent rise in LT treasury rates reduces the impetus for the Fed to hike again.

Powell also pooh poohed the stubborn Dot Plot reading, which should also be considered dovish.

The bottom line is, we should expect a less rigorous Fed in the NT until they have more information. This is quite good for equity markets. Why? Because the economy is still on good footing and removing the specter of a fire extinguisher allows the fire to burn a little longer. Maybe next year we still get more retrenchment in the economy and the downtrend resumes. But Powell is expecting this and a reason why he is dialing back the rhetoric.

Does this mean we are back to goldilocks in the stock market, and we should levitate back to ATH’s. Of course not. The economy still has a rough patch in front of it to deal with sometime next year. The extent and duration of that slowdown will define what likely happens in the stock market in the intermediate future.

We can’t tell you with any certainty how that will unfold. We do know that our signals will give us ample warnings when to enter and exit the market. Markets don’t move in a straight line, and we are comfortable riding that wave in whatever direction it takes us.

Maybe it’s time to ride that wave together?

Consider signing up below for more analysis.