Price is the only thing that pays. Remember that because it’s a valuable lesson when investing and trading in the stock market. Forecasting direction in the economy more than a few months out is an extremely difficult game, and most who try are proven horribly wrong. We’ll use ourselves as an example, as we thought this year would likely see a recession. Historically, it was hard to argue against that notion with the Fed on a warpath to squash inflation and raising interest rates at the fastest pace in history. The Fed’s track record of orchestrating a soft landing is simply not very good. Thus, to take their direction and commentary at face value, can be devastating. But the market almost always looks past what the consensus rhetoric is and sniffs out reality. This is why price is what pays and why we follow it first vs our feelings.

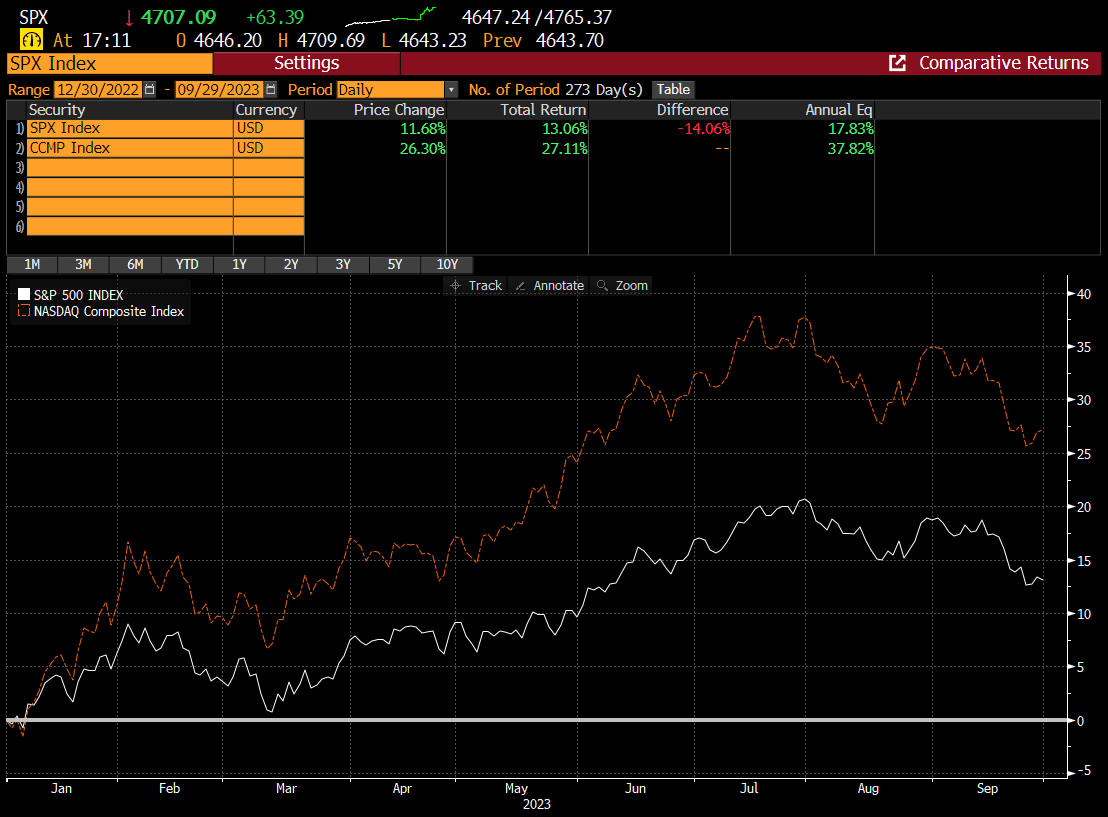

Let’s take the month of Nov as the most recent example. In Nov we received the Q3 GDP report. That report came in at +5.2% and had risen the most in almost 2 years. YTD through the end of Q3, the SPX was up +11.68% and the Nasdaq was up +26.3%.

