We entered the week a bit guarded about increased volatility into an OPEX week with a pivotal CPI, and so far, that predilection has transpired. For the last two weeks we have been warning that the macro picture was posing a major risk for the equity markets, and despite them both rising in tandem, something felt amiss.

We wrote this in our macro report from 2/4 highlighting the perplexing picture the macro was sending.

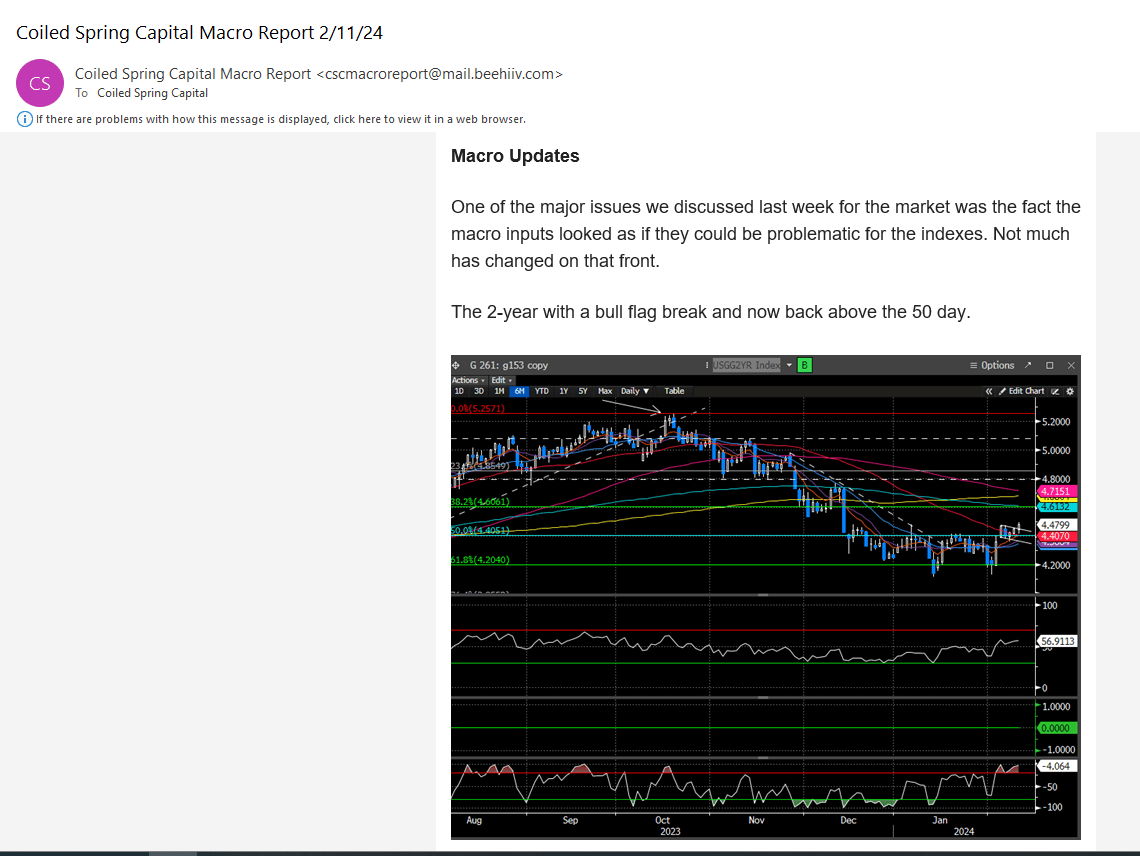

And we reiterated that concern this weekend when reviewing the major instruments. Here is an excerpt on the 2-year:

