Wow, how much partying did the stock market do over the Holidays? We were expecting a Jan hangover, but the aggressive rejection since the start of the year was not something we were considering. As we wrote over the weekend, we thought we would get an initial push this week that would eventually fail. Clearly that didn’t happen, and we were unable to sell our residual longs into strength and raise our stops to lock in bigger gains. Yes, we had aggressively de-grossed exposure into the Dec FOMO rally, so we are still in an extremely favorable position, but our residual longs have reversed a good portion of their gains in 2 days. In our Macro Report we wrote that unwinds are painful and we were hoping to avoid one, but the pace of this week’s sell-off caught us by surprise. The market is an unforgiving animal, and we must respect its wrath. Too much champagne over the Holidays we guess.

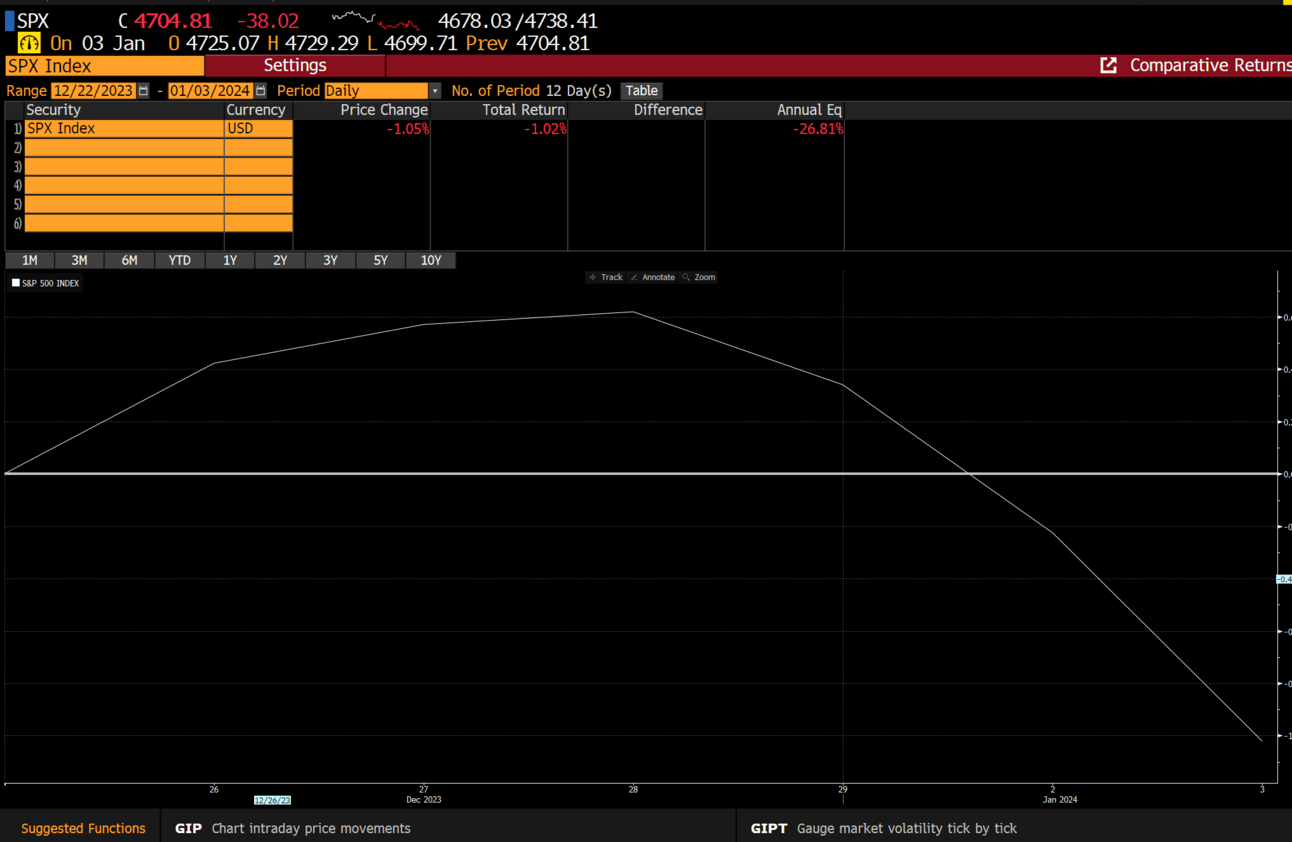

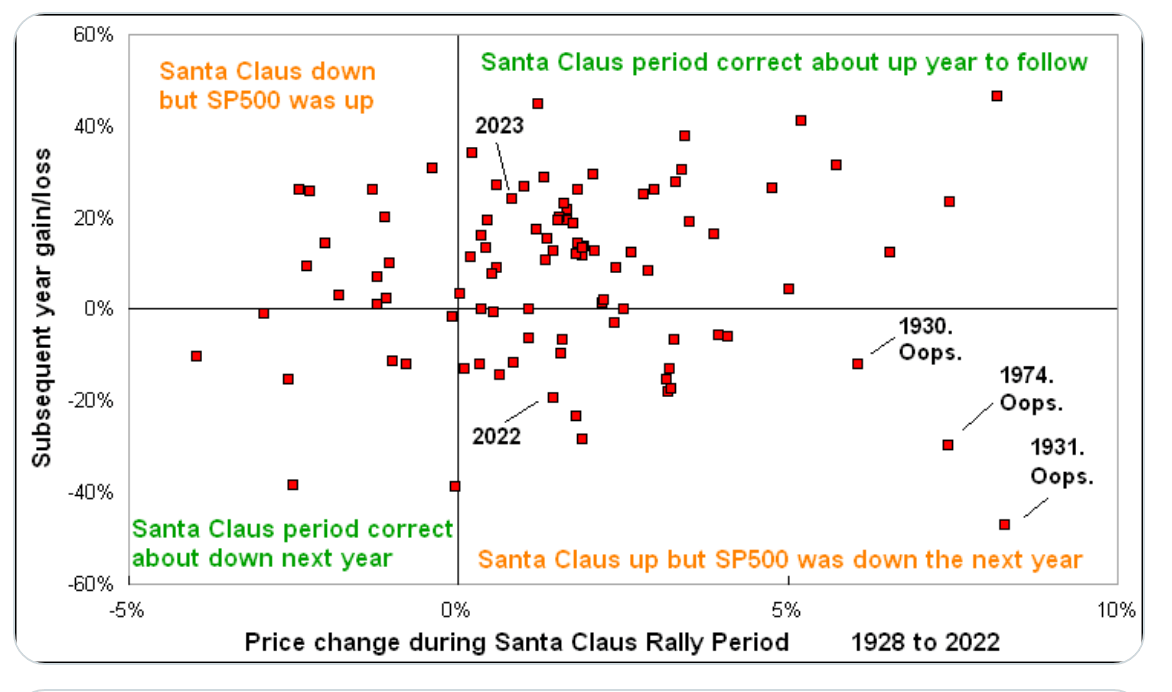

The Santa Claus Rally (SCR) period is now over, and the end result is negative.

Does this mean that the stock market is doomed to have a down year? No, not necessarily, it usually just means the year will have subpar returns. For now, we will put this in our negative column. But as Tom McClellan points out, the results are all over the map, so is it really predictive?

Statistically, a down SCR also leads to a down Jan. But this is in line with our expectations for a difficult month.

Regardless, we don’t rely on this sort of statistic in our analysis, it’s only something we consider when weighting the evidence for our directional bias. We follow price first and rely more on what our analysis tells us before relying on a singular statistic.