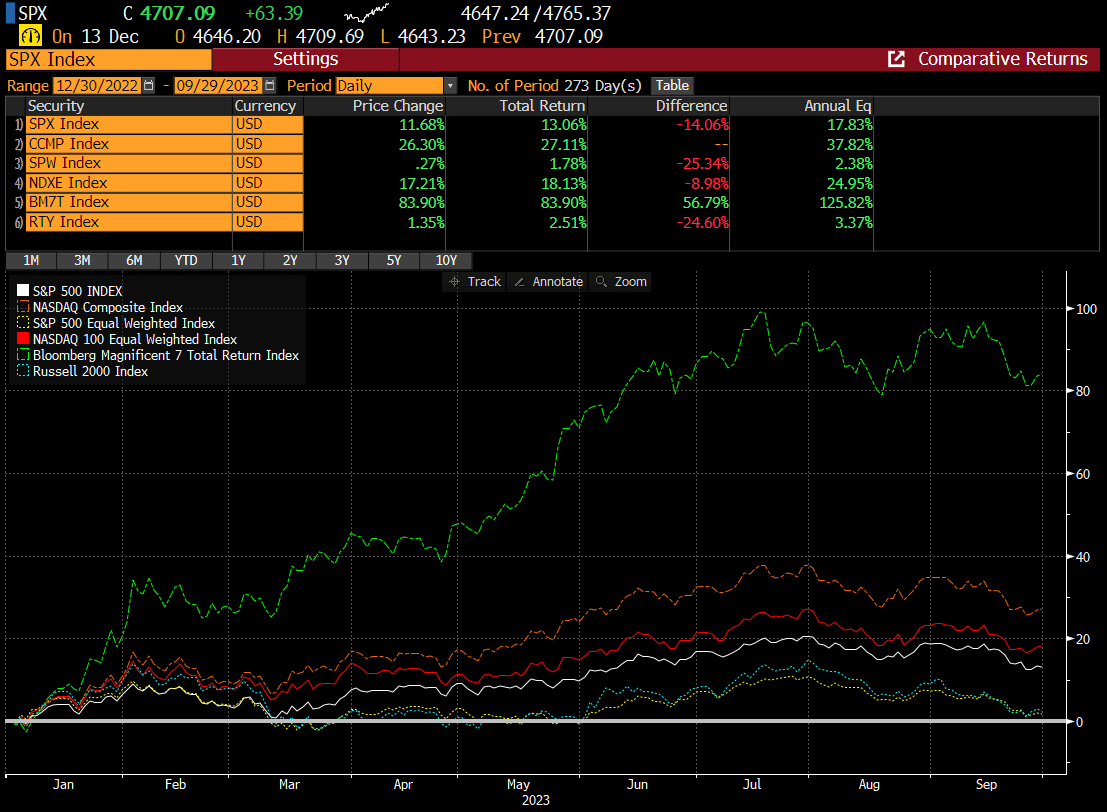

All year long we were told by the incessant bearish strategist community, the false prophet Furus, and the media, that the strength in the indexes were mainly because of the Mag7 Index and the AI thematic. Certainly, there is some truth to this as their substantial weight in the indexes were driving performance.

But this is only partially true since the equal weight Nasdaq 100 was still up +17% YTD by the end of the Q. The equal weight SPX (SPW) and the Russell were roughly flat. But isn’t it possible that the large caps were forecasting an already improving economy, while the rest of the market was starting to reprice a stock market that had been discounting a recession?