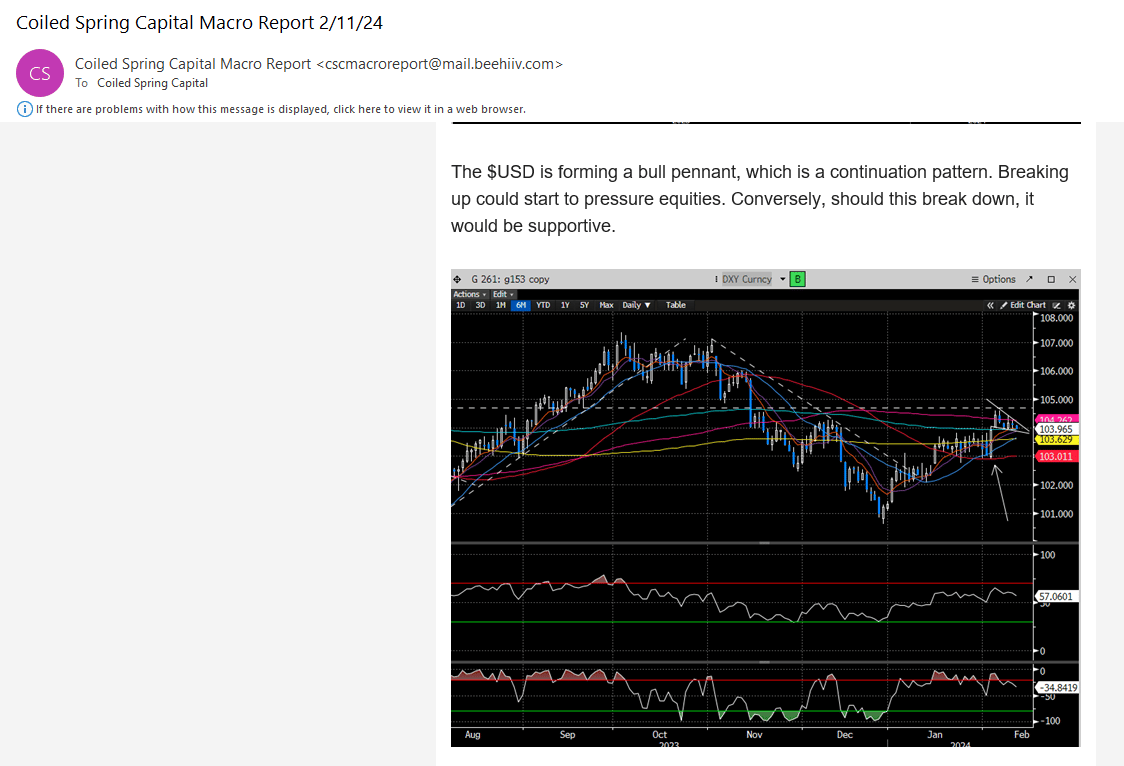

And here is one on the $USD (DXY)

Fast forward 3 days and these charts look much different.

The 2-year with a massive breach of the flag pattern post the CPI.

And the $USD with a similar look: falling wedge break and a massive candle to breach the pattern.

This all came on the backs of a seemingly sticky CPI that rose more than was forecasted, on a monthly and an annual basis, as did the core measures.

