Reminder that we are still traveling this week so this report will be shorter than usual. We will be returning in a few days and should be able to produce our typical comprehensive analysis for this Sunday’s Macro Report. Thank you for understanding.

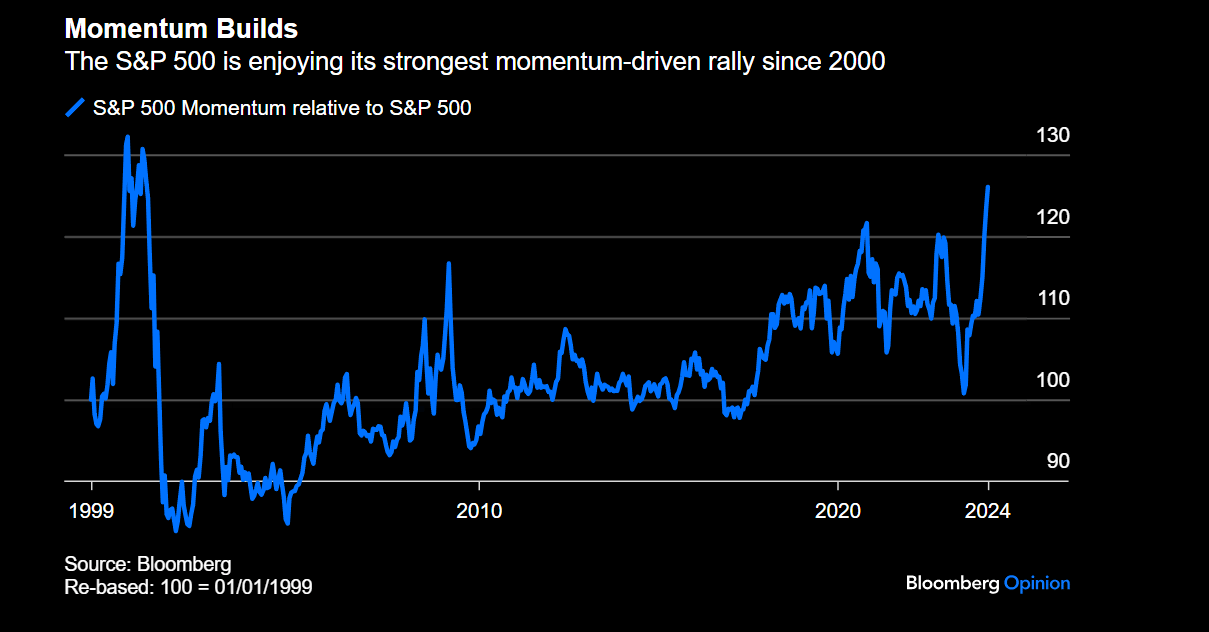

In our last weekend Macro Report, we expanded on the notion of momentum breaches showing up in some of the leading sectors. That hasn’t really changed much although this week the market is still defending important levels, and that’s bullish until it isn’t. We follow price first, and for now, the indexes are still holding where they need to.

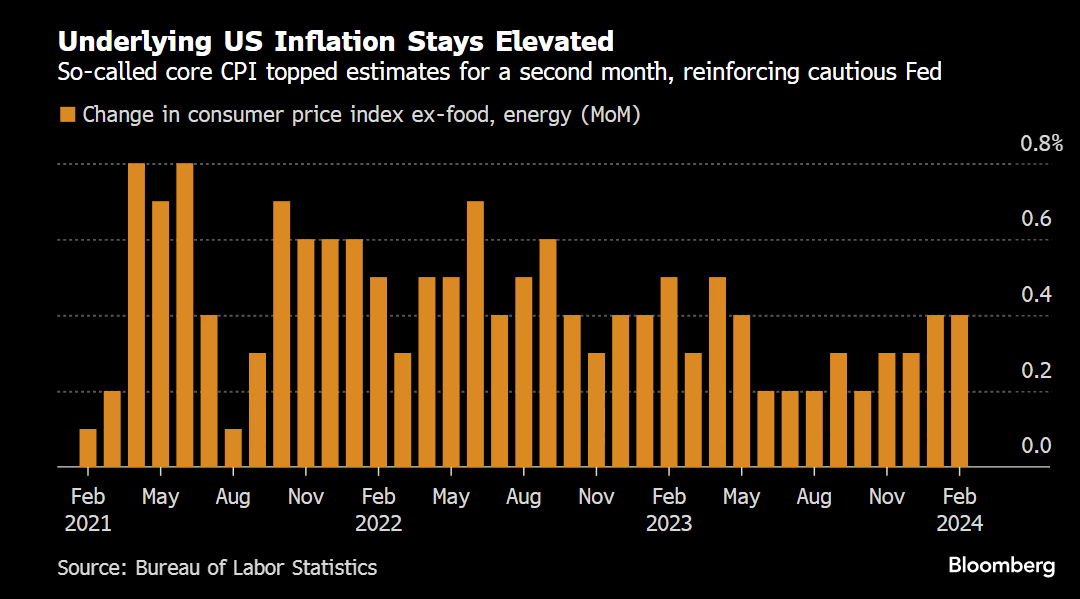

CPI was reported on Tuesday and despite the report coming in higher than expectations the stock market rallied. This is confusing most strategists, economists and even us. It’s hard to understand why the market would celebrate re-acceleration. This week is an OPEX week and sometimes there is too much exposure positioned for a specific direction which needs to get unwound. We don’t ascribe to be options experts so we will not opine on the machinations of their impact on the equity tape.