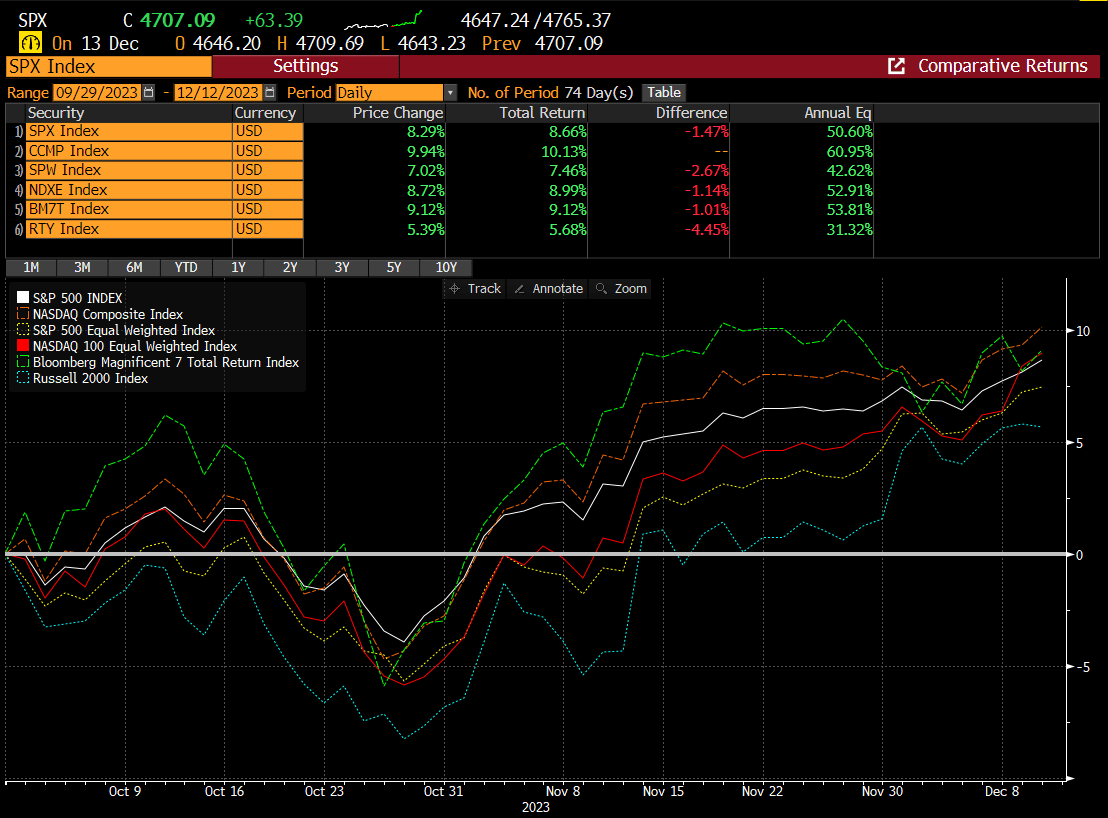

Fast forward to today, and you’ll notice that the equal eight versions of the indexes have kept pace with the main indexes, while the Russell has lagged.

