We are back to familiar times, the Nasdaq continues to levitate and now up 8 days in a row (+9%), while the bears, who ignore simple market structure changes, keep arguing that things will fall apart any day.

Their reasons change daily as they will find any reason to support their bias, while ignoring all the things that are happening around them.

In the summer, the bears were clamoring that oil prices were going to upend the Fed’s inflation fight and a reason the stock market needed to break back to the last Oct lows. Oil peaked in the mid $90’s and since has retreated almost -21%.

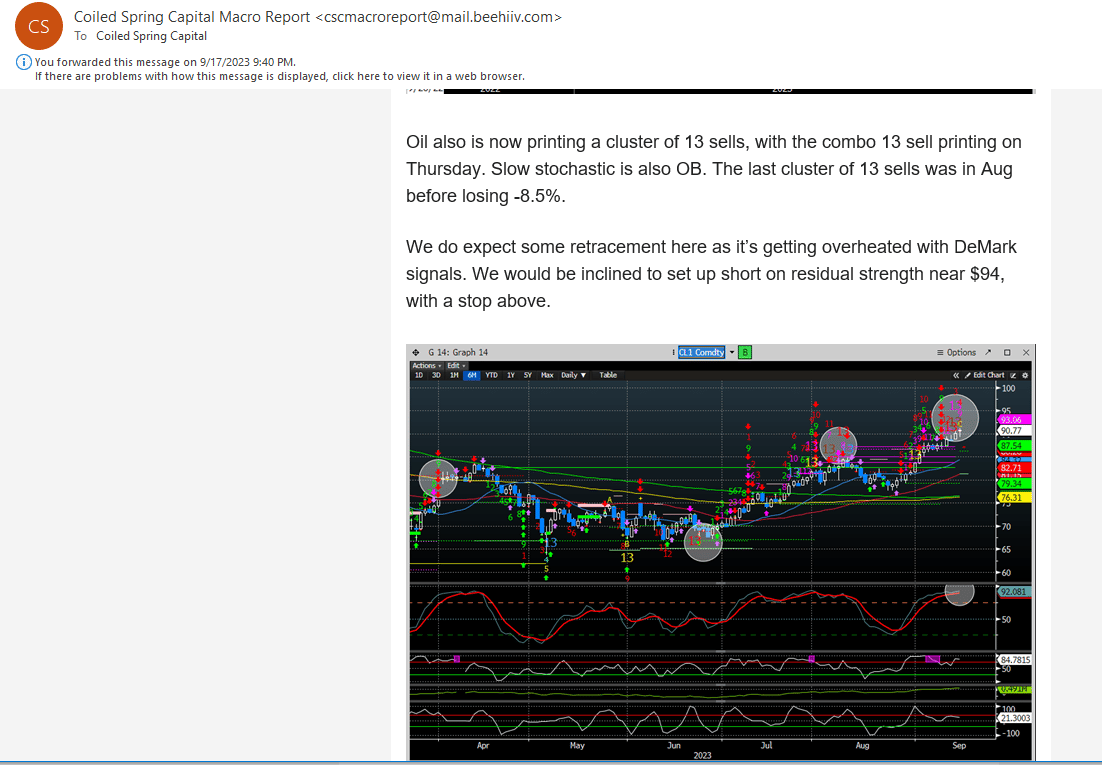

We actually made the call in our Sept 17th report to exit or short oil. Here is an excerpt from that report:

That narrative has since shifted, and now bears are saying the collapse in oil is because the US is heading into a recession. Forgive me, but why do they get to make the argument both ways? Oil goes up were screwed, oil goes down were screwed. It’s not that there isn’t merit in their logic. We certainly had our concerns about rising oil prices and why it was part of our “Three Horseman” indicator. And to be honest, we are equally concerned about oil collapsing, as it typically is the most sensitive to a global economic slowdown, but that doesn’t mean the stock market has to fall apart tomorrow. The market is simply more complicated than one instrument.

