In our last weekend report, we discussed the thematic around the stock market possibly broadening out. Despite what the media and doomsday Fintwitters will have you believe; the rally has considerably expanded away from the large caps.

If you don’t want to believe us, how about the largest money manager in the world?

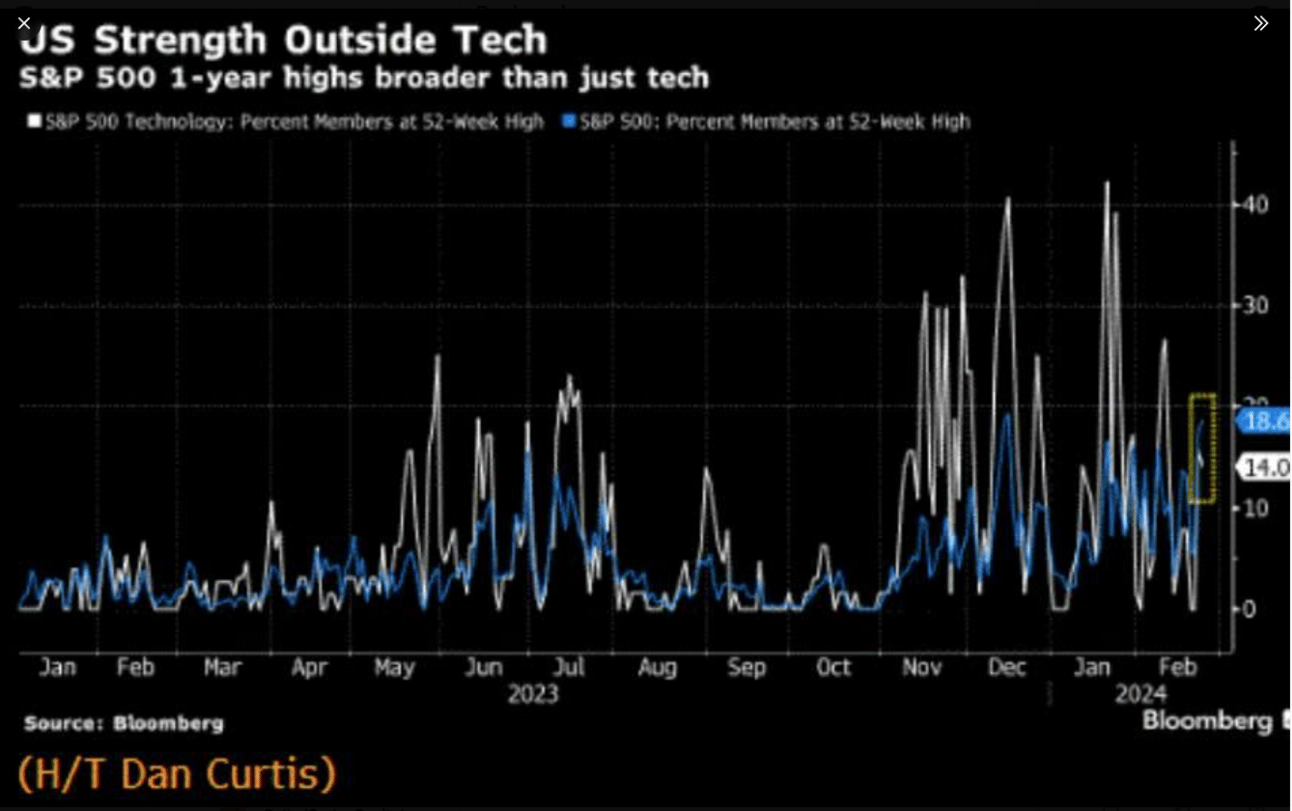

What about the team at Bloomberg?

We comprehensively illustrated this by reviewing a multitude of instruments to conclude that the early signs of a more robust rally were at hand. We always prefer our analysis to be supported by fact and to be confirmed by action, and Tuesday, a few of the instruments that we use to gauge underlying momentum, broke out.