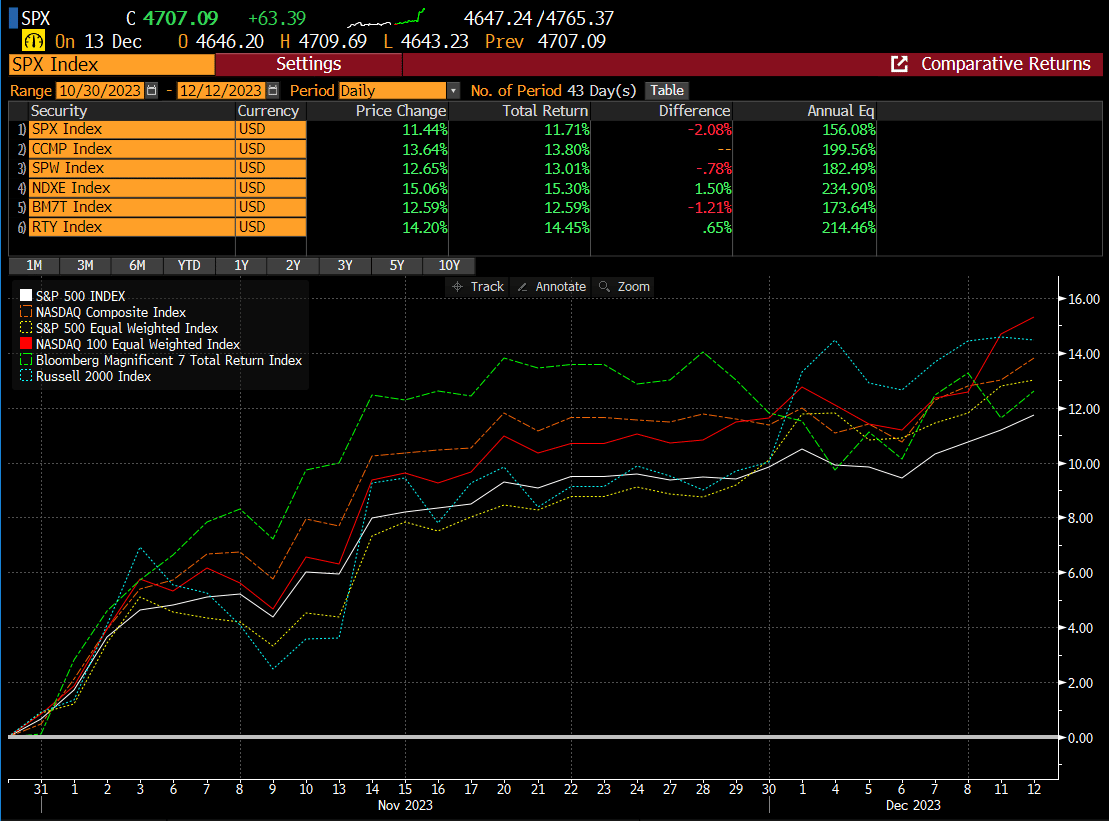

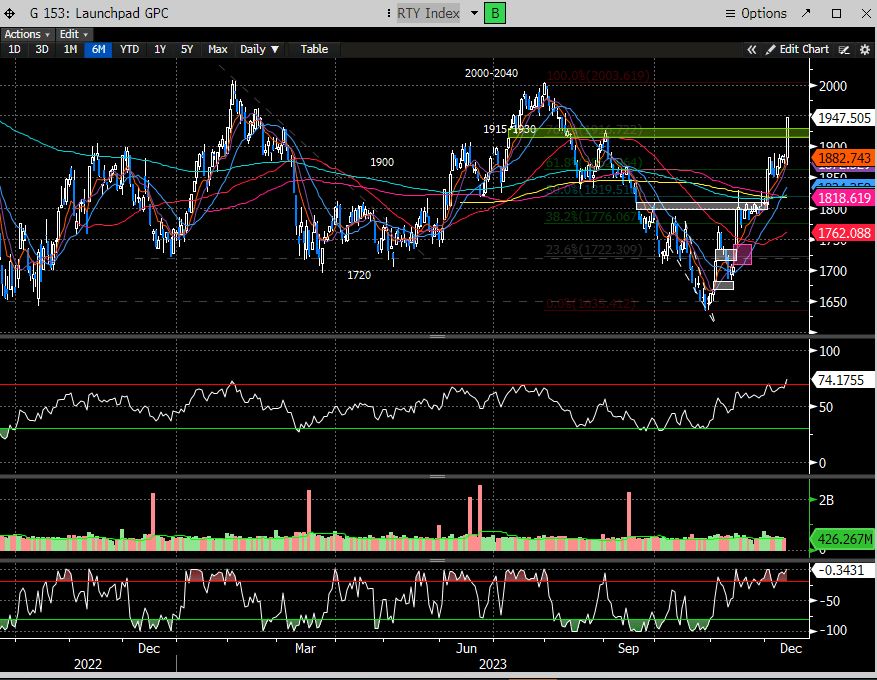

But since the lows in Oct, that leadership flipped.