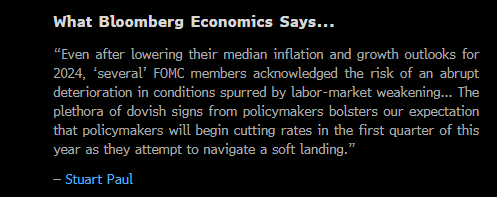

Today, we did get some macro data with the Fed Minutes and the JOLTS number. The Fed Minutes seemed a bit hawkish but nothing that should be alarming or change the narrative for the Fed. We always knew they would be data dependent and keep rates restrictive if the data supports it. More importantly there seemed to be more interest in protecting a soft-landing scenario, which would imply their rate cut narrative is alive and well.

Here is an excerpt from the Bloomberg Economics team:

Last week we showed this chart of the PCE reported before Christmas, and this supports their recent pivot as inflation is now below their target. Remember, the FOMC meeting took place prior to this report.

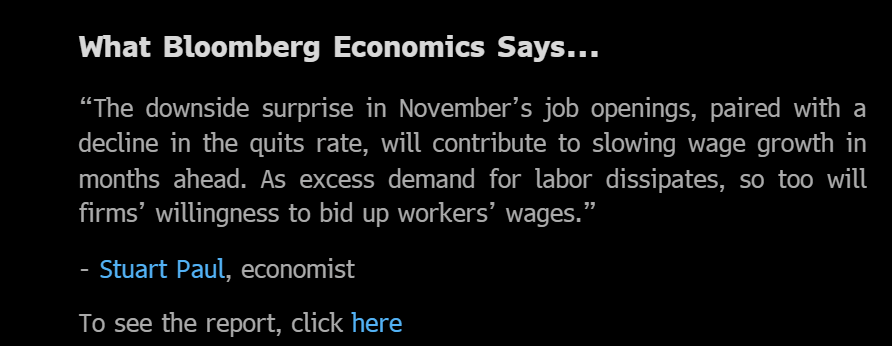

Regarding the JOLTS, US job openings eased in Nov and now at the lowest level since 2021. This is supportive of the Fed pivot narrative, as lower Job openings usually leads to slower wage gains, and thus supportive of slower inflation.

And here is the Bloomberg’s economic team comment:

This Friday we do get the payroll report which surely has the ability to upend the pivot narrative if it comes in too strong.

So here we are, stuck in the first week of Jan with an already massive headache from too much champagne. How long will the Jan hangover last? Will a few glasses of water and some Advil do the trick, or it lights out and back to bed for the bulls?

Let’s dig in below in our premium content.