What an absurdly volatile week for US stock markets. Post the long weekend, the indexes and mainly growth stocks front-ran the possible “sell the news” reaction to NVDA, only to be completely reversed, post NVDA’s eyepopping report that blew away the consensus forecasts, again.

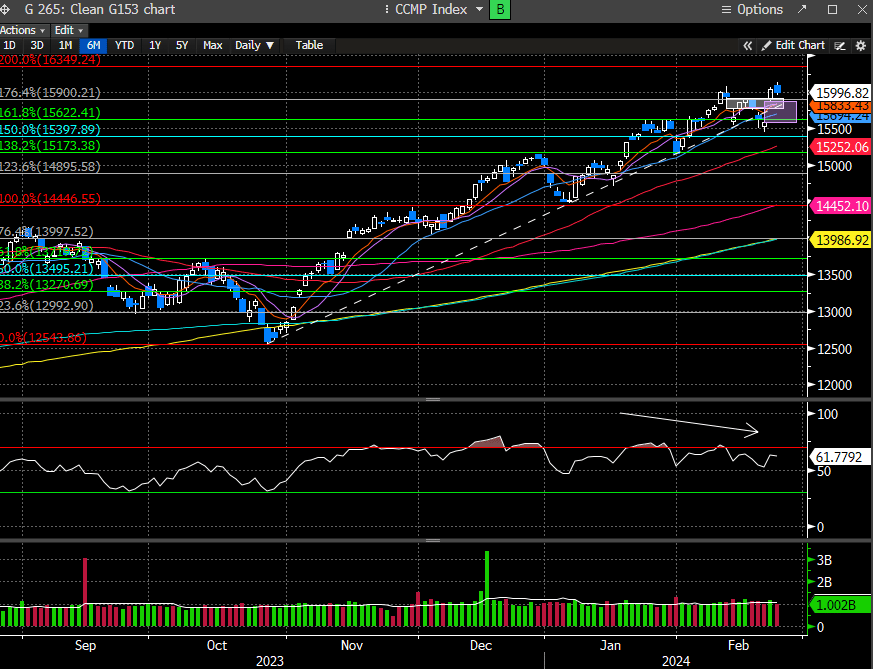

The chart below shows the dip prior to their release on Weds night, and the ensuing ricochet higher to forge a new ATH for the major indexes. The incessant bearish community is calling this a blow off top move, which is something that only can be confirmed in hindsight. Whether it is or it isn’t is something that requires more information, so you will never see us making some bold statement about the future. Predicting the future is risky business, and we approach it with careful and thoughtful analysis. The balance of our work and conclusions are reviewed in our premium section.

In our last weekend report, we came into the week expressing extreme caution, but were not positioning for any specific outcome into the NVDA report, since that outcome was going to be quite binary. We had advocated a lighter than typical posture to positioning into the event.

Here is the conclusion page from last weekend’s report:

“it’s very hard to suggest the risk/reward isn’t skewed to the downside…Of course, NVDA can report Weds some eyepopping numbers and get the animal spirits rolling again, but that isn’t an outcome where we want to be overallocated…”

The 2 trading days prior to the NVDA report had the look of a market that was finally going to roll over and undo some of the enthusiasm that has built up since the November Powell pivot. NVDA had a different opinion vs the stock market’s expectation, and proved the event to be quite binary, and especially tough for newly printed shorts.

The NVDA report blasted through the previous ATH and closed near the highs for that day.

The SPX gapped up to its previous ATH and pushed higher.

The Nasdaq found itself testing the ATH pivot.

After gapping up itself, illustrated by the purple gap window.

Gaps are typically associated with some sort of news event, that causes a repricing. Gaps are indicative of binary events.

While there may be some dissension that we missed a huge move in the indexes post the NVDA report; we disagree. We are always exposed to the stock market through long term portfolio holdings, where the bulk of our positioning lies. Our trading portfolio is much more short term and where we are more concerned with the short-term machinations of the stock market. Our bi-weekly analysis is mainly geared for those types of assessments. And in the ST, we typically avoid binary situations. There is simply no edge in analyzing binary events, so in essence, we don’t try to, we just avoid them. Remember, there is no such thing as perfection when analyzing and trading the stock market, there is only favorable risk/reward scenarios, and the risk of trading binary events is simply too great for us to feel comfortable advocating a directional bias.

This week we will get the next inflationary reading (PCE) on Thursday. If you recall in our previous report, we discussed the recent hotter CPI/PPI results adding risk to PCE also coming in above expectations. This is the Fed’s preferred inflation metric, and an above consensus report likely pushes the “higher for longer” narrative or even adds fuel around the next Fed’s move is a hike scenario.

Currently the core PCE (excludes food and energy) is seen rising .4% month/month. That would mark the second straight monthly acceleration over the last 2 years that has been receding. And when annualizing the data on a 3- or 6-month basis, that would push the rebound back over the 2% Fed target, after dipping below in Dec.

Interestingly enough, the Bloomberg Economics team believes there were seasonal adjustments that caused the re-acceleration in inflation and that the Fed will look past the recent blip. The stock market trading at ATH’s tends to agree.

But, the bond market does not, with the 3 month T-Bill trading at the highest level since Nov.

Who should we believe? The stock market or the bond market?

Consider subscribing below to read our conclusions.