January in the stock market has been anything but an easy walk. Our trepidation for the market coming into the month was correct, and the choppiness has been a bit tricky to manage. The underlying weakness is evident, and cracks are appearing everywhere. Large caps continue to do the heavy lifting and why we have been telling our readers to focus there and to tread carefully in the stock market. Their leadership is obvious and evidenced by NVDA, something we wrote about last week.

It’s little brother $AMD was a stock we have been highlighting since Mid Nov, and also posted publicly on Twitter X.

Here is that post:

Since that post, AMD has outperformed NVDA by 2x and the indexes by over 7x. Not bad. And yes, we are still long, but less so.

We bring this up because these sorts of moves from the clear leaders imply that the market is not entirely ready to give up its gains. Is the market in the final effort of a bull move or is it gathering energy for one more push higher? There is no clear answer. Sometimes the market likes to confuse us all.

The market has been bombarded with some fairly bearish news with reaccelerating inflation, sticky Jobs, and now a Chinese economy that seemingly has no floor.

To make matters worse, the narrative seems to have shifted (as we suggested might happen last weekend) to the increased probability of a hard landing, especially with a bond market that seemingly overestimated the extent of the rate cuts this year. Part of our thesis coming into Jan was that the market was pricing in a fairly rosy scenario, which usually means added risk for disappointment. Currently, the market is repricing that risk. The larger indexes have yet to fully reflect this narrative shift, but the Russell surely has and is down nearly -8% from the peak in late Dec. Thats a fairly healthy correction by most standards.

Fed Fund Futures are now pricing in a 60% chance of a cut in March from 100% at the beginning of the year. Repricing of interest rate forecasts will usually cause volatility, and that volatility quickly expresses itself in the small/mid cap areas, as they are the most disproportionately impacted by higher costs of capital.

Today was also VIX expiration and Friday is OPEX. This, coupled with our own analysis, left us very cautious heading into this week.

Here is an excerpt from last weekend’s report indicating such.

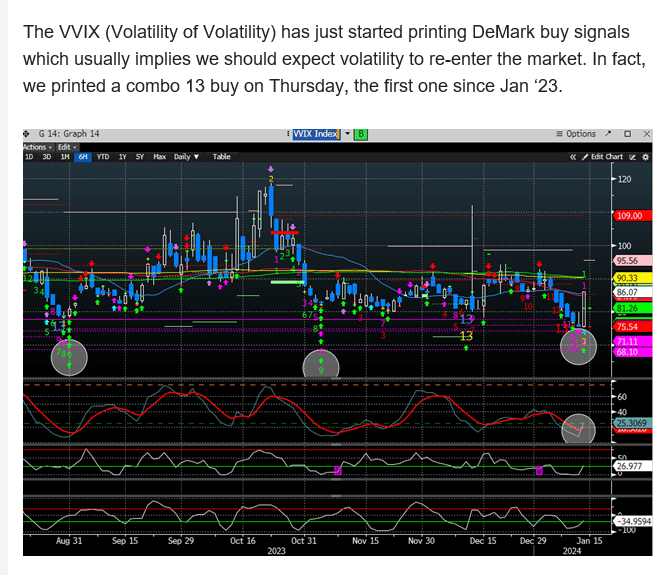

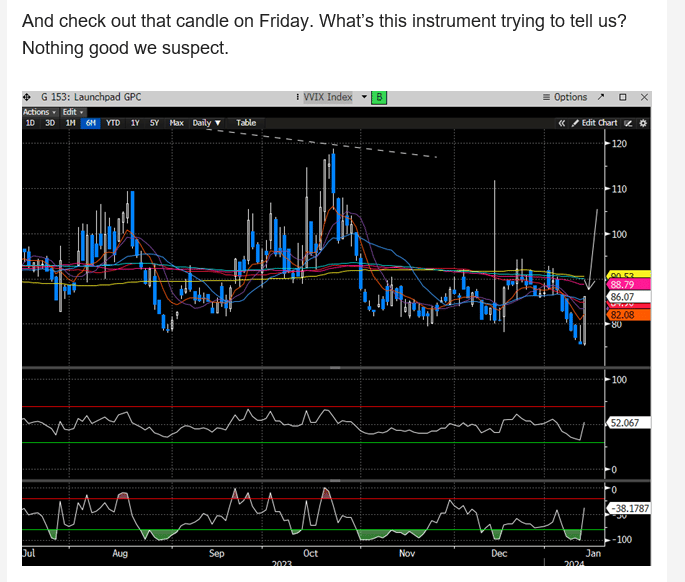

Last weekend we also highlighted this chart from Friday of the VVIX (volatility of volatility).

The VVIX was presenting clues to expect a difficult week. The $USD (DXY) is not helping the stock markets case either and something we alluded to as an added risk for risk markets.

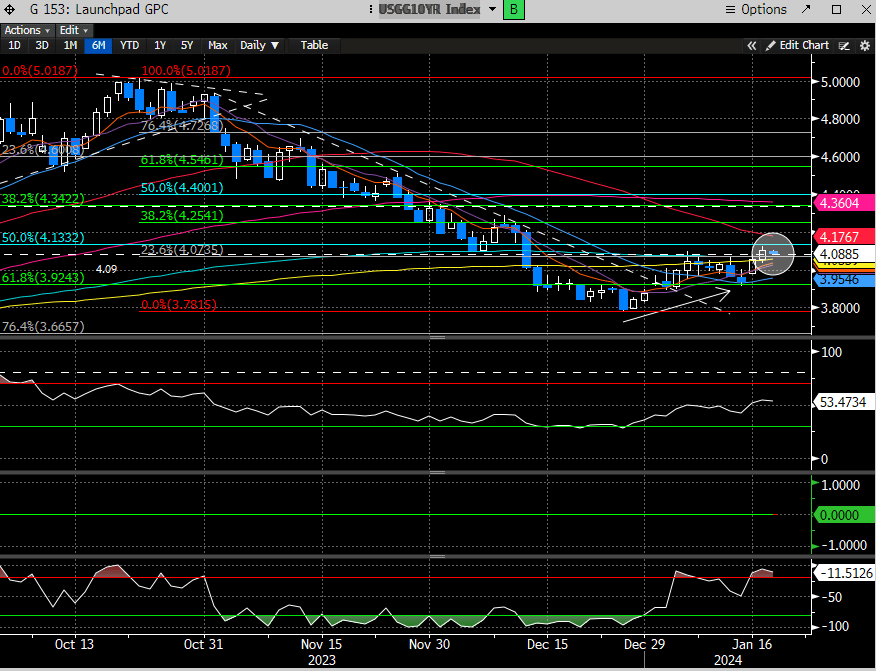

This was accompanied by higher treasury rates. The 10 year is now testing our 4.09 pivot and looks poised to break up.

It seems the stock market has a lot stacked against it these days and being rightfully cautious this month has allowed us to sidestep most of the carnage. The question remains, are we close to this turning around or should we expect more chop?

Premium analysis below.