Please note that the stock market is closed on Friday so this report will be condensed as we will cover the trading week at length in the weekend report.

This week marks the end of the 1Q of 2024. With the end of the Q, there is usually quite a bit of rebalancing and shuffling of positions, which results in decent volatility. This makes determinations around index trading much more difficult as the machinations driving much of the money flow are mechanical. This doesn’t mean they don’t have meaning. In fact, the rotations that we have seen this week, may very well be offering a forward view for where money will flow in 2Q.

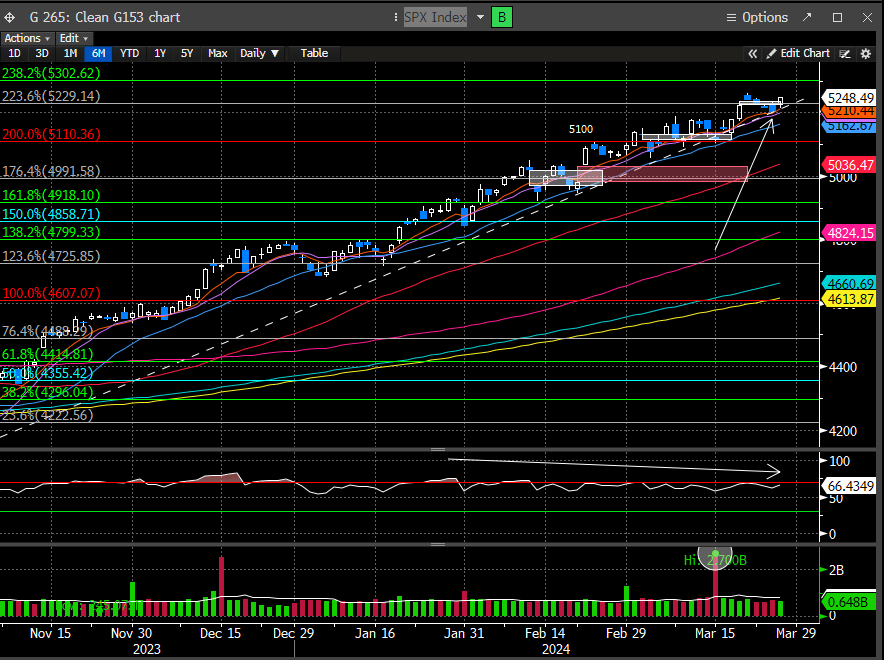

In our last weekend report, we discussed why the market didn’t look like it was ready to turn down yet and today we forged a new all-time closing high on the SPX.

Here is an excerpt from last week’s report:

The trend line from the Oct low continues to be defended as does the 8 day EMA. For a bullish trend to end, simple market structures have to deteriorate and break down. So far that remains elusive.

If the market can manage to close around here tomorrow, the SPX will notch a 10% gain for the Q. Only bested by the Mag7 index, thanks to NVDA, which was up a cool 82% (eat your heart out Lead Lag who has been calling for its demise since 300).

This will also mark the 2nd time in over 20 years that the index rose every month from Nov - March.

These are fairly substantial performance numbers and painful for those that walked into the year calling for higher rates/inflation to destroy last year’s stock market gains. Unfortunately, opinions don’t make money in the stock market, price does, and price is truth. We have largely been on the right side of the market since the Oct ‘22 low because we interpret and follow price. Despite some trepidation that the recent rally was losing steam, we have remained on the right side of the market. Our positioning remains steadfastly bullish and have been moving away from growth sectors and diversifying into other cyclical sectors. So far, that has been a good move as growth has somewhat stalled.