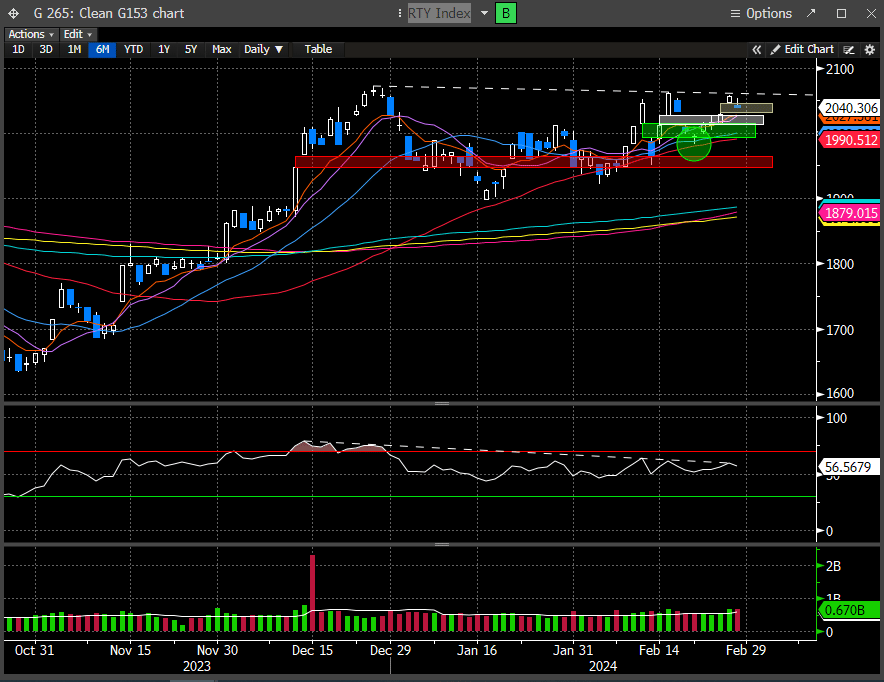

One being the Russell Small Cap index, which has traded quite erratic as of late, with multiple gaps in both directions and seemingly at the whim of the macro tape. Last week the Russell found support at the 50 day and has since broken resistance to test the Dec high pivot.

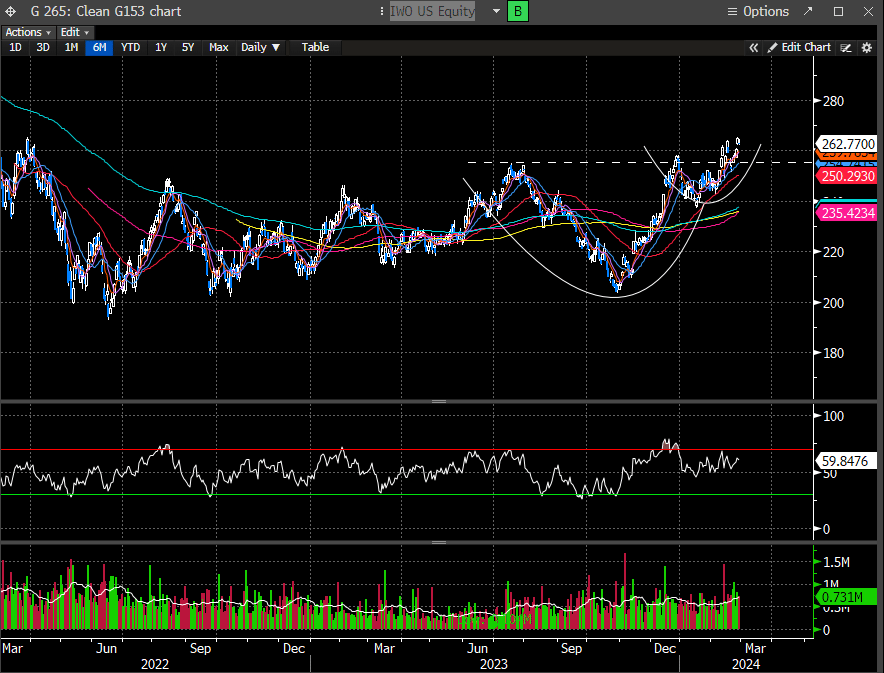

Not only is the Russell breaking out, but so is ARKK, which is the poster child for unprofitable growth, and houses quite a few SMID cap growth stocks.

The Russell 2K growth ETF (IWO) has already pierced its cup and handle pattern and is the highest since Mar ‘22.

