The global markets offer a broad collection of clues as to what’s happening under the surface of the global economy, but also can act as a fortune teller for future events. The clues offered need to be decoded in a way that synthesizes information into a digestible form. If the stock market would simply post a flashing billboard when the winds of change are a foot, we wouldn’t need people like us to translate the opaqueness of the multitude of signals it produces. Alas, this does not exist, and thus our attempts to make sense of the randomness has a market.

We are not here to run a popularity contest, and we are not here to boost our engagement on social media, we are here to be right. Not right sometimes, right all the time. But being right 100% of the time in the markets is an impossibility. The paradox that exists, is that way too many big stock market personalities make a living being wrong most of the time, yet they have investors, huge follower counts, and proclaim everyone’s ineptitude for not knowing what they know. We find their posts/work comical, as they selectively use certain indicators to prove their point, only when it runs in their favor. When it turns on them, instead of using it to question their own standing thesis, they ignore the change, flip the narrative and find another strand of evidence that supports their view. This is intellectually dishonest and misleading, and quite frankly fraudulent. Why their work has a market will always escape us, but here we are.

We have a view, if that view is supported by our work, then we act on it. The instant our indicators flip, we don’t overthink it, we reverse course and admit defeat. We are not married to any particular view, and when it’s time to cut bait and switch sides, we do it swiftly and unapologetically. The stock market doesn’t care how we feel, how you feel, it doesn’t care if it bankrupts your family, takes your home, or destroys your health and sanity. It’s an emotionless beast, and any emotion you decide to bring into the ring with it will undoubtedly be ripped apart.

The last two weeks of bullish stock market action was especially sweet for us. Not only were we excessively bullish leading up to the July top, but we also sold that July top. And for the ensuing 3 months, we stayed tactical until the end of Oct, where we started buying aggressively.

How did we know the stock market was poised to leap forward? We didn’t. Predicting stock market direction is about probabilistically weighing the evidence. Our Macro report dated 10/29/23, was previewed here:

“The Table is set”

Here is the excerpt from that reports conclusion page:

We told our readers to be ready to pounce on buying the stock market, most notably if treasuries retreated enough that signaled the top in rates was in. We had already been speculating for our readers that the top in rates had occurred in mid-Oct but we needed that confirmation to get more aggressive in buying stocks.

On Oct 31st, the day of the Fed meeting, the 10-year confirmed what we already hypothesized. It’s no surprise that this came on a Fed Day when Powell indicated the top in rates was likely in. The bottom line is we prepared our readers for this very moment.

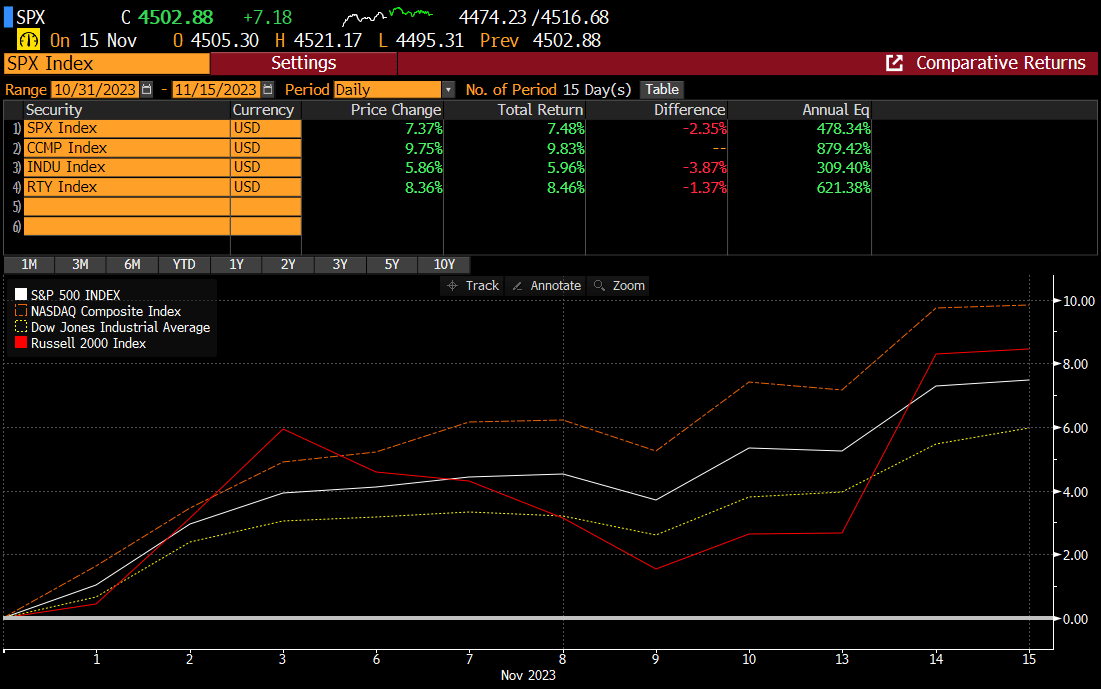

How has the stock market performed in Nov since that Fed Day? The short answer is, remarkably. A years’ worth of returns occurred in just two weeks. We are oversimplifying our analysis because it’s much more complicated than considering one instrument, but for brevity's sake, we are only showing the 10-year treasury rate.

The power of being able to time market swings cannot be understated and we think we do it as good, if not better than anyone. We do this all for $24.95 month.

If you are reading the free version of our newsletter, and have not signed up for the premium portion, then you are missing the valuable analysis and conclusions that drive our investment decisions.

If you had a choice to do significantly better in the stock market, for the price of a gourmet salad, would you take it?

This past week we realized why the horrible 30-year auction on Thursday that caused the stock market reversal, was reversed so quickly. Because the inflation readings reported this week slowed meaningfully. The market and the instruments we track had figured it out. In fact, we surmised this on our last weekend report.

Here is that excerpt:

“We are firm believers that collective stock market participants are the best predictors of the future, and last week’s reversal smells like a surprise is coming.”

In that same report, we discussed the complexion of the equal weight versions of the SPX and the Nasdaq, as leading indicators for potentially more bullish stock market action.

Here is that excerpt:

We still think there is plenty of time to ride this bull phase and we will offer some single stock ideas in some of our future reports to consider. But…