We knew this week in the stock market was going to be event heavy and pivotal. The most important stock in the market today is undoubtedly NVDA, and mainly because of the momentum surrounding the AI thematic. Should that become unraveled, we would expect the market to follow suit. Monday their highly anticipated GTC event began, and while most of the news flow surrounding it regarding their product releases was well known, the “sell the news event” never really transpired. We saw this as a big risk as NVDA is carrying quite a bit of the market’s momentum on its shoulders.

Last weekend we wrote that we had no idea how NVDA would trade post the event.

Here is that excerpt:

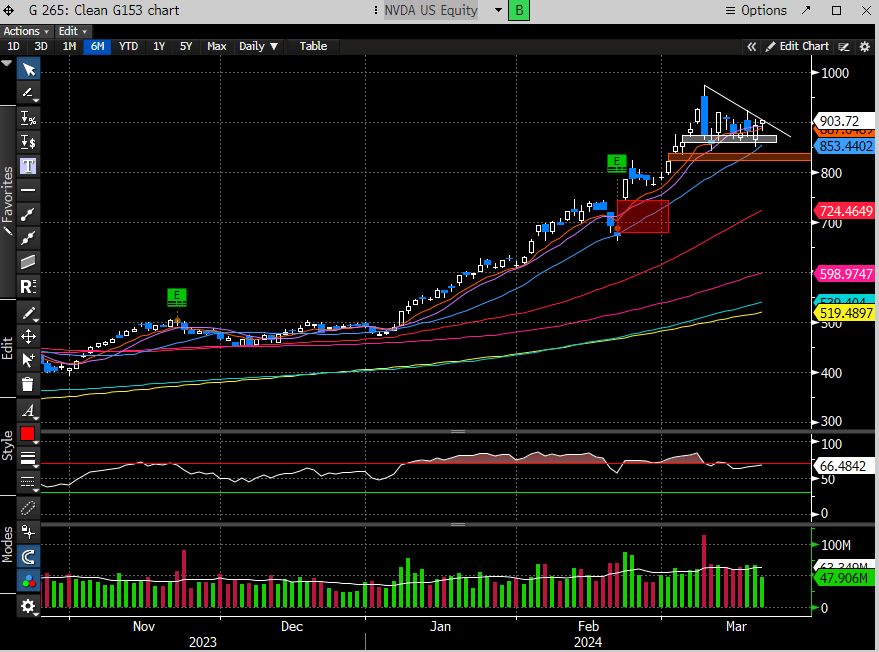

The event came and went and while not much new information came out of it, outside of some collaborations with other companies, the stock barely took a hit. Thats impressive given the sizeable reversal candle we saw back on Mar 8th. Since that day, NVDA has largely traded sideways, held the key momentum levels and MA’s and now forming a bull pennant. Bull pennants are continuation patterns, which means they typically resolve in the direction of the main trend. We think it’s safe to say that should NVDA break up out of this pattern, the stock market has more upside left in it.

While the NVDA event wasn’t nearly as important as the implications coming out of the FOMC, it still offers us a clue as to what the present risk appetite is in the market. If NVDA refuses to go down, then the appetite must be quite healthy.

Today’s Fed meeting was surprisingly less hawkish than what most were thinking. We thought they would keep things status quo for this year and that’s exactly what happened. Much to the dismay of the incessant bearish community, Powell shrugged off the recent higher inflation reports and doubled down on his conviction for rate cuts.

As a result, the Fed Fund Futures increased the probability of rate cuts in Jun. They did reduce their forecast for ‘25 to 3 rate cuts vs 4. This is shown in the newest Dot plot.

The market liked what Powell had to say and all those naysayers that have been arguing for a hike were stonewalled again. We always find the negative rhetoric around Fed meetings quite amazing, where outlier forecasts are peddled around that can shift the narrative. This undoubtedly left its mark on large groups of stocks, most notably SMID caps and unprofitable tech, with pervasive momentum breaches after the last CPI report. We follow price first, and price was telling us to be cautious. Our last report was riddled with caution flags as this week was presumably set up for lower prices. Alas, Powell steamrolled that notion and the SPX ripped to new highs today.

This is precisely why we do not make meaningful bets around momentous Fed meetings. The outcome for this meeting seemed quite binary, and binary situations we tend to avoid.

While the outcome for lower prices has not materialized, we also never advocated or were positioned short. We just had less long exposure and had been diversifying our positioning to other sectors of the market. So, while we wish we were 100% exposed to the stock market today, that seemed like a poor risk/reward, into a high-risk event.

In preparation for our report tonight, we studied price action in most of the stock market leaders, and we like what we are seeing. The momentum breaches that we discussed in the early to mid-March reports are largely reversing. This can only mean one thing, and we will be reviewing a few of those idea below to consider.