O NVDA, NVDA wherefore art thou NVDA? C’mon, who doesn’t love a good Shakespeare reference?

The obsessive love affair the stock market has had with NVDA this year carried on into the AH with a substantial beat on their quarterly earnings report. Revenue for the Q came in 10% higher than the already very bullish forecasts. This is being driven by its exploding datacenter revenue.

This report should help put the incessant bears to bed for a while who continue to claim fraud, stuffing the channel, and whatever fabricated concoction they can come up with to explain away NVDA’s incredible success. We have been at this game a long time, and we find most of what they say about NVDA as ignorant. NVDA has been the top chip company for over a decade, as they have not only blazed the path with their GPU’s for gaming, crypto, and datacenters, but now for AI. Good companies simply out-innovate their competition and NVDA has been doing it for as long as we can remember. The only thing NVDA is guilty of is that their stock price has gone up too fast. Quadrupling revenues in one year is enough justification for its meteoric ascent, if you ask us.

Over the weekend we had our concerns over a potential “sell the news” reaction to their earnings report, but the market decided to sell the news before it was delivered. Tuesday, we walked into a buzz saw of selling which knocked the wind out of most growth stocks into today. NVDA was challenging its ATH in the afterhours market, but how we close tomorrow is the bigger question for us? Time will tell and something we will expand on in the premium section.

Today also saw the Fed minutes released. These were notably hawkish, where the Fed is seemingly trying to stymie the easing financial conditions. Keep in mind the last Fed meeting took place before the last 2 hot inflation reports, so the dialogue is a bit stale. This only reinforces the idea that the Fed will remain and possibly lean more hawkish heading into the spring. This is certainly a head wind for markets.

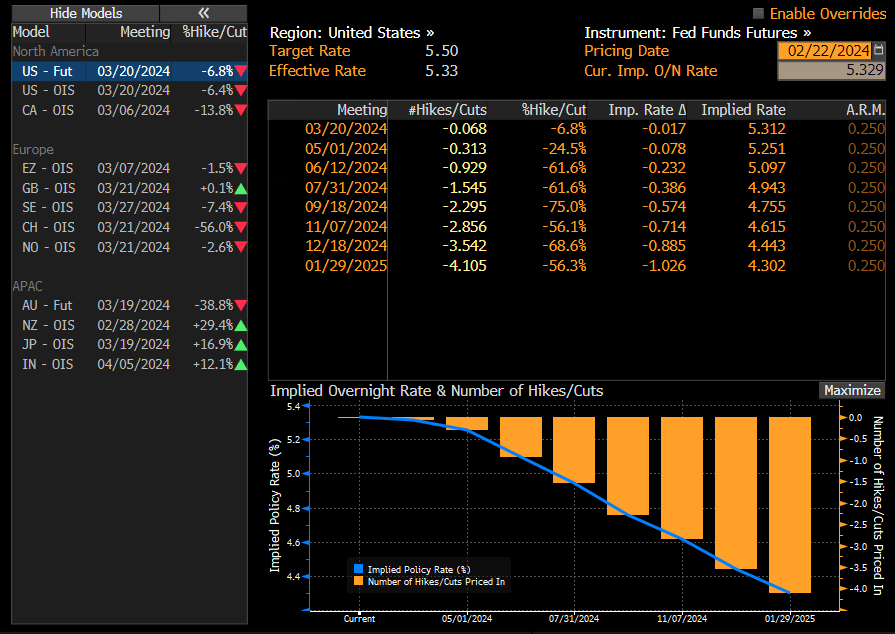

The new narrative making its way around trading desks and the media is that the Fed’s next move won’t be a cut, but a hike. While we don’t ascribe to this thesis, it is out there nonetheless, and if the market actually does experience a meaningful correction, we suspect this will be a leading narrative candidate. For now, the minutes did not show a hint of this possibility. That could certainly change should inflation keep re-accelerating, but for now this seems like a remote possibility.

The minutes did seem to suggest that the Fed is pleased with the current disinflationary trajectory, and while there was some discussion around them cutting rates too quickly, there were dissenters who believe that restrictive rates can cause downside risk to the economy. The bottom line is the Fed likely will remains guarded on being too optimistic around the pace of cuts but would be quick to pivot dovish should the economy weaken more than expected. This seems to be somewhat supportive, for now.

Fed Fund Futures seemed to have taken the minutes in stride and didn’t move much from the prior day.

In our last weekend report, we discussed the momentum breaches we were seeing across different instruments and posited that we are about to see the market sell down. While we were correct in our assumption, we didn’t think it would occur until after the NVDA report. With the markets already under duress prior to the report and testing key support areas, the NVDA report set up for the market was not as precarious.

Overnight futures are indicating a very strong open for growth stocks, which have been hammered the last 2 days. Will they run into overhead resistance or does the stock market push higher into new highs?

Consider subscribing below for the balance of the analysis.