There is also the growing narrative that the economy doesn’t need rate cuts and higher inflation readings certainly impacts the Fed’s rate cut trajectory. What’s not priced in, is a surprise fed rate hike, but we see that as a low probability, given we are in an election year.

Rate cut expectations did come down again post the CPI report and now only showing a 75% chance of a cut by June.

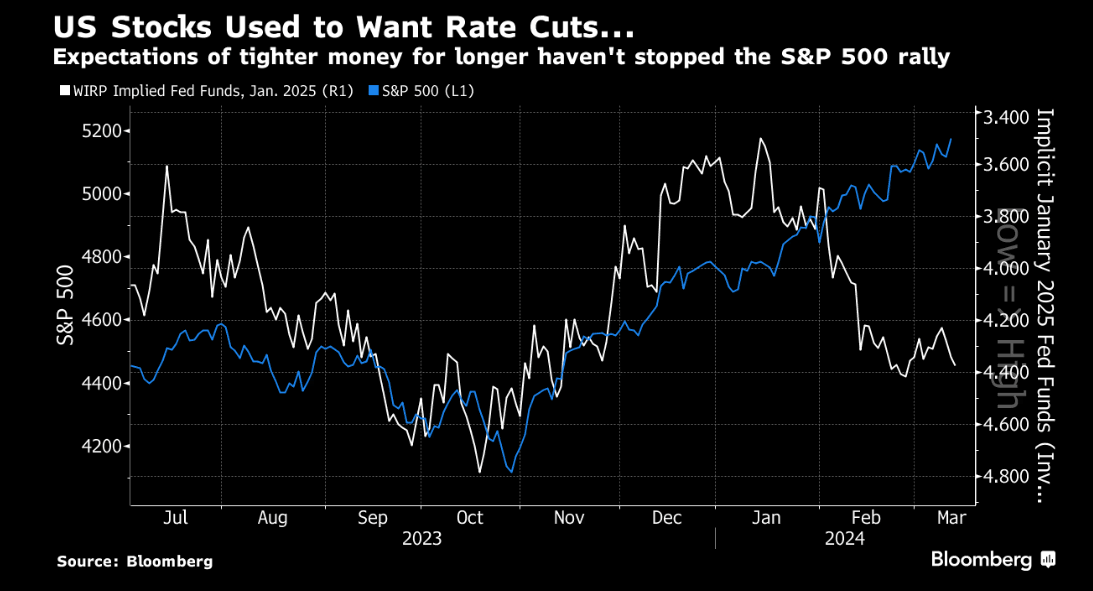

This chart shows the correlation breakdown of cuts to the SPX. Clearly the expected cut narrative was driving stock price performance last year but since the beginning of this year, that has reversed.

This is likely because of the surprisingly resilient macro-economic reports that is driving a reacceleration in the economy. This is in turn is boosting EPS estimates for stocks and driving them higher.

If the economy doesn’t need rate cuts to grow, and rate cuts are still slated to come sometime this year, why should stocks sell off meaningfully? They probably shouldn’t unless a slowdown is in the cards for the 2H of the year. That seems unlikely in an election year where Biden needs a strong economy for his re-election chances and any hint of rate cuts to offset slowing growth will likely boost risk/on sentiment.

A week ago, Jay Powell told the Senate Banking Committee that the Fed is inching closer to the confidence needed to cut rates. If this is his clear intention, then why shouldn’t we believe him? Inflation re-acceleration would have to fall largely out of line for him to change that tune and for now stickier inflation shouldn’t be enough to sway the Fed, especially with PCE retreating closer to the Fed’s desired target of 2%.

Tuesday’s CPI report did come in hotter than expected, so at the very least this will probably temper the Fed’s enthusiasm for next week’s FOMC meeting.

Next week we will also get the new Dot Plot for the first time since Dec. Currently the market is back in line with the Fed for 3 rate cuts by the end of the year. This can be a source of volatility next week should this get shifted, it would pose a risk to an inflated stock market.

For now, the momentum in the stock market is apparent. And trying to call tops with so much momentum is a dangerous game.

And as we have written for weeks, the broadening of the stock market rally has been occurring under the surface. Rotation is bullish.

But as we always like to say, stock markets do not move in a straight line. Is it time for a pull back or do we keep trucking higher?

Subscribe below to read the rest of our analysis.