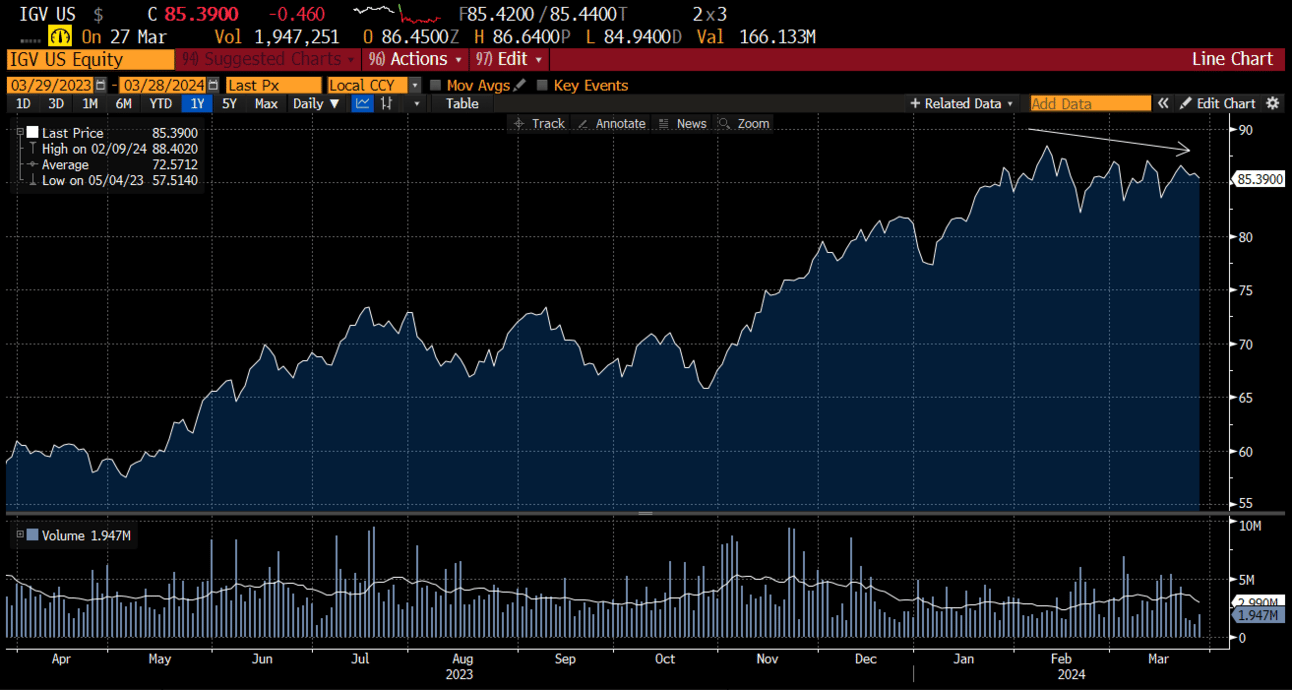

Software is a leading growth sector and has largely traded sideways to down since it peaked in early Feb.

Semis peaked in early March.

Technology (XLK) also peaked in early March.

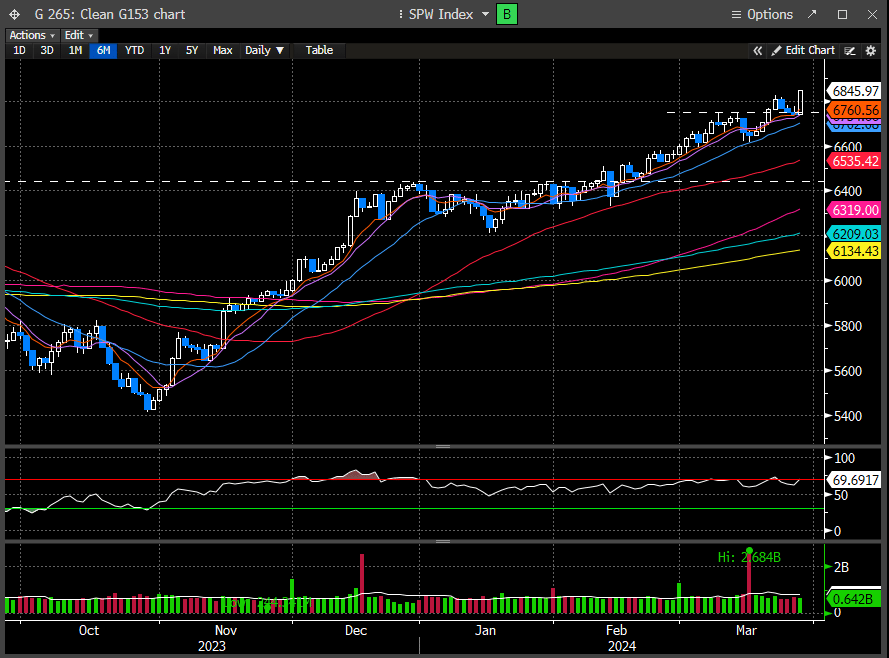

But the Equal weight SPX (SPW Index) just made a new ATH today.