Large caps can be viewed as defensive, because they have enormous market share with fortress balance sheets and can weather any recessionary storm or rising interest rate environment. Smaller companies, typically to do not carry those attributes, and thus are much more exposed to a slowing economy with higher costs of capital. This makes sense as to why they would be lagging as much as they did for most of the year. The future was uncertain as to the pace and length of the interest rate regime, and without any clarity on that trajectory, it was difficult to reprice this asset class for a different future.

Around the early part of November, this lagging asset class starting to re-ignite. The first clue was the topping of treasury yields, something we correctly called for in our Oct reports.

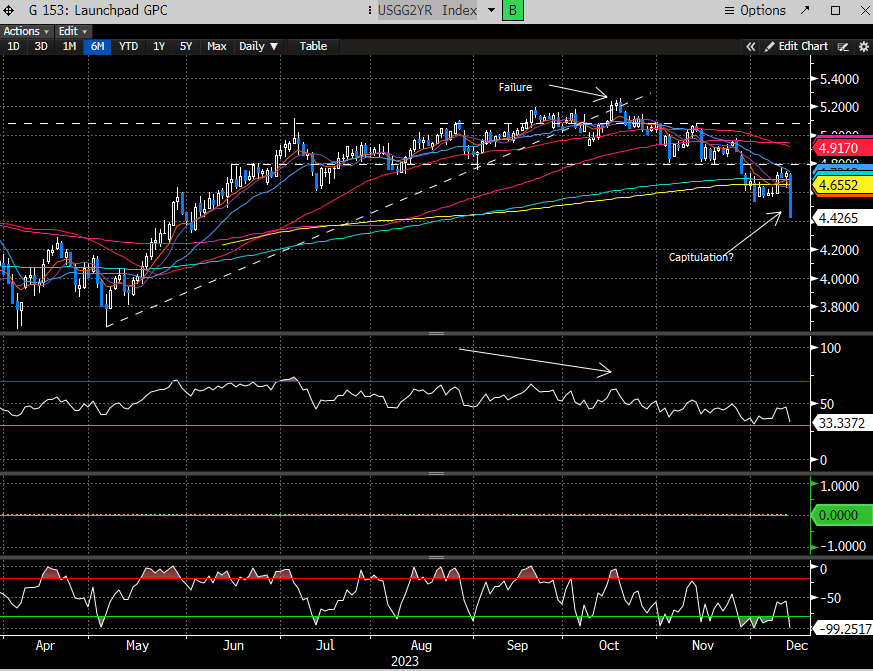

Here is a chart of the 2 year which peaked on Oct 19th.

How did we know it would peak? We didn’t, but our work suggested it was a good probability.