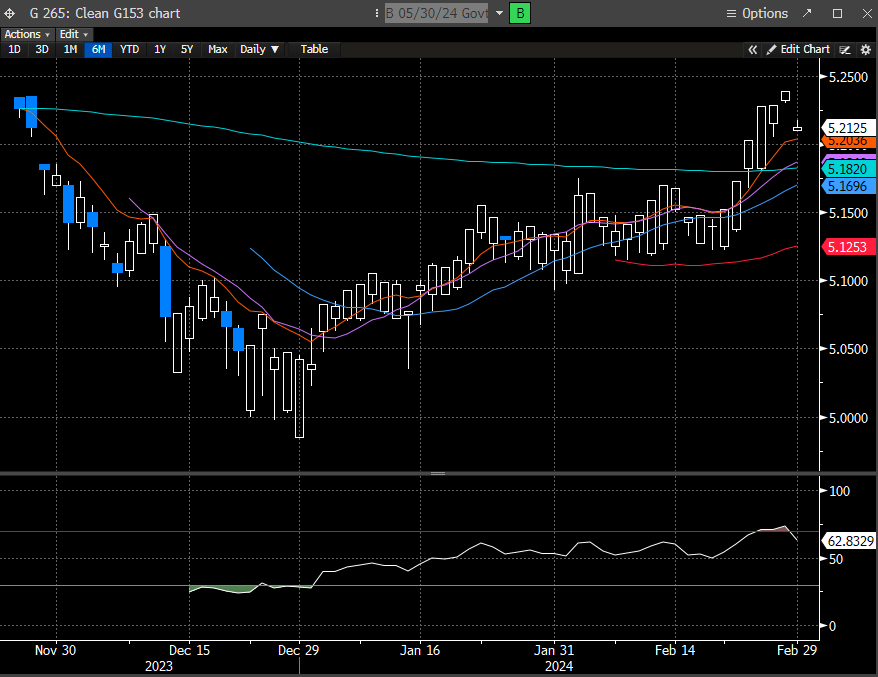

Yet T-bills are the highest since the Nov pivot, and small caps are disproportionately impacted by higher rates. So, what gives?

Tomorrow, we get the PCE, and the Fed’s preferred inflation metric. We have written extensively on this so we will not rehash, but the expectations are for a re-acceleration.

This week we have also had some Fed speakers hit the road parading their view that they want to avoid cutting rates too quickly, for fear that inflation forces have not subsided. This is building some tail risk into the markets for the Fed’s next move to be a hike, not a cut.

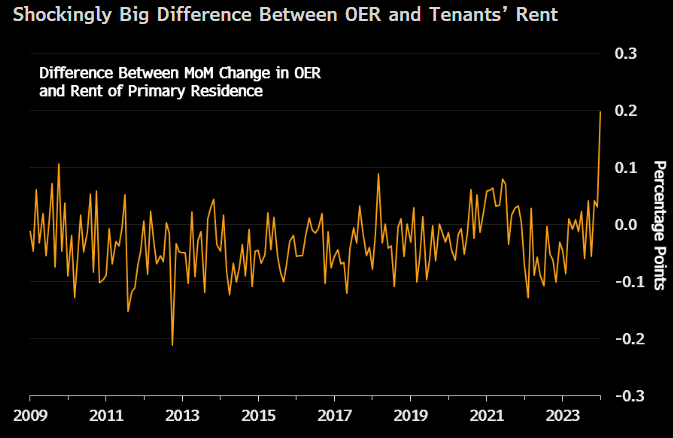

Should PCE vastly surprise to the upside tomorrow, can a Fed hike become a reality? We would say it’s unlikely. The Fed already achieved vast deceleration in inflation last Nov. Despite some outlier prints that drove the recent inflationary readings higher, we don’t think the inputs of Owner’s Equivalent Rent (OER) will hold up. Should this retreat from Jan’s unusually high reading, the Fed will be back in the driver seat with regard to hitting their 2% target.

Here is a chart of the relationship between OER and tenant rent. These are typically well correlated and tenant rent declined in Jan. This chart shows the extreme outlier reading in this relationship. A big reason we saw CPI tick up was because of housing and this subcomponent. It’s important to note that outlier relationships do not typically persist, and thus it’s possible the next CPI reading reverses the re-acceleration.

Is it possible the stock market is already looking through the likely bump in PCE tomorrow? Or is the bond market going to flex their muscles and stomp down the stock market’s recent enthusiasm?

Consider subscribing below to read our conclusions.