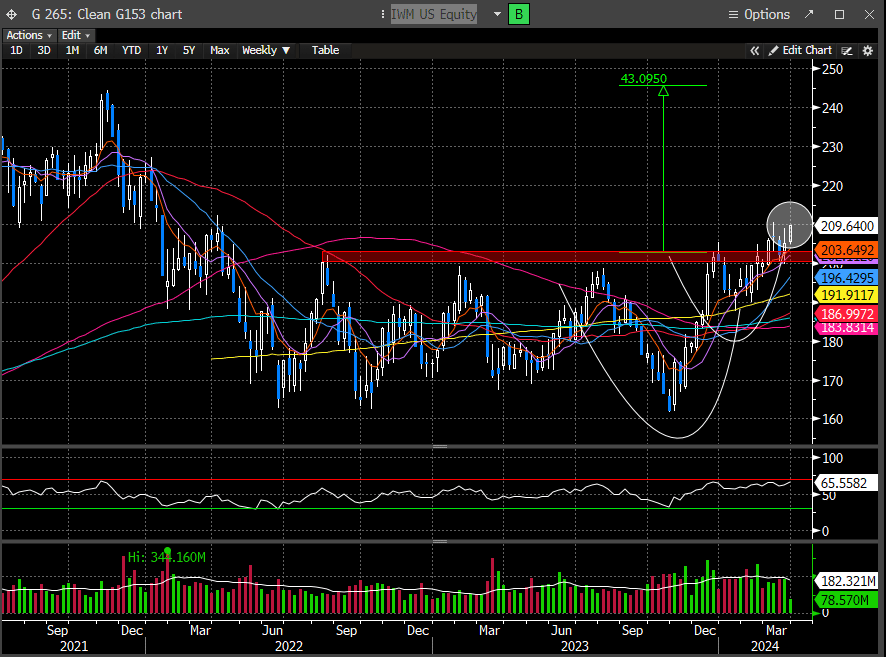

And Midcaps (MDY) are powering higher after making a new ATH in early March.

Even small cap growth just had its highest close in over 2 years.

Despite the fact that inflation remains stubbornly high, the rate of improvement in the economy and its resilience in dealing with higher rates is shifting money into cyclically exposed companies. That is why we are seeing mid-caps, industrials, materials, and financials grossly outperform as of late.

Materials (XLB) are on a tear since we highlighted in Feb (red circle).

Industrials (XLI) will not relent.

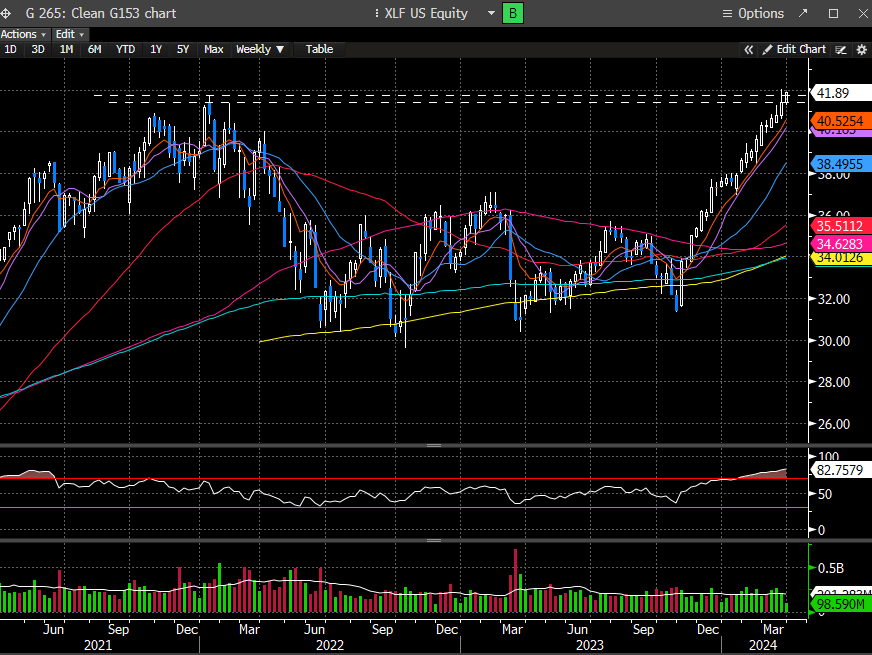

Financials (XLF) about to close at an all time weekly high.

This sort of strength in the cyclical parts of the stock market, is quite notable. Sure, NVDA looks like it might roll over here. Peel the onion a little and you’ll see that the market strength is broadening out quite a bit. Whoever keeps harping that the leadership in the market is narrow, simply isn’t paying attention.

We continue to reap the benefits of our comprehensive and exhaustive analysis of markets by staying with the trend. Don’t miss the next big move. Consider subscribing below.