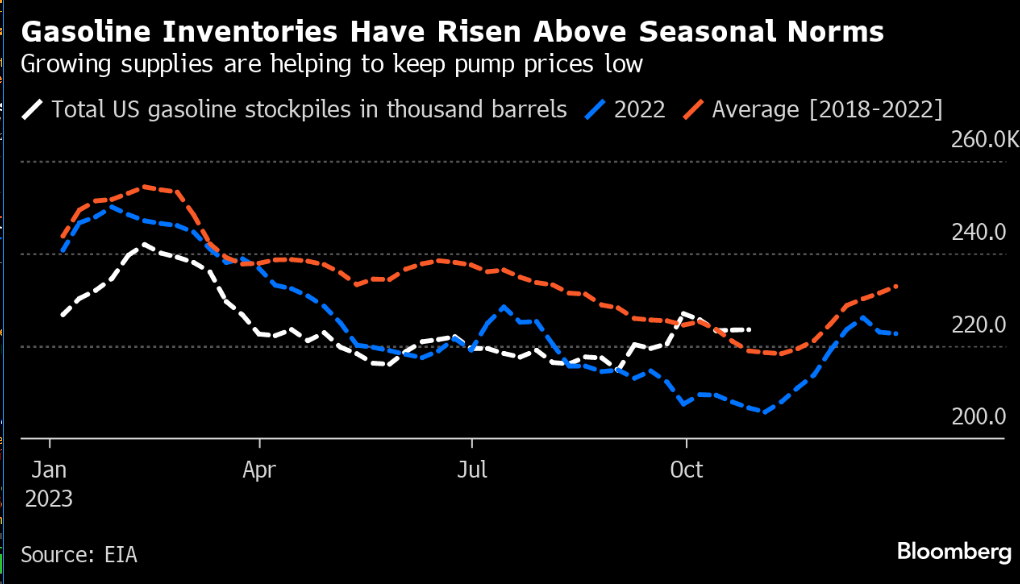

A feather in the cap for the bulls is that oil/energy prices find their way into every aspect of the economy and have a much bigger impact than the headline numbers read. For one gasoline prices, have been down for 41 days in a row. Thats quite a bit and should be a decent tailwind for future inflation readings as well as increased consumer consumption capacity. Gasoline price lows are now back to levels we haven’t seen since last year. Slowing demand, and higher inventories are pushing the prices lower.

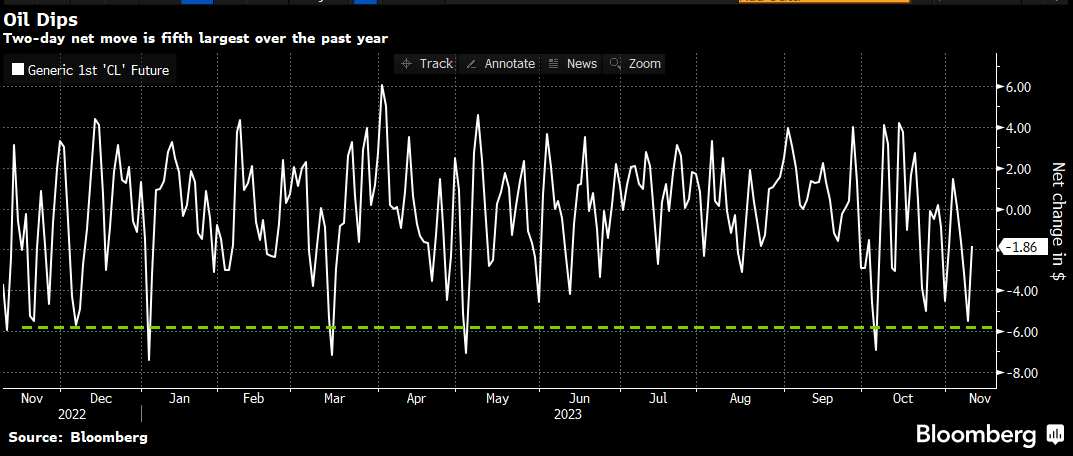

Clearly this is a function of lower oil prices. Lower oil prices tend to be a boon for stock prices in the short term. The 2-day move for oil is now the 5th largest this year. Every time this occurred over the last year, stock prices were higher a month later. The SPX on average has gained 5% on average a month after oil has seen larger 2 day moves this year.

Bond auctions so far this week have gone off without any major issues and seems to be supportive for equity markets. That was this week’s bearish missive on why the stock market would give up last week’s gains. So far, that couldn’t be further from the truth.

But there are concerns and we will talk about them below.

If you are struggling to stay on the right side of the market, we can help. Subscribe below.