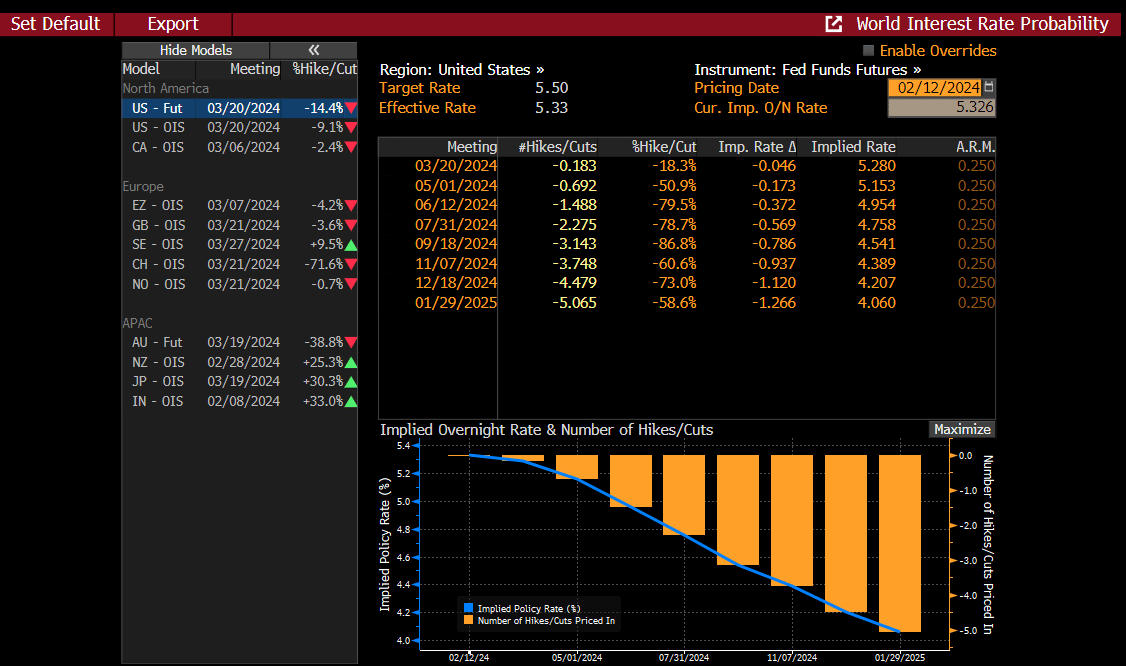

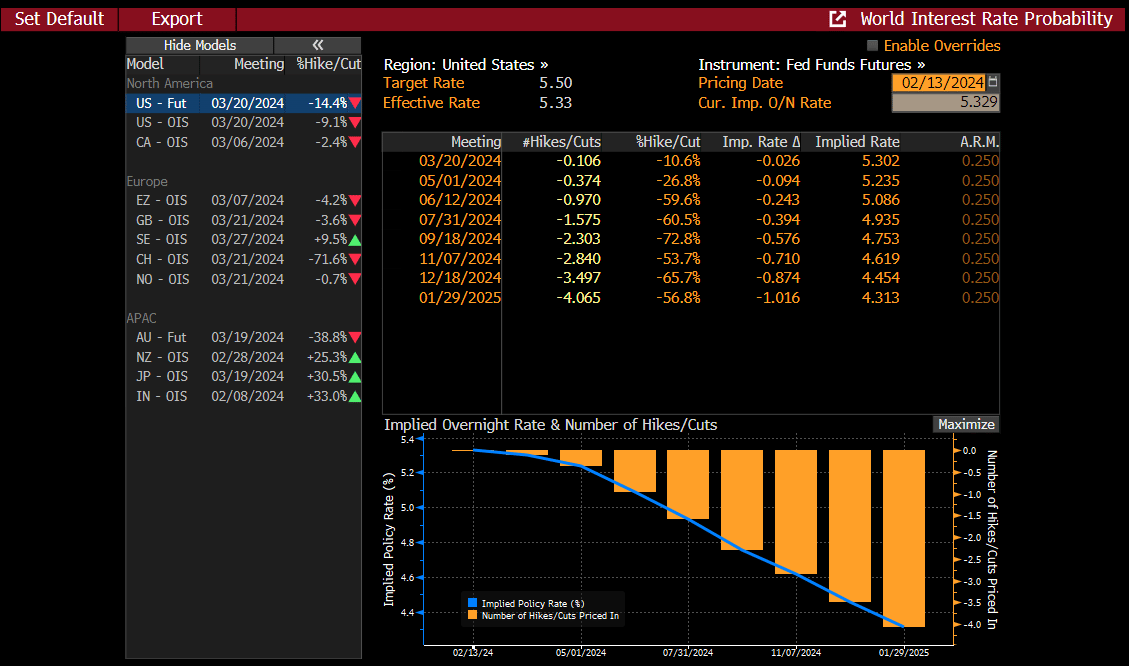

This pushed out the possibility of rate cuts from March to May. Interest rate expectations being drastically adjusted will almost always be met with market volatility.

The Fed Fund futures prior to the report were expecting an 18% chance of a cut in March and a 50% chance of one in May.

Post the report there was only a 10% chance of a cut in March and a 26% chance of one in May.

The silver lining was that shelter costs were 2/3 of the increase, and advanced .6%, matching the steepest gain since early ‘23.

Why is this a silver lining? Because its widely expected for this to moderate as we progress throughout the year. Here is a good post from Ryan Detrick discussing the notion of an elevated OER, which likely will revert.

It’s possible this is why the stock market ricocheted back today, as treasury yields gave back some of their gains.

But we know that Feb is a notoriously difficult month for the markets which usually begins around mid-month. This implies we are right in the middle of that poor seasonality, coupled with a typically volatile OPEX week. We opted to come into this week very lightly exposed in our trading accounts, but does today’s reversal change our thinking?

Consider subscribing below to find out.