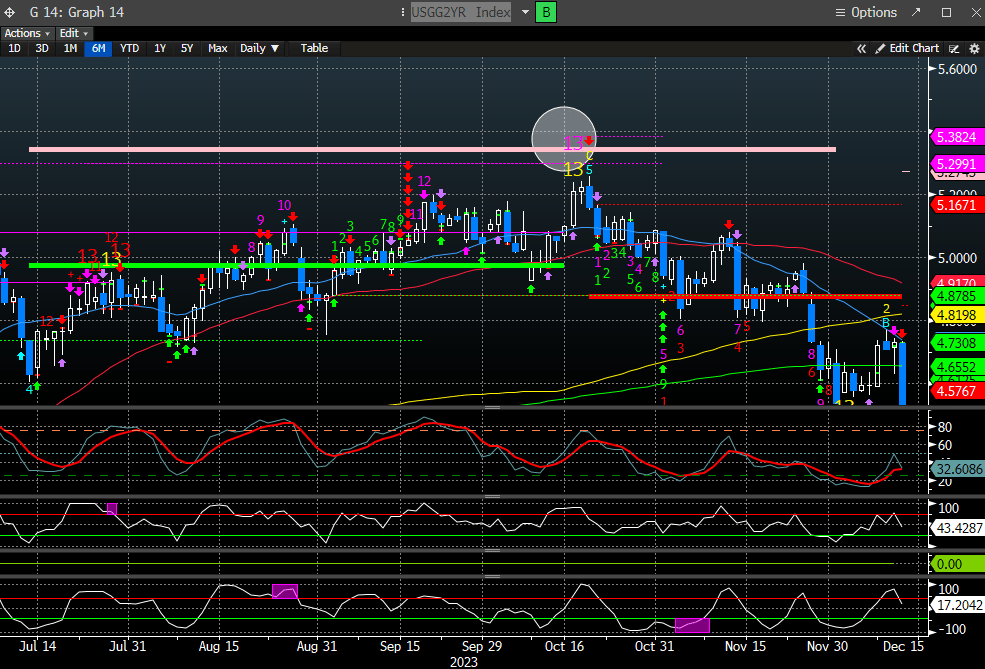

Here is the DeMark combo 13 sell that printed on 10/17. The 2 year topped on 10/19.

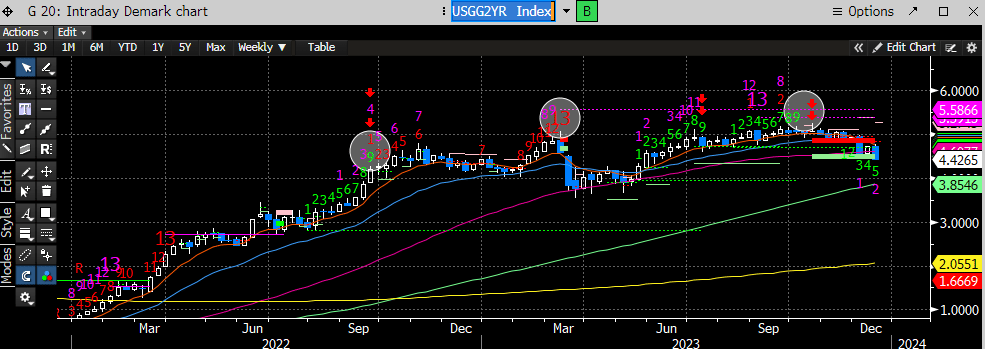

The weekly DeMark also with signal alignment and completing the 9-13-9 sell pattern the week of 10/6, but only perfected the 9 signal the week of 10/20.

During that time, we had been indicating to our readers that treasury yields were the most important factor driving the direction in the stock market. If yields could move lower, and convincingly so, we posited that a yearend rally could ensue. All markets are interconnected and understanding the interplay and how they influence each other, is imperative when attempting to make forecasts on index direction. This was the first clue for us to consider getting bullish on the stock market (keep in mind we were largely bearish and tactical from late July into late Oct). Clue #1

Confirmation of yields topping occurred on the last FOMC meeting in Nov when Powell was noticeably more dovish. Not only did yields breakdown that day, but the indexes gapped up. Without rehashing that gaps are repricing’s and what that means, the Russell Small Cap index gapped up after testing and breaking the previous Oct ‘22 lows. Clue # 2.

Then the Russell gapped up again with a massively wide-ranging bar to test the Sept gap down post the CPI report. Clue #3.

At that point, if you are not questioning your bearish thesis, then maybe you need to start reconsidering your process. Since the first Powell induced gap on Nov 2nd, the Russell is up a whopping +15%. Fortunately for our readers, we started repositioning our capital into small to mid-cap stocks, and those that are found in the Russell.

To come full circle on this argument regarding price, the stock market was telling us that Powell was about to signal rate cuts. We had no idea that Powell would go full dovish today, but we do know who did: the markets. The markets were discounting this outcome since early Nov. This should be a lesson to all the perma bears and incessantly wrong Furu’s/Strategists/Media pundits, to put down their egos, and learn to follow price. Price is truth.

It’s not that we didn’t let the world know to pay attention, we did. Here is one of our posts on public twitter from Nov 4th:

If you are struggling to decipher the code of the market, we can help. And we do it all for a small $24.95/month. Join us.