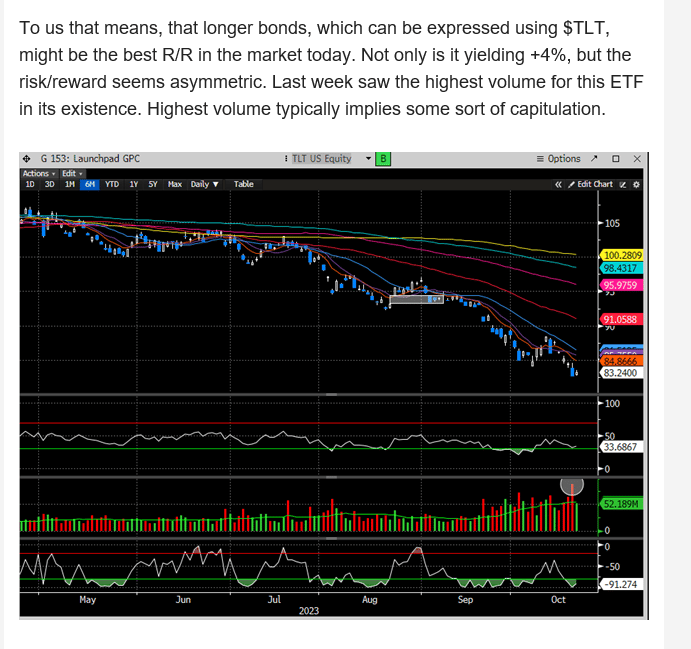

In our Oct 22nd weekend Macro Report, we discussed why we thought bonds (which could be expressed with $TLT), were the best risk/reward in the market. The next day, Oct 23rd, $TLT made a new low and never looked back. $TLT is now up over +12% since the first trading day post our publication. This is now outperforming any major index since that day.

After posting the best month for bonds since 1980. 43 years seems like a lot.

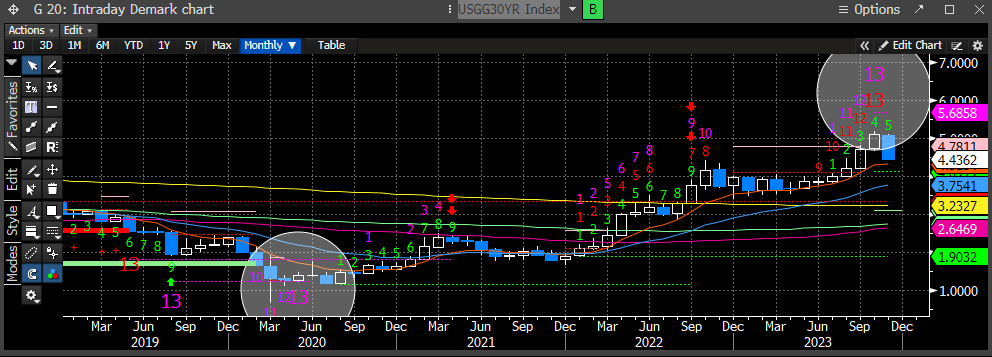

We wrote this in concert with the DeMark signals firing for the 30-year yields, across daily, weekly, and monthly time frames. A very rare alignment.

This is the monthly DeMark chart for the 30 year. Not only did this signal call the all-time low in yields in ‘20, but it also potentially just called the peak after the fastest ascent for treasury yields in history? One word, remarkable.

Here is one excerpt from that report:

“longer bonds, which can be expressed using $TLT, might be the best R/R in the market today…risk/reward seems asymmetric.”

Not only were we bullish bonds but the reversal of treasury yields is what confirmed our positioning to get aggressively long equities towards the end of Oct and into the beginning of Nov. This has been an outstanding month for our bigger inflection calls. Our main goal is to call the meaningful inflections for our premium subscribers, in any instrument that we track. Whether it be bonds, equities, crypto’s or commodities, we take our best stab at defining those inflections.

Last weekend we mentioned how the easy money off the lows had likely been made in areas of the stock market. When the pundits coming on CNBC are parading around the network calling for an end of the year rally, when they were unanimously bearish at the end of Oct, then the set up to get long is a bit precarious and prone to disappointment. Thus, buying into the late throws of a trend move can be dangerous.

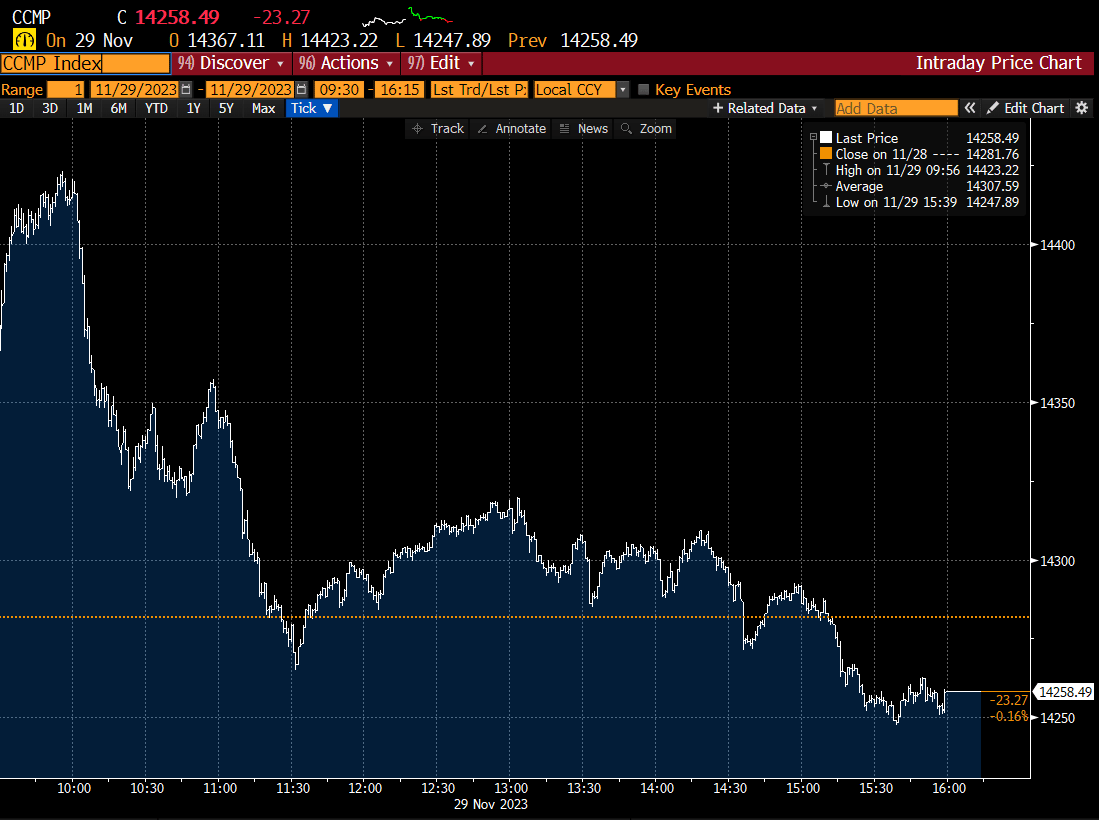

This was apparent in today’s Nasdaq trade where the strong lift to the index, that had been trading sideways for a week, broke out to test the July highs, and ended up closing on the lows. Hence, “dangerous.”

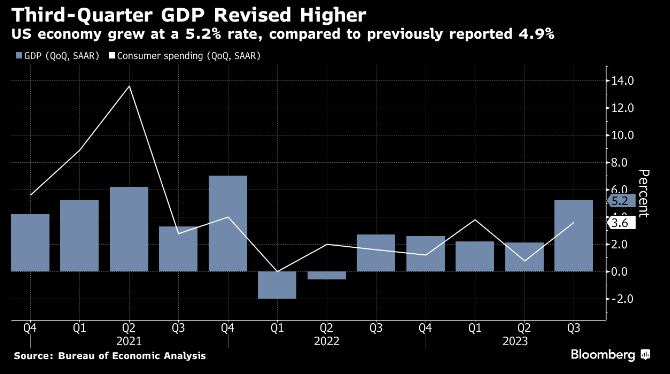

Today we saw the Q3 GDP report that trounced expectations (+5.2%), rising the fastest in nearly two years.

These sorts of reports, while backward looking, and prone to revision, can explain why the stock market has done so remarkably this year. Last Oct, the stock market was being priced for a recession that never came, and now is reflecting the reality of a very robust economy. Stock markets reflect the future and with pretax corporate profits posting their biggest increase in more than a year, it’s no surprise the SPX is up +18% this year.

There are certainly a plethora of smashed egg faces out there, who have been calling for cataclysmic wipeouts of the economy and the stock markets. If only they would follow price and not their egos, maybe they would have saved a few dozen eggs.

Tomorrow we will get PCE. And surely, this has the potential to disrupt markets if it comes in too hot. But the stock market and the bond market have been pricing in a different scenario. Could they both be wrong? Certainly, but we doubt it. The bigger question is what’s priced into the markets today.

We will discuss this in our premium analysis below. Please consider subscribing.